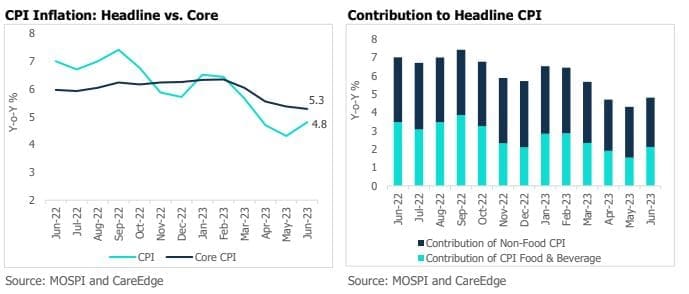

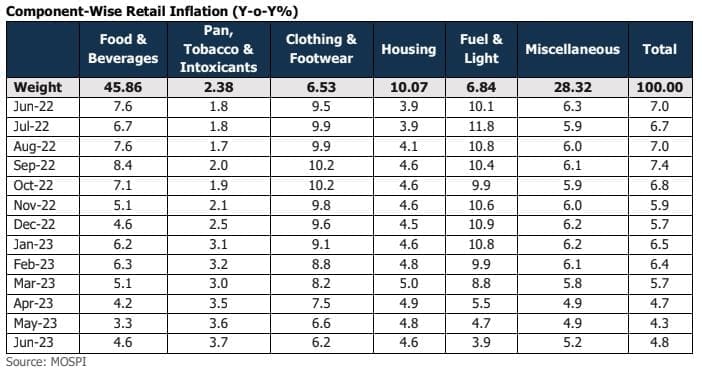

India’s retail inflation snapped a four-month decline, rising 4.8% in June, but remaining within RBI’s tolerance

band. The uptick was largely driven by a sharp rise in food inflation. Food inflation rose to 4.6% from 3.3% a

month ago, taking the share of food inflation in overall inflation to 44% in June, from 36% a month ago. Amongst

food items, categories such as vegetables, pulses, spices and meat & fish registered a significant uptick. Inflation

in the miscellaneous segment, which accounts for nearly 30% of the CPI basket, also reported an increase of 5.2%

y-o-y in June from 4.9% in May.

Core inflation remained high at 5.3% y-o-y in June (vs 5.4% in May), with slight moderation in inflation in segments

such as housing, personal care & effects and recreation. However, inflation in categories such as transport and

communication, health and education firmed in June.

Food and beverage inflation spiked on account of seasonal uptick in vegetable prices and elevated pulses inflation.

Uneven monsoon and heatwave conditions are likely to have impacted essential perishable foods. Inflation in items

such as onion (8.1%), tomato (64%) and potato (10.5%) witnessed a significant uptick on a sequential basis in

June.

Cereal and pulses inflation remained elevated in June at 12.7% y-o-y and 10.5% y-o-y, respectively. Retail prices

of pulses, especially that of tur dal have risen 24% y-o-y in June, reporting double-digit growth for the third

consecutive month. On a sequential basis, wheat and rice inflation also picked pace in June. Looking ahead, the

sale of wheat and rice from the government’s buffer stock via Open Market Sale Scheme (OMSS) auctions could

help cool retail prices of rice, wheat and atta. However, with regards to rice prices, deficient monsoons in West

Bengal- a key rice-producing state, could impact sowing, putting upward pressure on prices. Overall, the total sown

area of kharif crops has declined nearly 6% as on July 9, compared to a year ago period, with that of rice and

pulses reporting declines of 16% and 18%, respectively. Despite rainfall at 2% above long period average (LPA)

as on July 11, skewed spatial distribution of rainfall could hurt crop yields and pose as a headwind to the inflation

outlook.

Although milk inflation moderated in June (8.6% y-o-y vs 8.9% in May), it continues to remain sticky above 8%,

reeling from the impact of a continued demand-supply mismatch and high fodder costs. Milk prices could remain

higher in the coming months, if unabating cereals inflation keeps cattle feed expensive.

Notably, fuel and light inflation moderated to a 30-month low of 3.9%- y-o-y in June from 4.7% in the previous

month. The softening of prices in this category was largely on account of kerosene (by PDS) segment contracting

27% y-o-y in June. Inflation in the LPG category too moderated in June, with sequential momentum reporting a

contraction for the second straight month. However, electricity, which accounts for the largest share in fuel and

light inflation, rose 8.7% y-o-y in June, from 5.2% a month prior.

Way Forward

The rise in sequential momentum of food inflation is concerning. The share of food inflation in the headline inflation

has risen to 44% from 36% in the previous month. While a part of the increase in food prices is seasonal, for some

items like vegetables, the increase is more than the seasonal pattern seen in previous years. With high inflation for

basic food items like rice, pulses, vegetables and milk, the Central Bank will be concerned about the adverse impact

on household inflationary expectations. Progress of monsoon in July would be specifically critical. If the spatial

distribution of rainfall remains skewed, it could have an adverse impact on kharif sowing and further aggravate

food inflation, going forward. Due to excessive rainfall in some regions, total sown area of items such as rice, pulses

and oilseeds is already lower than last year, which is worrisome. While food inflation is concerning, the comforting

factor is that the WPI has been contracting. Deflation in WPI will have a lagged impact on CPI inflation going

forward. Having said that, RBI would remain cautious and adopt a wait and watch mode. We reaffirm our view that

RBI would maintain an extended pause in 2023.