Synopsis

- Net Interest Income (NII) of Scheduled Commercial Banks (SCBs) grew by 25.5% y-o-y to Rs.1.78 lakh crore in Q3FY23 due to a healthy improvement in credit offtake, and a higher yield on advances.

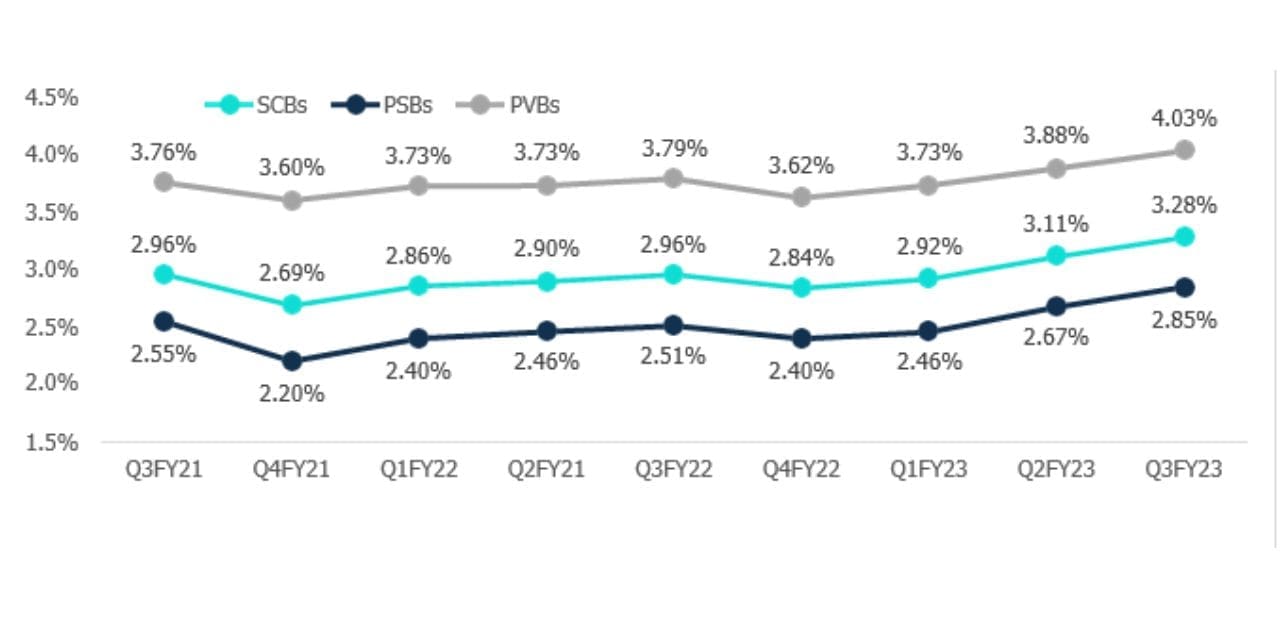

- Net Interest Margin (NIM) of SCBs improved by 17 basis points (bps) y-o-y to 28% in Q3FY23 as loans were repriced at a faster rate, while deposit rates have yet to reflect the rise in repo rate coupled with a substantial increase in advances. NIMs are expected to stabilise with negative bias due to the repricing of liabilities.

- SCBs reported a robust rise in its advances by 5% y-o-y in Q3FY23. Public Sector Banks (PSBs) net advances grew by 18.9% in the quarter whereas PVBs rose by 17.9%.

NII and NIM Movement

- NII of PSBs and PVBs grew by 24.6% and 26.7% y-o-y, respectively, in Q3FY23. PVBs reported a higher NII growth as compared to PSBs, indicating their strong franchise with both depositors as well as

- Interest income of SCBs rose by 8% y-o-y in Q3FY23 wherein PVBs rose by 27.0% and PSBs grew at 23.5% in the quarter.

- Interest expenses of SCBs rose by 2% y-o-y in Q3FY23, wherein Private Sector Banks (PVBs) rose by 27.3% and PSBs by 22.6% in the same period.

- Banks reported a record level of NIM in Q3FY23. NIM of SCBs improved by 17 bps y-o-y at 3.28% in the quarter, within this, PSBs improved by 17 bps at 2.85%, whereas PVBs rose by 15 bps at 4.03%.

Figure 1: NIM Movement

Banks Report Steady NIM Growth in Q3FY23

On a cumulative basis, RBI has increased the repo rate by 250 bps to 6.5% in FY23. The last hike of 25 bps which was on February 08, 2022, has not been reflected in the banks’ lending as well as deposit rates. It is expected to reflect first in lending rates and then followed by deposit rates. Weightage Average Lending Rates (WALR) on fresh loans increased by 120 bps y-o-y to 8.9% in December 2022 from December 2021. WALR on o/s loans increased by 66 bps to 9.52% in the same period. On the other hand, Weighted Average Domestic Term Deposit Rates (WADTDR) on deposits grew by 74 bps in December 2022 from December 2021. Deposit rates are expected to rise due to a lag effect driven by the rise in policy rates, an increase in competition for raising deposits to meet strong credit demand, and a wide gap between credit & deposit growth.

Outlook

Credit growth has generally been trending upward throughout FY23 and is expected to be in the mid-teens in FY23. RBI has increased the repo rate by 250 bps in FY23. The last hike of 25 bps (February 08, 2023) has not been reflected in the above numbers and is expected to reflect first in lending rates followed by the deposit rates. Deposit rates have already increased and are expected to rise further. Banks which have been able to maintain a higher CASA as well as EBLR-based floating loans are expected to benefit and sustain the NIM in the current rising interest rate scenario. Overall, NIMs are expected to stabilise with a negative bias as lending rates would likely complete their rising cycle while liabilities would continue to be repriced.