Legendary fund manager Li Lu (who Charlie Munger backed) once said, ‘The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.’ It’s only natural to consider a company’s balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Sarla Performance Fibers Limited (NSE:SARLAPOLY) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Sarla Performance Fibers’s Net Debt?

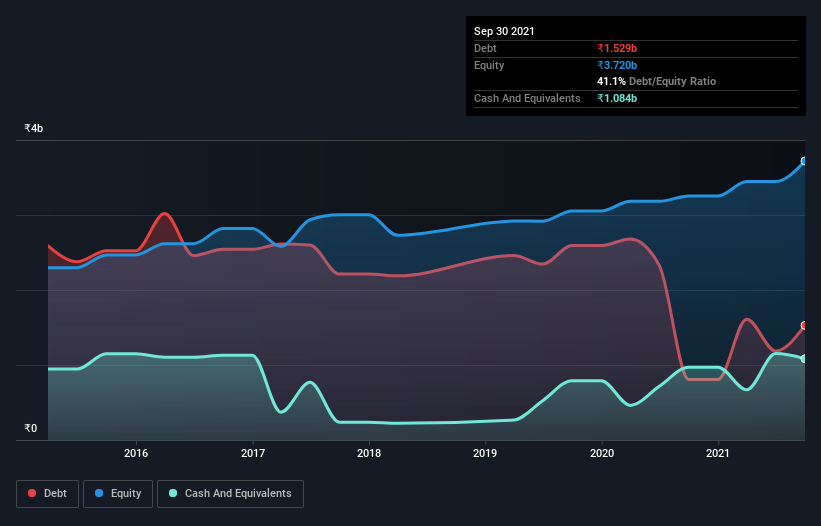

The image below, which you can click on for greater detail, shows that at September 2021 Sarla Performance Fibers had debt of ₹1.53b, up from ₹806.5m in one year. However, it also had ₹1.08b in cash, and so its net debt is ₹444.8m.

According to the last reported balance sheet, Sarla Performance Fibers had liabilities of ₹1.91b due within 12 months, and liabilities of ₹582.9m due beyond 12 months. On the other hand, it had cash of ₹1.08b and ₹1.05b worth of receivables due within a year. So its liabilities total ₹357.8m more than the combination of its cash and short-term receivables.

Given Sarla Performance Fibers has a market capitalization of ₹5.13b, it’s hard to believe these liabilities pose much threat. Having said that, it’s clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company’s debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Sarla Performance Fibers has a low debt to EBITDA ratio of only 0.56. But the really cool thing is that it actually managed to receive more interest than it paid, over the last year. So there’s no doubt this company can take on debt while staying cool as a cucumber. Even more impressive was the fact that Sarla Performance Fibers grew its EBIT by 263% over twelve months. That boost will make it even easier to pay down debt going forward. There’s no doubt that we learn most about debt from the balance sheet. But you can’t view debt in total isolation; since Sarla Performance Fibers will need earnings to service that debt. So when considering debt, it’s definitely worth looking at the earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it’s worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Sarla Performance Fibers recorded free cash flow of 30% of its EBIT, which is weaker than we’d expect. That’s not great, when it comes to paying down debt.