⬤ Lenzing to accelerate its profitable growth journey after the successful start-up of its recent capacity additions

⬤ Strong financial target set for 2027: EBITDA above EUR 1 bn, ROCE above 12% ⬤ Continued focus on sustainable and high-quality premium fibers for textiles and nonwovens ⬤ Intensification of the transition from a linear to a circular business model

⬤ Commitment to consistently provide attractive dividends to shareholders with a minimum dividend of EUR 4.50 per share as of the 2023 financial year

Lenzing – In recent months, the Managing Board of Lenzing AG and its leadership team carried out a comprehensive review of its corporate strategy to maximize the use of growth opportunities and enhance the company’s leading position in sustainability and circularity. As a result, Lenzing will sharpen its corporate focus, prioritize projects that best serve its customers’ needs, while contributing positively to society and the environment. At the same time, this strategy will improve its financial performance and yield attractive returns on investments.

Sustainable innovations based on strong product brands

Lenzing will continue to leverage its leading position in the growing market for sustainable cellulosic fibers by innovating, developing, manufacturing and distributing high-quality premium products. As a key value driver, Lenzing will further intensify its ingredient branding activities as this has proven to be an effective means of communicating the superior properties and sustainability advantages of its nature-based fibers more broadly in the customer and consumer spheres.

By repositioning its product brands, the Lenzing Group has been sending a strong message to consumers since 2018. With TENCEL™ and LENZING™ ECOVERO™ as umbrella brands for all specialty products in the textile segment, VEOCEL™ as the umbrella brand for all specialty nonwoven products and LENZING™ for all industrial applications, the company is showcasing its strengths in a targeted manner.

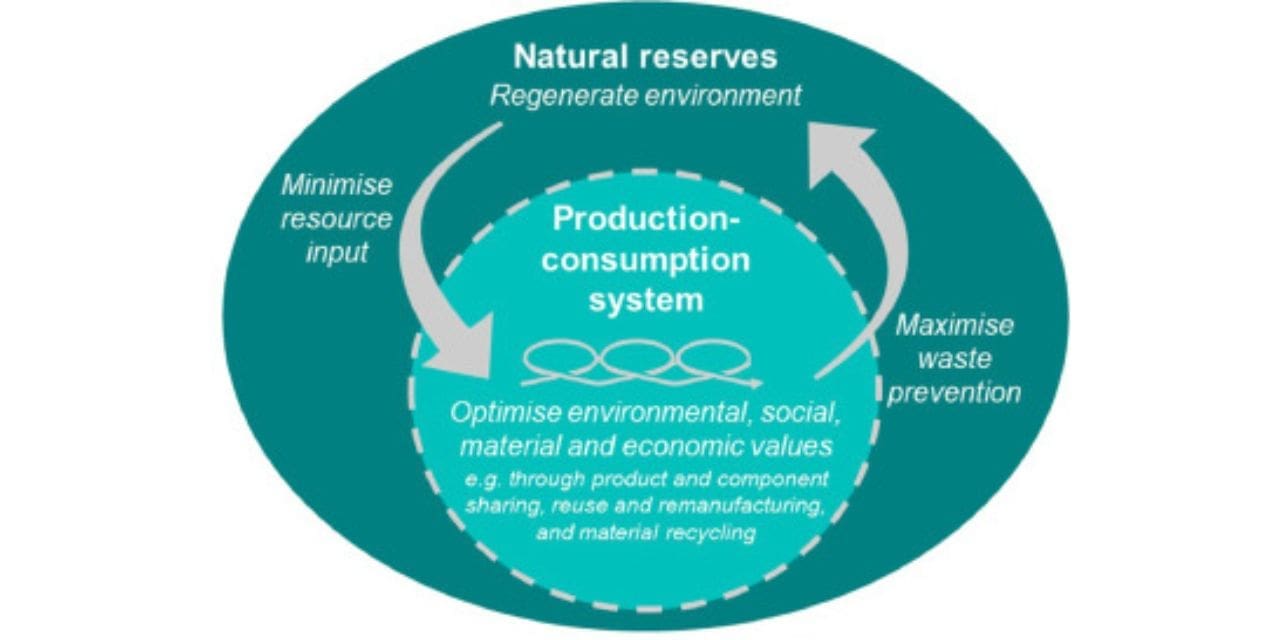

“We will maintain our pioneering role by further strengthening the integration of recycling and thereby accelerate the transformation of the textile business from a linear to a circular model. As champions of sustainability, we know that moving towards a circular economy is vital in the textile and nonwoven industries,” comments Robert van de Kerkhof, Chief Commercial Officer Fibers.

Further expansion of sustainable energy sources

“As part of the strategy process, we also reviewed our current energy mix. The result of this analysis is that, following the construction of the largest photovoltaic plant in Upper Austria, we will also invest in sustainable energy sources at all other sites”, says Christian Skilich, Chief Pulp Officer.

Strong set of financial targets

After the successful start-up and market launch of key investments in Brazil and Thailand, as well as sustainability investments in existing plants during the last two years, the new corporate strategy is based on the positive resonance within the market. The core outcome of the corporate strategy has led to higher financial targets for 2027:

⬤ EBITDA: above EUR 1 bn (versus EUR 363 mn in 2021)

⬤ ROCE1: above 12% (versus 8.1 % in 2021)

⬤ Net financial debt/EBITDA: below 2.5x (versus 2.7x as of December 31, 2021)

Stephan Sielaff, Chief Executive Officer of Lenzing AG comments: “We will continue to drive excellence and make significant investments while maintaining a balanced risk profile at all times. Based on this strategy, we will further enhance our financial performance by significantly increasing both EBITDA and ROCE by 2027, allowing us to drive up total shareholder returns substantially while consistently paying attractive dividends, assuming a healthy economic environment prevails.”

Dividend strategy revised

Furthermore, the Managing Board of Lenzing AG decided to revise its dividend policy. As of the 2023 financial year (with payment scheduled for 2024), Lenzing plans to pay an annual dividend of at least EUR 4.50 per share (adjusted for inflation). The revised dividend policy is subject to the approval of the Supervisory Board. Payment of the dividend in any year will be subject to the specific dividend proposals of the Managing Board and the Supervisory Board. These proposals may deviate from the new dividend policy if appropriate under the then prevailing circumstances and will be subject to the approval of the Annual General Meeting.