It is five months since Mecardo took a gander at the clothing fiber background to the oily fleece market. It appears ideal to check what is going in the bigger attire fiber markets to give some setting to fleece costs.

To recap, the universe of attire filaments is both wide and complex. Different value arrangements for clothing filaments and the feedstocks used to build up these strands (it is questionable that oily fleece is the feedstock for fleece yarn) help to put oily fleece costs in setting, as the fleece market doesn’t work in a vacuum. Other clothing fiber costs won’t really reveal to us where fleece costs will exchange, yet they will assist us with understanding what the current prevailing cycle or pattern is.

Source: https://mecardo.com.au/wp-content/uploads/2021/05/2021-05-04-Wool-fig-1.png

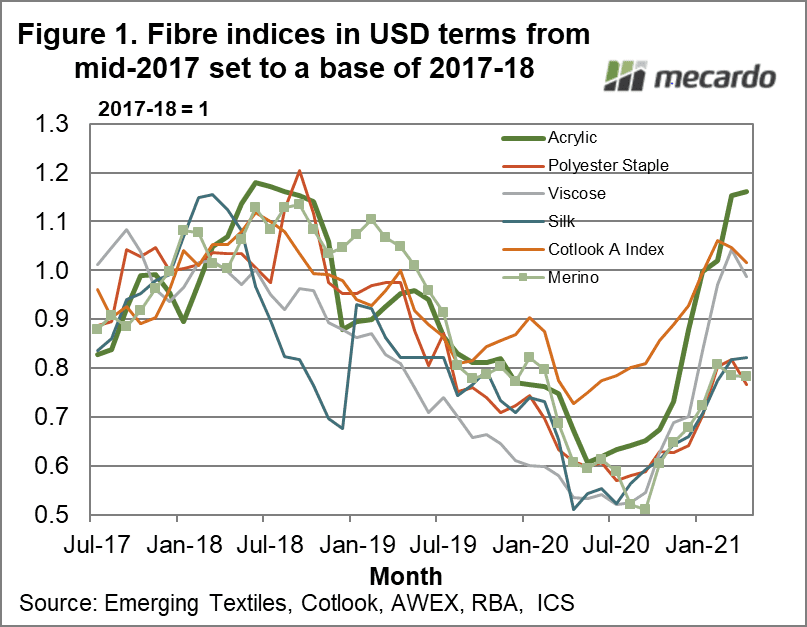

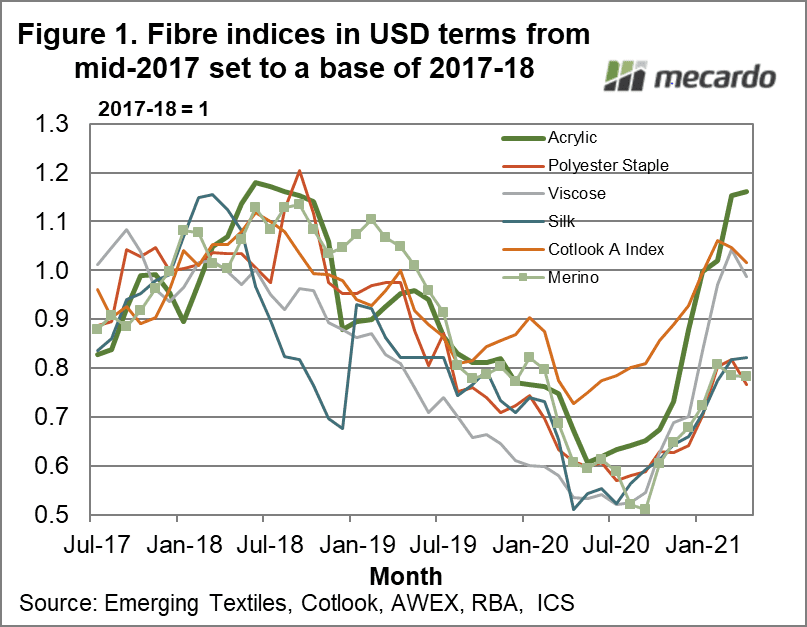

In Figure 1 a scope of clothing fiber value arrangement appeared from mid-2017 to November 2020, in US dollar terms. US dollar terms are utilized as we are keen on the hidden value cycle as seen by the interest side of the market. To permit correlation of the different clothing fiber value arrangement, every arrangement has been changed over to a record dependent on the normal cost for the 2017-2018 season. This puts all arrangements on a similar scale.

The rising pattern shown last December has sped up for all filaments, with costs bouncing back from the mid-2020 lows definitely more emphatically than anticipated or expected. Regarding the re-bound the three stand apart filaments are acrylic, gooey and cotton which have gotten back to levels close to top 2018 levels. The three different filaments (merino, polyester staple and silk) are bunched together some 30% beneath the pinnacle 2018 levels, around late 2019 levels. This discloses to us that the ascent in merino costs seen since last September is a generally moderate one in US dollar terms when seen in setting with the more extensive attire fiber local area.

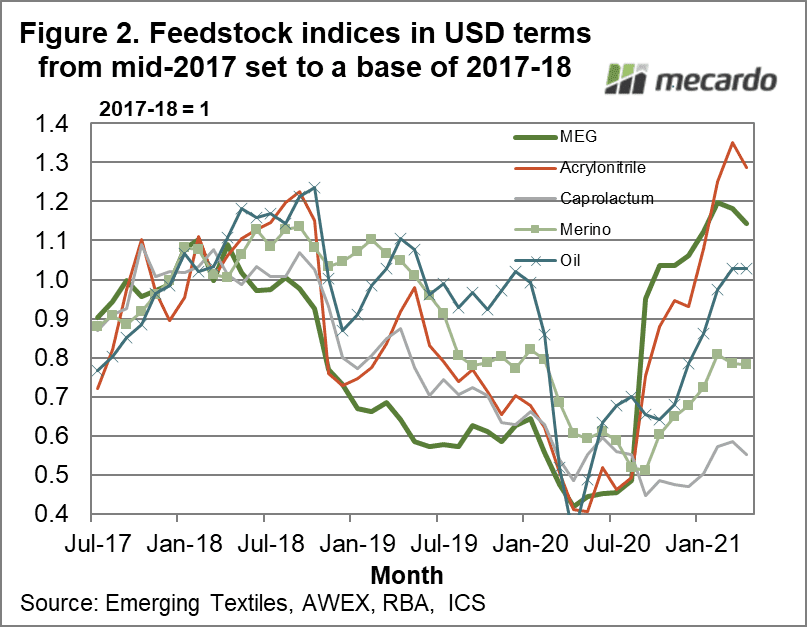

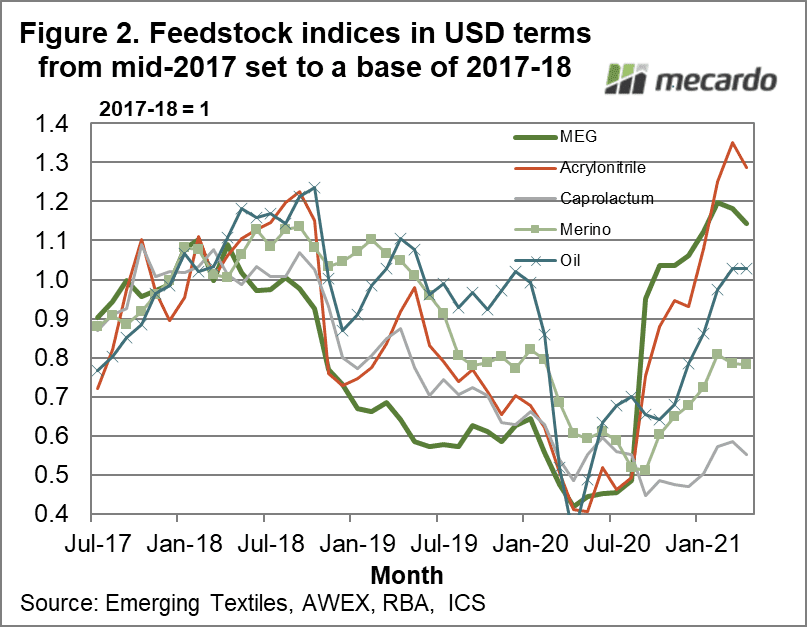

In Figure 2 merino is contrasted with the value records for artificial fiber feedstocks and a normal unrefined

Source: https://mecardo.com.au/wp-content/uploads/2021/05/2021-05-04-Wool-fig-2.png

petroleum cost. Generally the merino cost (though of a more extensive fiber width) has had a more grounded connection with feedstock costs which may have to do with their basic situations toward the start of the inventory network. In this examination the bounce back in the merino cost has failed to meet expectations of the oil value, MEG and Acrylonitrile (which feed into polyester and acrylics individually). Just caprolactam, which takes care of nylon, has failed to meet expectations that the merino bounce back.