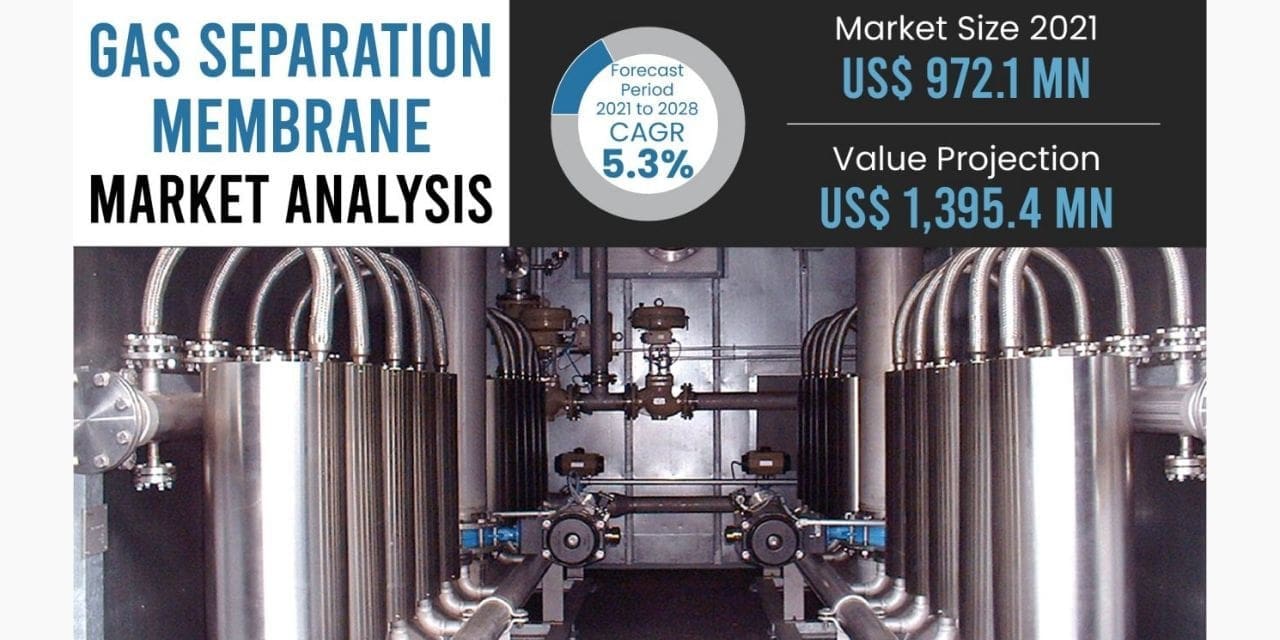

As per the recently published report by MarketsandMarkets™, The “Gas Separation Membrane Market by Material Type (Polyimide & Polyaramide, Polysulfone, Cellulose Acetate), Application (Nitrogen Generation & Oxygen Enrichment, Hydrogen Recovery, Carbon Dioxide Removal), and Region – Global Forecast to 2028″, is projected to reach USD 1.4 billion by 2028, at a CAGR of 7.1% from USD 1.0 billion in 2023. The growth of the global gas separation membranes market is driven by regulations regarding carbon capture and the growing demand for nitrogen generation. The demand for clean energy is driven to improve the efficiency and sustainability of various processes, i.e., essential for achieving cleaner and more environmentally friendly energy solutions.

Download PDF Brochure: https://www.

Browse

- 103 Market data Tables

- 33 Figures

- 154 Pages and in-depth TOC on “Gas Separation Membrane Market – Global Forecast to 2028”

This report also provides a comprehensive analysis of the companies listed below:

The key global players in the gas separation membrane market are Air Products and Chemicals, Inc. (US), Air Liquide (France), UBE Corporation. (Japan), Honeywell UOP (US), Fujifilm Manufacturing Europe B.V. (Netherlands), Schlumberger Limited (US), DIC Corporation (Japan), Parker-Hannifin Corporation (US), Membrane Technology and Research, Inc. (US), and Generon, Inc. (US) among others. These companies are strong in their home regions and explore geographic diversification alternatives to grow their businesses. They focus on increasing their market shares through new product launches and other expansions.

Recent Developments in Gas Separation Membrane Market Industry

- In July 2021, Air Liquide has completed the construction of Canada’s largest helium purification facility, which is anticipated to provide crucial support to North America Helium’s operations in southwest Saskatchewan, Canada. This plant stands as the largest helium production facility in the country.

- In October 2021, Air Products has unveiled a fresh brand identity for its membrane business divisions, unifying them globally as “Air Products Membrane Solutions.” This streamlined approach brings together the previous business units like Air Products PRISM Membranes, Air Products Norway, and Permea China Ltd. under a single banner, aiming to enhance the customer journey and promote collaboration and innovation.

- In November 2021, Honeywell has announced a partnership with SK Innovation and Energy, a Korean energy-refining company, to conduct a feasibility study regarding the retrofitting of SK’s hydrogen plant with carbon capture capabilities. SK Innovation and Energy aims to investigate the capture and storage of 400,000 tons of carbon dioxide (CO2) from their current hydrogen production facilities. Honeywell UOP brings a range of technologies, including solvents, membranes, cryogenics, and pressure-swing adsorption (PSA) systems, which can be tailored to meet the specific needs of the project.

- In November 2020, Generon has successfully produced and supplied a purification system for Sulfur Hexafluoride (SF6) to FluoroMed. This system incorporates multiple stages of Generon membranes to effectively purify SF6 gas, ensuring it reaches a remarkable purity level of 99.9%.

- In January 2020, The National Energy Technology Laboratory has chosen MTR’s PolarCap membrane process technology for a substantial phased trial to demonstrate post-combustion CO2 capture on a large scale.

Request Sample Pages: https://www.

Honeywell UOP – Honeywell UOP is one of the leading manufacturers of catalysts, membranes, and adsorbents. It is a part of Honeywell’s Performance Materials and Technologies business group and is a wholly owned subsidiary of Honeywell International Inc. The gas processing business segment provides gas separation membranes for various applications, such as acid gas removal, hydrogen recovery, and others. The company has adopted organic and inorganic growth strategies and intends to focus primarily on business opportunities in the areas of renewable fuels, reducing emissions, and environmental sustainability. In addition, strong distribution channels have helped the company establish a strong foothold in various countries.

In November 2021, Honeywell announced collaboration with SK Innovation and Energy, a Korea-based energy refining company, for a feasibility study to retrofit SK’s hydrogen plant with carbon capture. SK Innovation and Energy is expected to explore capturing and sequestering 400,000 tons of carbon dioxide (CO2) from existing hydrogen production facilities. Honeywell UOP has multiple technology offerings like solvents, membranes, cryogenics, and pressure swing adsorption (PSA) systems that can be optimized to meet the project requirements.

Generon – Generon is one of the leading players in the design and supply of nitrogen generators, membranes, and pressure swing adsorption systems. These membranes are used in oil & gas, petrochemical, marine, and industrial applications. These membranes are used for nitrogen generation, natural gas purification, oxygen generation, and custom gas separation. The company has put a high emphasis on R&D and adopted a new product launch strategy to develop gas separation membrane technology. This strategy will enable the company to be one of the leaders in the gas separation membranes market.

In November 2020, Generon manufactured and delivered a Sulfur Hexafluoride (SF6) purification system to FluoroMed. The system consists of Generon membranes in multiple stages, which purify SF6 from gas. The system provides 99.9% purity SF6 gas.

Inquire Now to Get 5% Discount: https://www.