Automotive Textiles- Untapped Market in India

By: Mr. Avinash Mayekar, MD & CEO, Suvin Advisors Pvt. Ltd.

Change is the need of the hour. Change & Success go hand in hand. Recently we are witnessing the changing face of India due to change in leadership. Textile- The golden industry of India has at last accepted that change is inevitable & has taken steps in new direction. Entrepreneurs are now shifting from conventional textiles and thinking about investing in the future of textiles i.e. technical textiles. Recently a lot of technical textile projects are being thought about.

Though India is the 2nd largest textile economy in the world after China; our contribution in one of the growing textile segment, technical textile is negligible. This is an eye opener to how much behind we are as far as technical textile market is concerned. Moreover the other hard hitting fact of Indian technical textile scenario is that we have penetrated our roots in technical textile segments like packtech (36%), Clothtech & Hometech. These segments though are very well technical textile products having ample of growth however when it comes to the monetary value of the end products it is sadly on the lower side. The global technical textile market on the other hand is dominated by Mobitech having 23% share followed by Indutech, Sportech which are high value products.

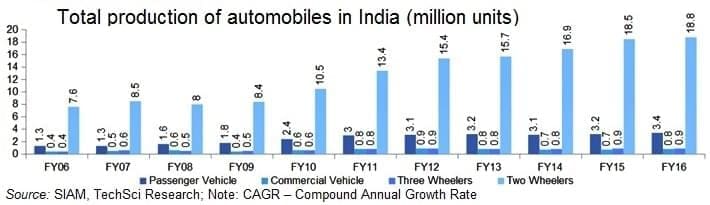

When it comes to demand supply analysis of Mobitech, the huge potential of this sector is very much evident to the layman as well given the tremendous growth in Automobile industry. With rising economy having high disposable income & growing standard of living the demand for Cars is increasing day by day. In 2016 there were around 7.2 crore cars produced globally whereas, in India 36 Lakh cars were produced. Indian automobile industry is one of the largest in the world. It accounts for 7.1 per cent of the country’s Gross Domestic Product (GDP). The Passenger Vehicles segment witnessed a growth of CAGR 10.09% & the commercial vehicle segment witnessed growth of CAGR 9.4% during FY06-16. This ever increasing demand of automobiles is mainly due to the status symbol that Cars are having in India & also recently this has further accelerated with the launch of rental car service provider as people have now

started investing in cars & registering them with rental services giving them an added source of income just as over the years they have been investing in property, gold to secure their futures.

All said & done be it any kind of car, the automotive textiles is a must in any types of vehicle. The various automotive textile products are Nylon tyre Cord, Seat belt, Car body covers, Seat upholstery, Automotive Carpets, Headliners, Sunvisors/sunblinds & Airbags.

Apart from the huge demand for the utmost essentials of cars like seat covers, car flooring, seat belts etc. Recently the awareness of one’s safety has also increased the demands of air bags. Safety is of utmost importance today, The scenario has changed gone are the days when people insisted on Cars without air bags in order to get affordable lower prices. Today there are Cars that are marketing purely on basis of the number of Air bags in the car thereby ensuring the safeguard of maximum passengers on board.

In India, the government has recently made it mandatory for all the Cars to have air bags & three additional safety features for on board protection from accidents post October 2017. This compulsion will thus increase the demand for air bags exponentially as most of the budget Cars today like Alto, Eon, Santro, Nano, and the Datsun GO are not providing air bags. A per Car need of minimum 2 bags in such cars that are currently having highest market dominance in India will ultimately create a huge market for air bag manufacturer.

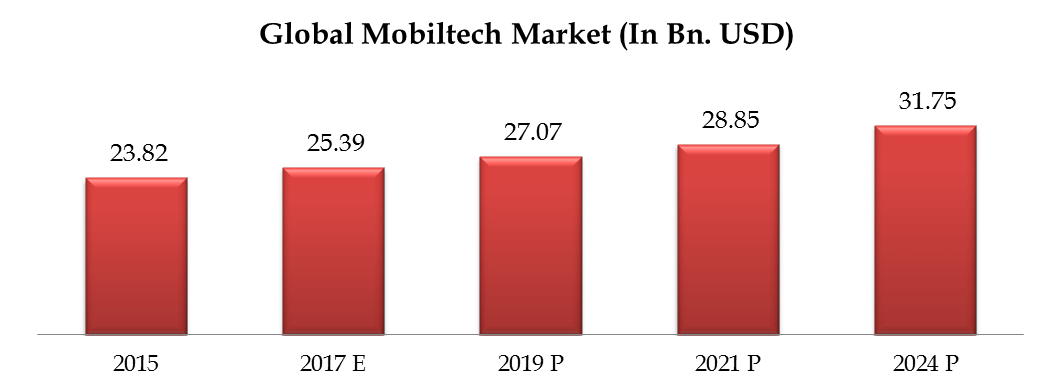

In value terms, the global automotive textiles market size was USD 23.82 billion in 2015 and is expected to reach USD 31.75 billion by 2024. Whereas, in volume terms, it was 3.81 million tons in 2015 and is expected to reach 5.14 million tons by 2024.

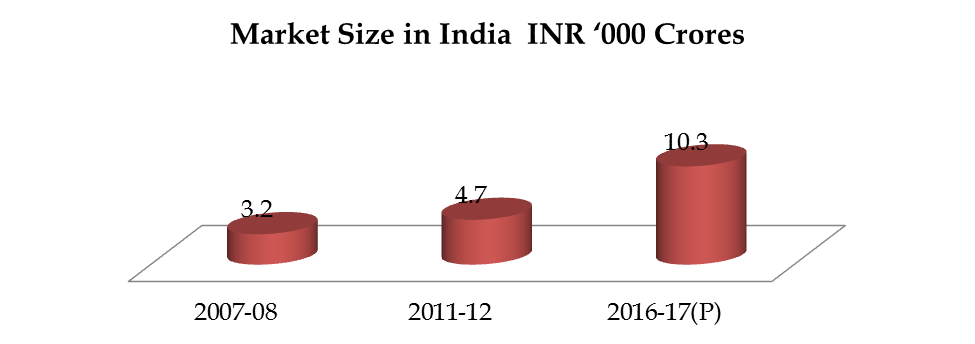

The Indian Automobile industry is estimated to reach 10.3 thousand Cr. by 2017 having a CAGR of 14%. Amongst the various automotive textiles produced in India, Nylon tyre cord accounts over 60% of the total technical textile consumption in the segment followed by seat upholstery / fabric with a share of around 14%. Though the Indian market is showing promising growth there is ample of opportunities for Indian entrepreneurs to encash by investing in auto textiles due to the growing global demand for this market.

Conclusion:

Globally Mobitech market accounts US$ 36 Bn contributing 20% to technical textile market whereas in India the mobitech market is Rs. 11,433 Cr contributing only 10% of technical textile market. This shows that there is a huge mobitech market that can be explored by entrepreneurs. Despite such great demands the Indian market is still fragile for investing in mobitech projects. The major reason for this setback is the lack of tie up with Car Assembly suppliers. Most of these vendors are stationed in developed nations thereby increasing logistic cost of the product. Tie-ups with these vendors for setting up assembly units in India will ultimately decrease the logistic cost. Also from other point increased manufacturers of mobitech products will help in to bring these vendors to India.

Investing in mobitech product is highly sensible as most of these products are high end products having huge potentials ensuring a shorter span & higher return on investments. Domestic production of the airbags & other automobile textiles means that the Indian manufacturers can easily compete with other international mobitech suppliers due to reduced logistics charges. It’s time that we start playing on our strengths & invest in products that will help us compete with global players. We must take advantage of the new windows that are opening & become global leaders than just followers. It is sensible to be the first of a kind rather than just repeating someone after. Indian Entrepreneurs can come out with business modules to supply all mobitech products to Indian branded Cars in low segment which is the largest market in India.

Let us make Automobile Industry as 100% Make in India product