As the new year begins, let me start by sharing the joy of the victory of our Tiger boys who beat the World Test champion New Zealand by eight wickets in a 2-match series at the Bay Oval, Mount Maunganui in New Zealand. Young pacer Ebadot Hossain shined with his career-best 6-46 which broke down the last of New Zealand’s resistance in the match. My heartiest congratulation to the winning team for this historic victory. It was not only a great victory for the cricket team but also a good comeback.

Let me now focus on the topic. I am writing today to share with you the RMG export performance review and some analysis for the year 2021 as the Export Promotion Bureau (EPB) has recently published the export data for all sectors.

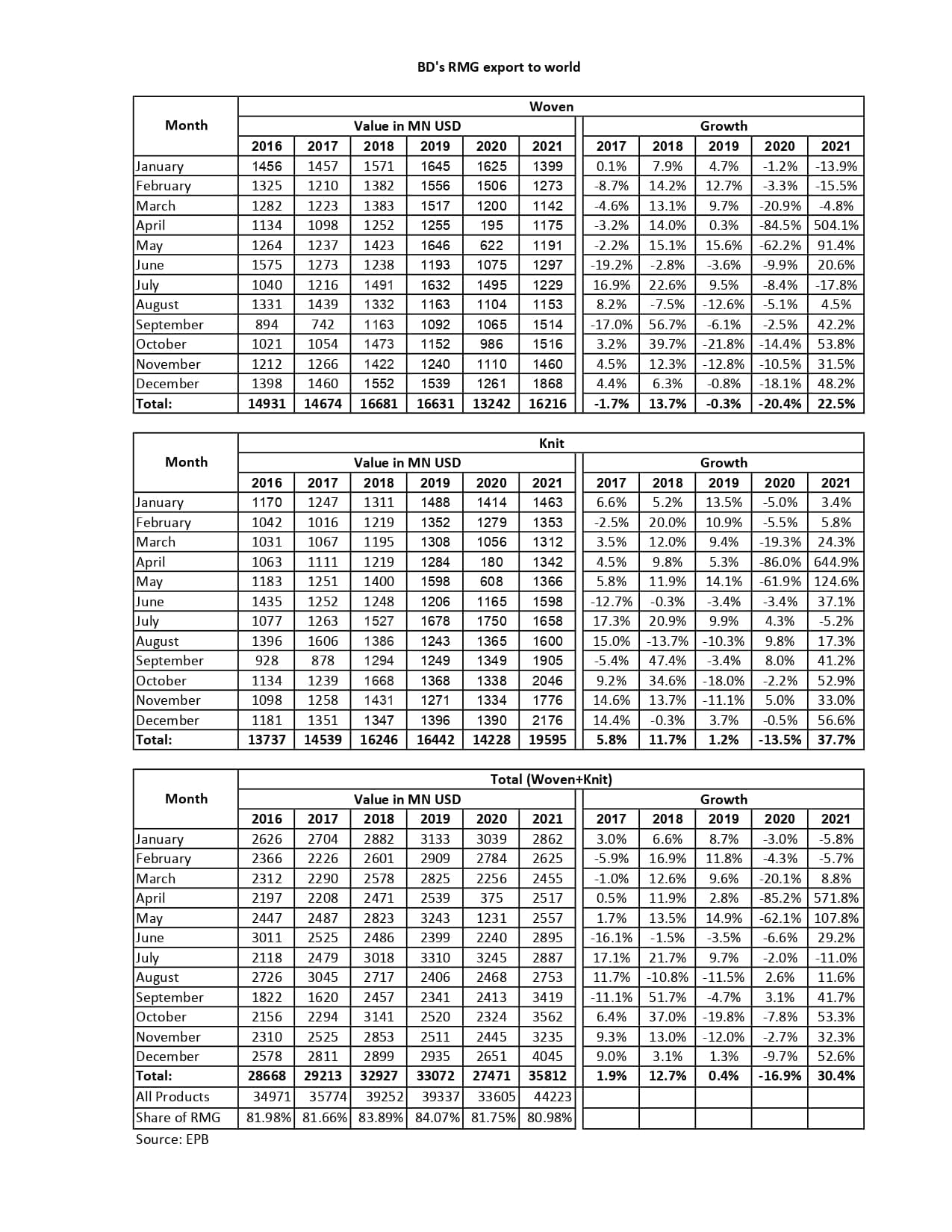

As we completed another year 2021, the starting was turbulently caused by the devastation of COVID which impacted our industry badly in 2020. The year 2021 started with negative growths in export, however, in the following months, we saw a promising recovery that kept till the end of the year. Particularly, the final four months of 2021 changed the entire scenario of the aggregate export growth for the entire year. The year ended with a total RMG export worth USD 35.81 billion having a growth of about 30.4% compared to 2020. The year will also be marked with distinction since the month of our 50 years of our victory, i.e. December 2021 fetched USD 4 billion dollars from RMG export, highest export in a single month ever recorded and exceeded the 4 billion dollars marks for the first time. The growth of RMG export in December was 52.57%.

A detailed analysis of the major categories – knit and woven – shows that the performance of knitwear was better than the woven during the beginning of 2021, and woven garment growth accelerated in the latter half of the year. In 2021, knitwear exports saw 37.7% growth on average whereas the growth of woven garments was 22.5%. Since people had to stay at home for a long time due to lockdown measures, the demand for knitwear stayed persistently stronger in the last two years. This may be noted that knitwear is classified into two categories, which are circular knitwear and flat knitwear. The flat knitwear items are a sweater, pullover, and cardigan.

Looking back over the past five years, RMG export in 2016 was USD 28.67 billion, which increased to USD 29.21 billion in 2017. As exports continued to grow they reached USD 32.92 billion in 2018 and USD 33.07 billion in 2019. COVID hit the industry in 2020, and export came down to USD 27.48 billion. From there we reached USD 35.81 billion. So, this is good come back as far as growth is concerned, yet challenges kept mounting throughout the time.

We are struggling to keep the supply chain smoother as COVID disrupted the global freight system pushing the freight cost up by 350%-500%. In fact, the overall price of raw materials including textiles, chemicals, accessories, and freight costs have significantly increased, but the price trend does not justify such an increase in cost. We believe the freight cost will start to normalize as the global trade is gaining momentum and global economic projections are showing a positive outlook. Though it’s still a volatile time, McKinsey&Co. forecasts that the global fashion industry may start recovering from the end of 2022. I hope our valued buyers will also constructively and responsibly engage with their suppliers as far as price negotiation is concerned to ensure that the story of responsible and ethical sourcing/manufacturing continues despite all the difficulties.

Another important issue to consider is that a temporary shift in sourcing pattern and diversion in order flow is happing as some manufacturing countries are facing difficulties caused by the spread of the virus. At this time, the abnormal rise in export orders could be the possible result of such diversion, so we have to observe the situation, and we should consider the long-term trend before making an investment or expansion decision.

At the same time, we need to keep exploring new avenues of opportunities and the collaboration of our buyers will be crucial. As we prioritize product diversification and innovation, building capacity through technology up-grading and efficiency enhancement, we need to bring our partners, the brands along in this journey which will bring a win-win situation for all of us.

Moreover, let me share an inspiring fact. Though the export of garments has increased, our share in the overall export of Bangladesh has decreased to 80.98% from 84% in 2019. So this means that other sectors have done comparatively better! This is a very positive sign for us in this very challenging time. This also indicates the country’s stride toward sector diversification.

I am sending the RMG export statistics of the past five years in the attachment for your kind information. As the country-wise data is yet to be published, we will send it in another email.

My last note is that since the new variant of Covid is highly infectious, please follow extra precautions, wear a face mask and please continue our efforts to maintain health protocols at home and workplaces.