Fashion & apparel, along with homeware and department stores drove demand in Jul-Dec’23

Bangalore, Mumbai and Pune accounted for nearly 64% of the total absorption in Jul-Dec’23

National – Jan 24, 2024 – CBRE South Asia Pvt. Ltd, India’s leading real estate consulting firm, today announced the findings of its report – ‘India Market Monitor Q4 2023’. According to the report, the retail sector recorded an all-time high leasing in 2023, touching a historic level of 7.1 mn. sq. ft. across eight cities, an increase of ~47% on a Y-o-Y basis. India has emerged as one of the most promising consumer markets, indicating heightened retailers’ interest in new setup, expansion and upgradation of stores. Demand for retail spaces in recently completed malls played a significant role in shaping the overall retail space occupancy during the year, and nearly 30% share in total absorption was led by primary leasing in these malls. Additionally, the total retail supply also reached a historic peak at 6 mn. sq. ft. in 2023, over 316% Y-o-Y increase. This rise in supply can be attributed to the commencement of operations of 12 investment-grade malls located in Bangalore, Pune, Mumbai, Hyderabad, Ahmedabad, Delhi-NCR and Chennai. During Jul-Dec ‘23, nearly 4.9 mn. sq. ft. of new retail space became operational across the major cities.

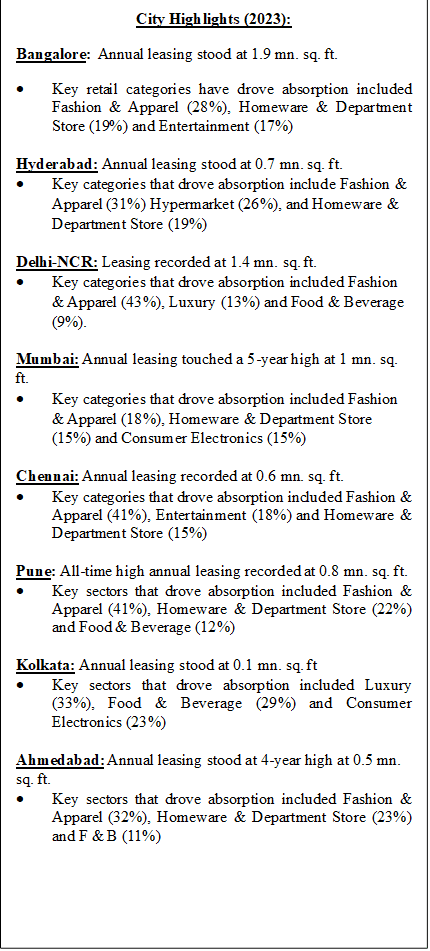

In 2023, the retail sector in India witnessed a surge in leasing activity, with Mumbai and Pune recording 5-year high leasing at 1.0 and 0.8 mn. sq. ft., respectively. Bangalore, Ahmedabad, Delhi-NCR, Ahmedabad, Kolkata and Hyderabad witnessed steady leasing activity.

The retail leasing in 2023 was predominantly steered by fashion & apparel, with a ~32% share in total leasing. This was largely influenced by mid-range fashion value and athleisure brands. Homeware & Department stores accounted for a 17% share, followed by Food & Beverage with a share of 12%, Luxury at a 9% share, and Consumer Electronics at 6% share in overall leasing during 2023.

During Jul-Dec ’23 period, there was a notable increase in space uptake across tier-I cities, witnessing a 67% Y-o-Y increase, totalling to 4.2 mn. sq. ft. The leasing trend in Jul-Dec’ 23 saw an uptick of 43% as compared to Jan-Jun ’23 period when the leasing stood at 2.9 mn. sq. ft. Bangalore led the leasing activity, followed by Mumbai and Pune, contributing to nearly 64% of the total absorption in Jul-Dec ‘23. The anticipation of increased mall supply and favourable consumer spending patterns is expected to encourage expansion among both international and domestic retailers in the future. Jul-Dec ’23 period recorded a significant increase in supply across tier I cities, showing a 389% Y-o-Y growth.

| Key Retail Investments in 2023 | |||

| SECTOR | INVESTOR | INVESTEE | DEAL VALUE

(USD MN.) |

| Retail | QIA | Reliance Retail | 1010 |

| Retail | ADIA | Reliance Retail | 598 |

| E-Commerce | Undisclosed Investor | PharmEasy | 420 |

| Retail | KKR | Reliance Retail | 252 |

| E-Commerce | Multiple Investors* | Zetwerk Manufacturing Businesses | 118 |

Foreign retailers continue to place their bets in India through local partnerships. Canadian lingerie retailer La Vie en Rose made its debut in India in partnership with Apparel Group India and launched its first store in Delhi-NCR in July 2023 and later expanded in Pune and Bangalore. Similarly, Rimowa, a German luxury luggage brand, entered India through its partnership with Reliance Brands and opened its first store in Mumbai. Other notable expansions by international players include French fashion & apparel brand Bugatti Fashion and the American furniture brand West Elm opening their stores in Pune, and American lingerie brand Victoria’s Secret opening stores in Hyderabad and Pune during Jul-Dec ’23 period.

Anshuman Magazine, Chairman & CEO, India, Southeast Asia, Middle East & Africa, CBRE, said, “As we navigate global challenges, the resilient discretionary spending and robust retail consumption, coupled with easing inflationary pressures, is propelling retail leasing activity. In 2023, retail leasing in tier-I cities surged to 7.1 million sq. ft., surpassing the 2019 peak. Constituting around 30% of overall absorption, newly completed malls are pivotal in the total leasing momentum. Key sectors like fashion & apparel, homeware, department stores, food & beverage, entertainment, and luxury are driving this growth. The luxury sector, which saw a 162% increase in 2023, shows a promising trend with the entry and expansion of international brands. This positive momentum is expected to continue, aligning with our anticipation for a similar trend in the years ahead.”

Ram Chandnani, Managing Director, Advisory & Transaction Services, CBRE India, said, “As retail leasing in major tier II cities of India (Chandigarh, Lucknow, Jaipur, Indore and Kochi) surges to 1.2 million sq. ft. in 2023, we witness a transformative shift led by sectors such as fashion & apparel, homeware, entertainment, and hypermarkets, commanding over 70% of leasing activity. The increased demand for organized retail spaces has attracted leading developers and institutional players to these markets, evolving retail formats from vanilla stores to shopping malls, department stores, hypermarkets, and dedicated entertainment zones. Notably, cities with tourism and spiritual significance are becoming focal points as retailers seize the opportunity to establish a presence, enhance brand awareness, foster customer interactions, and create immersive in-person shopping experiences. The trajectory indicates a promising future for retail expansion and innovation in these dynamic markets.”

India Retail Outlook 2024

-Leasing dynamics: Primary leasing is expected to remain steady, given the strong supply pipeline; secondary leasing to take cues from the escalating rentals in key malls and the pressure that may mount on consumer spending going forward.

-Luxury brand gaining traction: Luxury brands are expected to continue strengthening their footprint across various retail formats, including malls, high streets, and premium standalone developments.

–Innovation and In-Store Experience: The retail landscape continues to be in a state of constant evolution, driven largely by innovation. Retailers strive to enhance in-store experiences through technological upgrades, consumer engagement, space redistribution, and personalised services. This is particularly evident in the burgeoning luxury market.

–Consumer spending pattern: Consumer spending and retail sales are expected to stabilize in 2024 in comparison to the previous year. Retailers across categories will need to be realistic around the expected growth in a high inflationary and cautious economic environment.

–Retailers will continue to explore tier II and other markets: Several tier-II cities and other cities of significance for spiritual tourism are likely to witness greater traction as retailers look to tap these high-potential markets to build brand awareness, increase customer engagement, and facilitate in-person shopping experiences.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE: CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world’s largest commercial real estate services and investment firm (based on 2022 revenue). The company has approximately 115,000 employees (excluding Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services.

CBRE was the first International Property Consultancy to set up an office in India in 1994. Since then, the operations have grown to include more than 11,000 professionals across 15 offices with a presence in over 80 cities in India. As a leading international property consultancy, CBRE provides clients with a wide range of real estate solutions, including Strategic Consulting, Valuations/Appraisals, Capital Markets, Agency Services, and Project Management. The guiding principle at CBRE is to provide strategic solutions that make real estate holdings more productive and economically efficient for its clients across all service lines. Please visit our website at https://www.cbre.co.in/