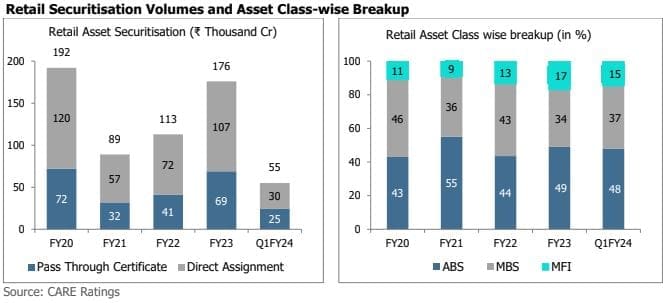

The retail asset securitisation market has experienced its highest volume in the first quarter of the last five years, indicating significant growth and strong market demand. This growth can be attributed to high credit growth, originators’ aim to diversify their funding sources and the increased investor demand for retail Priority Sector Lending (PSL) books. Furthermore, the stable performance of rated transactions during the pandemic, with very few instances of stress, highlights the resilience and viability of securitisation as an investment avenue.

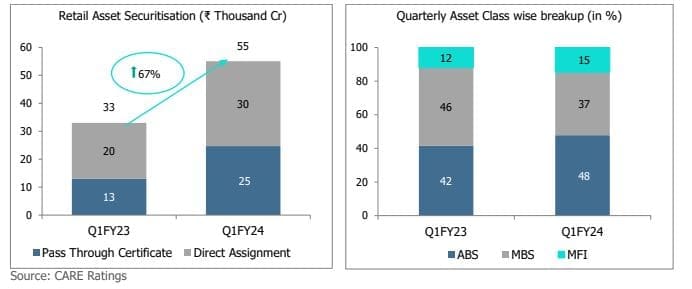

In Q1FY24, the market witnessed a total volume of approximately ₹55,000 crore (according to CARE Ratings estimate), marking a surge of 67% compared to around ₹33,000 crore in Q1FY23. Direct assignment (DA) transactions dominated the overall volumes, constituting around 55% of the securitisation market, while pass-through certificates (PTC) accounted for the remaining volume. This split between DA and PTC transactions has largely remained consistent over the years. Additionally, the volume of wholesale securitisation transactions in

Q1FY24 stood at approximately ₹2,100 crore.

Asset Class-wise Break-up

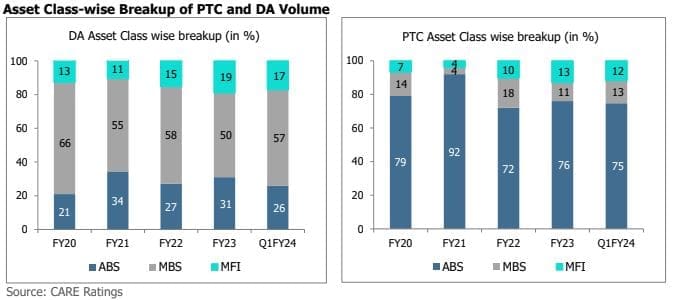

A majority share of the DA volume was contributed by Mortgage-backed securitisation (MBS) transactions, comprising 57% of DAs. Asset-backed securitisation (ABS) and microfinance (MFI) loan transactions constituted

around 26% and 17% of the DA volumes, respectively.

Once again, ABS pools constituted most of the PTC volume, accounting for approximately 75% of the total PTC issuances. Vehicle loan financing made up around ₹15,700 crore (64% of PTC issuance), followed by MBS loans and MFI loans, contributing around 13% and 12%, respectively.

Asset classes such as personal loans and education institution loans have gained greater acceptance among investors in recent times.

New Structures and Preference for Higher Ratings

In last few years, besides plain vanilla timely payment structure, replenishment, timely payment of principal and

interest (TITP) with turbo amortisation, ultimate payment of interest and principal (UIUP) and Partial TIUP & TITP

structures have gained traction. The acceptance of TIUP structure where the interest is promised to be paid to the investor on a monthly basis while the principal is promised to be paid in full by the final legal maturity has been relatively higher. CARE Ratings has also observed that the TIUP structure with turbo/partial turbo amortisation is also finding favour with investors in recent times. Around 21% of the total PTC deals in Q1FY24 had a TIUP structure with turbo/partial turbo amortisation. The market also saw instances of coupons (both PTC and DA) getting linked to floating rate benchmarks, even though the underlying loans in the transaction were fixed-rate loans.

In Q1FY24, PTCs with ratings of ‘AA-’ and above comprised around 83% of total issuances (issue size), a figure

that remained relatively consistent compared to Q1FY23. However, there has been a slight decline in the share

of ‘AAA’ rated issuances, dropping from around 69% to 60% in Q1FY24.

Outlook

With the Monetary Policy Committee keeping the repo rate unchanged in the recent meetings, CARE Ratings expect the disbursement trends for NBFCs and HFCs to remain healthy over the near term, which will support the growth in securitisation market across all asset classes. CARE Ratings believes the influx of new originators into the securitisation market coupled with the growing reliance of the existing originators on securitisation as a fundraising tool, will more than make up for the expected dip in volume due to the consummation of the merger of the HDFC twins (refer ‘Retail Securitisation at ₹1.76L cr – up by 56% in FY23’).