Man-made filaments & fibres (MMF)

Production

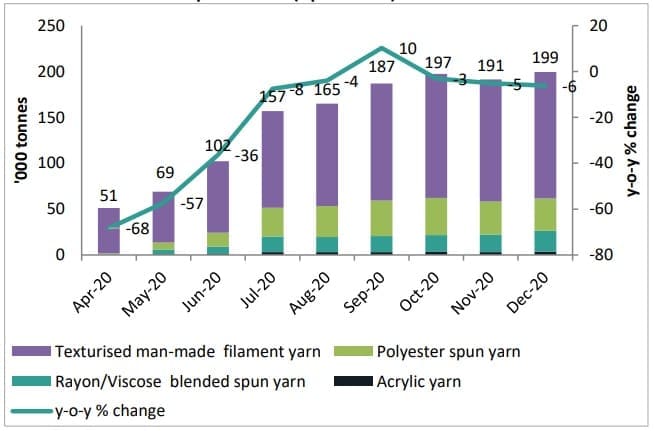

During April-December 2020, output of MMF declined by 18.2% y-o-y to 1,319 thousand tonnes on a cumulative basis. The production had fallen sharply in the initial 3 months of FY21 due to Covid-19 induced lockdown restrictions. In the following months, the decrease in output reduced and, in fact, the production increased by 10.3% in September 2020 backed by easing of lockdown restrictions. In the months of October-December 2020, the output however declined but the fall in production was restricted to the range of 3%-6% during these months. The improvement in MMF output in the past few months is on account of unlocking of economy which is believed to have supported the demand for MMF.

Chart 1: Trend in MMF production (Apr-Dec 20)

Source: CMIE

It is to be noted that MMF here includes texturized man-made filament yarn which has a highest share of 70.8% during April-December 2020 followed by polyester spun yarn (18.2%), rayon/viscose blended spun yarn (9.5%) and acrylic yarn (1.6%). Man-made fibre production primarily includes polyester and viscose. Polyester accounts for a majority of the total man-made fibre output close to 80% and viscose holds a share of about 15% in the total production.

MMF exports

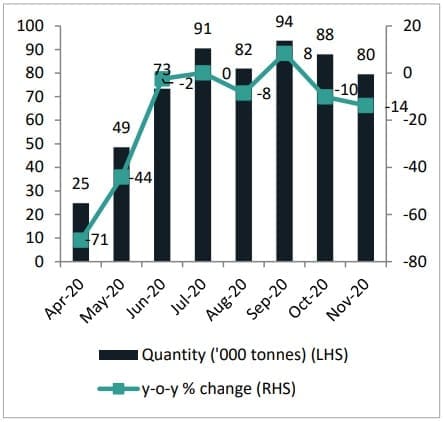

On a cumulative basis, the exports of MMF declined by 17.5% y-o-y to 580 thousand tonnes during the period AprilNovember 2020. The exports which had declined considerably due to Covid-19 disruptions in the initial 2 months of FY21 saw some respite going ahead with the unwinding of global economies and trade. As a result, the decrease in outbound shipments narrowed down in the range of 2%-8% in the following 3 months except for July 2020 where exports remained almost stable at the year ago levels. While exports grew 8.4% in the month of September 2020, the downward trend in outbound shipments continued during October-November 2020 in the range of 10%-14%.

Polyester segment (the most common used textile across globe) which accounts for the largest share in Indian MMF exports contributed to around 90% of the total outbound shipments in April-November 2020 and exports from this segment fell by 20.1% to 520 thousand tonnes during the period. This was mainly due to disturbance caused by Covid-19 in the polyester market. While exports of PSF (polyester staple fibre) increased by 2.6% to 191 thousand tonnes, outbound shipments of PFY (polyester filament yarn) (which accounted for 57% of the total exports) declined by 29.1% to 329 thousand tonnes which dragged down the polyester exports and, in turn, overall MMF exports from India during April-November 2020.

Chart 2: Month-wise trend in MMF exports (Apr-Nov 20)

Source: CMIE

Chart 3: Variety-wise cumulative MMF exports (Apr-Nov 20)

Source: CMIE

Trend in MMF prices

The prices of PSF 1.4 den variety remained range bound (Rs.66-Rs.67 per kg) during April-July 2020 while that of POY 130/34 (POY (Partially Oriented Yarn) is a type of PFY and is made from polyester fibres) declined from Rs.87 per kg in April 2020 to Rs.79 per kg in July 2020 due to Covid-19 disruptions. After this, the prices of both the varieties increased sequentially in each of the months during August 2020 to January 2021 except for POY 130/34 for which the prices remained unchanged in September 2020. The price rise on m-o-m basis was highest in December 2020 as the prices of both the varieties increased by about 12%.

The growth in prices can be attributed to better demand for MMF backed by unlocking of domestic and international markets. Also, the firmness and an increase in raw material prices (which is discussed in the report going ahead) is believed to have led the rise in prices of both the varieties during August-January 2021.

Chart 4: Movement in polyester prices (Rs./kg)

Source: Textile Excellence Note: The prices of both the varieties for the months of November 2020 and January 2021 were available for the date of 12th of the respective month

Trend in feedstock prices (PTA and MEG)

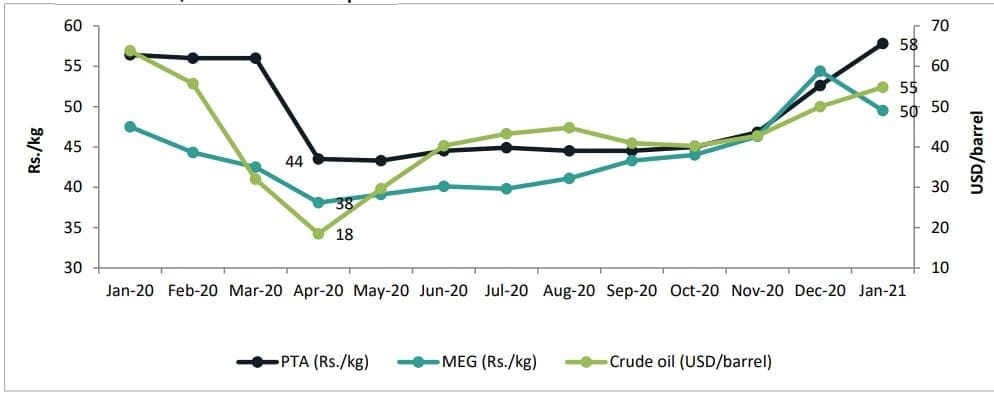

Chart 5: Trend in PTA, MEG and crude oil prices

Source: CMIE

The primary or key raw materials used to make polyester are Purified Terephthalic Acid (PTA) and Mono Ethylene Glycol (MEG). The prices of PTA and MEG had declined in the range of 20%-23% in April 2020 from their levels in January 2020 due to Covid-19 disruptions. The Brent crude oil prices had fallen by a sharper 71.1% to USD 18 per barrel in April 2020 from January 2020. PTA and MEG are derivatives of crude oil and thus their prices are influenced by the movement in crude oil prices.

Later on, while the prices of PTA remained stable at Rs.45 per kg during June-October 2020, the prices of MEG either remained stable or increased by Rs.1-2 per kg during this period. The crude oil prices also had seen some improvement during this period. The prices of both the raw materials grew in November 2020 and increased by 12%-18% in December 2020 backed by improved downstream demand amid lower inventory in China. India is net importer of PTA and MEG and thus the demand-supply situation in the international market have an influence on the domestic prices. In January 2021, while the prices of PTA increased by 9.9% to Rs.58 per kg, the prices of MEG declined by 9% to Rs.50 per kg on m-o-m basis.

With current recovery in crude oil prices (the Brent crude oil prices increased and averaged at USD 59.2 per barrel in the first half of February 2021), the feedstock prices of polyester (PTA and MEG) are likely to see some uptrend which, in turn, may inch up the polyester prices in coming months. In addition to this, some uptick in global textile demand is also expected to provide some support to polyester prices.

Readymade Garments (RMG)

Chart 6: Trend in RMG exports (Apr-Dec 2020)

Source: CMIE

Chart 7: Market-wise exports of RMG (Apr-Dec)

Source: CMIE

The RMG exports had declined by more than 50% in the first 2 months (refer chart 6 above), April 2020 (-91%) and May 2020 (-66%) of FY21 mainly due to the outbreak of Covid-19 pandemic. The fall in exports however receded y-o-y as decrease in outbound shipments reduced in each of the months during June-August 2020 and the exports posted a growth of 10% in September 2020 and 6% in October 2020 backed by unwinding of global economies and international trade. In the following month November 2020, while the RMG exports decreased by a marginal 1%, the outbound shipments fell by a higher 15% in December 2020. Thus, RMG exports on a cumulative basis declined by 28.6% y-o-y to USD 8.2 billion during April-December 2020.

From chart 7 above, it can be seen that exports to the major markets like Europe and USA declined by around 30% to USD 2.6 billion and USD 2.1 billion, respectively, in the first 9 months of FY21. Europe here includes only UK, Germany, France, Netherlands, Spain, Italy, Denmark and Belgium. Also, outbound shipments to the market described as others were down by 30.7% to USD 2.4 billion. It is to be noted that exports to the UAE market however fell by a slower 13.4% to USD 1.1 billion compared to the other 3 markets during April-December 2020 backed by 32.6% growth in RMG exports to UAE in September 2020 and 82%-91% increase in outbound shipments in October-November 2020.

Does India need to strengthen the position in global apparel export market?

USA (one of the largest textile importing nation in the world) announced ban on imports of China’s cotton products made in Xinjiang region at the end of 2020 due to forced labour issues which consequently provides an opportunity to other textile exporting nations including India. However, the share of India in apparel imports by USA was only 4.97% in FY20 compared to the other nations, China held the highest share of around 28%, Vietnam (17%), Bangladesh (7.4%) and Indonesia (5.3%) followed by India.

During the pandemic period, total apparel imports by USA declined by 27.2% to USD 46.2 billion in April-December 2020. Now it is important to note that while USA’s apparel imports from China declined at a rate of 37.9% to USD 11.9 billion, imports from Vietnam, Bangladesh and Indonesia fell by a slower 11% to USD 9.2 billion, 18.5% to USD 3.6 billion and 26.1% to USD 2.4 billion, respectively, during this period. USA’s imports from India however decreased at a faster pace of 35.3% to USD 1.9 billion compared to other nations mentioned above. Also, Cambodia entered the race as USA’s apparel imports from this nation were down only by a marginal 0.1% to USD 2.1 billion. Thus, India needs to beat competition and strengthen the position in global exports in order to gain the benefits of USA’s import ban on China’s cotton products from Xinjiang region or any such other global development. Apart from this, apparel exports from India also faces tough competition from the competitors Bangladesh and Vietnam as they get preferred access to India’s other major market – the European Union.

Some schemes announced by government to promote textile exports

In order to provide support to the exports of textiles industry, the government has announced some schemes which are mentioned below:

- The government has decided to continue the RoSCTL (Rebate of State and Central Taxes and Levies) scheme until such time the RoSCTL scheme is merged with Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme.

- For this purpose, the government has approved ad-hoc allocation of funds of Rs.7,398 crore for FY 2020-21 for issuance of duty credit scrips under RoSCTL Scheme.

- Government has decided to extend the benefit of the Scheme for Remission of Duties and Taxes on Exported Products (RoDTEP) to all export goods with effect from 1st January, 2021.

- Government has also notified a special one-time additional ad-hoc incentive of upto 1% of FoB value to be provided for exports of apparel and made-ups to offset the difference between RoSCTL and RoSL + MEIS@4%, from 7 March 2019 to 31 December 2019.

- In order to boost exports in MMF sector, government removed anti-dumping duty on PTA, a key raw material for the manufacture of MMF fibre and yarn.

- Announcement of Scheme of Mega Integrated Textile Region and Apparel (MITRA) Parks with 7 textile parks to be established over 3 years in the Budget FY22 which will enable textile industry to become globally competitive, attract large investments and boost employment generation.

- MITRA will be launched in addition to the Production Linked Incentive Scheme (PLI) scheme announced for MMF segment and technical textiles for Rs. 10,683crore which will be spread over a period of 5 years.

The effect of these schemes on textile export numbers however can be felt only with their effective implementation and trade pact agreements by India with the major export destinations to ensure smooth textile exports.

Concluding remarks

- With current recovery in crude oil prices (the Brent crude oil prices increased and averaged at USD 59.2 per barrel in the first half of February 2021), the feedstock prices of polyester (PTA and MEG) are likely to see some uptrend which, in turn, may inch up the polyester prices in coming months. In addition to this, some uptick in global textile demand is also expected to provide some support to polyester prices.

- There is an urgent need for India to beat competition and strengthen the position in global exports in order to gain the benefits of USA’s import ban on cotton products from China’s Xinjiang region or any such other global development. To achieve this, effective implementation of government schemes to promote textile exports is must and trade pact agreements by India with the major export destinations are required to ensure smooth textile outbound shipments.