Decorated Apparel Market Outlook from 2023 to 2033

The global decorated apparel market is anticipated to reach US$ 99 billion by 2033. It is estimated to record a steady CAGR of 12.9% from 2023 to 2033. It is likely to rise to a valuation of US$ 29.4 billion in 2023.

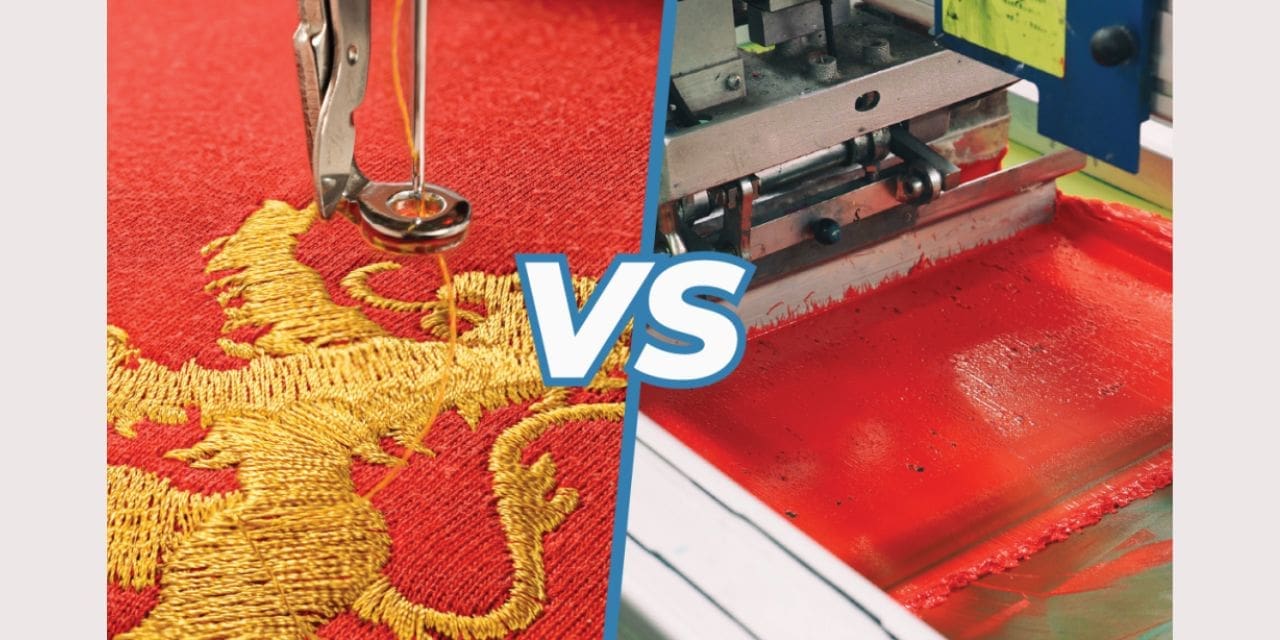

Growing demand for screen printing, embroidery, sublimation, and heat transfer work on garments is anticipated to help grow the global decorated apparel market. The rising demand for reflective finishes on clothing has also allowed businesses in the industry to grow.

Due to changing trends, augmented demand for graphic T-shirts and other apparel will lift product sales during the forecast period. Considering the increasing popularity of designer clothing among customers worldwide, the growing drift of luxury clothing as a status symbol among individuals is endorsing the use of decorated apparel.

The evolution of printing from screen printing to digital printing is significant in the market. Several textile/fabric business vendors are capitalizing on digital printing technology as fabric printing evolves into modern printing practices. The market undercurrents are expected to be meaningfully influenced by technological developments in the digital textile printing sector.

With a rising preference for cotton, silk, and polyester as primary substrates, fabric suppliers bid a wide range of textiles for digital textile printing, impacting the value chain. Several aspects, such as reduced ecological impact and greater customization flexibility, have increased demand for digitally printed garments from business possessors and consumers alike.

High-resolution patterns and prints are becoming progressively popular in the decorated apparel market. The advent of inkjet technology has had a wider impression on fashion seasons, business models, and supply chains.

Several issues challenge the worldwide decorated apparel market, especially in manufacturing. As decorated apparel gains consumers’ attention worldwide, safeguarding product quality and constancy remains an obstacle for the decorated apparel market. Safeguarding consistency is mostly an issue when brands, especially SMEs, are focused on introducing a new product.

Historical Performance of the Decorated Apparel Market

The global decorated apparel market registered an astonishing CAGR of 14.6% in the historical period between 2018 and 2022. It is anticipated to rise at a decent CAGR of 12.9% in the assessment period.

The development of digital printing techniques, such as direct-to-garment (DTG), has revolutionized the decorated apparel market. This makes it possible to print high-quality full-color designs directly onto clothing, expanding customization options. The rapid growth of e-commerce platforms has changed how decorated apparel is sold and distributed. Online stores and marketplaces allow for wider reach and make it easier for consumers to order custom clothing.

In response to increasing environmental awareness, there is a growing demand for sustainable and eco-friendly decorated apparel. This has led to adopting methods such as water-based inks and the custom of organic or recycled fabrics. Customers are increasingly looking for unique clothes. This trend is driven by technological advances, making it easier and more cost-effective for companies to offer customization options.

Software and automation solutions have played an important role in streamlining production procedures, reducing lead times, and improving efficacy in the apparel industry. As consumers expect faster processing times, print-on-demand services are becoming increasingly popular. This allows for smaller production runs without the need for large inventories.

While screen printing remains dominant, the range of decorated apparel has expanded. This includes sublimation printing, vinyl heat transfer, and laser engraving. The growing popularity of activewear has influenced the decorated apparel market. This trend has augmented demand for performance fabrics and specialized trim techniques suitable for sportswear.

Latest Trends, Hindrances, and Opportunities in Decorated Apparel Market

Attributes Latest Trends Growth Hindrances Upcoming Opportunities

Key Factors

· Sustainable and environmentally friendly practices: Growing customer awareness of ecological issues has led to an increasing demand for clothing that is decorated in an eco-friendly and sustainable manner. This includes consuming recycled or organic materials and environmentally friendly techniques and inks.

· Advances in digital printing: Continuous advancements in digital printing technology, such as direct-to-garment (DTG), have made it possible to print high-quality full-color designs directly onto clothing. This gives more flexibility in customization.

· Creative decoration techniques: Besides traditional methods such as screen printing and embroidery, new decorative techniques are emerging. These comprise sublimation printing, vinyl heat transfer, laser engraving, and other innovative methods.

· Print-on-demand and small batch production: The print-on-demand trend allows production to be carried out on a smaller scale, deprived of the need for large inventories. This gives more flexibility to the business and reduces waste.

· Sports and performance wear: The popularity of sportswear has influenced the decorated apparel market. The demand for performance fabrics and specialized decorative techniques suitable for sportswear is increasing.

· Domination of e-commerce: Online platforms and e-commerce markets continue to play an important role in delivering decorated apparel. The ease of online shopping has reshaped how customers interact with this marketplace.

Country-wise Insights

The table below explains the decorated apparel market size and CAGRs of the top 5 countries for 2033. Among them, the United States is anticipated to remain at the forefront by crossing a valuation of US$ 17.2 billion. China is expected to reach around US$ 14.4 billion by 2033, less than the United States. South Korea is anticipated to be followed by Japan, with a value of US$ 5.7 billion and US$ 9.8 billion, respectively.

Surging Popularity of E-commerce in the United States to Boost Demand

The United States decorated apparel market is anticipated to hit US$ 17.2 billion in the forecast period. It expanded at a CAGR of 15.0% in the historical period. Trends in the apparel market in the United States often reflect broader client trends. For instance, an increasing demand for environmentally friendly and sustainable decorating approaches and materials exists.

The market consists of a mix of small local businesses and large firms that operate nationally or internationally. Some highlight specific decorating methods, while others bid a wide variety. Online platforms and e-commerce outlets play an important role in distributing decorated apparel. The ease of online shopping has redesigned how consumers interact with this marketplace.

Research and development is a key focus for textile materials vendors. They are pioneering advancements like conductive fabrics with antistatic properties, antibacterial fibers, and electronic textiles. These are popular materials used to produce creatively decorated apparel in the United States. These factors contribute towards a positive outlook for the decorated apparel market in the country.

The rise of print-on-demand has spurred the development of decorated apparel e-commerce in the United States. According to Forbes, businesses like Printify have seen increased sales through the COVID-19 pandemic due to augmented sales – key highlight being the demand for decorated apparel based on the domestic elections and the pandemic.

Competitive Landscape

Key players in the decorated apparel market are trying to strengthen their presence in the worldwide market by growing production amenities in several regions. The market comprises both global and domestic players. Key market participants focus on new product development and innovation approaches to improve their portfolio offering and brand prominence in the market.

For instance,

· In November 2022, Lynka launched a new division, PODIOM, focused on print-on-demand (POD), the fastest-growing segment of the textile printing market.

· In April 2021, Delta Apparel broadcasted a technology merger with Autoscale.ai to assimilate product design, market listing, and advertising management purposes to improve online retail workflows.

· In February 2021, Hanes announced their partnership with G.O.A.T., a company of Authentic Brands Group, to develop the Muhammad Ali collection as part of its Champion Sportswear portfolio.