Synopsis

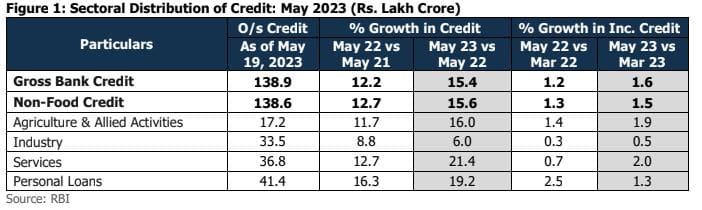

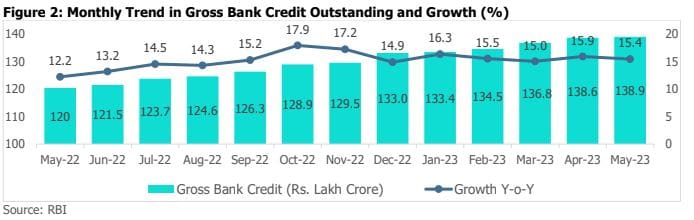

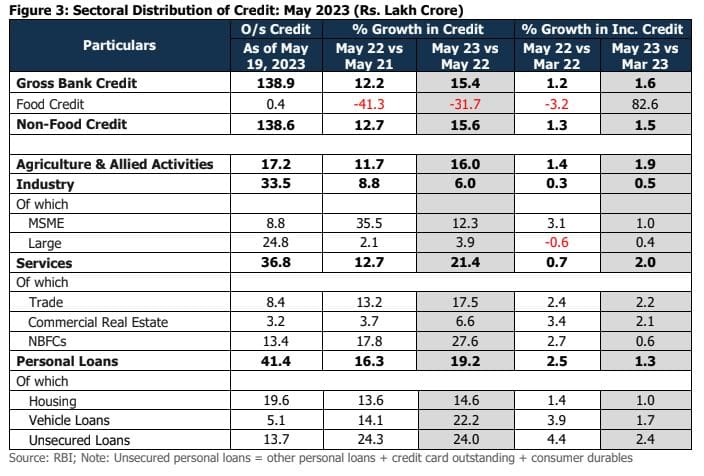

• Gross bank credit offtake witnessed a continued rise of 15.4% year-on-year (y-o-y) in May 2023. The growth was driven by services and personal loans as Non-Banking Financial Companies (NBFCs), vehicle loans, unsecured personal loans1 and retail trade reported robust growth.

o Services segment jumped 21.4% y-o-y in May 2023 as compared with 12.7% a year-ago due to growth in NBFCs, retail trade and other services.

o Personal loans rose by 19.2% y-o-y in May 2023 from 16.3% a year ago, driven by growth in unsecured, housing and vehicle loans loan.

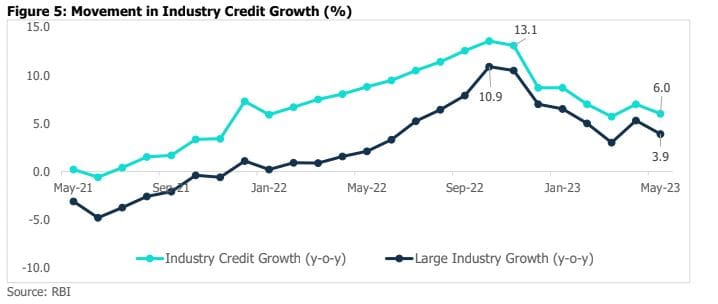

o Industry moderated at 6.0% y-o-y in May 2023 from 8.8% over the year-ago period due to moderate growth in MSME and infrastructure. Infrastructure rose marginally by 1.7% y-o-y against 9.8% in May 2023 as credit for power witnessed a slower rate, road moderated, and telecommunication reduced.

o Agriculture and allied activities segment also rose by 16.0% y-o-y in May 2023.

Summary of Sectoral Performance

Incremental gross bank credit rose by 1.6% in May 2023, vs. 1.2% over the year-ago period. Generally, the

beginning of the fiscal sees marginal growth or drop. The growth was positive and strong for April and also May

2023, which was driven by services and agriculture & allied activities.

Personal Loans Segment

The personal loan segment (largest segment with a 32.1% share) witnessed a robust growth of 19.2% y-o-y in May 2023 due to strong growth in unsecured loans, vehicle, home and education loans.

• Housing loans (share of 47.3% within personal loans) grew by 14.6% y-o-y in May 2023 compared to 13.6% a year ago. Despite reporting healthy growth, the share of housing loans reduced to 47.3% in the personal loans segment as of May 19, 2023, vs. 49.2% over a year ago as unsecured loans grew at a faster pace.

• Vehicle loans (share of 12.3% within personal loans) registered a robust growth of 22.2% y-o-y in May 2023 as compared to 14.1% in the year-ago period on account of strong growth in sales volume. According to the Society of Indian Automobile Manufacturers (SIAM), vehicle sales in all segments improved in May 2023 compared to May 2022. Passenger vehicle sales registered a healthy growth of 13.5% y-o-y in May 2023, while Two-Wheelers also posted a growth of 17.4% y-o-y. Domestic sales of Three-Wheelers grew by a robust 70.4% y-o-y, although on a low base. Outstanding credit for vehicle loans stood at Rs 5.1 lakh crore as on May 19, 2023.

• Unsecured loans reported a robust growth of 24.0% y-o-y in May 2023 due to the granularisation of credit, digitalisation of loans, and preferences for premium consumer products. Its share increased to 33.0% in the personal loans segment as of May 19, 2023, vs. 31.7% over a year ago. Within unsecured loans, credit card outstanding witnessed a robust rise of 29.9% y-o-y to Rs 2.01 lakh crore in May 2023 driven by wedding season and summer vacations. After housing, unsecured loans is the second biggest component in the personal loan segments. Given the strong demand for different personal loan verticals, we anticipate the growth to remain robust for FY24.

• Loans against gold jewellery also witnessed a strong growth of 22.1% y-o-y vs. a drop of 2.2% in May 2022 due to a sharp increase in gold prices in May 2023 vs May 2022. As the price of gold rises, it gives borrowers an additional opportunity to get more credit from the banks with the same quantity of gold.

• Education loans saw a rise of 18.3% y-o-y in May 2023, vs. a growth of 6.1% in May 202. This can be partially attributed to the rise in student visas as a higher number of students opted for foreign education and also growth reported in India.

Services Segment

The services sector registered robust growth of 21.4% y-o-y in May 2023 compared to a growth of 12.7% over a

year ago.

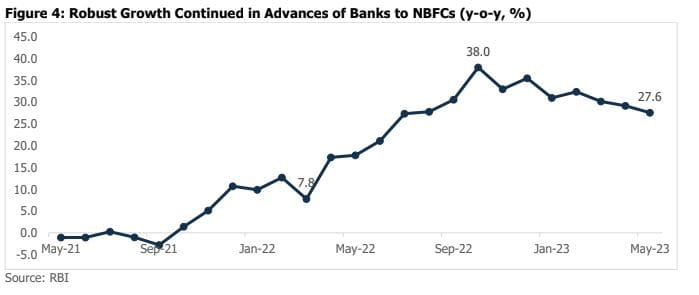

• Lending to NBFCs (within services, the share of 36.4%) grew by 27.6% y-o-y in May 2023 from a growth of 17.8% in May 2022. It was continued driven by healthy growth reported by NBFCs for their loan disbursement and a shift of borrowings to the banking system.

• The trade segment (share of 22.8% within services) grew 17.5% in May 2023 as compared to 13.2% in the year-ago period due to growth in the retail trade (21.8%).

• The growth in services is largely driven by NBFCs, If NBFCs are excluded, the credit growth would have been lower but would have remained robust at 18.1% on a y-o-y basis.

• The growth in services was also led by growth in ‘other services’, which grew by 26.6% on of y-o-y basis compared to 13.4% last year.

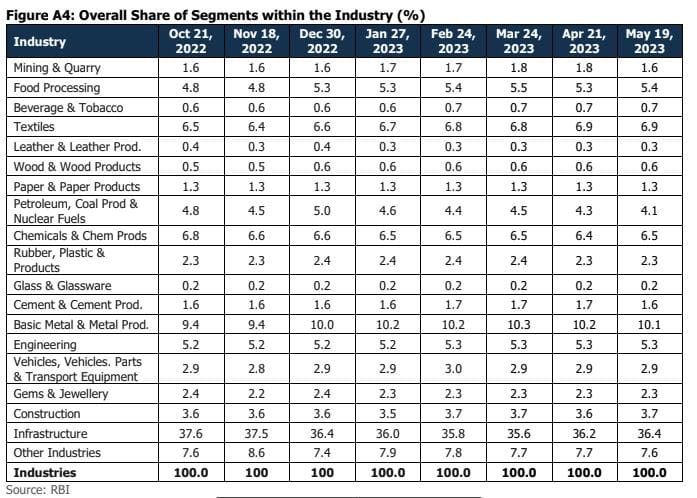

Industry

The credit outstanding of the industry segment (share of 26.0%) registered a moderation in growth at 6.0% y-o-y in May 2023 from 8.8% in the year-ago period. Within the industry, MSME credit growth moderated from 35.5% y-o-y in May 2022 to 12.3% y-o-y in May 2023 due to a high base. The credit to large industries rose by 3.9% y-o-y from 2.1% in May 2022, however, the growth is much lower as compared with other segments.

o The infrastructure segment (share of 36.4% within the industry) rose by 1.8% vs. 9.8% over a year ago period due to a slower growth witnessed by the power and road, also a drop in telecommunication and port segments. Overall, slow growth in infrastructure impacted the industry growth.

o The power segment (share of 50.5% within infrastructure) witnesses a marginal growth of 0.3% in May 2023 vs. 9.3% in May 2022. The banks provided special support to the power plants in the last year summer to pile up coal stocks as it finished due to an all-time high demand for power. The credit offtake for roads also slowed from 17.6% in May 2022 to 5.2% in May 2023, meanwhile, telecommunication declined by 0.8 y-o-y in the same period.

As per the CareEdge Report titled “Infrastructure – Key Driver of India’s Amrit Kaal March”, to meet the demands of India’s growing population and economic development, substantial investments in transport infrastructure are necessary. The budget for overall capex in 2023-24 has seen a significant increase of 33% to Rs.10 lakh crore (USD 122 billion), amounting to approximately 3.3% of GDP. Additionally, the establishment of the Infrastructure Finance Secretariat aims to facilitate private investment opportunities in various sectors, including railways, roads, urban infrastructure, and power.

• Petroleum, coal products and nuclear fuels (share of 4.1% within the industry) witnessed one of the highest growths of 31.0% y-o-y vs. 23.9% in the year-ago period. Working capital requirement for the sector decreased as crude oil prices have come down in the period. Though, credit for term loans increased due to increasing capacities and rise in expenditure for marketing and distribution setups.

• The mining and quarrying, including coal, (share of 1.6% within the industry) rose 17.7% y-o-y vs. growth of 8.2% in the year-ago period.

• Basic metals and products (share of 1.8% within the industry) rose by 16.5% in May 2023 vs. a drop of 2.3% over a year ago period.

Conclusion

The outlook for bank credit offtake continued to be positive due to the economic expansion, rise in capital expenditure, implementation of the PLI scheme, and retail credit push. The growth has been broad-based across the segments. The personal loan segment is expected to continue doing well compared with the industry and service segments. The medium-term prospects look promising with diminished corporate stress and a substantial buffer for provisions. This growth would be coming off a high base in FY23 which would impinge marginally on the growth rate. CareEdge forecast GDP growth of 6.5% in FY24 (revised upwards from 6.1% earlier) from 7.2% in FY23. Hence, based on GDP forecasts sectoral credit growth expectations, and management expectations, CareEdge estimates the credit growth to be in the range of 13%-13.5% during FY24 excluding the impact of the merger of HDFC with HDFC Bank. If we include the merger, the growth is likely to be higher by around 3.0%.

However, elevated interest rates and global uncertainties could impact credit growth in India. Further ebbing inflation could also reduce the working capital demand.

Annexures