Through international partnerships, foreign investments, and market diversification, the export of garments has increased steadily over time. Today, Bangladesh is a significant partner in the export of clothing to the European Union, the United States, Canada, Australia, Latin America, Mexico, the Middle East, and a number of other nations.

In the early 1990s, the European Union was Bangladesh’s top export market for RMG products, but over time, the European Union has eclipsed the United States. More than 90% of Bangladesh’s overall revenue from RMG exports is generated by these two markets (BGMEA and the Export Promotion Bureau websites and Quddus and Rashid, 2000). In terms of its impact on the GDP, employment opportunities for rural residents, women’s empowerment, and socioeconomic advancements, the RMG business has revolutionised the nation over the past 15 years (Hasan et al., 2020; Mostafa & Klepper, 2018; Zaman, 2021). According to Akter 2020 and Chandra & Ferdaus 2020, Bangladesh contributed 6.4% of the global RMG market share in 2020. As compared to several rival nations, such as Vietnam (6.2%), India (3.3%), and Turkey (3.1%), this figure is higher (Hasan et al., 2020; Islam, 2021). The RMG business was able to expand at a steady rate each year thanks to the enormous volume of garment exports.

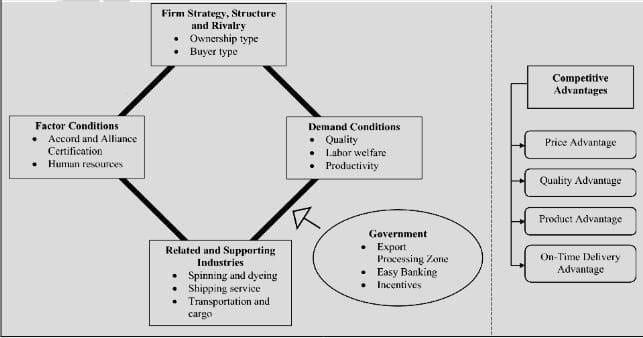

The Porter’s Diamond Model is considered a strategic economic model and explains how or why one country or nation is more competitive in a particular industry than another nation (Liu, 2021; Porter, 1990; Wang & Li, 2020). Porter (1990) found four primary determinants that affect firms’ competitive performance, including (1) factor conditions, (2) demand conditions, (3) related and supporting industries, and (4) firm strategy, structure, and rivalry. The determinants interact with each other to develop national competitiveness for any particular industry (Liu, 2021; Wang & Li, 2020).

Factor Conditions: Physical resources, capital, and human resources like aptitude, drive, cost, and expertise are examples of factor conditions. Cheap labour, a good location, and a good climate can be seen as the primary factor conditions from the perspective of the Bangladeshi RMG manufacturing firm, while communication and infrastructure can be seen as the advanced factor conditions (Hasan et al., 2020; Mostafa & Klepper, 2018; Rahman, 2021; Uddin, 2014; Yunus & Yamagata, 2012).

Demand Condition: The product or service must have a significant amount of domestic demand. As a result, there is pressure to innovate since it affects how businesses understand and address customer wants. A domestic market that is compliant is detrimental because it prevents the industry from driving innovation and excellence. Compared to the global market, Bangladesh’s local clothing demand is substantially smaller. Due to the decreased demand, garment companies are less competitive. The outlook for local garment demand in Bangladesh has also been worse as a result of the steady rise in global demand and the apparel companies’ increased attention to meeting it (Rahman & Anwar, 2007; Islam, 2021; Zaman, 2021).

Related and Supporting Industry: Suppliers and associated sectors may play a role in an industry’s success. According to Liu (2021; Tsai et al. 2021) and Tsai et al. (2002), related and supporting industries are those that are available as suppliers or any other associated industries that help a certain sector develop and become more competitive. The textile raw materials industry, subcontractors, logistics, and financial institutions can all be considered associated and supporting industries in the RMG sector of Bangladesh (Akter, 2020; Islam, 2021). The RMG industry also receives support from the banking and insurance sectors, which provide working capital so that it may meet its contractual obligations (Bhuyan & Oh, 2021; Uddin, 2014). However, because the demand for clothing in Bangladesh has consistently outpaced supply, the country’s textile sector hasn’t provided it with significant assistance. Therefore, the majority of the raw materials used by the apparel sector, such as yarn, zippers, buttons, and labels, had to be imported from other nations, which lengthened the production process and raised the cost of the finished good (Islam, 2021).

Firm Strategy, Structure and Rivalry: According to Porter, home competition was essential for fostering innovation and improved global competitive advantage. In contrast, national monopolies that have been urged by governments to merge in order to reach the necessary critical mass to become a global player have generally failed to do so over the past 20 years, Bangladesh’s RMG sector has gradually evolved its firm structure and business strategy. Since the tragic building collapse in 2013 (Ahlquist & Mosley, 2021; Liu et al., 2019), European retailers have been inspecting and certifying the majority of RMG companies (Accord on Fire and Building Safety certification). A faster delivery process is now made possible by the RMG companies’ improved transportation infrastructure (Islam, 2021).

Figure: Bangladesh’s Emergence as a Ready-Made Garment Export Leader: An Examination of the Competitive Advantages of the Garment Industry, adapted from Porter’s (1990) model.

Government Policy:

Bangladesh is attractive as an apparel-sourcing destination. In 2021, the export value of ready-made garments (RMG) in Bangladesh amounted to approximately 31.46 billion U.S. dollars. This was an increase from the previous year, in which RMG exports in Bangladesh amounted to just nearly 28 billion U.S. dollars (statista, 2023).

Figure: The export value of ready-made garments (RMG) in Bangladesh from 2012 to 2021, Statista, 2023.

Both the 2012 Tazreen factory fire and the 2013 collapse of the Rana Plaza plant brought to light serious issues with working conditions, which caused some foreign purchasers to discontinue sourcing from Bangladesh and forced the United States to revoke its favourable tariff deal. As a result of initiatives started in the wake of the disasters, such as the Accord on Fire and Building Safety in Bangladesh, the Alliance for Bangladesh Worker Safety, and the RMG Sustainability Council, Bangladesh’s RMG sector is currently a leader in transparency regarding factory safety and value-chain responsibility. Numerous dangerous, low-tier factories were shut down as a result of these actions, while many others saw the expansion of their rehabilitation efforts. These actions helped Bangladesh regain its allure.

It was discovered that another government assistance program aiding Bangladeshi RMG enterprises was international banking and financial services. Easy access to banking services for clothing businesses and business loans with low-interest rates were also identified as crucial tools assisting Bangladeshi RMG firms to obtain a competitive advantage. A crucial factor in the development of Bangladesh’s RMG business, according to Alam et al. (2017), is banking infrastructure.

By Nazifa Bashir Leuna

B.Sc. in TE (ADUST, Dhaka), MA in Fashion Business Management (University of Westminster, London)