Author: Sumit Parmar, Wazir Advisors

Goods and Service Tax (GST) rolled out on July 1st, 2017 starting a new era of economic reform in the country. GST subsumed all the central as well as state taxes and brought the country into one single regime thus replacing the complex multiple indirect tax structure. This reform is intended to create India into a single market for manufacturing and selling of goods, bring in greater tax compliance and efficient resource allocation which in turn will help in improving manufacturing productivity.

GST has now replaced Central taxes and duties such as Excise Duty, Service Tax, Counter Veiling Duty (CVD), Special Additional Duty of Customs (SAD), central charges and cesses and local state taxes, i.e., Value Added Tax (VAT), Central Sales Tax (CST), Octroi, Entry Tax, Purchase Tax, Luxury Tax, state cesses and surcharges and Entertainment tax (other than the tax levied by the local bodies).

GST is a destination based tax structure and it is levied only at the consumption point. Under this structure, a merchant has to pay tax only on the value addition of its product and allows manufacturers and retailers to reclaim input tax credit paid during the purchase of raw material thus setting off the indirect tax. This feature eliminates the cascading effect of taxes which used to trickle down to the end consumers.

GST council has approved on five base rates i.e. 0%, 5%, 12%, 18%, and 28% on different goods and services.

GST and the textile industry

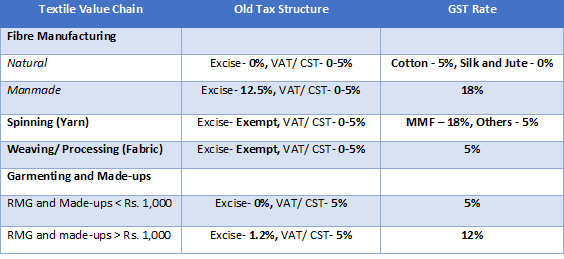

Under the new regime, textile commodities will fall under the 0% to 18% tax cloud. The below given table illustrates the change in the tax structure at different segments in the textile industry:

Table 1: Tax Structure in Textile Value Chain

On comparison between the two duty structures, cotton value chain which was exempted of any excise duty (exclusive of VAT/CST) will now have to pay a minimum of 5% duty across different segments. While in case of MMF value chain, which was earlier paying 12.5% excise duty on fibre and yarn level (exclusive of VAT/CST) will now pay now pay 18% GST for the same. This indicates that the textile industry will be paying higher taxes overall.

Textile industry faces a unique issue in the presence of a differential duty structure both in different fibre value chains and within specific value chains also. This situation was prevalent in the earlier tax regime and is still relevant for the new GST regime. The result of such a structure is the accumulation of duty at a certain point in the value chain wherein the duty paid on the input is higher while the duty on the output is comparatively lower. This accumulated duty is embedded in the cost of the final product by the seller as he/she is unable to set off the input duty which in turn leads to higher prices.

Now, with the onset of higher duties, the quantum of duty accumulation will increase which will lead to further increase of prices.

To analyze these implications, four basic value chains have been considered which encompasses the majority of textile production in India.

- 100% Cotton Value Chain

- MMF Rich Blended Value Chain – PC (65/35)

- Cotton Rich Blended Value Chain – PC (48/52)

- 100% MMF Value Chain – PV (50/50)

Implications on 100% cotton value chain:

Cotton textile value chain attracts a singular rate of 5% across the value chain except on cotton garments with retail value of more than Rs. 1000 per piece. Due to a constant duty rate being charged on subsequent products (with higher value addition) across the value chain, there will be no duty accumulation. At each stage of this chain, manufacturer will be able to avail input credit on the purchase of raw material and will only pay duty for the value addition. Due to the balanced tax structure, prices of intermediate products (i.e. fibre, yarn and fabric) are not expected to increase. However, on the retail end of the chain, prices of cotton garments (value more than Rs. 1,000) will rise due to higher duty paid by the retailer.

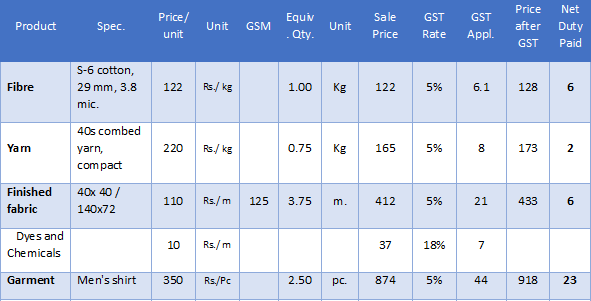

Table 2: Scenario for 100% Cotton Value Chain

The above shown table represents duty flow in a 100% cotton value chain, taking 1 kg of cotton fibre and further converting it into subsequent products. At retail level, retailers keeping price points above Rs. 1,000 per garment will have to pay approximately 4 times higher net duty to government as compared to garments sold at price points below Rs. 1,000.

This will lead to the following two scenarios:

- Dip in prices of low cost garments below Rs. 1,000 per garment so that they are subjected to 5% rate

- Increase in prices of high cost garments above Rs. 1,000 per garment as they will attract significantly higher duty rate of 12%

Implications on MMF Rich Blended Value Chain:

This situation is particularly complex for 100% MMF and MMF blended value chain as there is significant variation in the tax rates at fibres/yarn (18%) and fabric level (5%). This duty differential will create a higher tax incidence on fibre and yarn level than on the successive value chain segment i.e. fabric which will lead to duty accumulation at the weaving stage.

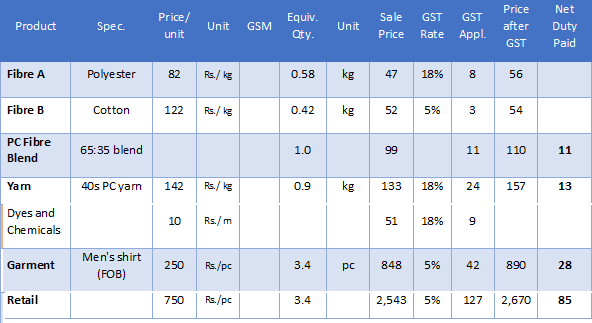

Table 3: Scenario for MMF Rich Blended Value Chain

Source: Wazir Analysis

The above shown table represents duty flow in polyester cotton (65/35). The applicable duty at finished fabric level is smaller than the cumulative duty paid on the input raw materials i.e. fibre and yarn resulting in a net negative duty. This means that weaver will not be able to reclaim full input credit on purchase of yarn and hence the weaver will increase the price of fabric in order to mitigate the loss. This increase in fabric prices will further reflect in the increased prices of MMF blended garments.

Implications on Cotton Rich Blended Value Chain:

Duty structure under this chain will be such that duty accumulation will occur at both yarn and fabric stage. As mentioned earlier, a cotton rich value chain will attract 5% duty rates at all levels (i.e. fibre, yarn, fabric etc.), however, due to addition of MMF at the fibre stage, the net duty at that level will become greater than at the subsequent yarn stage which will trickle down to fabric also.

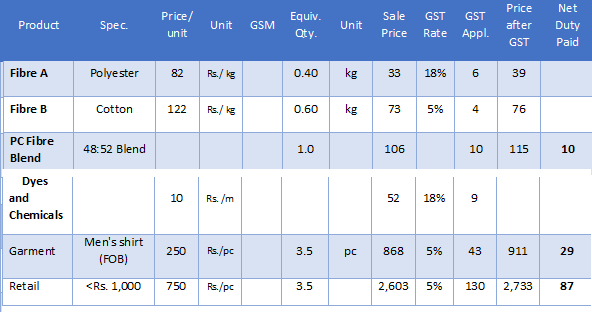

Table 4: Scenario for Cotton Rich Blended Value Chain

Source: Wazir Analysis

This situation will result in blended yarn manufacturers keeping MMF component on the higher side in the blend composition as compared to the cotton component in order to avoid duty accumulation at this stage. This might also result in an increase in both yarn and fabric prices to offset the accumulated duty loss.

Implications on 100% MMF Value Chain:

A 100% MMF value chain will face the implication as that of MMF rich value chain wherein there will be duty accumulation at the fabric stage.

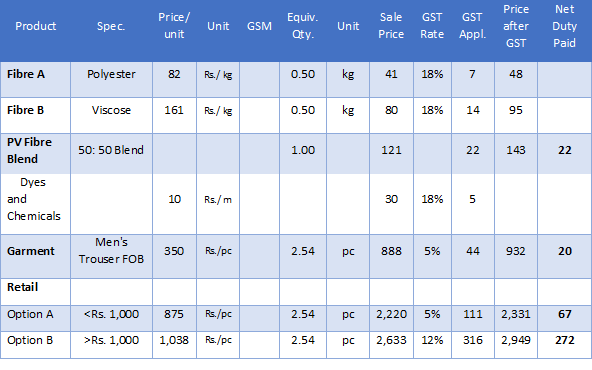

Table 5: Scenario for 100% MMF Value Chain

Source: Wazir Analysis

To set off the higher duty paid on raw material i.e. yarn, weavers will increase the prices of fabric which will further result in increased garment prices.

Conclusion

As per its defined objectives, GST will have a positive influence on the textile industry in terms of eliminating distortions in the tax system, reducing compliance for industry, facilitation of input tax credit etc. However, GST has failed to resolve the issue of differential duty structure in the industry as well as the issue of fibre neutrality. Duty accumulation was an issue for the MMF industry earlier also, however, with the increase in the duty rates, it will become more prominent and it will lead to a likely increase in the prices of finished goods.

For further information, please connect at:

sumit.parmar@wazir.in