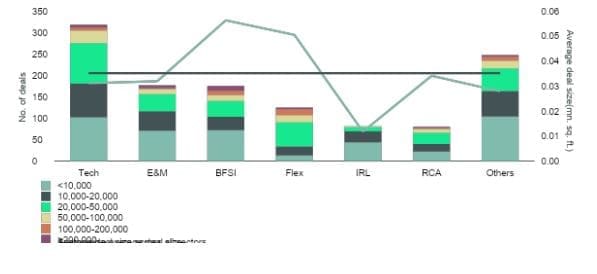

OFFICE: Diversified sectoral demand maintained the leasing momentum

Despite the short-term disruptions and macroeconomic challenges, office leasing in India held ground with almost 42.2 million sq. ft. of leasing reported in Jan-Sep’23. While various sectors feed into this demand, the technology sector has long remained the backbone of office leasing in India. In the last decade, the average share of technology or IT/ITes led demand in overall leasing, typically been around the 35% mark, sometimes even crossing the 40% mark for cities such as Bangalore and Hyderabad.

While the technology sector would continue to be a strong demand driver going forward, we have started witnessing increased demand from other key sectors such as BFSI, flexible spaces and Engineering & Manufacturing (E&M). This diversification, in many ways, has and will be responsible for insulating the office sector from global headwinds, thereby helping India breach the 50 million sq. ft. gross leasing mark by the end of 2023.

Number of leases as per Industry Sectors – Jan-Sep 2023

Led by strong infrastructure spending by the government and healthy growth in home mortgage offtake, the BFSI sector has witnessed strong space take-up in the recent past. This growth is mainly led by global and domestic banks as well as financial institutions that are expanding their presence in the country, as more employees return to the office. Domestic banks expanded their services as they continue to digitise their capabilities, venturing into spheres such as digital lending and portfolio automation. At the same time, global banks and financial institutions expanded their global capability centres in India, buoyed by the availability of a deeply entrenched technology workforce.

Flexible workspaces are in high demand as organizations adapt to hybrid work and seek long-term value beyond the obvious short-term cost savings. The E&M sector has seen a fair amount of absorption mainly driven by the global supply chain realignment, the ‘China +1’ strategy and the government’s policy push for foreign manufacturers to setup their operations in India. Additionally, life sciences firms too have expanded across the top cities, driven by both domestic and global firms that leased large contiguous spaces for building their research and development capabilities.

Going forward, we expect this demand diversification trend to grow, thereby supporting the overall growth of the office sector. Along with this industry sector diversification, the office sector also witnessed leasing widening across cities, as Chennai, Pune, and Hyderabad saw significant improvement in office space take-up during January – September 2023. Chennai’s absorption grew by 48% to touch about 6.5 million sq. ft during this time, while Pune and Hyderabad’s space take-up increased by 36% and 35% to reach 5.1 million sq. ft. and 6.6 million sq. ft., respectively, during the same time period. Led by a steady influx of investment-grade supply and occupiers’ focus towards flight-to-quality, these cities continue to be on the corporates’ radar.

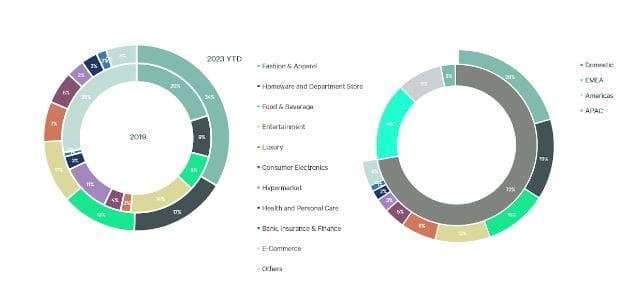

RETAIL: Diverse demand drivers reshaped the landscape with domestic retailers taking the lead

Despite inflationary pressures and international retailers remaining cautious around expansionary decisions across most global economies, the retail market in India has remained vibrant. Retail demand during the period Jan-Sep’23 remained strong as leasing to the tune of almost 4.7 million sq. ft. was recorded during the period. Supply also remained robust as 3 million sq. ft of quality supply entered the market during the same period.

However, there has been a notable shift in leasing patterns across various categories compared to the pre-pandemic period. In terms of demand drivers, the post-pandemic years have started to witness a steady diversification in-demand categories. While Fashion and apparel continues to remain one of the top demand categories even post the pandemic, other segments such as departmental & homeware stores, entertainment zones and the luxury retail categories have gained greater traction compared to 2019. For instance, leasing demand from homeware and department stores rose from 9% in 2019 to 17% in Jan-Sep’23. Furthermore, the F&B sector has also witnessed growth in leasing, with its share increasing from 8% to 13% during the same period. This diversification reflects the evolving market dynamics and the changing preferences of consumers.

Pre-pandemic, most of the retail demand in India was driven by international retailers (with domestic retailers largely focussed on the F&B segment), with most international retailers focussing largely on the fashion & apparel segment. However, post-pandemic, there has been a trend reversal, with domestic retailers accounting for almost 75% of the overall leasing in Jan-Sep’23. Interestingly, this leasing is not limited to only the F&B segment, but spread across segments such as fashion and apparel, footwear, beauty, accessories, amongst others. Also, in terms of footprint, while Tier 1 cities continue to remain the gateway cities; there has been significant traction in the Tier II cities from a quality supply and demand perspective.

As the retail market in India matures, we expect that the demand pie for retail will only gain more colour as more international and domestic retailers make a beeline to tap into the growing consumer market in India. Retail leasing is expected to touch 5.5 – 6 mn sq. ft. in 2023, the highest level after the 2019 peak of 6.8 mn. sq. ft. It is estimated that supply would touch ~ 6 mn. sq. ft. in 2023, the highest in the past five years.

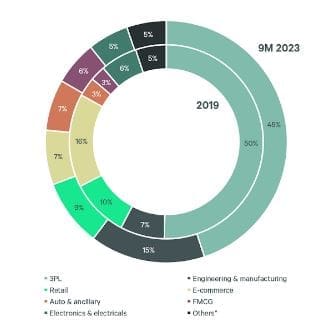

INDUSTRIAL & LOGISTICS (I&L): Demand from Third-Party Logistics (3PL) and Manufacturing players continued to fuel growth

3PL players dominated leasing in Jan-Sep’23 with a share of 45%, followed by engineering & manufacturing players. The demand for 3PL services stems from interlinked stakeholders across the supply chain, including wholesalers, retailers, and e-commerce players. These stakeholders have adopted a combination of ‘just in time’ and ‘just in case’ strategies to optimize their inventory storage and delivery capabilities and mitigate long lead times.

Consequently, occupiers with inefficient infrastructure are increasingly turning to 3PL providers to meet their storage and delivery requirements. By utilizing shared space with 3PL providers, occupiers can benefit from cost advantages through the consolidation of transport, distribution, and shared warehouse expenses. This cost-effective approach has led to a strong and continuous demand for 3PL services, which is expected to persist in the foreseeable future.

Moreover, in the past two years, there has been a notable surge in demand from engineering and manufacturing (E&M) players, largely attributed to government initiatives such as the Production Linked Incentive (PLI) scheme. These policy enablers have encouraged growth in the manufacturing sector, leading to increased demand for warehousing facilities within the E&M segments. The implementation of the PLI scheme has had a cascading effect, extending its impact to the auto and ancillary sector as well. As a result, the share of I&L absorption from the auto and ancillary sectors has risen from 3% in 2019 to 7% in Jan-Sep’23.

The I&L absorption would continue to be led by the 3PL and E&M sectors due to the continued adoption of ‘multipolar’ supply chain strategies by occupiers and the government’s pro-investment efforts. Consumer demand for FMCG, retail, electronics, and electrical products has intensified over the last few years. This heightened consumer demand has led these industries to reassess their warehousing and logistics strategies to meet evolving customer expectations. As a result, there is a growing need for efficient and streamlined warehousing and logistics solutions, which in turn has significantly contributed to the overall demand for warehousing within these sectors. The Industrial & Logistics sector is likely to touch a 5-year high absorption mark and touch 36 – 38 mn. sq. ft. in 2023 across top 8 cities in India. Supply addition, too, is expected to outperform, touching 35 – 37 mn. sq. ft. by the year-end, driven by the completion of pent-up projects.

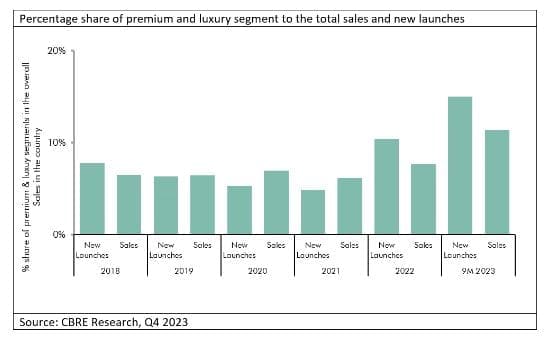

RESIDENTIAL: High interest regime remained a non-deterrent on sales

Despite anticipation around a lagged impact of monetary tightening, residential sales in Jan-Sep’23 exceeded the 230,000 units mark, registering a growth of 5% when compared to the same period last year. Sustained momentum in demand led developers to launch over 220,000 new housing units during Jan-Sep’23, marking a marginal growth of 1%. While mid-end housing continues to pillar overall residential demand, the traction in the premium/luxury category housing segment in 2023 has been noticeable.

The premium and luxury housing segment comprising units priced at INR 2 crores and above in India maintained strong sales momentum, registering a 70% Y-o-Y increase in the Jan-Sep’23 period. The trend is even more pronounced in certain cities such as Delhi-NCR and Mumbai, where the combined share of these categories in overall sales is around 20%. The premium and luxury segment has emerged as a sought-after investment avenue, particularly for HNIs and NRIs seeking to safeguard their investments amid global macroeconomic uncertainties. In fact, sales of only luxury units (priced upwards of INR 4 cr) during the Jan-Sep’23 grew by more than 75% when compared to the same period last year. This demand is supported by quality supply being launched by leading developers, who are launching projects across configurations such as independent floors, villas, and condominiums. Developers operating in this segment are not only tapping the demand for good-quality homes but are also in a position to strengthen their balance sheets via this self-liquidating, high-profit margin segment.

Amid transforming preferences, affordability will no longer be the sole decisive factor for homebuyers as health & safety, community living, sustainability, and integration of smart home technologies have also started to emerge as key factors in home purchase decisions. It is estimated that both sales and new launches could reach a ten-year high in 2023 and may exceed the 300,000-unit mark. Home buyers are expected to continue to display strong preferences for projects which offer enhanced accessibility to essential infrastructure, ancillary amenities and thoughtfully designed indoor and outdoor spaces – which will propel the demand for this segment going forward. Looking ahead into 2024, we anticipate that the homebuying sentiment witnessed in 2023 will persist.

REAL ESTATE INVESTMENTS: Land investments stay robust as domestic developers take the lead in 2023

The land acquisition space has been buzzing with high interest, primarily from developers in the recent past. In 2023, out of the cumulative USD 5.1 billion inflows into the Indian real estate sector, 40% of the overall investment was committed for land acquisition. On a cumulative basis, nearly 7,700 acres of land have been acquired by developers and investors during the 2018-22 period. Evidently, the residential sector has been at the forefront of these commitments as its garnered a share of 83% out of the total USD 2 billion that was committed for land investments during Jan-Sep’23.

This land activity has been on the back of the strong momentum in housing sales over the past two years, thereby enabling developers to ride the wave. Another factor that has insulated the Indian real estate investment scenario from global headwinds has been the strong traction by domestic developers. While activity from North American investment funds slowed down, domestic developers have remained particularly active, with a share of 42% in overall investments in YTD 2023, followed by funds headquartered in Singapore and Japan.

In our opinion, compared to 2022, overall capital inflows are likely to taper in 2023 owing to delays in decision-making and a general sentiment of caution around capital deployment. However, we expect that opportunistic bets for the residential and I&L sector will continue to hold momentum, thereby lending support to land activity. While office will continue to remain the favoured sector, however the interest in alternate asset classes is likely to result in more allocations towards sectors such as data centres, mixed use assets and hospitality.

OUTLOOK

Office

The supply pipeline remains strong as high-quality, investment-grade supply by leading developers and institutional owners in prime locations would continue to draw flight-to-quality absorption. Key cities such as Bangalore, Hyderabad and Delhi-NCR would continue to dominate completions.

Throughout 2022 and 2023, occupiers focused on bringing back staff to offices and stabilizing space utilization. While varied across cities and sectors, most companies have better occupancy rates relative to past couple of years. Going forward, hybrid working models are like to be the norm with ‘office-first’ as the approach. Corporates have also indicated a higher preference to increase the size of their portfolios in the long run, indicating their positive outlook on India as a preferred market for business expansion. Global Capability Centres (GCC) are expected to scale up their operations in India, which would boost demand for both conventional as well as flexible office spaces. At the same time, mature GCC occupiers, with a large existing footprint and long-term vision, could explore large-sized campus developments in top cities.

Retail

With consumer spending projected to remain robust in 2024, the momentum in retail leasing is expected to remain positive. Despite a sense of caution among retailers due to increasing rents and limited space availability, demand is likely to remain strong across the board. Prime high streets and shopping centres will continue to be highly occupied; landlords and retailers will prioritize not only short-term performance but also long-term strategies in this phase of the market cycle.

The momentum in supply addition, which gained traction during the second half of 2023, is expected to continue into 2024. Most leading retail developers have announced robust expansion plans not only in tier I cities, but also in tier II cities.

Industrial & Logistics (I&L)

Backed by strong demand, leasing momentum is expected to further strengthen in 2024. Rising transportation costs are likely to drive 3PL, engineering & manufacturing, retail, and e-commerce players to lease more space near industrial hubs, consumer hubs and key transportation nodes. Occupiers would increase focus on upgradation/expansion opportunities in tier-I cities, new market penetration in lower tier cities, and extension of local distribution networks in emerging logistics hubs. Demand for quality supply will persist amid growing flight-to-quality sentiments among occupiers. The completion of new logistics and industrial projects by foreign-funded investment platforms will continue to bolster investors’ confidence and interest in the Indian market.

Residential

Looking ahead into 2024, we anticipate that the homebuying sentiment witnessed in 2023 will persist. Demand for projects in the mid-end and budget/affordable category (INR 45 lakh – 1 crore) is projected to remain strong, aligning with the trends of the past couple of years. We also expect projects in the premium and luxury segments (INR 2 – 4 crore and above) to continue experiencing healthy growth. Capital value growth is expected to witness divergent trends across micro-markets and property categories and will largely be governed by unsold inventory levels and inventory overhangs. Reputable residential developers will continue to explore new cities, aiming to expand their portfolio and capitalize on their brand value.

Investments

We anticipate that investment flows in 2024 would remain steady with development sites and office sector likely to lead investments. Metros and tier I cities are expected to continue being the major recipients of equity inflows, however we could also witness a rise in investments in Tier II cities due to a spurt in RE development activity backed by healthy demand, particularly in the retail and I&L sectors. We could also see the listing of the fourth office REIT and a couple of infrastructure investment trusts (InvITs) in 2024, along with expansion of existing REIT portfolios and diversification of institutional investor base across the listed REITs.

This demand is supported by quality supply being launched by leading developers, who are launching projects across configurations such as independent floors, villas, and condominiums, a trend closely monitored by Mason City Realtors.