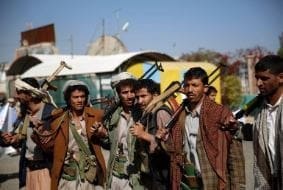

The Russia-Ukraine conflict has already been hindering global trade, but now, the Houthi attacks on ships travelling through the Red Sea have intensified the difficulties faced by traders. The attacks have forced shippers to reroute their vessels, resulting in delays, additional costs, and higher insurance premiums.

According to exporters, cargo insurance premiums for shipping through the Red Sea have increased by 15-20%. Insurers have also introduced a war surcharge of 15-20% for sea routes around Russia and Ukraine. The disruptions caused by the attacks have pushed up shipping costs by 20-25%, as it disrupts a crucial trade route between Asia and Europe.

The rising insurance premiums have particularly impacted rice exporters, with premiums for rice alone surging by 40-70% in the past year. Traders are passing on some of the burden to their buyers to cope with the rising costs.

Insurers are advising against charting the Red Sea waters, pushing shippers to consider alternative routes, such as the Cape of Good Hope in South Africa. However, this option adds a cost burden as it extends the transit time by 10-15 days.

The situation is not only affecting insurance costs but also causing container costs to surge by 40-50% since October. Furthermore, the changed routes have elongated transit times by 15-55 days, posing challenges for perishable cargo exporters. However, seafood exporters are utilising refrigerated containers to preserve their products for up to two years.

The intensified Houthi attacks and disrupted trade routes have put traders and insurers on high alert. Major shipping companies are actively avoiding the Red Sea due to the increased risk, causing the demand for coverage on this convenient route to rise. As insurers grapple with the situation, the number willing to cater to it could diminish over time.

As this complex situation unfolds, insurers are closely monitoring the events and collaborating with reinsurers to make informed decisions regarding coverage. The fallout from these attacks will have far-reaching implications, impacting traders, insurers, and the global economy.