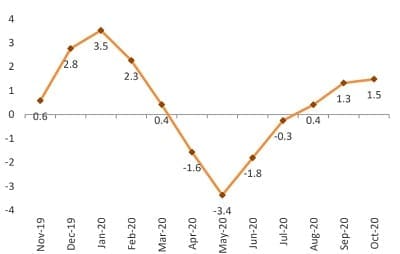

Wholesale inflation firmed up to 9-months high of 1.6% in November 2020 compared with 0.6% in November 2019 and 1.5% in the previous month. CARE Ratings’ had estimated wholesale inflation at 1.8% for the month. Wholesale inflation has been registering a gradual pick-up in the last 5 months reflective of improvement in the pricing power of the

manufacturers. The build-up in wholesale inflation for the month can be ascribed to inflation in the manufacturing basket (weight of almost 2/3rd in the WPI basket) which has risen to a near 2-year high. This pick-up has been chiefly driven by firming up of global metal prices. However, cooling down of wholesale prices in the food basket and persistent deflation in the fuel component capped the upside.

Chart 1: WPI based inflation (YoY%)

Source: Office of Economic Advisor

Highlights

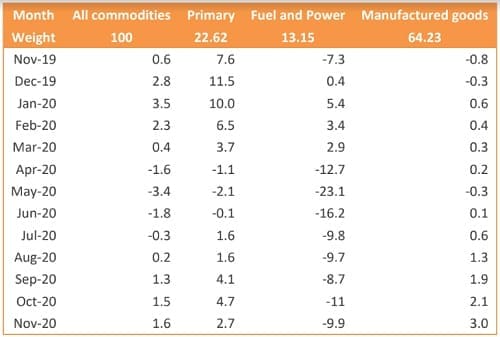

- The inflation in primary articles, having a weightage of 22.62% in the WPI basket, narrowed to 2.7% in November 2020 compared with 4.7% in November 2019 and 7.6% in the corresponding period previous year.

- Inflation in the food basket declined to 3.9% in November 2020 compared with 6.4% in November 2019. This sharp decline can be partially attributed to a high base effect.

– The decline in wholesale price inflation in the food basket has been on account of persistent deflation in cereals (-5.5%), wheat (-10.1%) and fruits (-3.8%).

– Double digit inflation in pulses (13.1%) and vegetables (12.2%) owing to supply chain disruptions and seasonal variations limited the downside in the food WPI.

– Inflation in potatoes continues to remain in triple digits (115.1%) for the 3rd consecutive month and this is the highest inflation since the inception of 2011-12 series. Potato prices were affected due to crop loss owing to reduced sowing area, supply of inferior quality seeds and inadequate stocks.

– Non-food articles registered a sharp increase in WPI to 8.4% in November 2020 compared with 2.8% in November 2019. This increase has been on account of pick-up in wholesale prices of oil-seeds.

– Crude petroleum and natural gas prices remained in a deflationary zone supported by benign global crude oil prices.

- Inflation in fuel and power registered deflation for 9th consecutive month at -9.9%, marginally higher than a month ago.

- The inflation in the manufactured products reached a near 2-year high of 3% in November 2020 compared with 2.1% in the previous month and (-)0.8% in the corresponding period a year ago. Further opening up of the global economy and higher demand for metals has led to firming up of global metal prices.

– Out of 14 industries, 11 industries witnessed positive WPI which includes basic metals (7.2%) and food products (5%). The pick-up in food products has been on account of rise in vegetable and animal oil fats (23.2%)

– 3 industries have recorded negative growth: textiles, leather and paper and it is less than 1%.

– WPI of chemicals (1%) and rubber (2.9%) have seen a perceptible pick-up in November 2020 from the previous month.

CARE Ratings’ View:

Wholesale prices will continue to see a pick-up in the coming months, especially in the manufacturing segment owing to firming up of global metal prices following the opening up of the economy. The recent surge in global crude oil prices will also narrow the deflation in the fuel and petroleum segment. Food prices will come down going ahead as kharif crop enters the market. However, the farmer’s protests in North India could disrupt supplies to some extent and limit the downside.

Table 1: Wholesale price Inflation (yoy%) for select commodities in November 2020

Source: Office of Economic Advisor