The production of the Textile Engineering Industry (TEI) recorded a marked jump of 130% to Rs.11700 crore in 2021-22 as against Rs.5,095 crore achieved during 2020-21 and its capacity utilisation was 94%, according to the Textile Machinery Manufacturers Association’s (TMMA).

The fiscal year 2021-22 would be regarded in the years to come as one of the best performance years of the entire textile and the textile machinery industry in the last several decades. A 130% rise in production, 94% capacity utilisation, 58% jump in exports and a 14% rise in the installed capacity that was stagnant for almost a decade are the highlights of the year 2021-22.

Though the year started on a gloomy note when the second wave of the deadly Covid-19 pandemic broke out across the globe causing fresh disruption. It appeared that the renewed lockdown measures to contain mass population, industry and the institution from contracting the pandemic didn’t yield much result as there were mixed reactions from different quarters of the polity, community and decision makers globally on the issues of sustaining lives versus economies.

While the developed countries including India were successful in developing the Covid-19 vaccine and initiating the mass vaccination programs, the rate of inoculating the populace proved insufficient. The coming quarters in the new fiscal year looked gloomy, but the industry proved all that wrong, as the entire value chain across the markets globally performed exceptionally well barring a few segments. The Government of India continued on the previous year’s strategies and action plans for business continuity, sectoral revival and further improving ‘Ease of Doing Business’ in the country.

The Office of the Textile Commissioner coordinated and processed the ATUF Scheme efficiently, barring a few months of complete lockdown. Majority of the cases related to the enlistment of textile machine manufacturers, induction of new machine types in the ATUF scheme and the release of ATUF subsidy were cleared on time. A total of 19 Internal Technical Committee (ITC) meetings chaired by the Joint Textile Commissioner, 4 Technical Advisory Committee Meetings (TAMC) meetings chaired by the Textile Commissioner, and 1 Inter Ministerial Standing Committee (IMSC) meeting chaired by the Honorable Minister of Textile; were held during the year. However, the uncertainty prevailed in the industry about the lack of information on continuation of ATUF Scheme after 31st March 2022, when the scheme concludes.

The Textile Machinery Manufacturers Association worked closely with Kalam Institute of Health Technology (AMTZ Vishakhapattanam) and Invest India both of whom conducted separate studies on the Indian Textile Engineering Industry (TEI) under the aegis of ‘Ministry of Textiles’ during the year. The KIHT conducted a ‘Technology Gap Analysis in the Indian TEI’, and Invest India published an Opportunity Paper covering the Textile Machinery Industry in India. Written in association with TMMA, it showcased India’s strengths in Textile Machinery to both global and domestic players and highlight the opportunities and advantages of investing in the Indian TEI.

While the KIHT’s report didn’t draw much attention of the industry, the Invest India’s Opportunity Paper encouraged the industry to present their capabilities, challenges and future aspirations. Inspired by the report’s mass appeal the industry requested the association to work with Invest India again to bring out segment specific papers that would enable both the MHI and MoT to bring out suitable policies/ schemes for the industry.

As the ATUF Scheme would end on 31st March 2022; the time would be ripe to map the prospects of the textile and textile engineering industry. Earlier, the Government had launched the ambitious schemes such as Technical Textiles, PM MITRA, and PLI for the textile industry. However, it was felt that the MSMEs and the Textile Machinery Industry should also be brought under similar schemes for the technology development and import substitution to promote “Make in India”.

The association worked closely in this regard with the MoT to prepare a draft for ‘Textile Technology Development Scheme (TTDS)’ that would benefit both the textile and the textile machinery industry. The scheme would consist two sections; section 1 for textile machinery industry that would incentivize ‘Technology R&D, Acquisition, Capital Investment, and Commercialization’ and section 2 for textile industry that would incentivize incremental ‘Production’. A budget outlay of approximately INR 16500 crores for 5 years was proposed in the draft scheme which is still under deliberation. There may be lot of iterations and additions before it could be announced after cabinet’s approval during 2022-23.

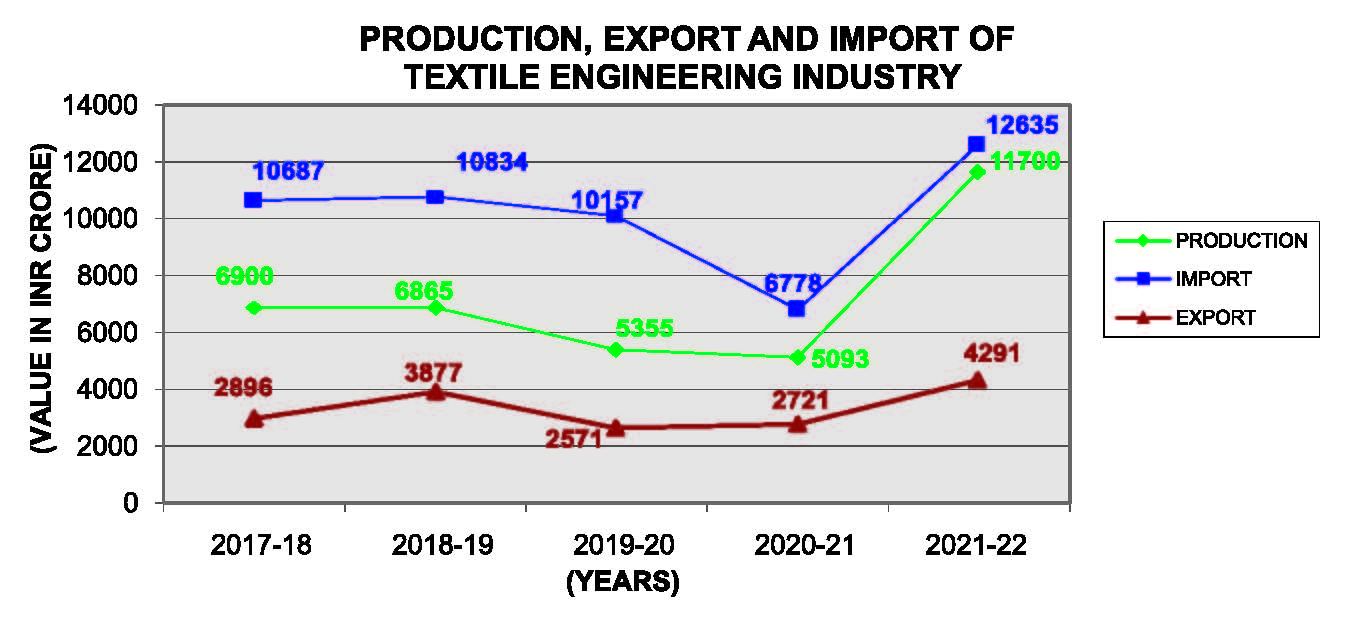

PRODUCTION, EXPORTS, AND IMPORTS

The production of the Textile Engineering Industry (TEI) recorded a substantial increase of 130% viz. Rs.11700 crore in 2021-22 as against Rs.5,095 crore achieved during 2020-21. Except the complete lockdown during Q1 of 2021-22 due to the disastrous second wave of Covid Pandemic, the majority of the industry segments continued on the momentum of the market gains picked up during 2nd, 3rd and 4th quarters of 2020-21quite well. Both greenfield and brown field projects were explored with clients during the Q2, Q3 & Q4 of the fiscal. Throughout the year, the capacity utilization was close to 100% and the industry was able to achieve up to 130% of their annual turnover as compared to 2020-21. Perhaps it was the best year the industry witnessed in the last several decades.

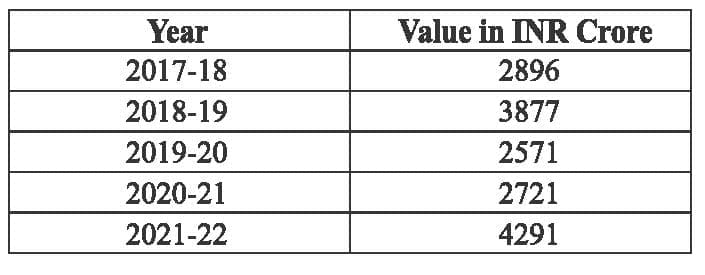

Most encouragingly, the export of textile machinery jumped during the year as compared to preceding year. On the basis of the data furnished by the Directorate General of Commercial Intelligence & Statistics (DGCI&S), Kolkata, the export of Indian TEI stood at Rs. 4291 crores in 2021-22 from Rs. 2721 crores in 2020-21. TMMA assessed export performance of the Indian TEI from the private source as well and found that TEI exports for the 2021-22 was Rs.5572 crores as against Rs.3307 crore achieved during 2020-21.

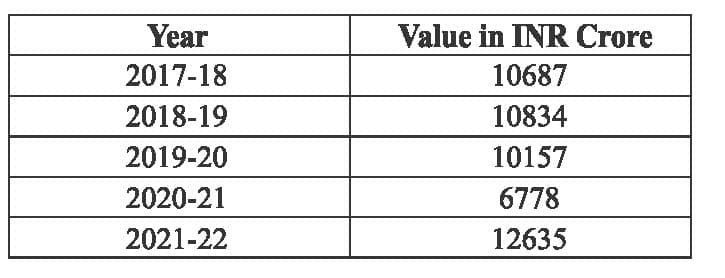

On the other hand, the import also spiralled up due to enhanced domestic demand of the user industry. Based on the data procured from the DGCI&S, Kolkata, the import of the Indian TEI stood at Rs. 12635 crores in 2021-22 as compared to Rs. 6778 crores in 2020-21. It was assessed from the private source as well that showed the TEI imports for the 2021-22 to be Rs.15115 crores as against Rs. 8096 crores achieved during 2020-21 period.

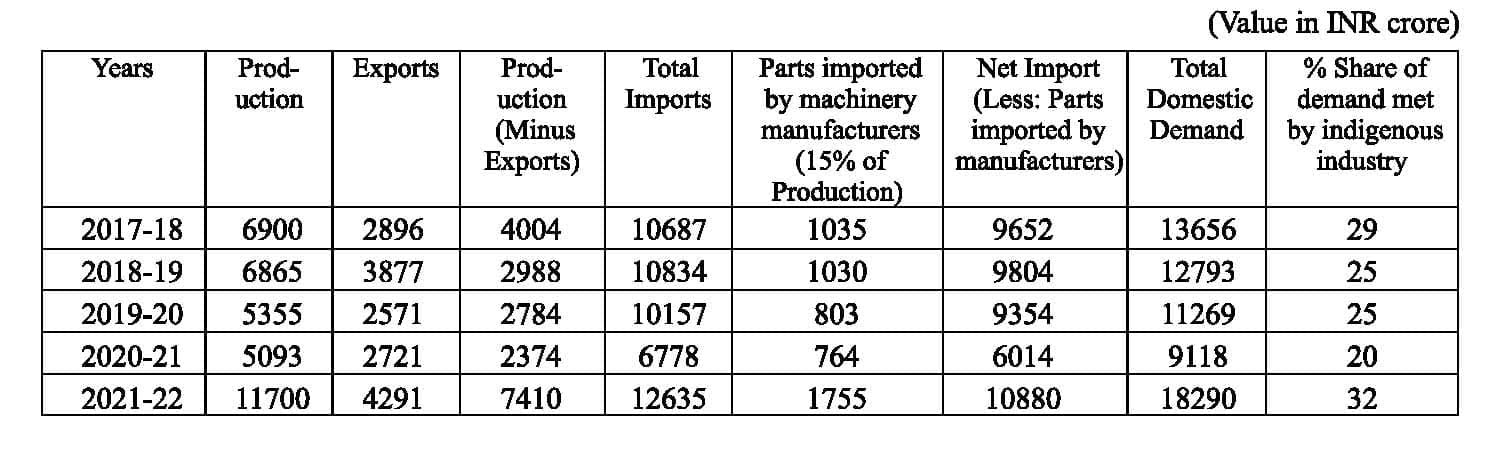

The chart below shows the trend of production, import, and export for the last 5 years.

During the year, TMMA started procuring EXIM data of two additional HS Codes i. e. 8443 and 9024 from the private source as per the request from the industry. The accuracy of the data procured from private source was validated again and found out to be quite good. Besides, the data was procured from DGCI&S also.

The association also shared this EXIM data on monthly as well on yearly basis (after compilation & analysis) to all the members concerned. They appreciated the valuable assessment on the EXIM data shared with them that would enhance their business opportunities. The data also helped analysing the import of different makes and models of textile machinery particularly machinery which may be second hand or reconditioned in nature to the office of the textile commissioner, Mumbai.

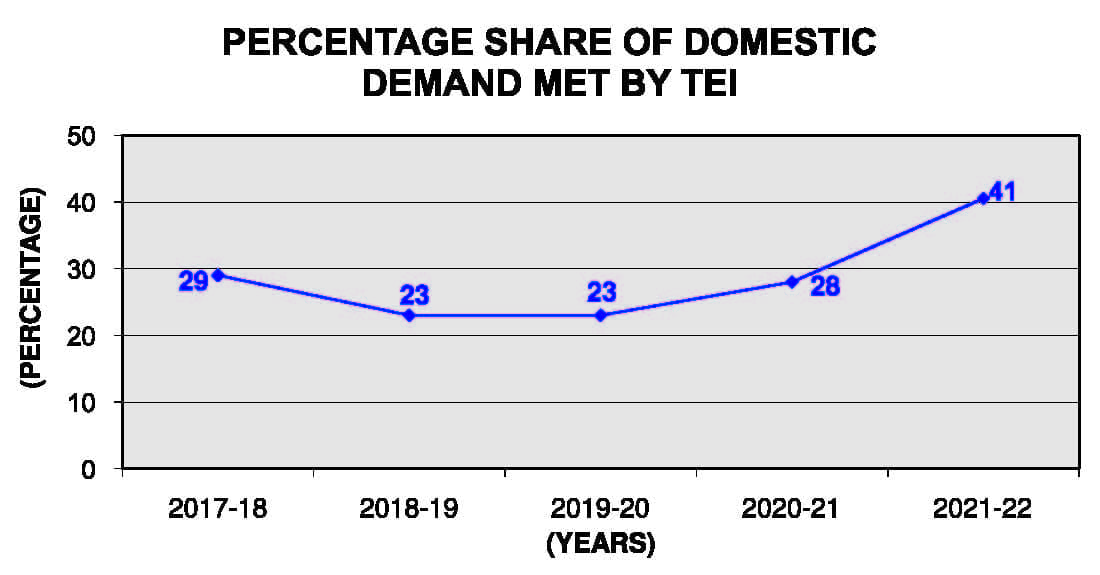

Based on a survey report done by the Textiles Committee with support of TMMA in 2007, and the import and export data analysed in subsequent years, the domestic share of demand of the TEI shows a downtrend as per the graph given below:

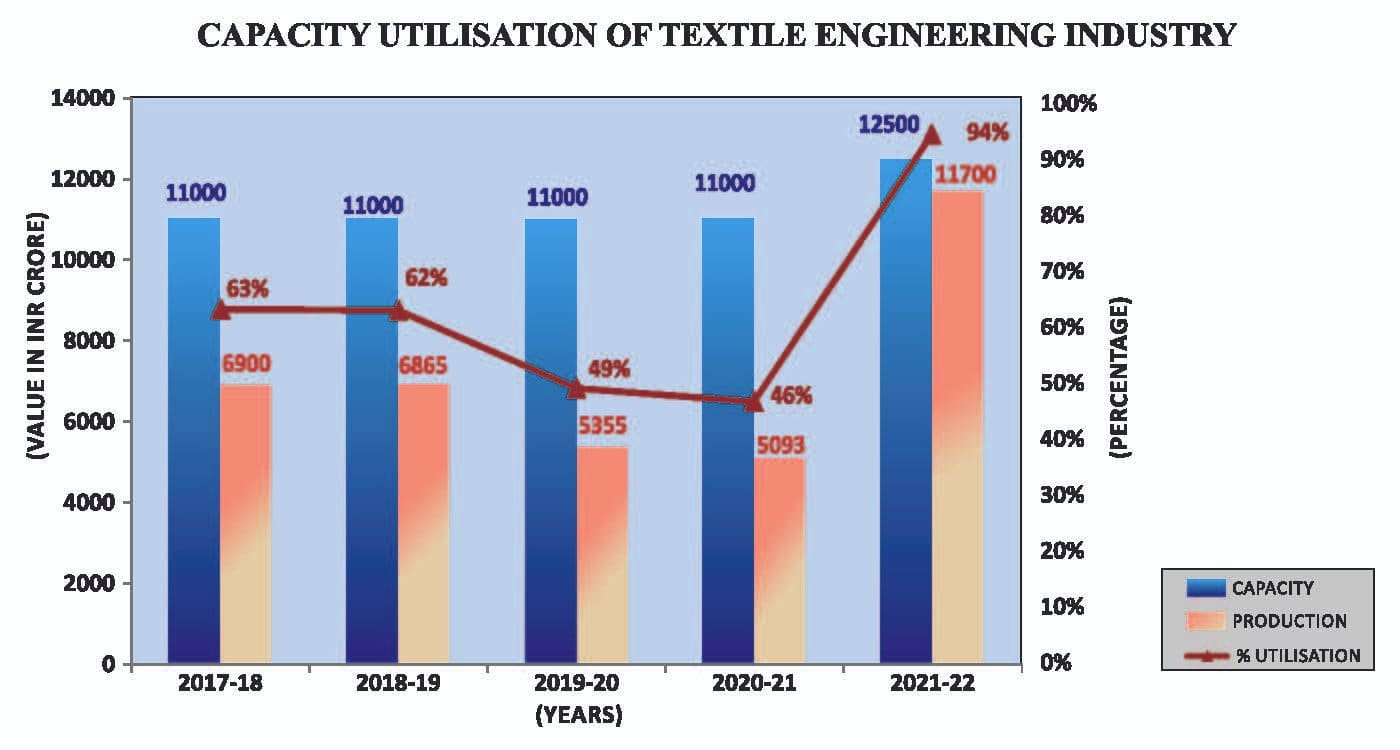

The estimated capacity of the domestic TEI was increased to Rs.12,500 crore in 2021-22. The production was Rs.11700 crores as against Rs. 5095 crores during the previous year; due to increase in the capacity utilization from 46% in the previous year to 94% in the current year perhaps due to the pent-up demand, rising cost of raw materials etc.

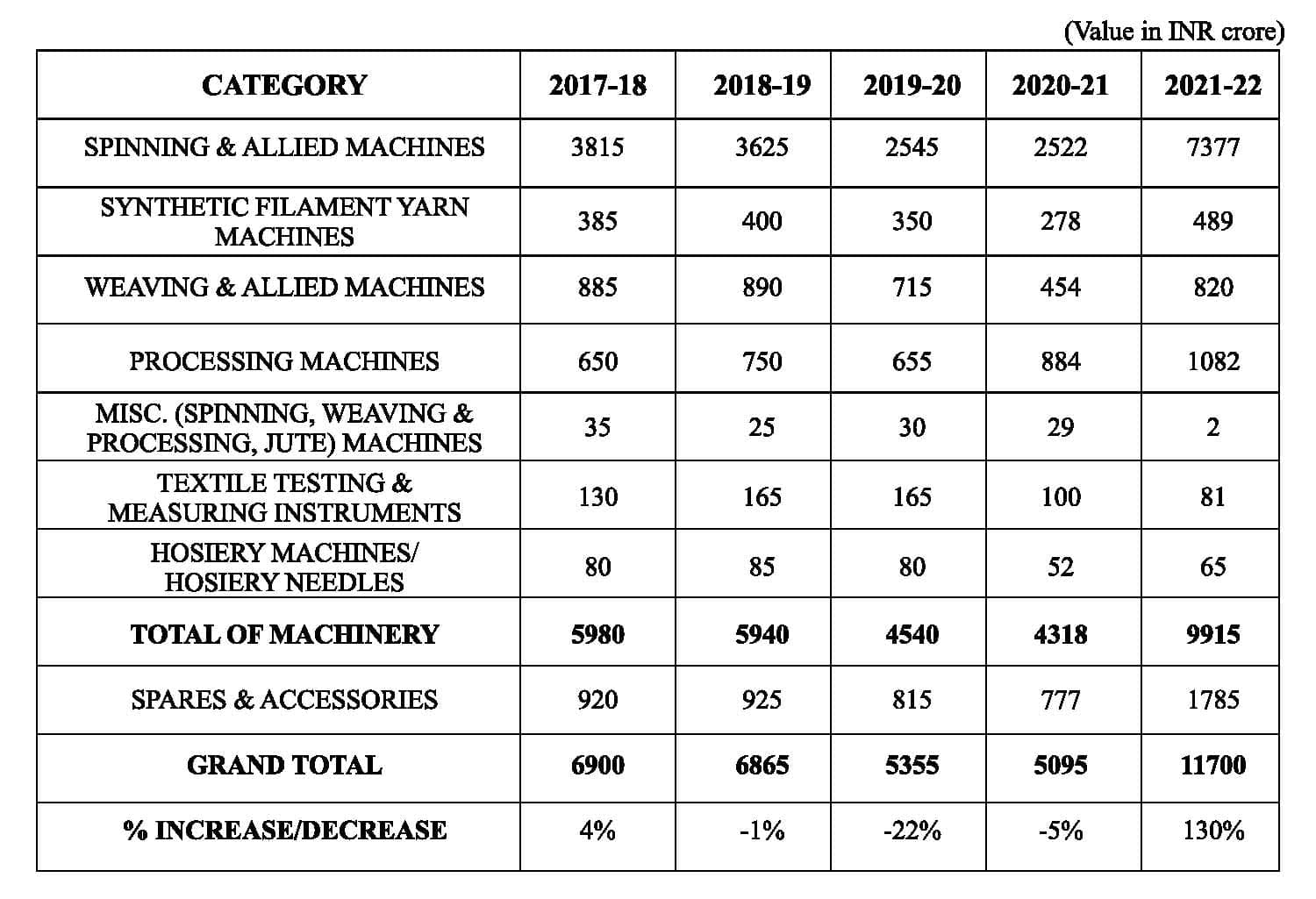

DATA ON THE TEXTILE ENGINEERING INDUSTRY

- Production

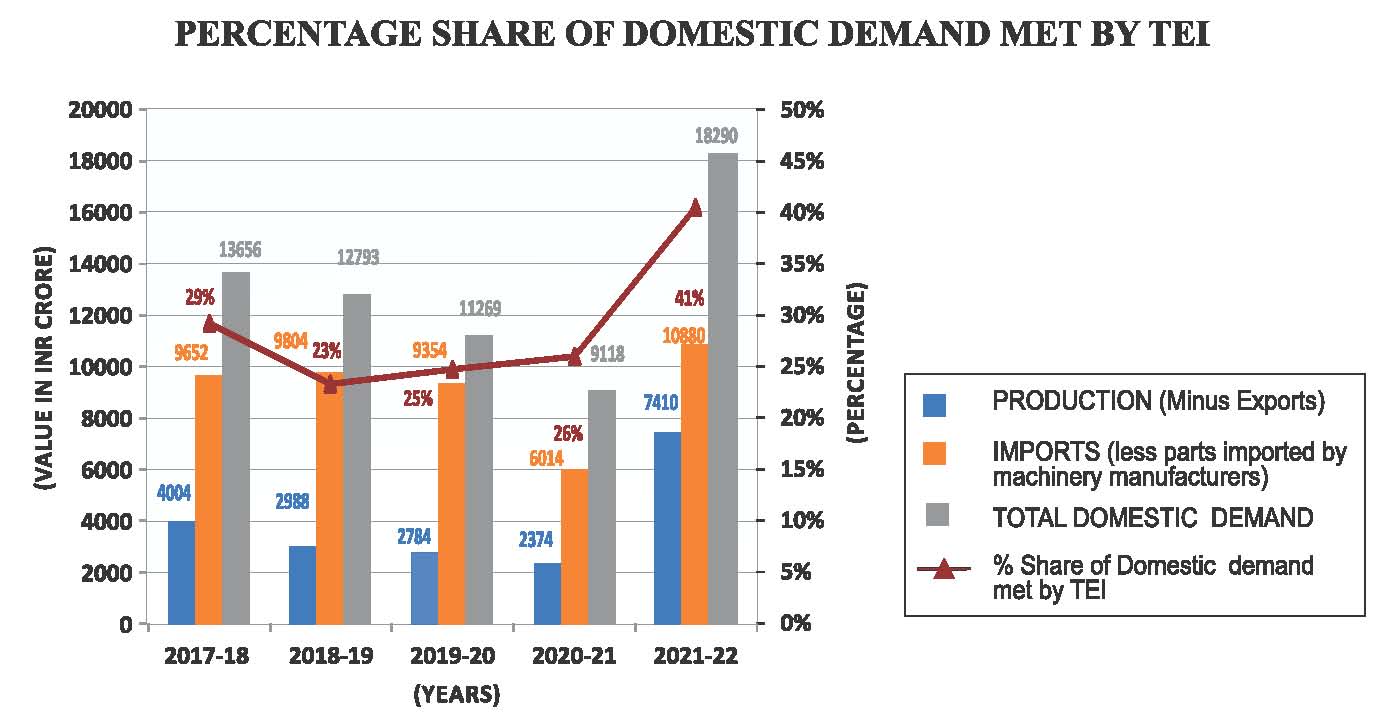

Value-wise overall production data of different categories of the industry during the last 5 years is given as under:

- Demand

The demand for textile machinery, parts and accessories from 2017-18 to 2021-22 is given below. Export of Textile Machinery The total domestic demand for textile machinery during 2021-22 was Rs.18290 crores as per the chart above. The bulk of the demand was met through imports. Total capacity increased to Rs.12700 crores in 2021-22 over 2020-21 whereas the capacity utilization trend shows the increase to 94%.

Export of Textile Machinery The total domestic demand for textile machinery during 2021-22 was Rs.18290 crores as per the chart above. The bulk of the demand was met through imports. Total capacity increased to Rs.12700 crores in 2021-22 over 2020-21 whereas the capacity utilization trend shows the increase to 94%.  Export of Textile Machinery

Export of Textile Machinery

Import of Textile Machinery

Note: These figures are assessed/estimated by TMMA(I) based on the surveyed, capacity, market survey and market intelligence.

PROGRESS OF TUFS

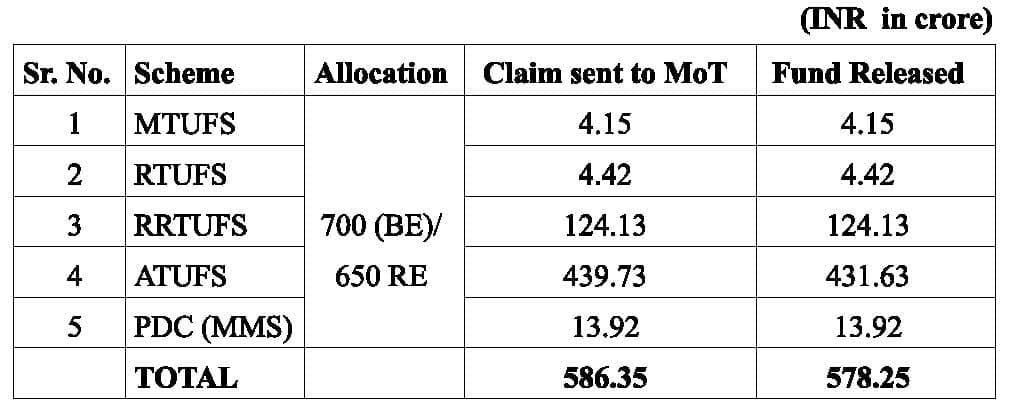

As per the 26th meeting of the Technical Advisory-Cum-Monitoring Committee (TAMC) held on 22.03.2022 under the Chairmanship of Ms. Roop Rashi, Textile Commissioner, the review progress of TUFS, Fund Allocation and Expenditure under TUFS in 2021-22 as on 17.03.2021 was as under:

a) Fund allocation and expenditure under TUFS in 2021-22 (as on 31.03.2021)

b) ATUFS (Position as on 22.03.2022): The total subsidy cap available – Rs.5151 Crore (including 1% administrative expense)

UIDs were auto generated w.e.f. 9th August 2019. As on 21st March 2022 total 13483 UIDs with provisional subsidy Rs. 4582 crores with project cost of Rs 63138.50 crores had been generated.

Source: TMMA’s 62nd Annual Report 2021-22.