Securitisation Market has Broken all the Records in FY25

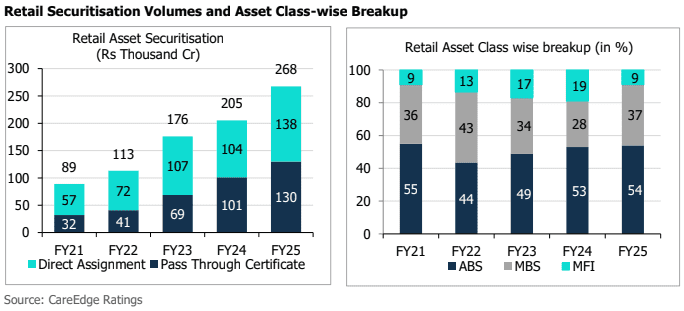

The securitisation market reached an all-time peak in FY25, with total volumes reaching ₹2,68,000 crore (CareEdge Ratings’ estimate), encompassing both pass-through certificates (PTC) issuances and direct assignment (DA) transactions. In FY25, the market experienced a robust growth of approximately 39% (CareEdge Ratings’ estimate) compared to FY24. The securitisation market issuances gained momentum in the second quarter of the current fiscal, primarily driven by substantial contributions from Private Banks and other large originators, as well as from continued demand for loans that meet Priority Sector Lending (PSL) norms.

The aggregate volume for Q4FY25 stood at around ₹69,000 crore, up from ₹62,000 crore for Q4FY24. The DA volume was marginally higher than the PTC volume, constituting 51% of the overall volume. The share of PTC issuances was higher than DA volumes over the first nine months of FY25. However, large DA transactions in the last quarter pulled overall DA volumes ahead of PTC issuances in FY25. The securitisation market also saw the entry of over 45 new originators in FY25.

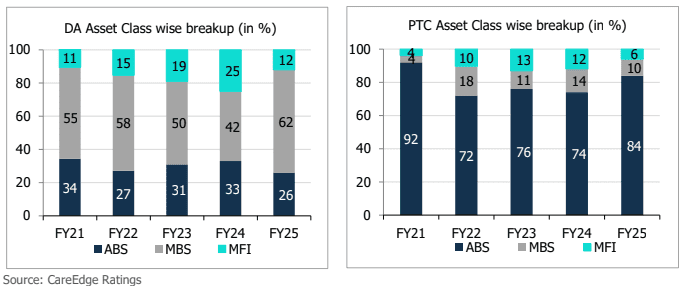

Asset Class-wise Breakup of PTC and DA Volume

Asset-backed securitisation (ABS) pools constituted a substantial portion of the total PTC issuances accounting for almost 84% in terms of volume, with the share of Mortgage-backed securitisation (MBS) transactions reducing to 10% (14% in FY24). The share of PTC issuances originated by the Microfinance Institutions (MFI) also declined to 6% of total PTC issuances (12% in FY24). Vehicle loan financing, including loans against commercial vehicles, cars, two-wheelers, construction equipment, and tractors, accounted over ₹93,000 crore, making up 71% of overall PTC issuances.

Mortgage-backed transactions dominated the DA segment in FY25, comprising 62% of DA volumes, while Asset-backed DA transactions accounted for 26%. The overall proportion of DA transactions backed by MFI loans dropped to around 12% compared to 25% in FY24.

Outlook

CareEdge Ratings expects the momentum to continue into the next fiscal year. While the surge in the securitisation market volume for FY25 was primarily driven by issuances from a few large private sector banks, we expect the market for residential mortgages to gain some traction driven by the push from RMBS Development Company Limited (RDCL). Additionally, the anticipated easing of monetary policy in the upcoming fiscal year and renewed interest from mutual fund houses could further boost the securitisation market. The updated PSL guidelines have expanded the range of assets that qualify under PSL norms. This is expected to influence the demand for securitisation, though the extent of this impact is yet to be determined. These factors will play a significant role in shaping the retail securitisation market in India in FY26 and beyond.

“The securitisation market in India is experiencing significant growth, driven by resilient rating performance and high volumes from select banks and large NBFCs. The market reaching an all-time high of Rs. 2.68 lakh crore is impressive! This growth is largely supported by banks’ focus on expanding retail assets and meeting Priority Sector Lending (PSL) norms. The activity in the Residential Mortgage-Backed Securities (RMBS) space this financial year will be a key monitorable and has potential to reshape securitisation market dynamics in medium term.” said Vineet Jain, Senior Director, CareEdge Ratings.

“Over the past year, we’ve seen a rise in delinquencies within unsecured asset classes, notably in MFI portfolios. We expect this trend to persist into FY26. By the end of Q2 FY26, we’ll have a clearer picture of whether this is the new normal or if there is a further shift in delinquency patterns. In terms of securitisation issuances, FY25 experienced an increase from universal banks, a trend that is likely to continue,” said Sriram Rajagopalan, Director, CareEdge Ratings.

“This year’s volume was primarily driven by HDFC Bank and other large originators. There was a decline in the securitisation volume of unsecured asset classes, such as business loans, personal loans and microfinance loans, due to industry-wide stress resulting in slower disbursement growth in the NBFC sector in Q3 FY25. However, the market rebounded in Q4FY25, fuelled by the growth of MBS transactions, which helped mitigate the earlier impact,” said Chirag Gambhir, Associate Director, CareEdge Ratings.