Synopsis

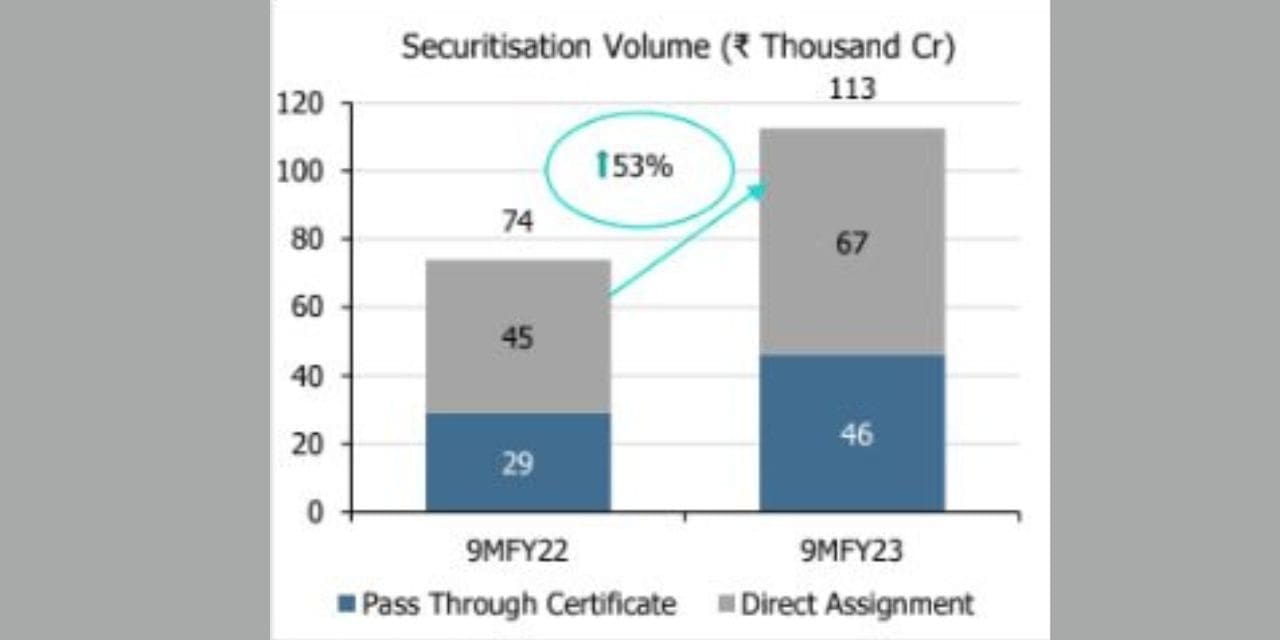

- The overall securitisation market volume grew by around 53% in 9MFY23 year on year.

- The securitisation market kept up the momentum gained in H1FY23, with overall volume of around ₹41,000 crore (CareEdge Ratings’ estimate) in the third quarter of the fiscal (30% growth over Q3FY22).

Securitisation Volume Stabilised in Q3FY23

The retail asset securitisation market in India has exhibited healthy growth in FY23 so far. The overall market volume in Q3FY23 is almost similar to the immediate previous quarter. There are a couple of factors driving this moderation in volume in Q3FY23; the amendments notified in the RBI guidelines on December 5, 2022 (covered in our article Residual Maturity Norms May Hurt Fintech Lenders) and the reduced participation from some of the bigger HFC’s in the securitisation market. Direct assignment (DA) transactions continue to account for the bulk of the volume (at around 54% in Q3FY23 and 59% in 9MFY23), with securitisation (pass-through certificate [PTC]) transactions making up the rest.

Retail Securitisation Volume and Asset Class-wise Breakup

During 9MFY23, mortgage-backed securitisation (MBS) and microfinance [MFI] loans transactions constituted around 52% and 18% of the DA volume respectively, while asset-backed securitisation (ABS) transactions which include pools backed by all the other asset classes accounted for around 30%.

PTC volume was mainly driven by ABS pools contributing around 76% of the total issuances, with vehicle loan financing making up the lion’s share of PTC issuances at around ₹29,100 crore (63% of PTC issuance).

Outlook

The revisions in the guidelines were a speed bump for the securitisation market. The revisions are expected to impact the securitisation of short-term loans from fintech lenders. However, given their scale of operations and low leverage, this is not expected to have a significant impact on the credit profile of fintech lenders. CareEdge Ratings reiterates that recent changes in regulations are unlikely to affect the overall volume significantly as these loans only made up a small portion of the market. CareEdge Ratings still expects overall market volume to cross ₹ 1.6 lakh crores in FY23, registering a growth of more than 40%.