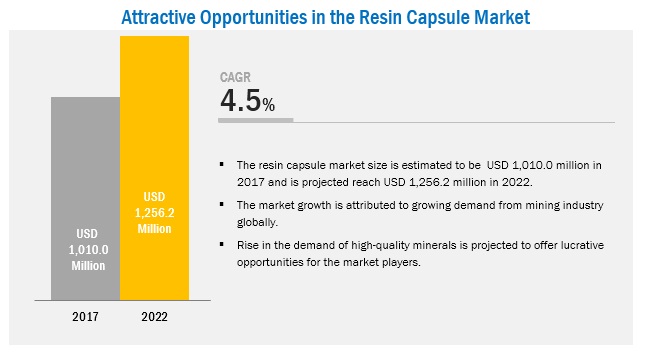

The market for resin capsules is projected to grow from USD 972.8 million in 2016 to USD 1,256.2 million by 2022, with a CAGR of 4.46%, as studied from 2017. The resin capsule market across the globe is driven by their increasing mining capacity of various metals and minerals. By catalyst type, organic peroxide is expected to grow at a highest CAGR between 2017 and 2022. The increasing demand for resin capsule in this segment can be attributed to the high demand from the mining countries. The mining industry is projected to be largest end-use industry.

Market Dynamics

Drivers

- Increasing investments in the construction industry

- Rapid urbanization and industrialization stimulate the demand for resin capsules

- Increasing applications of resin capsules in the mining industry

Restraints

- Fluctuations in the prices of raw materials

- Cost-to-benefit ratio a concern for small manufacturers

Opportunities

- Mining sectors in Africa and Eastern Europe offer high-growth potential

- New product developments to offer high-growth potential

Challenges

- Shorter shelf-life of resin capsule

- Health implications of resin capsule

Increasing applications of resin capsules in the mining industry

Resin capsules play a vital role in supporting mining excavations. It is primarily used as an anchoring medium for rock bolts and cable bolts, and provides necessary roof and sidewall support to the underground excavations. It enhances the inherent strength of the rock mass stabilization and can be used with hydraulic and pneumatic type bolters. Owing to the operational ergonomics of the resin/bolt system, the installation time of rock bolting reduced significantly. Additionally, with the increasing use of resin capsules, accidents caused by the movement of strata in underground mines have significantly reduced.

The trend toward deeper mines has increased the need for automation and mechanization in the mining industry. AngloGold Ashanti Limited (South Africa), for instance, follows that mining below 13,200 feet (4km) needs to be fully mechanized, with few mineworkers involved, in order to ensure the safety at the workplace. With a large number of mines getting deeper, the stress level exerted on the surrounding rock increases. This, in turn, fuels the demand for reinforcement. With the emergence of resin capsules, challenges associated with providing sufficient load-transfer capability in primary and secondary roof-support systems reduced significantly. Resin capsules, owing to their dynamic loading and squeezing capabilities, are able to cope with increased stress loading, thus becoming increasingly important in the mining industry. This implies that the increasing number of applications of resin capsules in mining excavations will drive the market growth during the forecast period.

The following are the major objectives of the study.

- To describe and forecast the resin capsule market, in terms of value, by terminal type, and application

- To describe and forecast the resin capsule market, in terms of value, by region–Asia Pacific (APAC), Europe, North America, Middle East &Africa, and South America along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of reed sensor

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the resin capsule market.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the resin capsule market

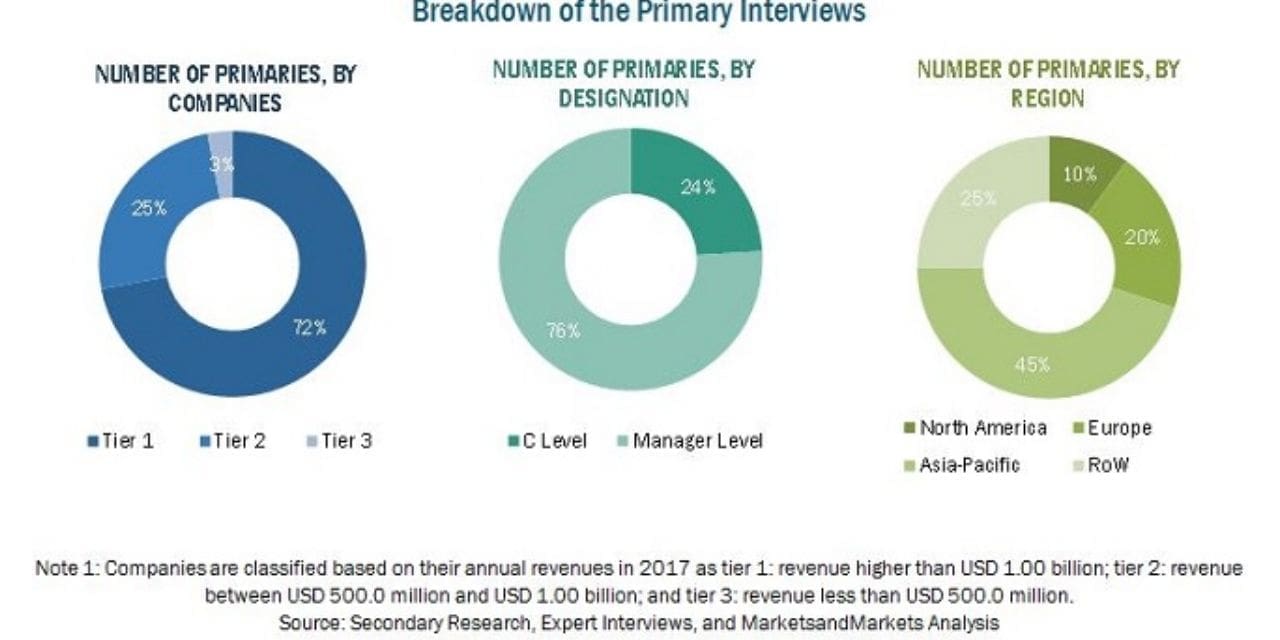

During this research study, major players operating in the resin capsule market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.