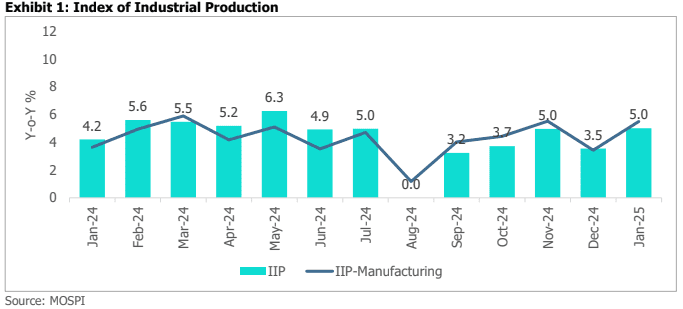

India’s industrial production grew to 5% in January, up from 3.5% the previous month. Manufacturing and mining output accelerated, supporting the overall IIP growth. On the other hand, electricity output slowed in January. In terms of consumption, the output of consumer durables demonstrated an encouraging performance, whereas non durables continued to experience contraction. Overall, a broad-based and sustained improvement in the consumption scenario remains critical for the industrial performance.

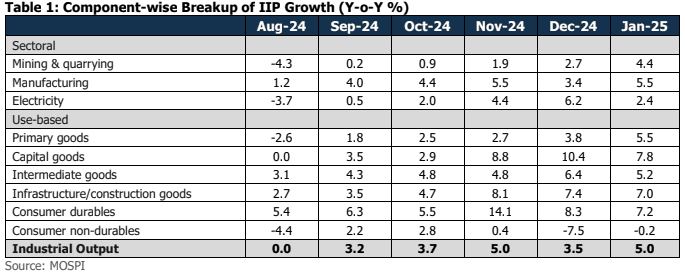

Manufacturing output growth accelerated to 5.5% in January, up from 3.4% in December. A year-on-year increase was observed in the output of 19 out of 23 subcategories. Within manufacturing, the output of the largest component, i.e., basic metals (weight of 12.8%), grew by 6.3% (Vs 7.6% in December). Among the export-oriented components, the output of textiles and wearing apparel logged a growth of 3.3% (Vs 1.4% in December) and 2.9% (Vs 5.3% in December), respectively. However, the growth in output of leather and related products remained in the contractionary zone (-5.3% Vs -7% in December). The mining output grew 4.4% (Vs 2.7% in December), while electricity output moderated to 2.4% (Vs 6.2% in December).

Within the use-based classification, the output of infrastructure and construction goods grew by an encouraging 7% in January. Improving public capex is a positive for the investment scenario. However, a meaningful pickup in private capex is yet to be seen. On the consumption front, the output of consumer durable goods increased by 7.2% (Vs 8.3% in December). However, production of consumer non-durables continued to contract (-0.2% Vs -7.5% in December). Given that the urban demand continues to lag, a sustained and broad-based improvement in consumption demand remains critical.

Way Forward

A revival in investment activity is closely tied to the strength of consumption demand in the economy. The sustained moderation in inflation, RBI’s policy rate cut, and the income tax relief announced in the FY26 Union Budget, remain positives for supporting household spending in the coming months. Going ahead, an improvement in the consumption and investment scenario remains essential for the overall IIP performance.