Synopsis

- After slowing in the pandemic period of FY21 and FY22, the number of insolvency cases increased by 25% y- o-y in Q3FY23. However, despite the increase, the number of cases admitted to the insolvency process continued to be lower compared to earlier quarters in FY19/20. The distribution of cases across sectors continues to remain broadly similar, compared to earlier periods given the extended resolution

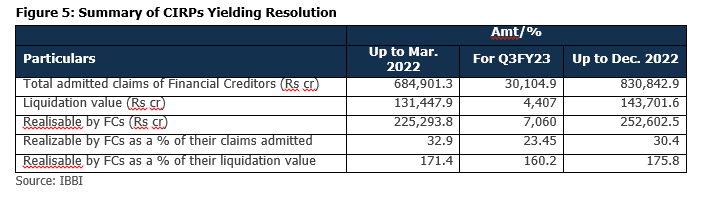

- The overall recovery rate till Q3FY23 was 30.4% implying a haircut of approximately 70%. The cumulative recovery rate has been on a downtrend, decreasing from 43% in Q1FY20 and 32.9% in Q4FY22 as larger resolutions have already been executed and a significant number of liquidated cases were either BIFR cases and/or defunct with high resolution time, coupled with lower recoverable values.

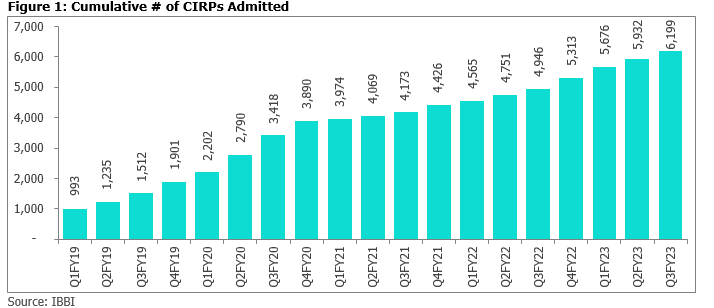

Corporate Insolvency Resolution Process Remains Popular… Figure 1: Cumulative # of CIRPs Admitted

The number of cases admitted for Corporate Insolvency Resolution Process (CIRPs) has increased each quarter since the launch of the Insolvency and Bankruptcy Code in 2016., highlighting the rising acceptance of IBC as an effective debt resolution mechanism. The admission of cases has increased y-o-y in Q3FY23 by around 25% after reducing in the last few quarters in FY21 and FY22, however, despite the increase, the number of cases admitted to the insolvency process continues to be lower compared to earlier quarters in FY19/20.

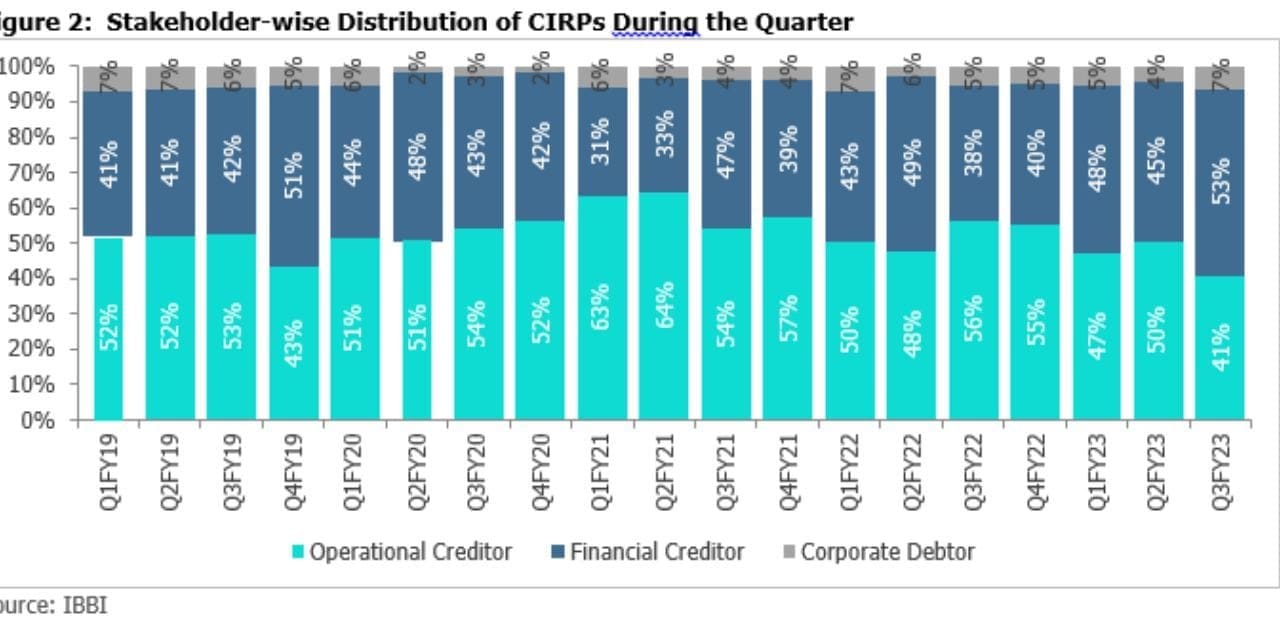

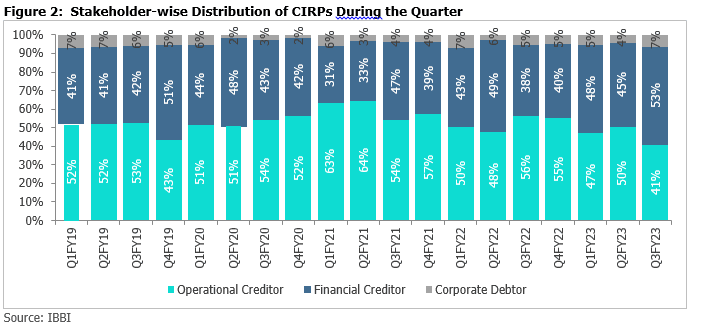

IBC has continued to gain in popularity, with close to 6,200 companies being admitted and a significant number of these cases on a cumulative basis till December 2022 being filed by the financial creditors (2,692 cases) and the operational creditors (3,133 cases). The share of corporate debtors has continued to remain the smallest over the same period.

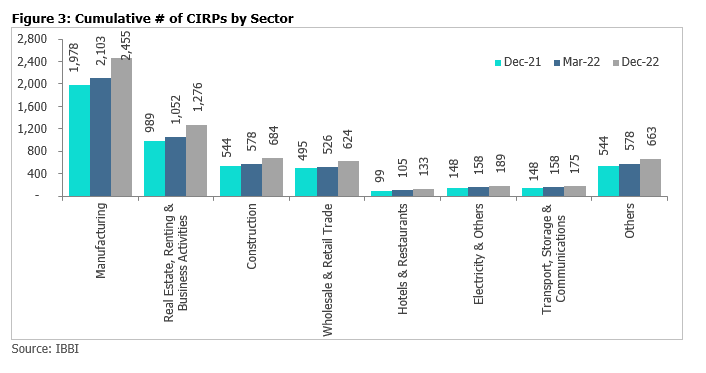

Figure 3 shows the dispersion of the admitted cases by sector. The share of the various sectors has largely remained constant compared with the previous period. As can be observed in Figure 3, the manufacturing sector accounts for the highest share at 39% of the overall cases, followed by the real estate (21%), construction (11%) and trading sectors (10%).

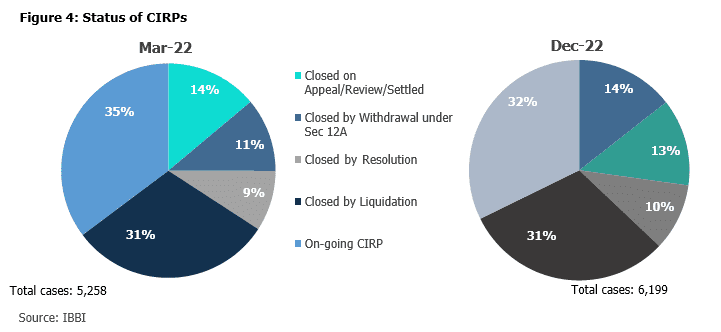

The status of the cases has largely remained constant compared with the previous period. Of the total 6,199 cases admitted into CIRP at the end of December 2022:

- Only 10% have ended in approval of resolution plans, while 32% remain in the resolution process vs. 35% as of the end of March 2022.

- 1,901 have ended in liquidation (31% of the total cases admitted). Meanwhile, 76% of such cases were either BIFR cases and/or defunct. These cases had assets which had been valued at less than 8% of the outstanding

- Around 14% (894 CIRPs) have been closed on appeal /review /settled, while 13% have been withdrawn under Section 12A. A significant number of withdrawn cases (around 54%) were less than Rs.1 crore, while the primary reason for withdrawal has been either the full settlement with the applicant (306 cases) or other settlement with creditors (210 cases).

…Despite Haircuts of approximately 70%…

Post the implementation of the IBC, as can be seen in figure 5, the overall recovery rate till Q4FY22 in India reached 32.9% which has been on a continuous declining trend. The recovery rate for Q3FY23 stood at 23.45%, while the overall recovery rate reached 30.4% till Q3FY23. Consequently, for the cases which have been resolved, the creditors have continued to face a haircut of approximately 70% on admitted claims.

…and delays in ongoing CIRPs…

Of the 2,000 going ongoing CIRPs, there has been a delay of more than 270 days for the completion of the process of 64% of ongoing CIRPs in December 2022 which is a decline of 9% as compared to 73% in December 2021. Further, we can observe that the ‘more than 180 days but less than 270 days’ segment is the second largest indicating that quite a few cases which had commenced in the earlier quarters have piled up, while the other two categories continue to have quite a few cases in them highlighting the significant delays in the process.

The delays for closure of CIRP is higher compared to Liquidation across various categories of stakeholders, but the corporate debtor segment takes somewhat lesser time for resolution compared to the other two stakeholders (financial creditor and operational creditor).

…and Even Liquidation

Figure 8 highlights the pendency even for cases which have gone into liquidation with around 50% of the cases pending for more than two years and another 25% (increase of 200bps over the previous quarter) of the cases pending for more than one year.

Update on Insolvency Resolution of Personal Guarantors

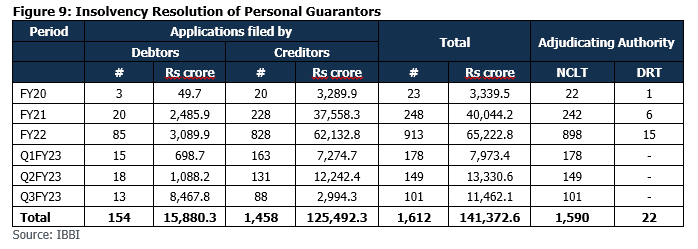

Apart from the details on the corporate insolvency process which have been covered earlier, figure 9 contains details on the insolvency resolution and bankruptcy proceedings related to personal guarantees.

Of the above 1,612 applications.

- 59 were withdrawn/rejected/dismissed before the appointment of a resolution

- Resolution professionals were appointed in 674

- 154 cases have been admitted. Out of these cases, 36 have been closed, 6 withdrawn, 28 have been closed due to non-submission/rejection of plans and only two have yielded approval of repayment plan with creditors realising 6% of their admitted claims.

- 33 cases have been withdrawn/rejected/dismissed.

Update on Avoidance Transactions

Under the IBC, resolution professionals (RP) can reverse any transaction entered by the debtor company before the IBC is invoked if the RP can prove that the transaction was intended to divert funds or alienate assets. These provisions are generally used on related party transactions, fund diversions and other relevant corporate actions and any money so recovered is distributed amongst the lenders. However, such claims can only be done after approval by the NCLT.

As per figure 10, RPs have filed 847 applications for avoidance transactions amounting to approximately Rs 2.8 lakh crore. Of these, only 143 transactions involving over Rs 41,300 crore (approximately 14.6% of the amount involved) were disposed of and only Rs 5,083.5 crore (12.3% of the amount disposed) have been recovered. Further, in one case 758 acres of land out of 858 acres which was earlier valued at Rs. 5,500 crore has been transferred; hence proportionate value has been considered.