Synopsis

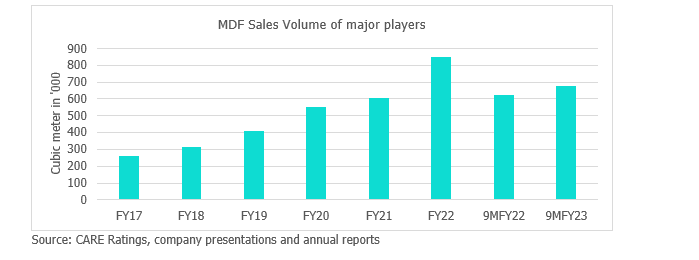

- The consumption of domestic Medium Density Fibreboard (MDF) saw a significant increase in FY21 and FY22, which has continued into the current fiscal year. The demand for MDF in India is growing at a compounded annual growth rate (CAGR) of approximately 15%, and this growth momentum is expected to

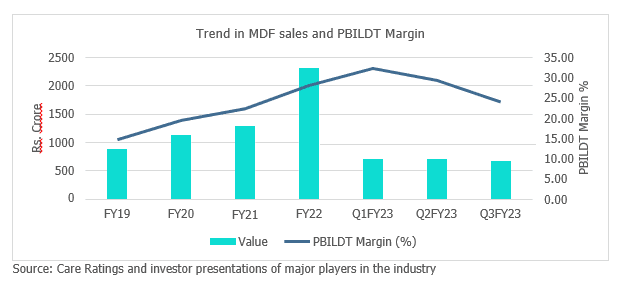

- Major players in the industry have witnessed substantial improvement in capacity utilisation and This has improved profitability, with MDF segment PBILDT margins crossing 30% in FY22 for some of the key Indian players. The industry has also seen announcement of significant capacity additions by existing and new players.

- With additional capacities coming online from FY24 onwards and high imports observed in the current fiscal year, CareEdge expects the profitability margins of the MDF industry to moderate in the near to medium term, declining by approximately 400-500 basis points from the recent highs, though still remaining

- To maintain optimum utilisation of capacities and build an alternate market, there is expected to be an increase in lower-margin export volume, which could impact Additionally, rising timber prices with limited upside potential in selling prices, given that the edge of MDF is its cost advantage over lower end of plywood, is also expected to result in margin pressure.

- Nevertheless, the robust demand growth being witnessed is expected to support the utilisation of capacities and maintain healthy margins, despite the expected

Healthy Growth Potential

MDF is an engineered wood product made by aggregating wood fibre with wax and resin into panels by applying heat and pressure. It has been gaining popularity as a cost-effective replacement for low to medium-quality plywood which constitutes about 35% of the unorganised plywood industry.

Factors driving demand growth of MDF are:

- Cost effective replacement for lower end of plywood with ease of machining and moulding

- Increasing demand for readymade furniture where MDF is majorly used

- Shortening of the replacement cycle for furniture and rapid urbanisation

- Increasing use in non-furniture applications such as flooring and decorative items

- Environment friendly as MDF re-uses wood waste

Globally, around 30% of the furniture requirement is met through plywood and 70% is met through MDF, while in India, there is a reverse trend. With the increasing acceptance of the product in the Indian markets, the gap is expected to narrow. The market size of MDF in India is about ₹4,000 crore and it is growing at the rate of 15% annually.

Given the high capital investment required for setting up an MDF plant, the domestic industry is dominated by organised interior infrastructure players with the top four players in the industry accounting for about 70% of the current MDF capacity in India.

Growth in Sales Volume

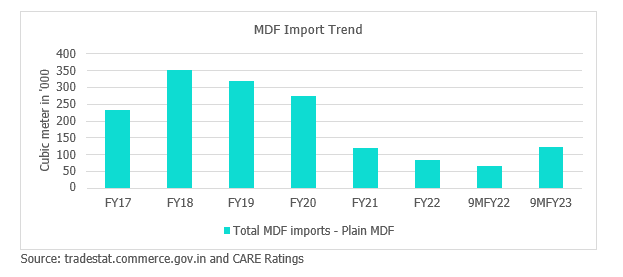

The industry had earlier been impacted by an oversupply situation with a slowdown in the real estate market and a significant share of cheaper imports (25%-30% of domestic demand) from countries like Vietnam, Malaysia, Thailand, and Indonesia. The imports have been dominant in southern India due to the proximity to the ports while the impact for north India players was limited.

The COVID-19 pandemic turned the table for domestic MDF players with the twin impact of the increase in demand and reduction in imports. Demand has increased due to a shift in customer preference towards readymade furniture and a shift towards value-added products like pre-laminated MDF, laminated floorings and UV-coated boards.

The Import Factor

Imports which had increased substantially in FY18 witnessed a dip in FY19 and FY20 with additional capacities coming up in the south Indian market and the relatively subdued real estate industry. However, there was a notable decline in imports in FY21 and FY22 due to the abnormally higher shipping costs and operational disturbances owing to the pandemic. Also, there has been a shift towards direct supply of furniture instead of MDF by the countries from where imports were coming in.

In the current fiscal, up to 9MFY23, the imports have increased again. The same seems to be a result of subdued demand for furniture from the US and European markets and ease in freight rates. Therefore, the supply of MDF from countries like Vietnam, Thailand and Indonesia to India has increased.

With the influx of cheaper MDF into the country, domestic sales have been impacted and the Indian players have increased their focus on exports to maintain effective capacity utilisation and build an alternate market for future growth which has resulted in moderation in their profitability margins.

Expected Rise in Capacities to Increase Pricing Pressure

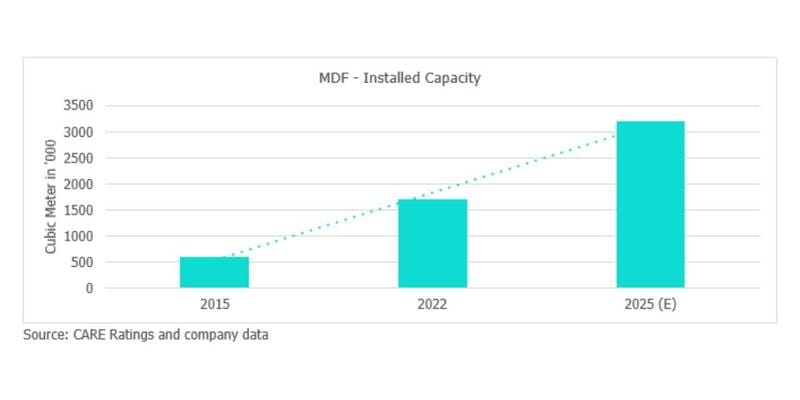

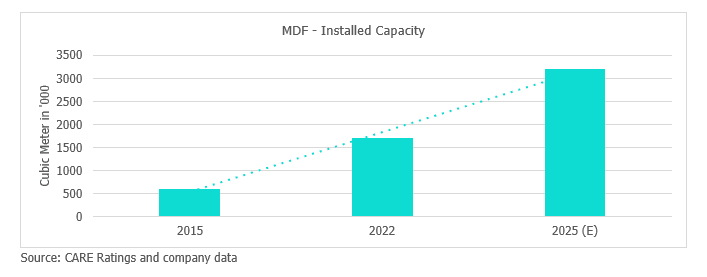

With the significant growth potential of the product in the interior infrastructure industry, there has been an addition of large and medium-sized capacities in the industry in the recent past. The demand and healthy profitability margins have resulted in plans for additional capacities by existing and new players in the industry. Most of these are expected to come fully onstream by end of FY24 with some expected to be operational in FY25. The major players’ capacities in the domestic industry over the years (excluding smaller fragmented capacities) are as under:

CareEdge Ratings’ View

“The demand for MDF appears to be well poised for sustained growth with the shift in consumption pattern towards ready-made and easy-to-install furniture. MDF also offers a cost advantage over its substitutes. Given the high fixed capital investment required to set up a quality MDF manufacturing facility, generating a high operating margin is imperative to earn a healthy return on investment. The present capacities are now being better utilized which has improved the profitability of the existing players.”

“However, the planned increase in capacities in the next 2-3 years is likely to lead to an increase in competitive intensity and exert pricing pressure. Also, imports have again exhibited an increasing trend in 9MFY23 and resulted in domestic players increasing their focus on the lower-margin export business. Furthermore, rising input prices (especially timber) would also be difficult to pass on in an increasing import scenario, impacting margins. Observing the recent trends, the MDF segment operating margin is expected to moderate by nearly 400-500 bps in the near to medium term. Nevertheless, despite the moderation, the margins are expected to remain healthy,” said Mamta Muklania, Associate Director, CareEdge Ratings.