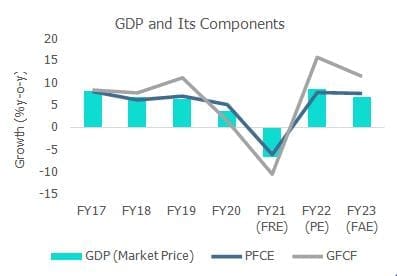

The Indian economy made resilient progress in FY23 despite the drag from the global spillovers. In line with our projection, India’s GDP is estimated to grow by 7% in FY23 as per the First Advance Estimate (FAE), after a growth of 8.7% in the previous fiscal. Growth in the current financial year was supported by a visible pick-up in the services sector. Manufacturing sector, which has been consistently under pressure due to high raw material costs and uneven demand recovery, dragged down overall growth. With global growth slowing, there was a widening of net exports that ate into overall GDP growth.

With 9.7% growth achieved in H1 FY23, the H2 FY23 growth works out to 4.5% which is pretty much in line with CareEdge and RBI’s estimate. The higher growth in H1 was mainly because of low base of the previous year. On a sequential basis growth is likely to improve in H2 FY23.

The Gap between GDP and GVA growth narrowed in FY23 to 0.2 percentage points (pp) from 0.6 pp in FY22 despite strong growth in tax collections this year as the outgo on subsidies for nutrients and urea was much higher this year. This was done to shield farmers from the high fertiliser costs as a result of war-related supply-chain bottlenecks.

Source: MOSPI; FRE: First Revised Estimates; PE: Provisional Estimates; FAE: First Advance Estimates

On the expenditure side, private consumption which powers more than 50% of the GDP, is projected to grow by 7.7%. The growth could be attributed to pick up in discretionary spending primarily in contact-intensive sectors such as tourism, hospitality and other recreational services. Investment during the year was supported by steady government capital spending. The ratio of investment (GFCE) to GDP inched up to its highest in the last decade.

Going ahead, tighter financial conditions and global recession fears could weigh on external demand and private investment. The weak labour market recovery, high core inflation and fading of pent-up demand are the main downside risks to consumption. The demand uncertainty could also be detrimental to private investment.

Growth in Consumption and Investment (% y-o-y)

| FY19 | FY20 | FY21 (FRE) | FY22 (PE) | FY23 (FAE) | FY23/ FY20 | |

| Government Final Consumption Growth (GFCE) | 6.7 | 3.4 | 3.6 | 2.6 | 3.1 | 9.6 |

| Private Final Consumption Growth (PFCE) | 7.1 | 5.2 | -6.0 | 7.9 | 7.7 | 9.2 |

| Gross Fixed Capital Formation (GFCF) | 11.2 | 1.6 | -10.4 | 15.8 | 11.5 | 15.7 |

| GDP (at constant prices) | 6.5 | 3.7 | -6.6 | 8.7 | 7.0 | 8.6 |

Source: MOSPI; FRE: First Revised Estimates; PE: Provisional Estimates; FAE: First Advance Estimates

How Have Sectors Fared in FY23?

The year started on a positive note with hopes of economic rebound as the pandemic fears receded. The optimism was somewhat soiled due to the geopolitical turbulences which led to record high inflation levels. While the services sector (9.1% growth) supported growth gaining from the pent-up demand, the manufacturing sector (1.6% growth) was adversely impacted due to elevated input prices and uneven demand recovery. The climate-related disruptions (heat-wave, uneven rainfall etc.) posed challenges for the agriculture sector by impacting yields of some major crops but overall the agriculture sector performed well with a growth projection of 3.5%. In terms of pre- pandemic comparison, there was a broad-based recovery across sectors. Trade, hotels, transport and communication related sectors are projected to record a good growth of 13.7% on a y-o-y basis but are yet to see a meaningful recovery compared to the pre-pandemic period (0.8% growth).

While we expect agriculture to perform well in FY24 on assumption of a good Rabi harvest and normal monsoon, some deceleration in growth could be witnessed for services and manufacturing. Slowing external demand could offset the benefits of easing commodity prices for the manufacturing sector. The critical aspect would be the strength in domestic demand with a durable pick up in rural demand. Further, the cooling of pent-up demand could result in lower growth in the services sector than witnessed this year.

Sectoral Growth (% y-o-y)

| FY19 | FY20 | FY21 (FRE) | FY22 (PE) | FY23 (FAE) | FY23/ FY20 | |

| Agriculture, Forestry & Fishing | 2.1 | 5.5 | 3.3 | 3.0 | 3.5 | 10.1 |

| Industry | 5.3 | -1.4 | -3.3 | 10.3 | 4.1 | 11.1 |

| Mining & Quarrying | -0.8 | -1.5 | -8.6 | 11.6 | 2.4 | 4.4 |

| Manufacturing | 5.4 | -2.9 | -0.6 | 9.9 | 1.6 | 11.0 |

| Electricity, Gas, Water Supply & Other Utility Services | 7.9 | 2.2 | -3.6 | 7.5 | 9.0 | 13.0 |

| Construction | 6.5 | 1.2 | -7.3 | 11.5 | 9.1 | 12.8 |

| Services | 7.2 | 6.3 | -7.8 | 8.4 | 9.1 | 9.1 |

| Trade, Hotels, Transport, Communication & Broadcasting | 7.2 | 5.9 | -20.2 | 11.1 | 13.7 | 0.8 |

| Financial, Real Estate & Professional Services | 7.0 | 6.7 | 2.2 | 4.2 | 6.4 | 13.3 |

| Public Administration, Defence and Other Services | 7.5 | 6.3 | -5.5 | 12.6 | 7.9 | 14.8 |

| GVA (at basic price) | 5.8 | 3.8 | -4.8 | 8.1 | 6.7 | 9.8 |

Source: MOSPI; FRE: First Revised Estimates; PE: Provisional Estimates; FAE: First Advance Estimates

Way Forward

India’s economy held relatively well in FY23 compared to other emerging and advanced countries. Post-pandemic normalisation in economic activities, coupled with high pent-up demand and capex boost by the government, supported growth. However, with challenges looming on the external front due to slowing global demand and tighter monetary policy, India’s growth outlook for FY24 remains clouded. Manufacturing sector could benefit from moderation in commodity prices but will feel the pain of lower external demand. The risk of resurgence of Covid- 19 cases globally could pose additional downside risk.

On the domestic front, the expectation of easing inflation levels and good Rabi output will be supportive of domestic demand. However, some moderation in growth numbers could be seen due to cooling of pent-up demand and tighter financial conditions. While the government will continue its focus on capital spending, the main challenge will be a durable pick-up in private investment amid rising borrowing costs, demand uncertainty and global slowdown. Considering the headwinds arising on external front and its possible spillovers on the Indian economy, we expect the GDP growth to slow down to around 6.1% in FY24.