US is one of the leading importers of apparel goods in the world. The covid-19 pandemic, combined with a damaging trade war with China, made 2020 a watershed year for apparel trade and sourcing in the United States. Owing to the economic fallout from COVID-19 and government stay-at-home orders, most apparel stores in the United States were closed, and importers were either cancelling or slashing orders.

US’s import of Knitted Apparels has always been more than the woven apparel imports. The total import of knitted apparels was worth 48 million USD in 2019 which dramatically fell in 2020 due to the covid-19 pandemic and it was worth 38 million USD. Though the highest import was from China in both the years, China faced a sharp drop in the year 2020 due to the trade war. Import from China was worth 14 million USD in 2019, which lowered to 9 million USD in 2020. This shrink was mainly due to the ban or decrease imposed on imports from China. Despite the lowered exports, China was on the top 10 importers in US with the global share of 24.44% in the export to US. Apart from China, Vietnam also exported a huge quantity of knitted apparels to US which was worth 7 million USD in both the years with 19.38% global share. US imported the knitted apparels worth 2 million USD and 1.5 million USD from India in 2019 and 2020, respectively. India’s share was 4.03% among the global exporters of knitted apparels to US in the

apparels was worth 48 million USD in 2019 which dramatically fell in 2020 due to the covid-19 pandemic and it was worth 38 million USD. Though the highest import was from China in both the years, China faced a sharp drop in the year 2020 due to the trade war. Import from China was worth 14 million USD in 2019, which lowered to 9 million USD in 2020. This shrink was mainly due to the ban or decrease imposed on imports from China. Despite the lowered exports, China was on the top 10 importers in US with the global share of 24.44% in the export to US. Apart from China, Vietnam also exported a huge quantity of knitted apparels to US which was worth 7 million USD in both the years with 19.38% global share. US imported the knitted apparels worth 2 million USD and 1.5 million USD from India in 2019 and 2020, respectively. India’s share was 4.03% among the global exporters of knitted apparels to US in the  year 2019 and 2020. Cambodia’s share was 5.73% with the exports worth 4 and 5 million USD. Apart from the top 10 countries mentioned, the share of rest of the nation’s total export of knitted apparels to US was just 23.74% which was less than China’s total share. Bangladesh’s total export was worth 1.6 million USD in both the years giving it the share of 4.39%. Knitted apparels are a daily requirement and have witnessed consecutive hike in imports every year. There was a drop in this import due to the pandemic, but it is expected to rise eventually while the situation goes back to normal.

year 2019 and 2020. Cambodia’s share was 5.73% with the exports worth 4 and 5 million USD. Apart from the top 10 countries mentioned, the share of rest of the nation’s total export of knitted apparels to US was just 23.74% which was less than China’s total share. Bangladesh’s total export was worth 1.6 million USD in both the years giving it the share of 4.39%. Knitted apparels are a daily requirement and have witnessed consecutive hike in imports every year. There was a drop in this import due to the pandemic, but it is expected to rise eventually while the situation goes back to normal.

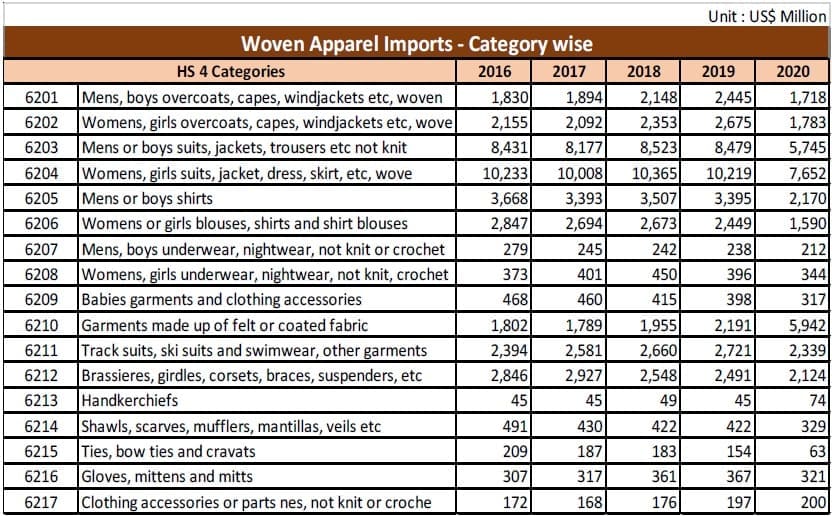

China was also the highest exporter of woven apparels to US in not only 2019 but also in 2020 despite the pandemic. US imported the woven apparels worth 12 million USD and 10 million USD from China in the year 2019 and 2020, respectively. Its total global share was 30.96% for woven apparel exports to US. Vietnam’s total share was 17.51% with the export worth 5 million USD in both the years each. US imported woven apparels worth 4 million USD and 3 million USD in the year 2019 and 2020, respectively from Bangladesh. Indonesia’s total share was 5.22% with the total export worth 2 million USD and 1 million USD in 2019 and 2020, respectively. India’s export to US was worth 2 million USD and 1 million USD in the year 2019 and 2020, respectively. Mexico’s share was 4.92%. Pakistan’s share was lowest i.e., 1.94% with the export worth 0.6 million USD in both the years to US.

US imported the woven apparels worth 12 million USD and 10 million USD from China in the year 2019 and 2020, respectively. Its total global share was 30.96% for woven apparel exports to US. Vietnam’s total share was 17.51% with the export worth 5 million USD in both the years each. US imported woven apparels worth 4 million USD and 3 million USD in the year 2019 and 2020, respectively from Bangladesh. Indonesia’s total share was 5.22% with the total export worth 2 million USD and 1 million USD in 2019 and 2020, respectively. India’s export to US was worth 2 million USD and 1 million USD in the year 2019 and 2020, respectively. Mexico’s share was 4.92%. Pakistan’s share was lowest i.e., 1.94% with the export worth 0.6 million USD in both the years to US.

There were falls in 2019 in the portions of US attire imports which came from El Salvador, Indonesia and Mexico as US apparel imports from these three nations declined yet there were ascends in the portions of US garments imports which came from Bangladesh, Cambodia, Honduras, India, and Vietnam- – reflecting solid development in US imports from each of the six nations.

In the initial five months of 2020, Bangladesh represented 9.40 percent of absolute US imports, notwithstanding Covid-19 and the US-China exchange war. The country’s solid capacity to create yarn and texture locally without depending on imports notwithstanding work cost added to a critical value advantage for Made in Bangladesh items. A significant number of work orders for piece of clothing things adding up to $3.2 billion have either been dropped, conceded or retained at different seaports as retailers in the US were hesitant to acknowledge conveyances in the midst of the ebb and flow monetary vulnerability, as per the Bangladesh Garment Manufacturers and Exporters Association (BGMEA). Presently, purchasers have requested up to 180 to 210 days to finish their installment.

Source: Trademap

Source: Trademap

BY:

RADHIKA BODDU