INTRODUCTION

The contemporary issue in the textile industry is a topic of frequent discussion in media. However, the discussion is mostly focusing on the consumers’ social point of view, neglecting the impact it has on the Indian export crisis and environment as well as other sectors. India is the second-largest producer of textiles and garments after China and also the second-largest producer of cotton. It is the largest producer of jute in the world. It employs 51 million people directly and 68 million people indirectly. However, these features do not summarise the current scenario of the sector. The Indian textile industry is highly fragmented and is being dominated by the unorganized sector and small and medium industries. The changing government policies at the state and central government levels are posing major challenges to the textile industry. The tax structure GST (Goods and Service Tax) makes the garments expensive. Another important thereat is raising interest rates and labor wages and workers’ salaries. There is a higher level of attrition in the garment industry. Although the central government is wooing the foreign investors the investment is coming in the textile industry. In India places such as Bangalore, Mumbai, New Delhi and Tirupur are the hubs of textile garment industries. These manufacturers have ability to produce the entire range of woven wear and knitwear at low cost with reasonably good quality within the short notices. The Indian textile industry has its own limitations such as access to the latest technology and failures to meet global standards in the highly competitive export market. There is fierce competition from China, Bangladesh and Sri Lanka in the low-price garment market. In the global market tariff and non-tariff barriers coupled with the quota are posing a major challenge to the Indian textile Industry. The environmental and social issues like child labor and personal safety norms are also some of the challenges for the textile industry in India. ( Satish Kumar R, May 2018).

CONTEMPORARY ISSUES

1)Shortage in supply of raw material

Shutting down some units in China and Europe due to pollution issues has resulted in an unprecedented rise in prices of basic raw materials in international markets. The chemical dyestuff industry of Gujarat is finding it hard to bag new orders as prices of basic raw materials intermediates have increased more than double in the past few months. Industry insiders claim shutting down of some units in China and Europe due to pollution issues has resulted in an unprecedented rise in prices of basic raw materials in international markets. “Gujarat is the hub of chemical dyestuff manufacturing with about 70% share in production. In recent times, prices of basic raw materials of dyestuff have gone up by more than double and because of this small and medium units are not getting new orders,” said Bhupendra Patel, president of Gujarat Dyestuffs Manufacturers Association (GDMA). Prices of materials such as acetic anhydride have shot up from Rs 65 to Rs 175 per kg, sodium bicarbonate prices have increased Rs 27 from Rs 20 a kg and caustic soda flakes have moved up to Rs 50 from Rs 38 per kg in past one month. Prices of beta naphthol, J acid, H acid, vinyl sulphonyl, gamma acid, and Tobias acid moved up by 15-30% in the past two months.

GDMA has urged the Union government to interfere to control prices. It is difficult to do business for small players in this condition. Patel said, “The price rise is completely unexpected, and it is challenging to do business for small units in this condition. We have urged the central government to intervene to control the prices.”

Availability of quality cotton has been a major issue for Indian spinning mills due to lower production in India following drought in its major cultivating states including Maharashtra, Gujarat, Telangana and Andhra Pradesh last year. A lack of moisture forced farmers to suspend picking of cotton in the field after the second of four rounds. The quality of cotton was very poor due to sporadic picking in the third round in some parts of the drought-ridden states.

Man-made fiber is derived from crude oil and, therefore, abundantly available across the world. Moreover, man-made fiber is substantially cheaper than cotton. Consumers opting for fabrics with synthetic blends find them cheaper.

Ujwal Lahoti, Chairman, Cotton Textile Export Promotion Council (Texprocil), said, “Some spinning mills in the South Indian states including Tamil Nadu have started using manmade fiber again after a wide gap of several years. Traditionally, they were using manmade fiber but had shifted to cotton about a decade ago. They have again switched to manmade fiber.” (Kumar.D., May 2019)

2)Increase in cost of raw material

Besides other prevailing challenges, apparel companies need to now tackle a steep increase in prices of raw materials as well. As per recent stats, wool prices have soared to record highs this year on booming demand, while a drought in Texas and rising Chinese imports have sent cotton futures to a nearly six-year peak in the US. The price of oil used to make synthetic fabrics like polyester and rayon is up over 50 percent from a year ago. The rise in prices of imported raw materials has increased the prices of dyes made by for Gujarat-based dye-makers by about 15 to 50 percent in one month, which industry representatives fear can reduce market demand.

Prices have seen an upward increase after many units in China were shut down due to pollution norms. The pollution caused by the manufacturing process was the main reason that led to the shutdown of units.

Cotton prices jumped to Rs 13,200 per quintal now from Rs 11,800 per quintal about a month ago. Comparatively, manmade fibers are 30-40 percent cheaper. Reasons for price rise Cotton prices are jacking up because bad weather is reducing global supplies. Cot look, an independent analysis firm, forecasts a deadline in the world’s stock of cotton by the end of this year. Chinese textile manufacturers have also begun drawing down massive government stockpiles. Oil prices have risen steadily over the last year, as the Organization of the Petroleum Exporting Countries, as well as Russia, have reduced production, and countries like Libya and Venezuela have seen supply outages. Brent crude, an international benchmark, traded at about $78 a barrel on Wednesday, compared to about $50 a barrel a year ago. The fashion industry’s demand for wool is rising faster than farmers can handle. Wayne Gordon, the commodities analyst at UBS Global Wealth Management Chief Investment Officer, highlighted that you must have the breeds of sheep, and it takes 2-3 years to have any impact on the market. It will put pressure on the fashion industry. However, in the case of cotton recently it’s different.The outbreak of Coronavirus in China is impacting cotton growers in Vidarbha as farmers in the city largely depend on government purchase at minimum support price (MSP) of Rs 5,550 a quintal. As private traders in the city continue to buy at lower rates, chances of open market rates crossing MSP are slim due to the absence of Chinese buying, which has been hit by the coronavirus outbreak.

China is one of the major buyers in the international market. The virus outbreak has hit logistics in China, even blocking exports of cotton consignments from India. This has in turn further dampened the rates in India. Traders said Chinese demand could have taken the rates up, at least crossing the MSP in the private market. A major chunk of cotton supply has been taken away by the government procurement mechanism, which is still not being offloaded in the open market. Though sizeable supplies have been sucked out of the market, rates of raw cotton have not inched up, leaving the farmers to settle at MSP. The price is even less if a farmer goes to private traders who are not offering more than Rs 5,200-5,300 a quintal. https://www.fashionatingworld.com/

3)Compliance: Environmental issue

Globally the textile industry has been under increasing pressure to meet stringent social and environmental norms in the international market. Environmental compliance often isn’t at the top of textile and garment importers’ concerns. But failing to comply with environmental regulations can put your supply chain in jeopardy, as pressure mounts for the apparel industry to improve environmental compliance efforts. So, let’s get started by exploring the environmental impact of garment manufacturing and how you can ensure compliance with environmental protection laws. (Vicky. Y. 2018) Textile processing is extremely chemical-intensive and involves the use of numerous environmentally unfriendly, non-biodegradable chemicals. In addition, large quantities of unused chemicals are left after the final stage of processing along with the process of water. The toxic, nonrecyclable chemicals utilized in the various processes are challenging to eliminate from bilge waters, as they require tertiary and additional treatments to address their various properties; however, neglecting to treat these wastewaters leads to environmental degradation when they are released to the environment. As most of the textile wet processing units are situated in developing or underdeveloped nations in which processing is conducted by small facilities that lack the financial resources to purchase and operate costly machinery for the appropriate handling of wastewaters, these effluents are instead being released into the surrounding environment without adequate treatment to make them safe. This has resulted in severe ecological harm in the vicinity of many of these facilities (Saxena et al., 2017).

On 1 March 2018, at an event in Geneva, titled ‘Fashion and the Sustainable Development Goals: What Role for the UN?’ the UNECE cautioned that the fashion industry’s practice of churning out increasingly large volumes of cheap and disposable clothing is an “environmental and social emergency.”Inefficient production practices and the blatant exploitation of informal and subcontracted workers in developing countries with capital-friendly labor laws allow big fashion companies to produce clothing in bulk at low prices ( Bhowmick.S., Feb 2019)

4) Infrastructure bottlenecks

Another challenge is the low quality of India’s infrastructure, which continues to lag behind that of many other Asian countries. Nearly 40 percent of the Indian road network was unpaved as of 2016. Indian fashion retail industry is hit by infrastructural bottlenecks due to the poor conditions of roads, highways, etc., which creates supply chain constraints and increases lead time, inventory holding cost and inventory carrying cost. India has a huge scope of improvement in the basic aspects of infrastructure like the quality of roads, ports, and the quality of electricity supply.

Among the consequences of poor and inefficient infrastructure we will highlight the low level of reliability in the fulfillment of delivery deadlines, high transaction costs, high interest rates and low level of direct foreign investments despite the efforts made to attract them.

While there are 3.35 million kilometers of roadways, 63.100 km of railway tracks, 13 large ports, 186 small and medium-sized ports, 11 international airports and 125 domestic airports, this is a critical aspect in the country. 90% of international commerce in India passes through its ports. WeWe must highlight the existence of special areas or SEZ (Special Economic Zones) that put industries together in a certain region. There are around 135 throughout India. The government has launched a public-private program aimed at providing adequate technical, physical and financial resources to establish a basis of efficient infrastructure through the “Committee on Infrastructure”. These efforts are developed on both national and provincial levels with roadways, aviation, railways, energy services, sea transport and telecommunication and internet services. Given the poor state of infrastructure, we must take into account the fact that transport times for products can be greatly affected by specific problems. The payment of provincial duties and taxes causes large traffic jams of trucks loaded with containers on the entry and exit lanes between two different states (Economic times, Feb 2016)

5) Impact of GST

It is expected that the tax rate under GST would be higher than the current tax rate for the textile industry. Natural fibers (cotton, wool) which are currently exempt from tax, would be taxed under GST.GST is a multi-stage tax levied on every value addition. By design, it was meant to transform the previous indirect tax system of the country from the origin-based model to a consumption-based model. But GST has created distortions in the Textile and Apparel sector in India, impeding its competitiveness. The man-made fiber yarn is now taxed at 18%, while the natural fabric is taxed at 5%. The small businesses which buy yarn and produce fabric are directly impacted by this imbalance, affecting their sustainability. Apart from the policy limitations, system errors, delay in reimbursement of input credit, untimely implementation (while the industry was still feeling demonetization blues) and limited knowledge of GST has hugely impacted the sector in the country. Although in the long-term GST is set to affect the apparel and textile sector of India positively, the short-term impact has brought many small-scale businesses to a complete halt (Ambastha , M., 2018)

6) Shortage of laborer’s due to a mass return

“Gujarat is a major textile producer. Hence, the mass return of migrant workers from the state is set to reduce India’s overall textile output by 10-15 percent this year,” said R K Dalmia, president, Century Textiles and Industries, a leading player. The country’s textile industry is concentrated in a few pockets of Gujarat and Maharashtra in the west and Tamil Nadu and Karnataka in the south. A large proportion of workers employed by these units comes from Bihar, Uttar Pradesh, and West Bengal. Unlike in developed countries, textile factories in India are not fully automated and remain labor-intensive. Gujarat contributes nearly 80 percent to India’s overall production in synthetic textiles. All units in the segment are facing labor scarcity. While large players have employed workers on a regular basis, adhering strictly to labor laws, small- and medium-sized units are facing huge problems in terms of labor availability. Most of such units have, therefore, reduced their production by 20-25 percent or higher. The flashpoint of the crisis was the rape of a minor girl allegedly by a migrant from Bihar. The incident triggered attacks on north Indians across Gujarat, resulting in their mass return to home states. The number of migrant laborers in Gujarat is estimated at 10 million. The exodus of Hindi-speaking migrant workers from Gujarat, following a series of violent attacks on them, could lead to a decline in India’s textile output by 10-15 percent this year. “Gujarat is a major textile producer. Hence, the mass return of migrant workers from the state is set to reduce India’s textile overall output by 10-15 percent this year,” said R K Dalmia, president, Century Textiles and Industries, a leading player. According to some textile representative bodies, the current labor shortage can partly be attributed to migrant workers returning to their native places on the occasion of Dussehra and Diwali. This, they said, was a seasonal phenomenon. “Typically every year, laborers take three-four months of leave around October and return a month or two after Diwali. “The industry prepares for the workers’ shortage of months in advance or extend their delivery schedule to meet the labor shortage.”This year, however, the impact is wider due to the mass return of migrant workers,” said Siddharth Rajagopal, executive director, the Cotton Textiles Export Promotion Council of India (Texprocil). Delivery of export orders has been a perennial issue for textile exporters due to labor shortage. While the outlook for textile exports improved due to a steep depreciation in the rupee against the dollar, the labor shortage could prove to be a speed breaker. A senior official of the Synthetic & Rayon Textiles Export Promotion Council, under the Ministry of Commerce, said labor shortage had always been an issue in this sector. “While the return of migrant workers might lead to some impact, it is hard to quantify in terms of their business volume and contribution in exports,” he said. “Moreover, with the employment guarantee schemes, workers also find jobs in their home towns. “So, many of them return after their leave period gets over, while a number of skilled workers also get migrated to other industries, including agriculture,” he added. The data compiled by the Confederation of Indian Textile Industry shows around 100 million people are employed in the Indian textile industry, directly or indirectly, across the country. (India today Oct 2018).

6)Fall in Apparel export

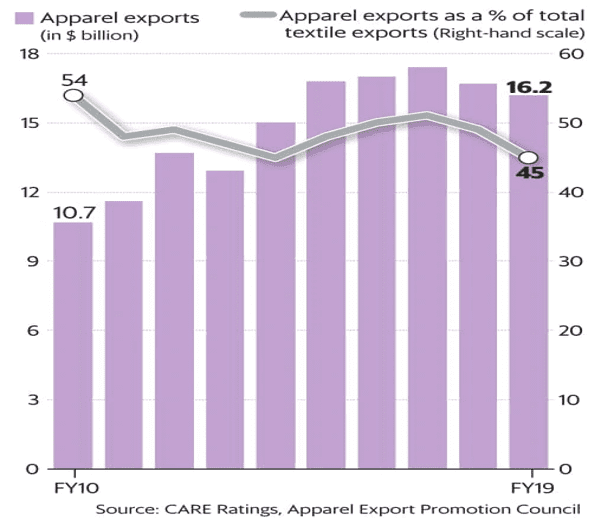

Estimated at $16.2 billion in FY19, India’s apparel exports fell by 1.2% from FY18, which in turn was 4% lower than the previous year

Even the share of apparel exports in the country’s total textile exports has fallen sharply from 51% in FY17 to 45% in FY19

India’s apparel exports have fallen for two years in a row. Estimated at $16.2 billion in FY19, the country’s apparel exports fell by 1.2% from FY18, which in turn was 4% lower than the previous year. This comes after an annual average growth of 5.7% between FY10 and FY16. The reasons for the slowdown range from issues on the domestic front to slackening global demand.

According to Chandrima Chatterjee, an adviser at Apparel Export Promotion Council (AEPC), the time taken by the industry to align to the new goods and services tax (GST) regime, a downward revision of export incentives, and the credit squeeze particularly faced by small and medium enterprises adversely impacted exports.

Initiatives taken to overcome issues

MAKE IN INDIA: THE VISION, NEW PROCESSES, SECTORS, INFRASTRUCTURE, AND MINDSET

New Processes: The government is introducing several reforms to create possibilities for getting Foreign Direct Investment (FDI) and foster business partnerships. Some initiatives have already been undertaken to alleviate the business environment from outdated policies and regulations. This reform is also aligned with parameters of the World Bank’s ‘Ease of Doing Business’ index to improve India’s ranking on it.

New Infrastructure: Infrastructure is integral to the growth of any industry. The government intends to develop industrial corridors and build smart cities with state-of-the-art technology and high-speed communication. Innovation and research activities are supported by a fast-paced registration system and improved infrastructure for Intellectual Property Rights (IPR) registrations. Along with the development of infrastructure, the training for the skilled workforce for the sectors is also being addressed.

New Sectors: ‘Make in India’ has identified 25 sectors to promote with the detailed information being shared through an interactive web-portal. The Government has allowed 100% FDI in Railway2and removed restrictions in Construction. It has also recently increased the cap of FDI to 100% in Defense and Pharmaceutical.

New Mindset: Government in India has always been seen as a regulator and not a facilitator. This initiative intends to change this by bringing a paradigm shift in the way Government interacts with various industries. It will focus on acting as a partner in the economic development of the country alongside the corporate sector. https://www.makeinindia.com/

A movie in 2018 was launched inspired by Make in India movement called “SUI DHAGA’ which showed the present scenario of Indian artisans and their upliftment.

2. Applauses will always overshadow the abuses you got

3. Self-employment is better than unemployment

4. Skills can give you everything you never expected

5. Best service to your nation is fueling its economy

6. Balance in life is maintained only when you keep going

Overcoming these current issues are vital. Various provisions are to be implemented including shifting towards sustainable fashion. Using environment-friendly textiles, organic fabrics. Presently dyes obtained from algae could be used for colors or mushroom leather. Smart stitch could be a working way for sustainability. Recycling/upcycling of garments as opposed to purchasing newly produced clothes also forms part of making sustainable fashion choices. There is a need to work on correcting the challenges in the form of outdated technology, inflexible labor laws and infrastructure bottlenecks. While India has abundant supply of labor, flexibility in labor laws and adequate skilling will give a big boost to the textiles industry These contemporary issues if are given attention to could be tackled in years to come. While weavers and designers are gradually shifting to sustainable fashion, what aids their shift the most is demand by conscious consumers. So, the demand of customers plays a major role in the working of the industry about what they need to supply should be fitting the customer demand. Thus, if the customers are aware and taking up their initiatives to switch to fashion that does not harm the environment could add to a better working industry not affecting environmental compliance.

The article was written by – Ms. Ayman Satopay. B.Sc in Textile and Apparel Design from Sir Vithaldas Thackersey College Of Home Science. Textile Value Chain intern. Email: [email protected]

Dr. Suman Mundkur, Retd. Associate Professor, Textiles and Apparel Designing, SVT College of Home Science.