The Textile Machinery Industry in India

The textile Machinery manufacturing section in India is one of the largest segments of the machinery manufacturing industry.

This industry is nearly sixty years old and has nearly a thousand machinery and component manufacturing units.

Nearly three hundred units produce complete machinery and the remaining various textile machinery components.

The Total investment in this industry is around 2000 Crores. However not all the units are working to full capacity or even the optimum capacity level.

Except for the units in the spinning sector who produce machineries in this sector are of international standards. The Other sectors manufacturing machinery for weaving, knitting and wet processing lack standard of quality and performance in most of the cases to compete with the European manufacturers.

In the weaving sector shuttle less weaving machinery either rapier or jet and in the knitting sector-circular knitting and Flat Knitting machineries have hardly any presence in the industry.

The Major problem in the textile machinery manufacturing industry is the lack of investment in R & D, with the result that excepting for the manufacturing units who have technical collaboration with reputed foreign companies no progress has been made in the quality of the machinery produced.

This dependence on borrowed technology and want of research has kept most of the sectors except for the sector manufacturing spinning machinery far behind in the standard and performance of the machinery produced. This has resulted in the import of second hand machinery specially in the area of weaving thus discouraging the advancement of technology in the manufacturing of similar machinery in India.

Lack of systematic fiscal support to the industry by the government has also added to the problems of the industry.

World production of textile machinery annually is over US $ 20 Billion. The major manufacturers of textile machinery are Italy, Germany, Switzerland, France and now China.

The Current annual demand of textile machinery in India is to the tune of Rs. 4500 Crores. And the annual growth rate is 12 to 15 percent.

With the growing demand in the export market of textile products India can avail of this opportunity by upgrading its textile industry especially in the area of modernization of it’s weaving and processing sectors.

China is leading in the field of textile exports today because they have set up a very large installation of spindles and rotor and shuttle less weaving machines. Today china is manufacturing the entire range of machineries for the textile industry, not only spinning weaving and processing but also knitting, embroidery and plants for the nonwoven industry.

Our Strengths

The Country has a large production base. Our spinning machineries are fairly updated in quality and technology. The spares and accessories manufacturing set up is fairly adequate in capacity and quality.

We have a well trained technically qualified engineering personnel and skilled labour in in this area.

Our Weaknesses

The industry is dependent on borrowed technology. There is very little investment in Research and Development.

The country has hardly any presence in the field of manufacturing of good quality weaving machines and knitting machines.

The wet processing machinery manufactured also need sufficient up gradation in technology.

The fiscal support required from the government to this industry is lacking.

Indiscriminate import of second hand machinery especially in the area of weaving machinery has discouraged the industry from investing in the area of shuttle less weaving machines manufacturing.

Import duty for spares required for the manufacturing of complete textile machines is very high today and this should not exceed 5% of the value of the import.

The future

It is estimated about 10/12 million spindles need to be modernized. The technology is adequate in this area and therefore the spinning machinery industry is expected to perform well in the coming years.

In the area of weaving the majority of the weaving machines in the power loom sector need to be scrapped and replaced by shuttle less weaving machines. At least another 50000 shuttle weaving machines need to be installed to replace some of the old machines in the next five years.

In the processing sector sixty percent of the units belong to the SSI sector. Up gradation of the technology and modernization is urgently required in this area.

India has to take up the matter of manufacturing textile machinery of high standard in all areas and to achieve this goal concentrated efforts need to be put by the manufacturers and the government.

Today china in a very short span in manufacturing machines in all the fields and are therefore able to boost their textile production in all the areas, right from spinning, weaving , wet processing to knitting, synthetic fibres and filament yarn and even non wovens.

Quite a few reputed manufacturers from Europe have switched over to china for producing machineries at a competitive price for the world market.

India has enough basic raw material for the production of quality textile machinery, has a competitive labour strength and has a highly capable qualified engineers for developing good machinery at a competitive price. However, there is very little work done towards research for developing sophisticated machinery for the industry. It is high time that sufficient funds are to be allotted in the area by the government.

The reputed foreign manufacturers should be approached for getting the latest know how and even setting manufacturing units in our country like in case of the automobile industry.

*

In the period of 2008-2009 the installed capacity of the textile engineering industry was Rs. 800 crores. During 2010-2011 the textile machinery and spares actual production was Rs. 6150 crores against Rs. 4200 crores in the previous year. Thus, the capacity utilization increased to 76 percent in 2010-2011 against 53 percent in 2009-2010.

Import of textile machinery has also increased to Rs. 5000 crores in 2010-2011 against Rs. 4500 Crores during 2009-2010. Export of textile machinery and spares was also worth Rs. 650 crores in 2010-2011against Rs. 580 crores in 2009-2010. And this figure can go up substantially with proper fiscal assistance from the government and systematic up gradation of technology with extensive research and design development.

In the country the import of second hand machinery has to be restricted …

1) In case of spinning where the country is manufacturing machinery of international standard the import of second hand machinery has to be stopped.

2) In the case of weaving machinery, the import of second hand weaving machinery running at speed lower than 700 Meters per Minute – Pick insertion rate should be discouraged. Also concession in the import duty for second hand weaving machines restricted. Immediate efforts are necessary to manufacture high speed weaving machines with collaboration with the best European groups in this field.

3) In case of the processing industry the machineries manufactured in the country need to be upgraded to reduce power consumption and fuel consumption and also make electronic control more effective.

4) Warping and sizing machines produced in the country are of fairly adequate standard, but efforts need to be put to manufacture good quality high speed circular knitting, flat knitting and embroidery machines. By the tie up with Japanese and Taiwan / Korea manufacturers of these machines

5) Substantial amount of involvement is necessary in research and development to implement the up gradation of the industry in a big way.

With proper involvement for up gradation and research and a rational approach of the government in the import duties India can become a leader in the field of textile machinery manufacturing in the world. A more dynamic approach jointly by the government, the textile machinery industry and the textile machinery users can definitely achieve the goal.

References: Textile Engineering Industry – Strategy paper deloitte touché Tohmatsu

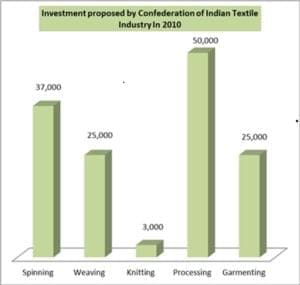

| Investment proposed by Confederation of Indian Textile Industry In 2010 | ||

| Sector | Investments (Rs. Cr) | |

| Spinning | 37,000 | |

| Weaving | 25,000 | |

| Knitting | 3,000 | |

| Processing | 50,000 | |

| Garmenting | 25,000 | |

| Total | 140,000 | |

| Import of Shuttleless Looms During 2007-2008 to 2010-2011 | ||||||||

| 2007-2008 | 2008-2009 | 2009-2010 | 2010-2011 | |||||

| No. | Value Rs. Cr.) | No. | Value Rs. Cr.) | No. | Value Rs. Cr.) | No. | Value Rs. Cr.) | |

| New Airjet Looms | 1113 | 240.91 | 507 | 127.46 | 692 | 225.12 | 1765 | 404.15 |

| New Rapier Looms | 719 | 134.61 | 1138 | 110.97 | 1607 | 164.36 | 154 | 11.9 |

| New Loom Total Import | 1832 | 375.52 | 1645 | 238.43 | 2299 | 389.48 | 1919 | 416.05 |

| Second Hand Airjet looms | 339 | 30.47 | 153 | 12.08 | 900 | 324 | 1062 | 57.92 |

| Second Hand Rapier looms | 1801 | 170.92 | 548 | 38.63 | 2644 | 164.44 | 3719 | 249.07 |

| Second Hand Rapier looms | 734 | 48.66 | 407 | 32.71 | 2060 | 307.06 | 2161 | 15.65 |

| Second Hand Rapier looms | 536 | 16.63 | 246 | 6.63 | 14.74 | 96.37 | 1497 | 49.38 |

| Second Hand Looms Total | 3410 | 266.68 | 1354 | 90.05 | 5618.74 | 891.87 | 8439 | 372.02 |

| Overall Total | 5242 | 642.2 | 2999 | 328.48 | 7917.74 | 1281.35 | 10358 | 788.07 |

| Srecond Hand Loom Import % | 65% | 45% | 71% | 81% | ||||

| Textile Industry: Production of Textile Machinery | |||||||||

| Item | Unit | 1999-2000 | 2000-01 | 2001-02 | 2002-03 | 2003-04 | 2004-05 | 2006-07 | 2007-08 |

| Production of Textile Machinery | Million US $ | 256.7 | 286.9 | 225.64 | 243.48 | 292.52 | 375.74 | 500.64 | 618.03 |