The report “Industrial Wax Market by Type (Fossil-based wax, Synthetic wax, Bio-Based wax), Application(Candles, Packaging, Coatings & Polishes, Hot-melt Adhesives, Tires & Rubber, Cosmetics & Personal Care, Food), and Region – Global Forecast to 2025″, The Industrial wax market was USD 7.3 billion in 2020 and is projected to reach USD 8.9 billion by 2025, at a CAGR of 4.0 % from 2020. The growing market for various application industry such as cosmetics and personal care, tire and rubber and candles is expected to drive the demand for industrial wax market. The demand for bio-based wax in food, packaging, cosmetics & personal care, and other applications is growing in developed region such as North America and Europe due to environmental regulations. Moreover, growing population, the GDP growth, increase in per captia and disposable income in countries such as china, India and other Asian countries is boosting the market for industrial wax.

Browse

• 445 Market data Tables

• 68 Figures

• 314 Pages and in-depth TOC on “Industrial Wax Market – Global Forecast to 2025″

Some of the prominent key players are:

- ExxonMobil (US)

- Royal Dutch Shell PLC (Netherlands)

- Sinopec (China)

- Sasol Ltd (South Africa)

- CEPSA (Spain

- Hollyfrontier Corporation (US)

- Calumet Specialty Products Partners (US)

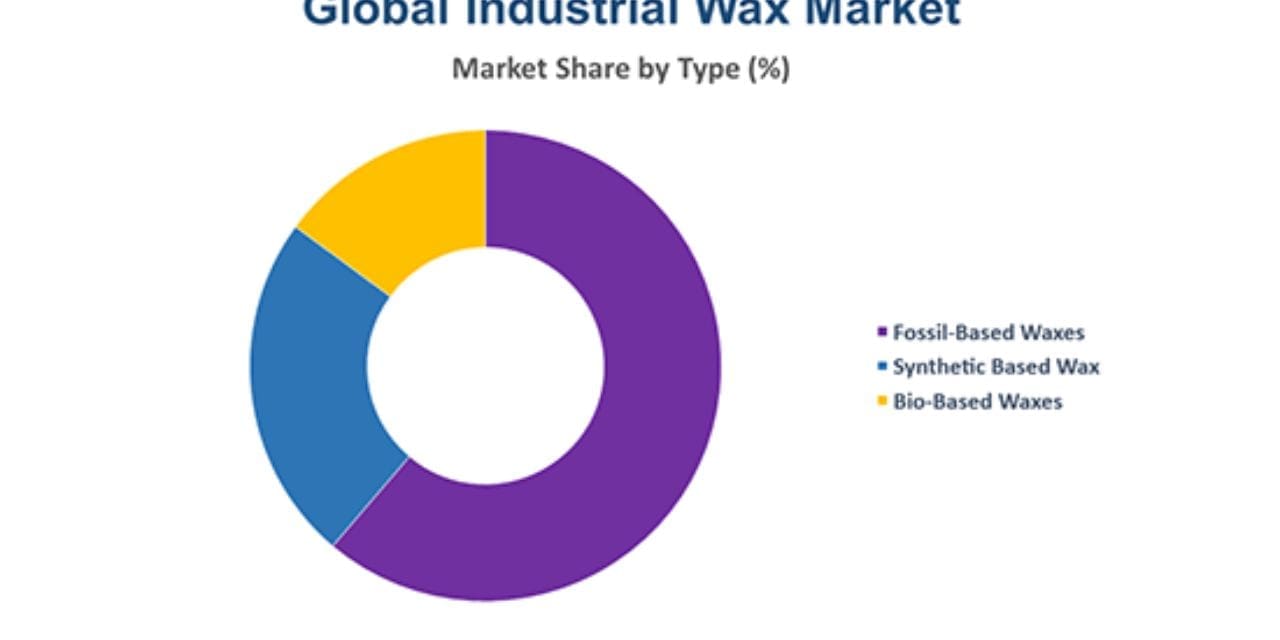

Fossil based segment is estimated for larger market share in 2019.

Fossil based wax such as paraffin and microcrystalline account for the majority of market share for industrial wax. The steady growth in demand from end-use industries such as candle, packaging, cosmetic, and coatings, among other supports for the growth of the market. Paraffin wax is mainly consumed across these industries due to abundant availability, low cost of the product, ease of production, suitability to several industrial application and performance characteristics. Their applications in various industries includes rubber, textiles, wood coatings, paper & printing, industrial coatings, and constructions. Moreover, microcrystalline waxes are widely used in cosmetics, food, packaging, coatings, and other industrial applications.

Candles industry is estimated to have largest share in Industrial wax market.

Candles are primarily made from microcrystalline wax, beeswax, and plant wax such as carnauba, soybean, and bayberry wax). Candles are one of the oldest applications of wax, which is still the fastest growing market owing to the increasing importance of decorative items and therapeutic uses. In terms of production, China has significant production capacities and export over half of the total production to North American and European countries. It has been observed that the import of candles in European and North American countries has increased significantly in the past five years. The growing importance of candles for religious purposes has enforced the wax manufacturers to produce wax from vegetable based materials such as soybean oil, palm oil, beeswax, and even tallow. This has triggered the demand for vegetable based waxes, globally.

APAC projected to account for the largest share of the industrial wax market during the forecast period.

Asia-Pacific has the largest share in the market due to growing economies such as China, India, Japan and other Asian countries like South Korea and Indonesia. The Asia-Pacific has the largest market for the candle industry. Within Asia, China dominates the market for candles and packaging industry. The growth is led by rapid industrialization, growing demand from various applications and growing per capita income in these regions. The growing demand for candles is derived by decoration, religious belief and various lifestyle, and living habitsNorth America is the largest market for synthetic waxes. The increasing in range of application for synthetic waxes is driving the demand in the region. Due to environmental regulations in developed countries such as Europe and North America, the demand for bio-based waxes is increasing in candles and food packaging industry for these region.