[1] Introduction:

In India, the pandemic coronavirus is giving rise to an economic slowdown along with immense human grief. The global outbreak has affected many businesses and is creating havoc in the Textile, Garment and other industries as well. The spread of the virus is bound to have serious implications and companies have started feeling the impact with store closures and uncertainty in orders. The Textile, Garment and all other industries will witness certain changes in the post-pandemic phase. The Situations cannot be predicted at this juncture.

This paper has given clear indications how the Industries Suffered in Quarter 1(Q1) and recovering in Q2 to Q3 but yet to gain the situations as on 2018-19.

It has got the set back in the Employment but with the Govt. initiatives and that of the Organised Sectors proper planning, it is almost over come.

The followings are the major causes of concerned for the sufferings and business dealings also. (Paper prepared in Oct-Nov`20, but the case studies were surveyed w.e.f. April `20)

[1.1] Retail Stores Closure is Forcing Brands to Hold Orders

Brands across the globe have announced temporary closure of their stores in an unprecedented move to prevent the spread of coronavirus. Retail stores in major markets all over India have been closed for months together and are expecting a prolonged closure in the wake of the virus. Moreover, retailers will continue to offer their employees full pay (or partial as per their capacity) and benefits during this time. Brands are facing a significant decline in their sales and are preparing themselves for potential revenue losses.

Store footfall will see a slow progression when the retail outlets reopen, as initially people will avoid crowded places although at most of the places crowd is found after the opening of the Stores and Markets during festival season (at some places the crowds found pre festival season, but that is just not enough). In addition, customers will pull back on spending and limit their purchases to essential commodities. The closure of stores has left brands to deal with surplus inventory, which they would need to stock out before the season ends. This is compelling buyers to cancel their further orders or reduce quantities, which will take a toll on the garment and the textile manufacturing industries.

However, after a two-month long production shutdown, Indian textile & apparel manufacturers are gradually commencing operations.

[1.2] Global Demand of Medical Textiles Increases

Sales of medical protective gears including surgical masks and protective clothing have jumped drastically. All the nations are importing large quantities of such products to battle the disease. The supply of these products is not able to keep up with the rising demand. The rapid spread of the disease across the globe has sensitized people to hygiene and healthcare. The demand for medical protective gear such as masks, Head covers, disposable gloves, Shoe covers, Body covers and hygiene products such as wipes are surged and sustain even after the end of the coronavirus pandemic. This is a lucrative opportunity for the textile & apparel industry presently and in forth coming days.

There are now 9 authorised testing Laboratories in India for PPE clearance

[1.3] Fashion Events Stalled

The coronavirus pandemic has put a halt to international travel, and this has immediately affected the annual fashion events including fashion shows, trade shows and conferences. These events draw huge crowds and allow buyers to see the latest fashion trends. Most of the lined-up fashion events of 2020 have been either postponed or cancelled. The postponing of these events may slow down new investments and impact the businesses of the existing stakeholders.

[1.4] Increased Focus on E-Commerce Sales and Digitalization of Supply Chain

To avoid the incidence of crowds and reduce the spread of coronavirus, malls and retailers took the step to close their brick and mortar stores. But the e-commerce channel of these stores is still operational in several places across India. During the initial phase of coronavirus, consumers increased their online purchasing as a safe alternative to visiting physical stores. This shift could lead to a changed buying behaviour post the pandemic and has the potential to build long-time e-commerce customers.

[1.5] what is in Store for India’s Garment Industry and that of Textile?

The black swan event has affected the Indian garment and Textile industries in terms of both trade and domestic consumption. With the steep reduction in demand due to sudden halt of global trade and domestic sales due to the closure of retail stores, the industry is likely to face unprecedented and severe losses.

Because of the spread of the virus initiated in China and later spread to globally, the Indian textile value chain is bound to face adverse repercussions of the pandemic. Brands are expected to postpone orders in the upcoming six months and will initially demand smaller order quantities at very tight margins as a step to recover from the reduced sales in the previous weeks.

Coming to the domestic market, brands are looking at very low consumer sentiment and a steep decline in consumption in the coming year. Retailers and brands have already started halting production lines, delayed season releases and cut buying budgets to prepare for these eventualities.

With the lockdown, there has been a migration of migrant workers going back to their respective places. It will be a challenge to get this workforce back to factories once the restrictions are lifted and hence, the industry needs to be prepared for this.

In Tirupur, as reported in the month of Oct`20, after the arrival of the work force, 85-90% factories have started operation to fulfil the Domestic and Export Orders. But facing difficulties in getting skilled operators. Shortage of Cotton yarn is another hurdle for the manufacturers. Similarly, in Bhiwandi Power loom sector, the problem is similar and only 50% looms are working.

[1.6] How can Indian Garment Industry Emerge from this Pandemic?

The Indian garment industry will need to gear itself to fight the economic consequences that the coronavirus has brought with it. Garment manufacturers need to maximize their internal capabilities and focus on building their efficiencies. This will enable them to work with the anticipated shorter lead times and tight margins. Companies should further focus on adopting digital ways of connecting with buyers.

Garment manufacturers need to maintain closely connect with buyers and be ready to respond to buyer requirements. Companies may also focus on planning for the winter or next spring summer season and target the channels of value retailing and e-commerce, which are expected to grow in the near future. Indian companies should also look out for new markets beyond US and EU like Japan, South Korea etc., and focus on diversifying both markets and products.

With depressed prices of raw materials like polyester, cotton etc. companies can also look at hedging raw material prices and wherever possible stock raw material which will be helpful once the market opens again.

[1.7.1] Scenario as on today (Oct- Nov):

Although all the organised sectors are able to run at 90-100% capacity today (refer table IV & V, Market survey) but some branded Organisations are running till at 30 -50% capacity because they are the manufacturers of High quality Shirting’s & Suiting, Denim which are most of the time luxurious product and because of Shortage of Pocket Money the people are going for daily and cheaper products.

The Organised sectors producing daily use like Towels, Bed Sheets and PPE, Home Décor etc are fully loaded. Although most of them have curtailed Staff strength, but somewhat managing with limited staffs.

Those who could retain the work force during the Month of April, May, June, and July are the gainer today.

The management could survive who are having proper fore sight ness, Vision and strategic planning’s are the big gainer today.

[1.7.2] About Polyester Sectors: As per the present situation (Mid of November), the polyester sectors who shares 40% of the Textile products (synthetic Fibre vs. Natural Fibre Ratio in India is 40:60) also suffered a lot during the month of April-June `20 because of no demand from the Markets. However, some big Giants could run at higher capacity than the comparative smaller Sectors but as on November`20, almost all are able to run the Units at full capacity. The comparison between Q1, Q2 and Q3 shows the gradual improvements in Production and sales but if compared with the last year (2019) for the same period, it is distressing! Pl refer table IX.

The big Giants adopted the policy of running the Units within them which were having more demands (like staple fibre), consumes less power (Say small CP Lines) and workforce. But from the month of Sept onwards, it is running at full capacity. Some Big Giants are having the accommodation of the workforce and could retain them with full facilities and medical Check-up (Say Covid test at every 7 days’ interval). (Market studies and surveys).

As on Mid of November `2020, some polyester Manufacturers at Silvassa area are running at the capacity of 70-90% because of the shortage of Raw Material like PTA and stock pile up. Everyone is trying to produce special products as per the market demands.

The PTA manufacturer says that they put shut down during the month of May – July`20 because of Low demand but now they are running at full capacity. The shortage of PTA is generated because of demand – Supply but they are sure that the supply will be normal soon. (Market survey)

[2] The GDP of India and other Vital Industries

[2.1] Estimates of Gross Domestic Product for The First Quarter (April-June) Of 2020-21

(National Statistical Office Ministry of Statistics & Programme Implementation Government of India)

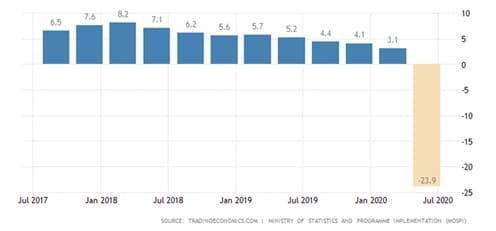

- GDP at Constant (2011-12) Prices in Q1 of 2020-21 is estimated at ` 26.90 lakh crore, as against ` 35.35 lakh crore in Q1 of 2019-20, showing a contraction of 23.9% as compared to 5.2 percent growth in Q1 2019-20. Quarterly *GVA at Basic Price at Constant (2011-12) Prices for Q1 of 2020-21 is estimated at `25.53 lakh crore, as against ` 33.08 lakh crore in Q1 of 2019-20, showing a contraction of 22.8 %.

- GDP at Current Prices in the year Q1 2020-21 is estimated at 38.08 lakh crore, as against 49.18 lakh crore in Q1 2019-20, showing a contraction of 22.6 percent as compared to 8.1 percent growth in Q1 2019-20. GVA at Basic Price at Current Prices in Q1 2020-21, is estimated at `35.66 lakh crore, as against `44.89 lakh crore in Q1 2019-20, showing a contraction of 20.6 percent.

*Gross Value added

(GDP at Market Prices = ∑ GVA at basic prices + product taxes – product subsidies.

In this context, when GVA from all sectors are added together and necessary adjustment for taxes and subsidies are made, we will get the GDP for the economy.)

- GDP of India in July`20 which is -23.9 %

Fig – 1

- Fitch Ratings on 8th September`20 projected a contraction of (-) 10.5% for India’s economy in the current financial year. As on 30th Sept Q2 it was (-) 9.6%. The Q3 results will be declared after 31st December `20

In July `20, official data showed that the country’s gross domestic product (GDP) shrank 23.9 per cent in the April-June period, in one of the sharpest contractions in the world. See fig -1 That was triggered by one of the most stringent nationwide lockdowns in the world.

“GDP should rebound strongly in 3Q20 (October-December) amid a re-opening of the economy, but there are signs that the recovery has been sluggish and uneven,” Fitch said.

[3.1] Performance of the corporate sector during April-June 2020-21 based on data received from BSE/NSE has been taken into account. Percentage change in the main indicators used in the estimation is listed below:

| Sl. No. | Indicators | Q-1 | Q1 |

| 2019-20 | 2020-21 | ||

| 1 | Production of Coal | 2.6 | -15 |

| 2 | Production of Crude Oil | -6.8 | -6.5 |

| 3 | Production of Cement | 1 | -38.3 |

| 4 | Consumption of Steel | 5 | -56.9 |

| 5 | total Telephone Subscriber | 1.5 | -2 |

| 6 | Sales of Commercial vehicle | -9.5 | -84.8 |

| 7 | Cargo handle at Major Sea Ports | 1.7 | -19.8 |

| 8 | Cargo Handle at Air Ports | -6.5 | -57.2 |

| 9 | Passengers Handle at Air Port | -0.6 | -94.1 |

| 10 | Railways | ||

| i. Net Tonne Kilometer | 0.7 | -26.7 | |

| ii. Passengers Kilometers | -2.2 | -99.5 | |

| 11 | Aggregate Bank Deposits | 10.4 | 9.6 |

| 12 | Aggregate Bank Credits | 11.9 | 5.6 |

| 13 | LIC Premium, Non- Linked | 35.6 | -14.7 |

| 14 | LIC Premium Linked | -3.7 | 20.9 |

| 15 | CPI General Index | 3.1 | 6.6 |

| 16 | IIP | ||

| I. Mining | 3 | -22.4 | |

| ii. Manufacturing | 2.4 | -40.7 | |

| iii. Electricity | 7.3 | -15.8 | |

| iv. Metallic Minerals | 17.9 | -43.3 | |

| 17 | WPI | ||

| I. Food Articles | 7 | 2.5 | |

| ii. Minerals | 18.3 | -1.2 | |

| iii. Manufactured Products | 1.5 | -0.03 | |

| iv. All commodities | 2.7 | -2.3 | |

| except LIC Premium Linked, all the Industries suffered especially Railway Passenger Kilo meter | |||

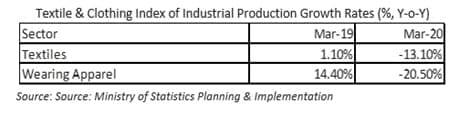

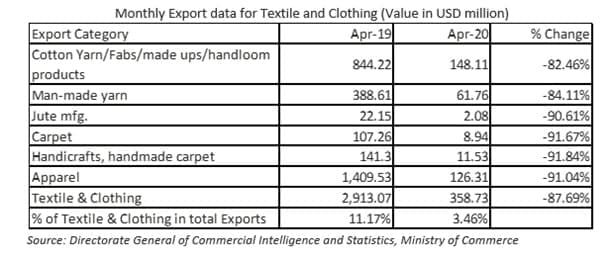

[3.2] The Impact of Carona in Textiles Industries. Please see table no II & III

Table II

Table III

From both the table II&III, it is very clear that at every sector in Textiles, there is high negative growth at each category when compared year to year. However, the situations are gradually improving in the Industries and the table no IV will show it.

Table IV

| Reiter Reports, CHF Million (source: Reiter Annual Report) | ||||

| 2018 | 2019 | Difference % | ||

| 1 | Order Intake | 868.8 | 926.1 | 7% |

| 2 | Sales | 1075.2 | 760 | -29% |

| 3 | Sales (India) | 146.2 | 99.9 | -32% |

| 4 | EBITDA (Operating results before interest, Taxes, Depreciation & Amartization) | 84.1 | 123.1 | 46% |

| 5 | – In % of Sales | 7.8 | 16.2 | |

| 6 | EBIT (Earnings before Interest & Tax) | 43.2 | 84.9 | 97% |

| 7 | – In % of Sales | 4 | 11.2 | |

| 8 | Net Profit | 32 | 52.4 | 64% |

| 9 | – In % of Sales | 3 | 6.9 | |

| 10 | Number of Employees (Excluding Temporary) | 5134 | 4591 | -11% |

The demand for new machinery remained at a low level until the third quarter of 2019. Due to the low Demand, Group sales declined by 29% to CHF 760 million (2018: CHF 1 075.2 million). Despite the low Volume, the EBIT margin was 11.2%. This was due to the non-recurring profit contribution from the sale of real estate in Ingolstadt (Germany). The Board of Directors proposes to the shareholders the distribution of a dividend of CHF 4.50 per share. In financial year 2019, Rieter recorded an order intake of CHF 926.1 million, which was 7% up on the prior year period (2018: CHF 868.8 million). This development is attributable to a strong fourth quarter, in which Rieter booked orders totalling CHF 401.6 million (4th quarter 2018: CHF 119.0 million). At the end of 2019, the company had an order backlog of around CHF 500 million (December 31, 2018: around CHF 325 million.

Table no VII (2019-VS 2020 Reiter)

| Reiter , Comparison of Sales between 2019 and that of 2020 ( before and after Covid ) | ||||

| January – June 2019 | January – June 2020 | Change | ||

| 1 | Order Intake | 372.3 | 250.7 | -34% |

| 2 | Sales | 416.1 | 254.9 | -39% |

| 3 | Sales in India | 66.7 | 17.7 | -73% |

| 4 | EBITDA, Operating result before Interest , Taxes, Depreciation & amartization | 18.3 | -36.1 | |

| 5 | in% of Sales | 4.40% | -14.20% | |

| 6 | EBIT before restructuring charges | -1.6 | -46.9 | |

| 7 | • in % of sales | 0.30% | -21.60% | |

| 8 | Operating result before interest and taxes (EBIT) | – 1.2 | – 55.0 | |

| 9 | • in % of sales | – 0.3% | – 21.6% | |

| 10 | Net profit | -3.8 | 54.4 | |

| 11 | • in % of sales | -0.90% | -21.30% | |

| 12 | Number of employees (excluding temporaries) at the end of the reporting period | 4743 | 4573 | -4% |

First Half of 2020 Severely Impacted by Covid-19

- Order intake of CHF 250.7 million down 34% on previous year

- Sales of CHF 254.9 million 39% below first half of 2019

- EBIT of CHF -55.0 million, before restructuring charges of CHF -46.9 million

- Implementation of COVID crisis management and restructuring according to plan

- Stronger second half of 2020 expected

- Continuous implementation of the strategy

- Change in the Group Executive Committee (as collected from the Company`s statement)

- The demand for wear & tear and spare parts declined sharply, due to the suspension of Production in many spinning mills around the world.

- This is reflected in the low order intake and sales of the Business Groups Components and After Sales

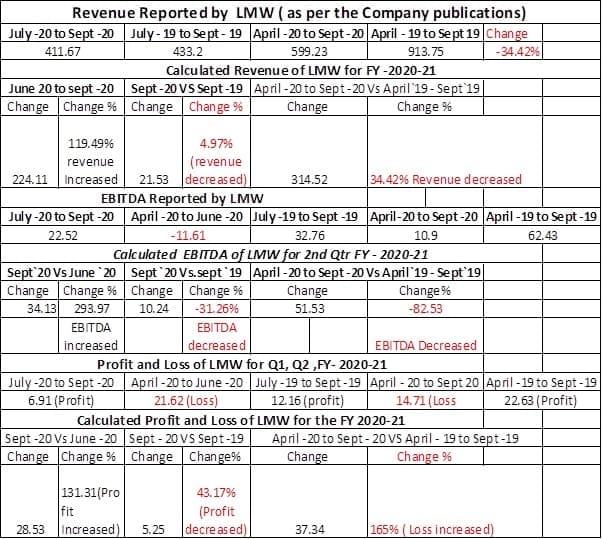

[3.4] The comparison of Q1 VS Q2 in the year 2020 and that of with 2019 of LMW.

Table VIII.

From the table no VIII above, the following conclusions can be drawn:

Revenue: Lakshmi Machine Works Limited’s financial report shows that the company’s revenue increased by 119.49% in (Quarter on Quarter) / current quarter(July, 2020 – September, 2020) for revenue increase of Rs.224.11 crores, as the company posted revenue of Rs.411.67 crores; in compare to previous quarter(April, 2020 – June, 2020) when the company reported revenue of Rs.187.56 crores.

The result also shows that the company’s revenue decreased by 4.97% in (Year over Year) / in current quarter (July, 2020 – September, 2020) for revenue decrease of Rs.21.53 crores; in compare to corresponding quarter (July, 2019 – September, 2019) when the company posted revenue of Rs.433.20 crores.

EBITDA/ Earnings before interest, tax, depreciation and amortization: The company’s financial report shows that the company’s EBITDA increased by 293.97% in (Quarter on Quarter) / current quarter (July, 2020 – September, 2020) for EBITDA increase of Rs.34.13 crores, as the company posted EBITDA of Rs.22.52 crores; in compare to previous quarter (April, 2020 – June, 2020) when the company reported Negative EBITDA of Rs.11.61 crores.

The result also shows that the company’s EBITDA decreased by 31.26% in YoY (Year over Year) / in current quarter (July, 2020 – September, 2020) for EBITDA decrease of Rs.10.24 crores; in compare to corresponding quarter (July, 2019 – September, 2019) when the company posted EBITDA of Rs.32.76 crores.

Profit and Loss / PAT (Profit after Tax): The company’s financial report shows that the company’s profit increased by 131.96% in (Quarter on Quarter) / current quarter (July, 2020 – September, 2020) for profit increase of Rs.28.53 crores, as the company posted profit of Rs.6.91 crores; in compare to previous quarter(April, 2020 – June, 2020) when the company reported loss of Rs.21.62 crores.

The result also shows that the company’s profit decreased by 43.17% in (Year over Year) / in current quarter (July, 2020 – September, 2020) for profit decrease of Rs.5.25 crores; in compare to corresponding quarter (July, 2019 – September, 2019) when the company posted profit of Rs.12.16 crores.

The company also reported that its loss increased by 165.00% in 6 months’ end (April, 2020 – September, 2020) for loss increase of Rs.37.34 crores, since the company reported loss of Rs.14.71 crores; in compare to corresponding 6 months’ end (April, 2019 – September. 2019) when the company posted profit of Rs.22.63 crores.

[3.5] The running capacity of the Polyester Sector. The table no IX shows that the polyester sectors are gradually recovering gradually from Q1, Q2 and Q3 but in compare to last year i.e.2019 it is not satisfactory. The data was collected from the Company`s own statement and for the fewer industries.

Table IX

| The Comparison of Total Income between 2019 vs 2020 as declared by them in CR. | ||||||

| Sr. no | Name of the Organisation | Sept `20 | March `20 | Sept`19 | March `19 | Sept `18 |

| 1 | Reliance Industries | 1,11,692.0 | 1,60,245.0 | 1,75,400.00 | 1,83,693.00 | 1,87,326.00 |

| 2 | Blue Chip | 45.17 | 101.76 | 119.98 | 127.77 | 130.02 |

| (-62.36%) | ||||||

| EBIT | Rs.-1.22 | |||||

| (-80.07%) | ||||||

| PAT | Rs.0.27 | |||||

| (-92.86%) | ||||||

| 3 | Mohit Industries | 51.09 | 92.87 | 96.8 | ||

| (-44.99%) | ||||||

| EBIT | Rs.-0.05 | |||||

| (-101.50%) | ||||||

| PAT | Rs.-2.80CR. | |||||

| -831.78% | ||||||

| 4 | Shekhawati | 8.48 | 75.68 | 87.81 | 54.97 | 93.48 |

| (-90.34%) | ||||||

| EBIT | Rs.-9.25 | |||||

| 23.93% | ||||||

| PAT | -9.33 | |||||

| 23.83% | ||||||

| 5 | Raj Rayon | 0.02 | 0.00 | 0.2 | 18.2 | |

| 340.00% | ||||||

| EBIT | Rs.-17.80 | |||||

| -5.18% | ||||||

| PAT | Rs.-17.80 CR | |||||

| -5.18% | ||||||

| EBIT > Earnings before Interest and Tax | ||||||

| PAT > Profit after Tax | ||||||

[3.6] The Impact of the Polyester Machine Manufacturer

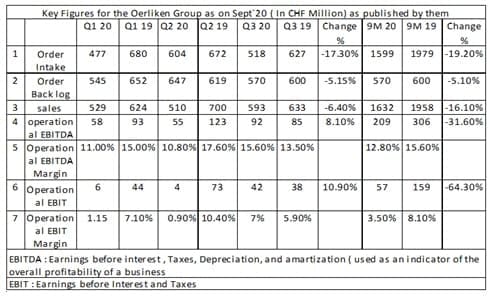

The survey was conducted on the most leading and pioneer POY machine Manufacturer i.e. Oerliken and their Sales figures were compared Q to Q of year 2019 and that of 2020. The table no- X explains the details.

Table – X

The table X shows that (i) the sales are improving in Q3 -2020 than that of Q-2 & Q1-2020, although it shows slight down trend in Q-2 than that of Q-1. (ii) Fantastically, the sales were highest in Q- 2 2019 in comparison to Q-1 and that of Q-3 of 2019. (iii) The sales were down by 16.10% if compared with 9 month reports of 2020 and 2019.

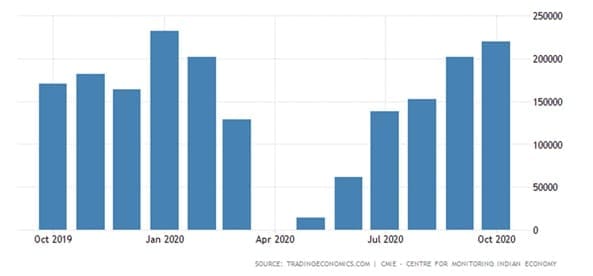

[3.7] The Impact of Car Manufacturer in India

From the figure 2, shown below it is clear that incomparisn to the previous year (2019), the present production rate is at comfortable position.

Figure 2

[4] The Impact on Employment:

India has more than 2,000 spinning mills with different spindle capacity. Workers in big units controlled by corporations reside in labour colonies adjacent to the factory premises. The majority of workers are migrants from Bihar, Uttar Pradesh, Orissa and other states. At present (April, May, June) they are being taken care of by some of the employers. Some workers were requested to stay back with more lucrative incentives. In the absence of means of transport following the lockdown some of them could not leave also. But in several places the workmen left in their native places looking to the uncertainties. In some sectors, because of Market demands, the organisations are running at 100% capacities with 80% Work force by paying them OT and other incentives. (Market survey)

There could be as many as one crore job cuts in the textiles sector, which has been severely hit by the ongoing lockdown, if there is no support and revival package from the government, according to apparel industry body Clothing Manufacturers Association of India, CMAI. (Economic Times April20). With around 80 per cent of the garment industry mostly micro, small and medium enterprises, CMAI, which has around 3,700 members employing over 7 lakh people, said most of its members do not have the kind of reserves to see them through 3-6 months of this magnitude.

“We have estimated that if no assistance comes from the government, either in terms of wage subsidy or revival package, there could be loss of almost a crore of jobs in the entire textile chains,” said CMAI Chief Mentor Rahul Mehta. He was speaking at a webinar on way forward for brick-and-mortar retail, hospitality and textile industries during and post COVID-19.

Volumes may come down, but will not disappear. Once life is back to normal, people are expected to shop as a feel-good element after months of lockdown and depression.

If the garment industry closes down, it would impact the entire value chain from fabric supply industry to brand to the zipper and label industry, he said. “If you look at the entire textile industry, I see a job loss of one crore if nothing is done by the government,” Mr. Rahul Mehta added. He, however, appreciated efforts taken up by the textiles ministry such as asking all leading global companies not to cancel orders from the Indian exporters and such steps send positive vibes to manufacturers, particularly to the smaller ones.

However, the latest report (Oct-November 2020) says that several industries including Garment sectors are working at 85-90% capacities and PPE sectors at full capacities. (Market survey)

On conclusion it can be said that almost all the organised sectors are now in a position to run at 90-100% capacity (Except a few) and they are absorbing the Workforce gradually. The unorganised sectors are yet to come at 100% working stage and they are also absorbing the work force (Market survey). The situations in April, May, June `20 is quite different than that of Novembar`20.

[5]: The Government Relief:

The government has recently announced a few relief measures for the industry, which will help, mitigate the crisis faced by companies. Some of these measures are given below:

- The Rebate of State and Central Taxes & Levies (RoSCTL) on apparel and made-ups has been extended for the upcoming financial year until merged with Remission of Duties and Taxes on Exported Products (RoDTEP). This will make the textile sector more competitive and boost exports.

- The government has announced to pay the entire employee provident fund for establishments with up to 100 employees where 90% of the employees are earning less than Rs. 15,000. This will be a huge aid for the labour intensive small and medium scale apparel manufacturers.

- The Reserve Bank of India has announced a moratorium of up to 3 months on payment of instalments of term loans.

- In Dadra & Nagar Haveli Area every villager (whether working or not working) was provided with 5 kg Rice, 5 kg Wheat, 1 kg Dal, 1Kg Sugar, 1 kg cooking Oil and spice packets during the month of April and May `20 at free of cost. It was distributed max 4 in a family i.e. per family it was 20 kg Rice, 20 kg Wheat etc. The village Panchayat was responsible in Distribution system. (Market Information)

Government Initiatives

Indian government has come up with a number of export promotion policies for the textiles sector. It has also allowed 100 per cent FDI in the sector under the automatic route.

Initiatives taken by Government of India are:

- Under Union Budget 2020-21, a National Technical Textiles Mission is proposed for a period from 2020-21 to 2023-24 at an estimated outlay of Rs. 1,480 crores (US$ 211.76 million).

- In 2020, New Textiles Policy 2020 is expected to be released by the Ministry of Textiles.

- CCEA approved mandatory packaging of food grains and sugar in jute material for the Jute Year 2019-20.

- In September 2019, textiles export witnessed a 6.2 per cent increase post GST as compared to the period pre-GST.

- The Directorate General of Foreign Trade (DGFT) has revised rates for incentives under the Merchandise Exports from India Scheme (MEIS) for two subsectors of Textiles Industry – readymade garments and made-ups – from two per cent to four per cent.

- The Government announced a special package of US$ 31 billion to boost export, create one crore job opportunity and attract investment worth Rs. 80,000 crores (US$ 11.93 billion) during 2018-2020. As of August 2018, it generated additional investments worth Rs. 25,345 crore (US$ 3.78 billion) and exports worth Rs. 57.28 billion (US$ 854.42 million).

- The Government of India has taken several measures including Amended Technology Up-gradation Fund Scheme (A-TUFS), estimated to create employment for 35 lakh people and enable investment worth Rs. 95,000 crore (US$ 14.17 billion) by 2022.

- Integrated Wool Development Programme (IWDP) was approved by Government of India to provide support to the wool sector, starting from wool rearer to end consumer, with an aim to enhance quality and increase production during 2017-18 and 2019-20.

- The Cabinet Committee on Economic Affairs (CCEA), Government of India approved a new skill development scheme named ‘Scheme for Capacity Building in Textile Sector (SCBTS)’ with an outlay of Rs. 1,300 crore (US$ 202.9 million) from 2017-18 to 2019-20. As of August 2019, 16 states signed pacts with the Ministry of Textiles to partner with it for skilling about four lakh workers under the scheme.

- Central government has assumed responsibility for municipalities’ and regions’ extraordinary COVID-19-related costs, and the local government sector has also received general funds to offset falling tax revenues. Funding has also been allocated to enhance skills in care of older people, support public transport and increase testing and contact tracing. (Ministry of Finance)

- To support viable businesses and reduce the number of jobs lost, measures have been adopted to reduce costs, reinforce liquidity and improve financing opportunities for businesses throughout the country. A new short-term layoff scheme and reorientation support have been introduced. Moreover, public venture capital has been strengthened to bridge the crisis for innovative businesses. Most of the measures have been of a general nature, but support targeting specific sectors – such as media, culture, sport, public transport, railways, aviation and shipping – has also been introduced.

- Temporary changes have been made to unemployment insurance to increase financial security. In addition, transition opportunities have been enhanced through increased educational opportunities and improvements to student finance. Housing allowance has been raised for families with children. The Government has also increased support to non-profit organisations that support vulnerable children and women, children and LGBTI people subjected to violence, and people subjected to domestic violence, including honour-based violence and oppression.

[6] Conclusions

- The author has studied the Textile and Garment Sectors mainly and found that these industries are recovering the losses gradually. The most suffering times were in April to June (Q1) but in the month of Oct- Nov `20 (Q3) they are gradually capturing the markets.

- In Textile Sectors, the studies were conducted in Cotton Spinning /Weaving (both organised and that of Unorganised sectors), Polyester yarn Manufacturers, Cotton Spinning Machinery Manufacturer, Polyester Machine Manufacturers and the tendency found almost at similar level that in comparison to Q1, the situation is better in Q3 `2020 but not at parallel with that of 2019.

- The GDP was (– 23.9%) in Q1, but it has reached to (– 9.6%) at September 2020 end. It will take its own time to reach at 7.1% as was during July `18. Right now no predictions can be made.

- The sufferers are in all sectors even in Non Textiles (see table no 1). The Car manufacturers, though suffered in April `20 but reached at par with 2019 in Oct`20. (See figure 2).

- Although the Organised sectors are doing well and some are over booked who are manufacturing the special products related to Covid-19, but most of the unorganised sectors are yet to compete.

- Some Organised sectors performed at full speed even during Q1 because of their Policy decisions how the retail the work force and to utilise them at right place.

- The Garment Sectors are mostly over booked with Export Orders because the large portion of the World Trade are boycotting China.

- The unemployment ratio is minimising with the increasing Running capacities of the Industries.

About the Author: Dr. B.Basu is an expert Textile Technologist in the field of Management, Weaving, Texturisation and Trouble Shooting. He is having 63 publications in National and International level. Having 48 year of Experiences in Industries, in research Institute and in education field.

Contact: 9867682084.

Mail id: bibekananda.basu1502@gmail.com

By Dr. B. Basu