Rushin H.Vadhani

AGM-Marketing

AYM Syntex Ltd.

The recent criticism from Mr Narayan Murthy and fellow billionaires Nandan Nilekani and Kris Gopalakrishnan burgeoned into a public confrontation over governance at Infosys, which works for many of the world’s biggest corporations, including Goldman Sachs Group Inc. and Toshiba Corp. At one point, Murthy called for a board shuffle. This raised many concerns for business houses to analyze quality of their corporate governance for business sustainability before it slowly erodes the glory of company.

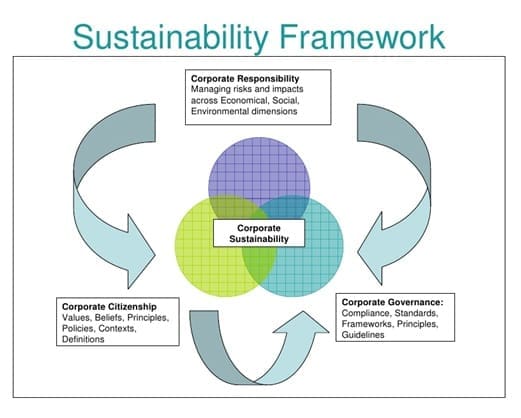

Modern corporate situations, characterized by the globalisation of the markets and of the information, highlight the need to link the potential of a not transient growth to the adequate reconciliation of all the expectations converging around the entrepreneurial formula and not only of those attributable to shareholders. In such a defined context, corporate governance tends to evolve from a situation of primary care for the expectations of shareholders (shareholder’s view) and for the correlated financial responsibility, to a wide consideration of all the stakeholders (stakeholder’s view) and related responsibilities (financial, environmental, social, administrative). The correct carrying out of governance processes requires, therefore, a clear focus on sustainable development and on the related assumption of a concept of global responsibility. The decisions made by the governing bodies must be driven by the purpose to create value in the long term according to conditions of fairness and sustainable development. From the delivered research it emerges how public utilities that promote behaviours in line with the sustainability conditions are marked out by stable growth paths. Conversely, the companies that assume a vision mainly addressed to the economic dimension, neglecting the other areas are generally compromised in the performance realized.

Corporate Governance and complexity of sustainable development calls for global cooperation, based mainly on joint coordination of strategies and adopting of the best decisions. What does the term sustainable development mean? Answer to the question, what does the sustainable development mean, is not unambiguous. There are many definitions of sustainable development, based on the world and inland specialized literature, trying to capture essence of the sustainable development. The concept of sustainable development, integrating the balance of three pillars, comprises the economic, social and environmental pillars. The economic pillar is based on the necessary retaining of ordinary capital with all the business activities performed, and use of only the generated profit. The social pillar involves people as individuals as well as the community. The environmental pillar focuses on environmental protection, specifically its improvement and prevention of exhausting the limited natural resources. The quality environment in turn strongly impacts the quality of life of the population, which already bears upon the social sphere.

A company that adopts sustainable development as its strategic goal will sooner or later face a question as to what method to use for the measurement of corporate sustainability, how to set its goals and what measures and procedures should be used to achieve the goals set. That is, a need arises to collect, record, analyze and transmit information about economic effects of the environmental and social activities.

The indicators used in the measurement of sustainable development in companies are developed on a continuous basis by different international organizations with the aim of achieving an internationally acknowledged standard. The most widely known international activity is the Global Reporting Initiative (GRI) which concentrates on standardization of a report on sustainable development (Sustainability Report).

Sustainability is strategy of the process of sustainable development. It wins a special importance where this process assists the man in reaching sustainability or can discourage the man from this process. It means that sustainability is the corporate strategy monitoring long-time corporate growth, efficiency, performance and

competitiveness by incorporating economic, environmental and social aspects into corporate management. In connection with Corporate Governance and Sustainability relating to measurement of corporate performance even the Corporate Sustainability Reporting gains a great importance.

Corporate Governance :

Corporate governance broadly refers to the mechanisms, processes and relations by which corporations are controlled and directed. Governance structures and principles identify the distribution of rights and responsibilities among different participants in the corporation (such as the board of directors, managers, shareholders, creditors, auditors, regulators, and other stakeholders) and includes the rules and procedures for making decisions in corporate affairs. Corporate governance includes the processes through which corporations’ objectives are set and pursued in the context of the social, regulatory and market environment. Governance mechanisms include monitoring the actions, policies, practices, and decisions of corporations, their agents, and affected stakeholders. Corporate governance practices are affected by attempts to align the interests of stakeholders. Interest in the corporate governance practices of modern corporations, particularly in relation to accountability, increased following the high-profile collapses of a number of large corporations during 2001–2002, most of which involved accounting fraud; and then again after the recent financial crisis in 2008.

Role of Corporate Governing Board :

- Rights and equitable treatment of shareholders: Organizations should respect the rights of shareholders and help shareholders to exercise those rights. They can help shareholders exercise their rights by openly and effectively communicating information and by encouraging shareholders to participate in general meetings.

- Interests of other stakeholders: Organizations should recognize that they have legal, contractual, social, and market driven obligations to non-shareholder stakeholders, including employees, investors, creditors, suppliers, local communities, customers, and policy makers.

- Role and responsibilities of the board: The board needs sufficient relevant skills and understanding to review and challenge management performance. It also needs adequate size and appropriate levels of independence and commitment.

- Integrity and ethical behavior: Integrity should be a fundamental requirement in choosing corporate officers and board members. Organizations should develop a code of conduct for their directors and executives that promotes ethical and responsible decision making.

- Disclosure and transparency: Organizations should clarify and make publicly known the roles and responsibilities of board and management to provide stakeholders with a level of accountability. They should also implement procedures to independently verify and safeguard the integrity of the company’s financial reporting. Disclosure of material matters concerning the organization should be timely and balanced to ensure that all investors have access to clear, factual information.

Organisation for Economic Co-operation and Development principles :

One of the most influential guidelines on corporate governance are the G20/OECD Principles of Corporate Governance, first published as the OECD Principles in 1999, revised in 2004 and revised again and endorsed by the G20 in 2015. The Principles often referenced by countries developing local codes or guidelines. Building on the work of the OECD, other international organizations, private sector associations and more than 20 national corporate governance codes formed the United Nations Intergovernmental Working Group of Experts on International Standards of Accounting and Reporting (ISAR) to produce their Guidance on Good Practices in Corporate Governance Disclosure. This internationally agreed benchmark consists of more than fifty distinct disclosure items across five broad categories:

- Auditing

- Board and management structure and process

- Corporate responsibility and compliance in organization

- Financial transparency and information disclosure

- Ownership structure and exercise of control rights

The OECD Guidelines on Corporate Governance of State-Owned Enterprises are complementary to the G20/OECD Principles of Corporate Governance, providing guidance tailored to the corporate governance challenges unique to state-owned enterprises.

Internal corporate governance controls:

Internal corporate governance controls monitor activities and then take corrective actions to accomplish organisational goals. Examples include:

- Monitoring by the board of directors: The board of directors, with its legal authority to hire, fire and compensate top management, safeguards invested capital. Regular board meetings allow potential problems to be identified, discussed and avoided. Whilst non-executive directors are thought to be more independent, they may not always result in more effective corporate governance and may not increase performance. Different board structures are optimal for different firms. Moreover, the ability of the board to monitor the firm’s executives is a function of its access to information. Executive directors possess superior knowledge of the decision-making process and therefore evaluate top management on the basis of the quality of its decisions that lead to financial performance outcomes, ex ante. It could be argued, therefore, that executive directors look beyond the financial criteria

- Internal control procedures and internal auditors: Internal control procedures are policies implemented by an entity’s board of directors, audit committee, management, and other personnel to provide reasonable assurance of the entity achieving its objectives related to reliable financial reporting, operating efficiency, and compliance with laws and regulations. Internal auditors are personnel within an organization who test the design and implementation of the entity’s internal control procedures and the reliability of its financial reporting

- Balance of power: The simplest balance of power is very common; require that the President be a different person from the Treasurer. This application of separation of power is further developed in companies where separate divisions check and balance each other’s actions. One group may propose company-wide administrative changes, another group review and can veto the changes, and a third group check that the interests of people (customers, shareholders, employees) outside the three groups are being met.

- Remuneration: Performance-based remuneration is designed to relate some proportion of salary to individual performance. It may be in the form of cash or non-cash payments such as sharesand share options, superannuation or other benefits. Such incentive schemes, however, are reactive in the sense that they provide no mechanism for preventing mistakes or opportunistic behavior, and can elicit myopic behavior.

- Monitoring by large shareholders and/or monitoring by banks and other large creditors: Given their large investment in the firm, these stakeholders have the incentives, combined with the right degree of control and power, to monitor the management.

External corporate governance controls:

External corporate governance controls encompass the controls external stakeholders exercise over the organization. Examples include:

- competition

- debt covenants

- demand for and assessment of performance information (especially financial statements)

- government regulations

- managerial labour market

- media pressure

- takeovers

- proxy firms

Benefits of Corporate Governance :

- Good corporate governance ensures corporate success and economic growth.

- Strong corporate governance maintains investors’ confidence, as a result of which, company can raise capital efficiently and effectively.

- It lowers the capital cost.

- There is a positive impact on the share price.

- It provides proper inducement to the owners as well as managers to achieve objectives that are in interests of the shareholders and the organization.

- Good corporate governance also minimizes wastages, corruption, risks and mismanagement.

- It helps in brand formation and development.

- It ensures organization is managed in a manner that fits the best interests of all.

It has been suggested that we need to look more closely at how these different mechanisms—shareholders, boards, and managers—work together to affect sustainability outcomes. As these corporate sustainability initiatives become more embedded, we may have to rethink the role of corporate governance mechanisms to monitor all aspects of firm behavior that affect society at large.

Key References:

- Various Media & Newspaper coverage of Corporate Governance of Infosys Company (Recent Articles)

- hiffingtonpost.com

- wikepedia.com

- proquest.com

- Book on Corporate Governance: Promises Kept, Promises Broken: Jonathan R