Download PDF Brochure: https://www.

Browse

- 355 Market data Tables

- 40 Figures

- 273 Pages and in-depth TOC on “Silicone Market – Global Forecast to 2027”

Major players operating in the silicone market include Wacker Chemie AG (Germany), Shin-Etsu Chemical Co., Ltd. (Japan), Elkem ASA (Norway), The Dow Chemical Company (US), Momentive Performance Materials, Inc. (US), Gelest, Inc. (US) and others are covered in the silicone market.

Merger & acquisitions, investments & expansions, partnerships & collaborations, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the Silicone Market.

Request Sample Pages: https://www.

Recent Developments in Silicone Market

- In September 2022, Elkem opens its new specialized facility for producing high purity medical silicones in York, S.C. This new 18,000 sq. ft. site features state-of-the-art ISO-certified Class 7 and Class 8 clean rooms and is designed to produce high purity silicone materials that meet the MedTech and Pharma market requirements.

- In July 2022, Wacker Chemie AG built a new silicone production complex at its Charleston site in the US state of Tennessee. This production plant will produce high-consistency silicone rubber and silicone sealants used in construction applications. A total of more than USD 200 million was invested in the new plant.

- In March 2022, The company is investing in the mobility and transportation market. At Dow’s Jincheon site in South Korea, investments are being made to support the development of moldable optical silicone technologies for both automotive and industrial lighting applications.

- In February 2022, Shin-Etsu Chemical planned to make an over USD 0.59 billion capacity-expansion investment mainly for its silicones advanced functional products line in Japan. The company aims to complete the capacity expansion project and begin operations by 2025.

- In October 2021, Wacker Chemie AG acquired 60% stake in specialty silane manufacturer SICO Performance Material Co., Ltd. (China) at a value of USD 139.66 million.

- In January 2021, Momentive Performance Materials, Inc. acquired KCC Corporation’s (“KCC”) Silicones business in Korea and the UK as well as its sales operations in China, further enhancing Momentive’s global capabilities in advanced silicones and specialized applications.

Elastomers segment is the largest and fastest-growing segment of the market globally, followed by silicone fluids. Silicone elastomers are widely used due to their unique properties. Their growth is driven by increasing use in the building & construction and transportation industries as well as by their increasing demand in the medical & healthcare end-use industries, particularly liquid silicone rubber, which is popular due to its ability to form high precision parts, flexibility, and easy processing.

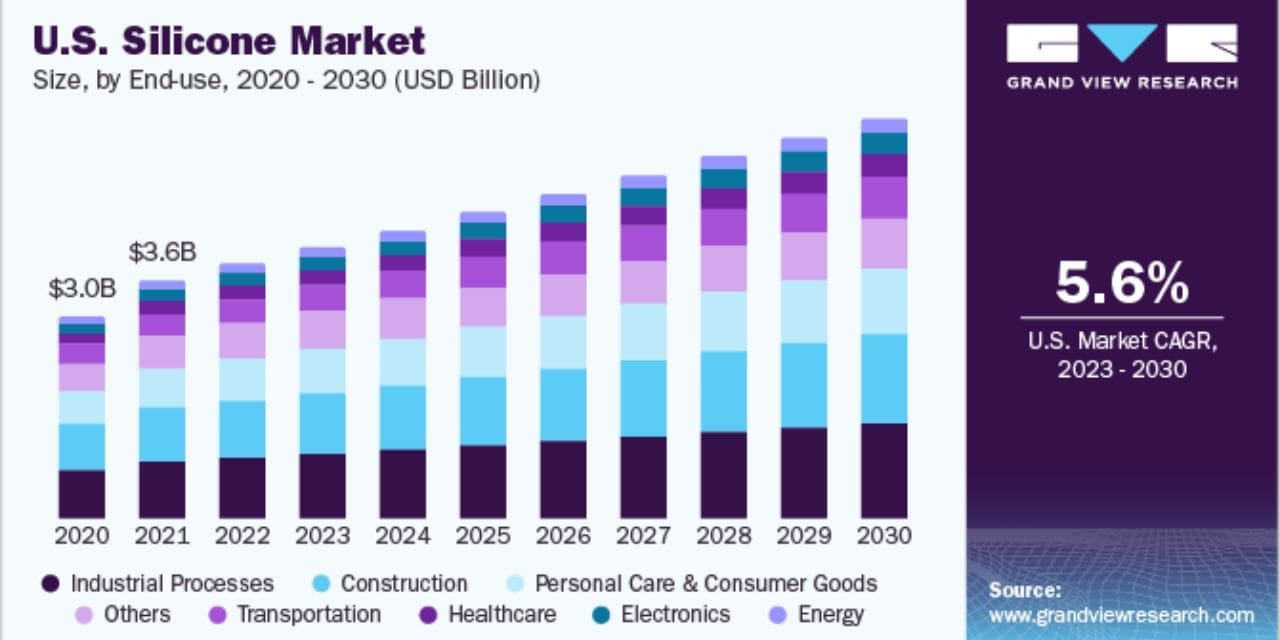

By End-use Industry, Industrial process accounted for the largest share in 2021.

The industrial process is the largest end-use industry for the silicone market. Silicones are extensively used for lubricants, antifoaming agents in offshore drilling, paper production, industrial coatings, and paint additives. The building & construction industry is the second-largest silicone end-use industry. Silicone materials are used in different forms in this industry, with products ranging from paste-like materials to flowable adhesives.

By Region, Asia Pacific accounted for the largest share in 2021.

The silicone market has been studied in Asia Pacific, North America, South America, Europe, and Middle East & Africa. Asia Pacific leads the overall silicone market in terms of both value and volume, followed by Europe. The rising disposable income of people, shifting of manufacturing facilities from the developed regions, such as North America and Europe, and rapidly growing industrial sectors are expected to drive the market in this region.

Inquire Now: https://www.