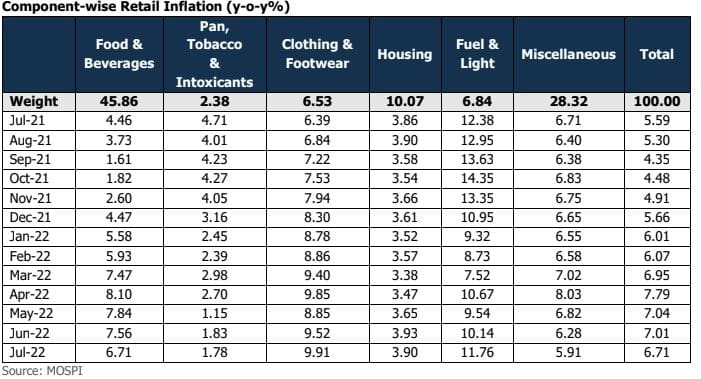

The CPI inflation print eased to a five-month low of 6.71% in July compared with 7.01% in June. The moderation in consumer inflation below 7% was primarily on account of a sequential decline in prices of vegetables, edible oils and protein items. Despite this moderation, CPI inflation still remained at uncomfortably high level and exceeded the RBI’s comfort zone for the seventh consecutive month. The July inflation print was below our expectation of 6.9%.

Core inflation also inched lower to 5.93% in July compared with 5.97% in June. The decline in core inflation was relatively muted as the inflation for clothing and footwear, housing and miscellaneous subgroups gained momentum amid resurgence of demand. The impact of rise in GST rates was visible for packaged food categories as it rose to 7.55% compared with 6.67% in the previous month.

In a positive development, rural inflation also inched down to 6.80% in July after remaining above 7% in the past four months. Rural inflation has been higher than urban inflation since January 2022 primarily owing to high food prices. In the past three months, the gap between the rural and urban inflation has narrowed as the food inflation has cooled off more in the rural areas than the urban areas. The moderation in rural inflation in the current month is comforting as it will support rural demand going ahead.

Food and beverage inflation softened to 6.71% in July from 7.56% in June with price of key items like edible oils, vegetables and meat and fish witnessing a sequential decline. Edible oil inflation has moderated in recent months owing to government interventions and easing global prices. Vegetable inflation although elevated at 10.9% is lower compared with the previous month. A huge relief came from a sharp drop in tomato prices in the month of July due to improved supply conditions with the arrival of monsoon. As per the government data, there was 24% drop in tomato prices (retail) compared with the previous month.

Cereals inflation, on the other hand, edged up to 6.90% due to consistent rise in wheat and rice prices on account of limited supply. Government has taken measures such as ban on wheat export in May and stricter regulations for exports wheat related products in August to ensure steady domestic supplies and to contain food inflation. However, a shortfall in production of wheat on account of heatwave led disruptions and lower rice acreage due to uneven rains could keep supply conditions tight resulting in high cereal inflation in near term.

Fuel and light inflation rose to 11.76% in July from 10.14% in June. The decline in prices for commercial LPG cylinders was offset by rise in kerosene prices and cost of domestic LPG cylinders. The Centre has significantly hiked the price of kerosene distributed through the public distribution system (PDS) by Rs 14 per litre in July 2022.

Way Forward

The slowdown in consumer inflation for the third consecutive month suggests that the inflationary pressures, though elevated, are on a downward trend. Encouragingly, households’ inflation expectations have also improved in July reflecting the effectiveness of RBI and government’s efforts to tame inflation. A downward revision of Q2 FY23 CPI inflation projection to 7.1% (earlier 7.4%) by the RBI at its August policy meet further confirms that inflation has already peaked and we could expect some easing going forward. Our inflation projection for Q2 is pretty much in line with the RBI at 7.1%. We expect inflation to be slightly lower than the RBI’s projection in Q3 at 6.1% and at 5.8% in Q4. Overall, our expectation is that the annual average for retail inflation could undershoot RBI’s projection of 6.7% by nearly 20 basis points. Nevertheless, volatility in rupee and uneven monsoon distribution continue to pose a risk to our inflation outlook.