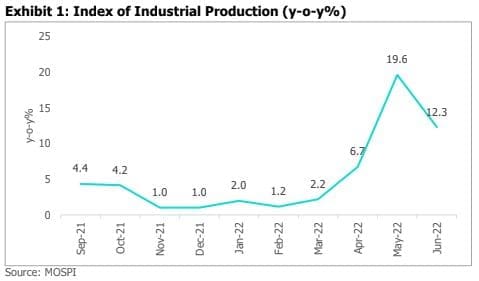

In June 2022, the IIP growth slowed to 12.3% from 19.6% in the previous month primarily due to some waning of the base-effect. The industrial activity continued to show recovery recording a growth of 6.7% when compared with the corresponding month of FY20 (the pre-pandemic year) aided by a broad-based growth across all sectors.

CareEdge had projected IIP growth at 12% during the month.

Output of mining and electricity sectors expanded by 7.5% and 16.4% respectively during the month. Monsoon related restrictions could weigh on the mining sector output over the coming months. Manufacturing sector having the largest share in the industrial output index grew by 12.5% in June. Manufacturing output witnessed an expansion of 5.7% compared with June 2019. Within manufacturing, an annual increase in output was witnessed in 21 out of 23 categories. Strong growth was recorded in manufacture of tobacco products (52.8%), beverages (44.8%), computer, electronic and optical products (44%), and printing and reproduction of recorded media (43.1%). Manufacture of textiles and pharmaceuticals, medicinal chemical and botanical products recorded a contraction of 3% and 4.1% respectively.

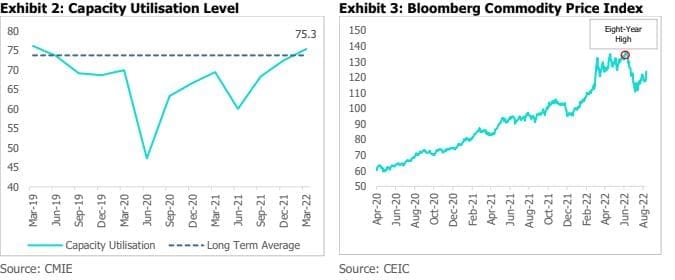

As per RBI survey, capacity utilisation in the manufacturing sector in the fourth quarter of FY22 rose to 75.3%, above its long run average of 73.7%. Furthermore, the Purchasing Manager’s Index (PMI) for the manufacturing sector jumped to an eight-month high of 56.4 in July. Improving capacity utilisation levels and upbeat PMIs are reflective of revival in demand and improving prospects for the manufacturing sector. We expect challenges from the elevated global commodity prices to persist despite the recent cooling in prices. The Bloomberg Commodity Price Index moderated by 9.5% from the eight-year high of early June this year. However, it remained elevated by 24% on a year-to-date basis.

Consumer durables and capital goods continued to record healthy growth of 23.8% and 26.1% respectively. This growth has been aided by the combined effect of a favourable base as well as some improvement in demand. The capital goods segment is yet to achieve a meaningful improvement with output only marginally higher by 0.5% when compared with the June 2019 level. In an encouraging sign, the output of consumer non-durables grew by 2.9% after having shown lacklustre growth in the previous months.

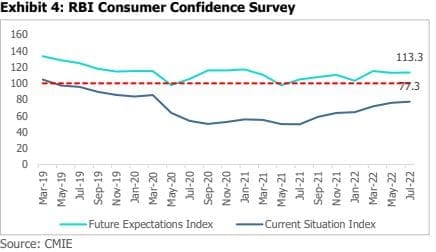

The results of the RBI’s consumer confidence survey showed that while consumer confidence stayed on the recovery path it continued to be in the negative territory. On a positive note, the Future Expectations Index (FEI) reading was largely steady supported by an optimistic outlook of the economic situation and overall spending over the next one year. Also, the retail credit offtake has been showing a healthy trend as it grew by 18.1% during the period up to mid-June in FY23 compared with 12.2% growth in the corresponding period last year. Signs of uptick in consumer confidence and encouraging credit growth corroborates the gradual improvement in consumption sentiment. Going ahead, an improvement in discretionary spending ahead of the festive season could bode well for these sectors, however, elevated price levels could be a dampener.

Way Forward

Industrial activity in June continued to exhibit signs of improvement recording double-digit growth for the second straight month. Healthy growth in credit offtake, gradual revival in the consumption sentiment, improving capacity utilisation levels and strong government spending are some positives for the industrial growth. However, downside risks are likely to persist owing to global growth slowdown and elevated input prices.