Polyester

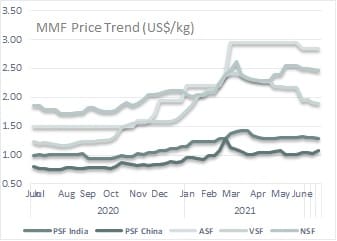

Polyester staple fibre prices were lifted in China and Pakistan during June while they stayed firm in India.

In China, bolstered by rising costs, offers for polyester trended higher. Trading prices were also hiked, indicating a smaller discount in firm deals under negotiation. In Shandong and Hebei, offers moved up, with available discount. The sale/production status appeared weak towards weekend, seeing most ratios at 70-120%. Offers for 1.4D direct-melt polyester staple were raised to average 6.74-6.85 Yuan a kg (US$1.05-1.07 a kg, up US cent 1) in Jiangsu and Zhejiang while the same in Fujian and Shandong were lifted US cents 1-2 to US$1.06-1.08 a kg.

In Taiwan, offer for 1.4D were rolled back US cents 5 to US$1.05 a kg FOB.

In Pakistan, polyester fibre offers were raised in the final two weeks of the month over stronger demand from downward processors. 1.4D PSF offers were raised PakRs3 to PakRs.203-205.25 a kg (US$1.29-1.31 a kg, down US cent 1 due to weak currency).

In India, producers had fixed their offers for H1 and H2 June amid flat demand and low buying interest from spinners. Producers offers for June were pegged stable at INR96.75 a kg (US$1.31 a kg) for 1.2D and at INR96 a kg (US$1.30 a kg) for 1.4D.

Overall, amid lack of improvement in demand, polyester markets will mainly track swings in feedstock costs in coming month.

Nylon

Nylon-6 staple fiber offers were lowered at the lower end and raised at the upper end in June as upstream caprolactum cost was up while polyamide or nylon chip cost was down. Fibre producers reported breakeven business, amid slightly improvement in demand. 1.5D offers averaged 16.00-17.00 Yuan a kg (US$2.49-2.65 a kg, up US cents 4 on the month at the upper end).

Acrylic

Acrylic staple fibre prices moved sideways in Asian markets during June as feedstock acrylonitrile cost adjusted downward and some acrylic fibre producers lowered run rates amid moderate demand.

Offers for Taiwan origin 1.5D acrylic fibre were rolled back US cents 10-20 over on the month to US$2.85-2.90 a kg FOB.

In China, reference prices of cotton-type staple fiber, tow and top were raised as market sentiment changed little. Demand for acrylic fibre was steady as downstream users only made hand-to-mouth volume purchase. Prices for medium-length and cotton-type acrylic fibre 1.5D and 3D tow were up at 17.90-18.20 Yuan a kg (US$2.79-2.84 a kg, up US cents 10).

In Pakistan, no change was reported in offers in Karachi market although freight rates were lifted. Offers from overseas suppliers for 1.2D ASF were steady at PakRs.450-455 a kg (US$2.86-2.89 a kg) in Karachi market.

In India, producers generally revise their offer on monthly basis, hence June offer were lowered on falling cost of production and weak demand. Offers for June were at INR221-223 a kg (US$3.00-3.03 a kg, down US cents 16 from May average).

Viscose

Viscose staple fibre markets remained weak during June in China, over a lack of demand from processors while prices appeared to have bottomed out in Pakistan.

In China, prices stayed at lower levels, with limited activities. Producers saw sparse fresh orders, as downstream mills were cautious about purchasing on the back of high stocks at the moment. In turn, the sentiment was stalemated. Spot prices eased somewhat as traders lowered their price in firm deals while producers maintained their offers steady for medium-end and high-end goods. In spot, average prices fell to 12.40 Yuan a kg (US$1.93 a kg) for 1.5D and 1.2D to 12.60 Yuan a kg (US$1.96 a kg), both down US cents 25 from May.

In Taiwan, offers for 1.5D were steady at US$2.10 a kg FOB.

In Pakistan, offers from overseas suppliers were raised in Karachi to PakRs360-365 a kg (US$2.29-2.32 a kg, up US cents 7).

Overall, transaction is expected to remain insipid, while prices may stand still in July. Players will generally hold weak expectation.