Market Highlights

Covid wave to shrink cotton consumption by 8 percent

The Government of India’s top cotton crop assessment body has projected cotton consumption to dip by a little more than 8 percent owing to the latest Covid-19 wave and the subsequent lockdowns in several States.

The Union Ministry of Textiles’ Committee on Cotton Production and Consumption (COCPC) has reduced cotton consumption for season 2020-21 (October to September period) from 330 lakh bales (each of 170 kg) to 303 lakh bales, primarily due to the current lockdowns as the severe second wave of Covid has gripped the entire nation. In the COCPC meeting held on April 30, the estimated cotton closing stock has been increased from the earlier projected 98.79 lakh bales to 118.79 lakh bales at the end of the season on September 30, 2021.

Exports likely to take a hit

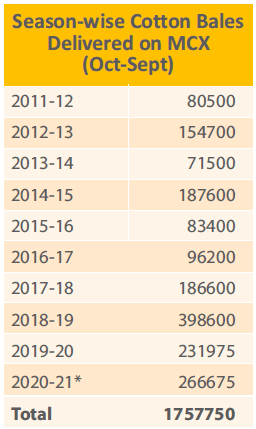

SOURCE: MCX | * TILL MAY’21

The COCPC, which was formed in September 2020 replacing the erstwhile Cotton Advisory Board (CAB), has also curtailed the projected cotton output for the season from the earlier estimated 371 lakh bales to 360 lakh bales. While cotton imports are estimated to remain stable at 11 lakh bales for the year, exports are likely to take a hit from earlier projections of 75 lakh bales to 70 lakh bales.

“Indian cotton sowing area has been increased from 133.73 lakh hectares to 134.77 lakh hectares. The big change was in Punjab, where sowing was reduced from 3.92 lakh hectares to 2.48 lakh hectares, whereas in Karnataka it increased from 6.37 lakh hectares to 8.17 lakh hectares,” COCPC noted.

For the year 2020-21, which started from October 1, 2020, with estimated opening stock of 120.79 lakh bales, the total cotton supply is projected to be 491.79 lakh bales, which includes 360 lakh bales of crop as per the latest estimates and 11 lakh bales of imports besides the opening stock. Total demand is projected at 373 lakh bales, including 303 lakh bales of domestic consumption and 70 lakh bales of cotton exports. Notably, cotton trade body, Cotton Association of India (CAI) has estimated India’s cotton output for the year at the same level as of COCPC i.e. 360 lakh bales. However, it has projected total consumption of 330 lakh bales during the year, leaving the closing stock of 106 lakh bales.

Source: The Hindu Businessline, Ahmedabad, Tuesday, May 04, 2021

Guntur: Spinning mills reduce yarn production due to lockdown

Like other industries, the textile industry is also hit by the raging Covid pandemic across the country. Since the textile mills are closed, production has come to a halt due the continuing lockdown in various states. As a result demand for cotton and yarn have dipped. In Andhra Pradesh, the spinning mills have reduced production of cotton yarn to 40 per cent due to declining demand in other states

There are 120 spinning mills in the state which produce 6,87,884 metric tonnes of cotton yarn per annum. They export Rs 842 crore worth cotton yarn to various countries and states. Spinning mills are directly providing employment to one lakh workers and indirectly generating employment to four lakh workers. Almost all the spinning mills have reduced 40 per cent of cotton yarn production for the last three months.

According to sources in the AP Textile Mills Association, due to the lockdown, textile mills in West Bengal, Gujarat, Tamil Nadu and Maharashtra States are not purchasing cotton yarn. Every spinning mill on an average has been producing 25 metric tonnes to 30 metric tonnes of cotton during the last three months. Over Rs 350 crore to Rs 450 crore worth cotton yarn stocks are piled up in the spinning mills. As a result the mills are facing working capital problem and unable to pay loan instalment to banks, maintenance expenses. When the Covid-19 cases on rise, the workers working in the spinning mills went to their native places taking their last year experience into consideration. If the same situation continues, the spinning mills will face severe financial crisis.

AP Textile Mills Association president Lanka Raghurami Reddy said: “Spinning mills have reduced 40 per cent of the production due to Covid -19 and workers shortage. At present cotton yarn exports started. If exports will pick up, demand for cotton yarn will increase. If the lockdown is lifted, we will sell cotton yarn stocks. We are eagerly waiting for the release of subsidies of Rs.1200 crore from the State government.”

Source: www.thehansindia.com, Thursday, May 27, 2021

India: Textile exports fell 13% in FY21 on COVID-19 lockdown

Textile and apparel exports in 2020-2021 are almost 13% less (in dollar terms) than the previous year, provisional data available with the Cotton Textiles Export Promotion Council shows. The exports were worth $29 billion last year as against $34 billion in 2019-2020. Exports of ready-made garments declined 20.78% last financial year compared with the previous year, while exports of man-made textile items fell 21.20 %

Siddhartha Rajagopal, the executive director of the council, said exports of cotton textiles had declined 2.12%. This was mainly because of the COVID spread and its impact on exports last April and May. However, all textile and clothing segments, including carpet, jute, apparel, and MMF products, showed significant growth in March this year and this trend is said to have continued in April too, Mr. Rajagopal said. The final data, expected later this month, may be better even for overall textile exports in 2020-2021. Textile and clothing exports are expected to do well at least till June since countries such as the U.S. and U.K. are looking up and China has also started buying.

Sakthivel, chairman of Apparel Export Promotion Council, pointed out that in April last year, apparel exports were just $127 million, while last month it was $1,294 million dollars. With the current trend, the industry can look at a 20% growth in apparel exports this financial year. However, it also depends on the pandemic and its impact world over.

Source: thehindu.com, M Soundariya Preetha, May 05, 2021

COVID-19 2nd wave to slightly impact India’s textiles

The second wave of COVID-19 might slightly impact the Indian textile sector’s supply and demand dynamics primarily in the first quarter (Q1) of FY22, as per India Ratings and Research (Ind-Ra). A sustained export demand, learnings from the first wave, stronger balance sheet and liquidity will enable the sector credit profile to remain stable in FY22. The supply chain has been impacted by the local lockdowns at key textile hubs such as Tirupur, Ludhiana, Surat and Bhilwara. The restricted movement of goods means non-availability of inputs such as yarns and fabric, which is likely to have a short-term impact on the finished output, the domestic rating agency said.

The labour availability has also been impacted moderately and shop floors are likely to remain functional at a few plantsites but with restricted occupancy. However, export markets are strong in Q1 FY22 and most cotton textile players are likely to have adequate inventory as fresh inventory comes during November to March, the Ind-Ra report said. T

he supply chain disruption may lead to a 20-30 per cent YoY of reduction in toplines in Q1 FY22. Export-focused garments and home textiles are likely to remain resilient compared to the spinning and fabric segment. The export order book was reported to be YoY higher at the end of March 2021 with garment players.

Challenges on the availability of containers and high shipping costs have been impacting profitability since Q3 FY21 and are likely to remain so in the near term.

Demand recovery continues in export markets, which is at least 30 per cent of the India’s total textile produce. Though raw material prices increased in the second half of FY21, the product pricing is only now beginning to catchup across upstream, mid-stream and downstream segments, leading to a margin expansion in FY22.

Source: Fibre2Fashion.com, Wednesday, May 19, 2021

MCX Cotton Bales Month-end Stocks & Delivery

Source: MCX website | 1 bale = 170kg | Note: Staggered delivery during tender period of last 5 trading days of the contracts.

COTTON

MCX May 2021 Cotton Futures contract traded between Rs. 21,710 and Rs. 23,110 per bale. MCX April 2021 Futures was up 4.81% in compared with that of the previous month’s close.

In May month, 990,150 bales of cotton were traded on MCX, with the average daily volume of 47,148 bales. In value terms, it was Rs. 2,213.04 crore and the average daily turnover (single side) was at Rs. 105.38 crore.

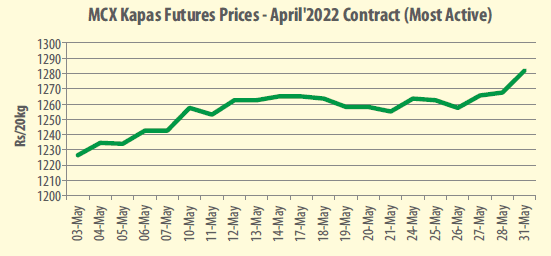

KAPAS

MCX April 2022 Kapas Futures contract (most active contract) traded between Rs. 1,226.50 and Rs. 1,282 per 20 kg. MCX April 2022 Futures was down by 1.91% in compared with that of the previous month’s close.In May month, 328 MT of Kapas were traded on MCX, with the average daily volume of 15.62 MT. In value terms, it was Rs. 2.06 crore and the average daily turnover (single side) was at Rs. 0.09 crore.

GLOBAL COTTON OUTLOOK

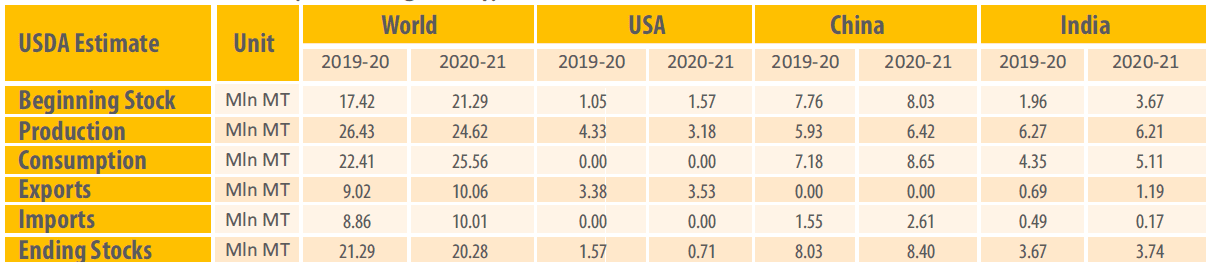

Global Cotton Balance Sheet (Season August-July)

SOURCE: USDA, MAY 2021