Basic textiles export comprising fibres, spun and filament yarns shipment was up 24% YoY in February 2021 in terms of US$ worth US$822 million or INR5,927 crore, accounting for about 2.9% of total merchandise exported from India during the month. The increase was mainly driven by sharpy in increase in cotton exports during the month. On a cumulative basis, exports were just 6.8% up in the first 11 months of 2020-21, compared same period a year ago.

Spun yarns shipment totaled 111 million kg worth US$530 million (up 3.4% YoY) or INR2,525 crore (up 5.7%) in February 2021. Compared to January 2021, they were down 16% both in US$ in INR terms. China reemerged as the largest importer in spun yarns, with value doubling over the year, followed by Bangladesh (down 14%). These two markets accounted for about 45% to total yarn shipped during the month.

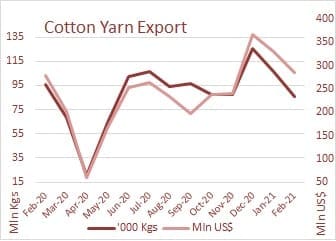

Cotton yarn export volume was at 86 million kg worth US$284 million (INR2,050 crore). These were shipped to 72 countries at an average price of US$3.30 a kg, up US cents 32 from previous month and US cents 38 from a year ago. China remained as the top cotton yarn market, followed by Bangladesh, Vietnam and Peru.

Cotton yarn export volume was at 86 million kg worth US$284 million (INR2,050 crore). These were shipped to 72 countries at an average price of US$3.30 a kg, up US cents 32 from previous month and US cents 38 from a year ago. China remained as the top cotton yarn market, followed by Bangladesh, Vietnam and Peru.

100% man-made fibre yarns exports of 9.2 million kg during February, comprised 3.9 million kg of polyester yarn, 2.8 million kg of viscose yarn and 2.3 million kg of acrylic yarn. Polyester yarn export was worth US$8.2 million or INR59 at an average price of US$2.10 per kg. Brazil was the largest market followed by USA and Turkey. Viscose spun yarns export was worth US$9 million and were exported at an average unit price of US$3.10 a kg. Turkey was the largest importer of viscose yarn, followed by Bangladesh and Belgium.

Blended spun yarns worth US$42 million were exported in February, including 12 million kg of PC yarns and 2.8 million kg of PV yarns. Brazil was the largest importers of PC yarn from India followed by Peru while Turkey was the largest importer of PV yarns from India followed distantly by South Africa.

All kinds of filament yarns shipment stood at 61 million kg, valued at US$102 million or INR734 crore. Nylon and viscose filament exports declined sharply in February from its level a year ago while polyester filament, which were falling sharply, were up 1% year on year. PP filaments export was up 4% during the month from a year ago.

All kinds of manmade staple fibres shipment totaled 34 million kg, valued at US$38 million or INR274 crore. Polyester staple fibre exports were down 8% both in volume and US$ terms. The per unit realization was flat year on year at US$0.95 a kg or INR68 a kg. Viscose fibre export continued to rebound, rising 9% in volume and 14% in US$ with price realisation averaging up 5%.

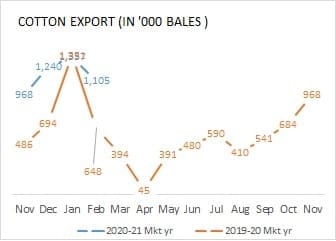

Cotton fibre shipment in February, took a downhill having peaked in January. However, compared to last year, volume were up 71 at 1.11 lakh bales worth INR2,395 crore or US$332 million. The high YoY increase was due to sharp decline recorded in February when China imposed lockdown to contain Covid that month. Bangladesh was the largest market for Indian cotton during the month, followed by China and Vietnam.

Cotton fibre shipment in February, took a downhill having peaked in January. However, compared to last year, volume were up 71 at 1.11 lakh bales worth INR2,395 crore or US$332 million. The high YoY increase was due to sharp decline recorded in February when China imposed lockdown to contain Covid that month. Bangladesh was the largest market for Indian cotton during the month, followed by China and Vietnam.

Export price realisation for cotton averaged INR128 a kg or US cents 80.29 per pound during February. This was much below Cotlook A index, the global spot price benchmark but was above domestic spot price for benchmark Gujarat Shankar-6. During the month, Cotlook averaged US$93.60 per pound while Shankar-6 was at US cents 77.99 per pound, keeping Indian cotton competitive in global market.