Prof. M.D.Teli, Sanket Valia & Pintu Pandit

Institute of Chemical Technology, Mumbai,400019

Introduction

Indian Textile Industry is the mother industry of this country as over 35 million population is directly dependent on its growth. Hence its growth not only constitutes the GDP growth but also it impacts the life of a large population of this country. The growth of this sector thus does not confine to economic reasons, but it is a social responsibility issue too, as it provides employment to a large number of population next to agricultural sector. Among the various strengths of this Textile sector, one of them is availability of diverse variety of fibre raw materials. Cotton, silk, wool, jute and manmade fibres like polyester, nylon, acrylic and viscose rayon are widely available in India. India is the world’s second largest producer of textiles and garments after China. India, is world’s second largest producer of cotton after China and also the second largest cotton consumer after China. India is the second largest producer of raw silk after China and at the same time India is the top most consumer of silk based fancy materials.

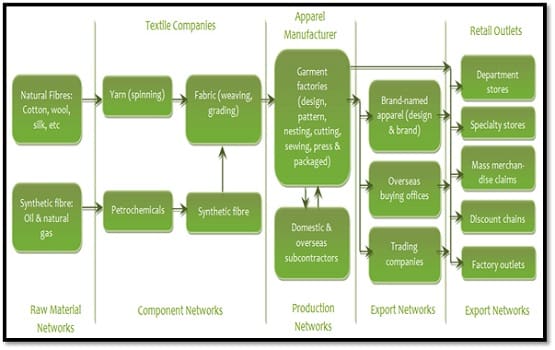

Due to the liberalization the of trade and economic policies initiated by the Government in the 1990s the last decade saw considerable growth much more than the that observed in previous decades. Over the last 10 years, India’s textile and apparel exports have grown at the rate of 11%.However, after the phasing out of export quotas in 2005 India’s export performance has been below expectations. Apparel is an ideal industry for examining the dynamics of buyer-driven value chains. The relative ease of setting up clothing companies, coupled with the prevalence of developed-country protectionism in this sector, has led to an unparalleled diversity of garment exporters in the third world.

In the domestic market, which is over 1.2 bn population, sustaining an annual growth rate of 12% should not be difficult. This implies that with a 12% CAGR in domestic sales the industry should reach a production level of US$ 350 billion by 2024‐25 from the current level of about US$ 100 billion for the domestic market. With a 20% CAGR in exports India would be exporting about US$ 300 billion of textile and apparel by 2024‐25.

This would of course imply that growth rates in exports of fibre and yarn would start declining and growth rates of apparel, homes furnishing, technical textiles and other finished products should grow very rapidly. This is going to be the trend as everyone is crystal clear about the benefits of climbing up on value chain and then exporting the products. The profitability is much more significant when you supply the finished garments as compared to supplying the yarns, and raw fabrics. This would also maximize employment generation and value creation within the country in the textile and apparel industry.

With regards to domestic market, within certain states such as West Bengal and North-Eastern states there exists a good room to develop the market in these areas. On certain existing problems in India in the field of fiber research, development and industrialization, India needs an alteration in research environment to bring in the needed radical change.

- Textile and Apparel Market:

India has overtaken Germany and Italy to emerge as the world’s second largest textile exporter.

But it lags China, whose exports are nearly seven times higher. Data released by the Apparel Export Promotion Council, the industry body for garment exporters, showed that India’s textiles exports were estimated at $40 billion in 2013, compared with China’s $274 billion. Textiles include everything from fibre and yarn to fabric, made-ups and readymade garments made of cotton, silk, wool and synthetic yarn. Over the past few months the Indian garment industry has staged a recovery of sorts which can be seen in the 23% rise in exports of shirts, trousers, skirts and other ready-mades during 2013.

Increasing labor cost and stringent environmental laws China is compelled to bring down its production; non-compliance of large number of factories in Bangladesh also provides India a big opportunity in view of its relative advantage and risk appetite of Indian entrepreneurs. A small push from the Government may help India to get more business as overseas buyers are looking at India as safe and reliable option for the sourcing. But to capture the space in market left by China and Bangladesh, we have to be competitive in price, better quality and delivery in proper time and therefore, Government agencies’ active support is very crucial.

In consultation with the Industry, meanwhile, the Ministry of Textiles has fixed an export target of USD 45 billion for textile products for the year 2014-15. Exports of textile products are supported through different schemes under Foreign Trade Policy e.g. Focus Market Scheme, Market Linked Focus Product Scheme, Focus Product Scheme and Duty Drawback Scheme. Exporters of textile products can also avail duty free import of capital Goods under EPCG and raw material under Advance Authorization Scheme.

raw material under Advance Authorization Scheme.

1.1 Textile Budget 2014-15

Everyone accepts the fact that India has to increase its share in export basket. In order to encourage exports of readymade garments it has been announced in “Union Budget 2014 – 15” to increase the duty free entitlement for import of trimmings, embellishments and other specified items from 3% to 5% of the value of exports.

The Prime Minister Narendra Modi government, in its first budget exuded its intent to kick start the investment cycle to nurse India’s ailing economy back to good health. Coming amid high expectations from the textile and garment industry, the Finance Minister Arun Jaitley, in his maiden Union Budget 2014-15, charmed the industry participants with an array of encouraging proposals.

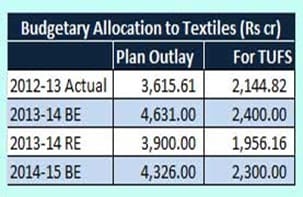

The Central Plan for Ministry of Textiles has been fixed at Rs 4,326 crore for 2014-15, about Rs 425 crore higher than the revised estimates for 2013-14, but Rs 305 crore lesser than the budget estimates for that year. A major portion of this has been allocated for Technology Up gradation Fund Scheme (TUFS) at Rs 2,300 crore. Comparatively, TUFS has got Rs 344 crore more than what was spent last year but Rs 100 crore lesser than what was intended for spending in 2013-14.

1.2 Modernization of the Industry

Technology Upgradation Fund Scheme (TUFS) is one of the flagship schemes of the Ministry of Textiles and has helped the industry to garner investments of Rs. 243,000 crore for Modernization of its set up. The scheme was launched in 1999 and has been instrumental in helping India achieve new heights in the development of the textile sector and particularly in the spinning segment. Personally I was involved in evaluating this scheme at some point of time and I can vouch that indeed this scheme has been a turning point in India’s modernization efforts of Textile Industry. It has definitely brought the industry to gain the competitive edge. In his Budget Speech of February, 2013, the Finance Minister had announced continuation of TUFS in the 12th Plan with a major focus on modernization of the powerloom sector. Higher subsidies for weaving / powerloom sector have accordingly been planned in the continued TUFS.

The textiles industry is provided credit at minimum rates both in the organized and the unorganized sector. In the 12th Plan period (2012-17), the past government had approved Rs 11,900 crore for the continuation of TUFS and so far more than 15000 crore has been spent on this scheme.

1.3 Setting up of six Textile Clusters

Development of various textile clusters has been one of the strategic path the Government is encouraging to boost the decentralized economy. The government proposed to set up mega textile clusters at Varanasi, Bareilly, Lucknow, Surat, Kuttch, Bhagalpur, Mysore and one in Tamil Nadu with a sum of Rs 200 crore.

It is claimed that the Budget recognizes the aspirations of a new India which is looking towards the government for decisively moving towards high growth, low inflation and more jobs. As per the minister, this budget aims for a 7 % or higher growth rate in a sustained manner within the next few years and will also usher in macro-economic stability in the near future.

1.4 Export target for readymade garments

To encourage exports of readymade garments, the Finance Minister announced an increase in duty free entitlement for import of trimmings, embellishments and other specified items from 3 % to 5 % of the value of their exports. The Government has fixed an export target of $17.2 billion for readymade garments during 2014-2015. The Scheme for Integrated Textile Parks (SITP) was launched in 2005 to encourage private investments and employment generation in the textile sector by facilitating world class infrastructure for common facilities, such as roads, water supply treatment and distribution network, power generation and distribution network, effluent collection treatment and disposal system, design centre, warehouse, first aid centre, etc. The textile parks are at different stages of implementation. Fourteen of the first 40 parks have been completed and 13 parks are operational. Investment in parks till date is Rs. 5,025 crores with direct employment of 47,167. Sixteen textile parks were sanctioned in the 11th Five-Year Plan, of which 11 textile parks have become functional. Five textile parks were sanctioned in the 11th Plan for Maharashtra, of which four are functional now.

1.5 Business friendly Taxes and Duty structures

Basic Customs Duty on raw materials (PTMEG etc.) required for manufacturing of spandex yarn reduced from 5 % to Nil. To encourage new investment in the chemicals and petrochemicals sector, the Budget has reduced the basic customs duty on reformate from 10 % to 2.5 %; on ethylene, propylene, and ortho-xylene from 5 % to 2.5 %. Adding to it, the government proposed faster clearance of import and export cargo which will help in minimizing transaction costs and improving business competitiveness. The FM also announced exemption of cotton transport loading and unloading services from the purview of service tax. Southern India Mills’ Association (SIMA) considers that this development will offer considerable relief to the industry and also to cotton growers.

1.6 Special Assistance to Handloom Sector

In a move to carry forward the rich tradition of handlooms of Varanasi, the FM announced to set up a Trade Facilitation Centre and a Crafts Museum with an outlay of Rs 50 crore to develop and promote handloom products. Government also proposed to set up a Hastkala Academy for the preservation, revival, and documentation of the handloom/handicraft sector in PPP mode in Delhi, for which it has set aside a sum of Rs 30 crore. Further, to provide employment to the people of Jammu and Kashmir, the government proposed to invest Rs 50 crore to start a Pashmina Promotion Programme and a programme for the development of other crafts in the state. Someone has rightly said that “It’s impossible to please everyone.” While the Union Budget 2014-2015 succeeded in fetching praises from almost the entire textile industry, there seemed to be a few who expected still more from the Budget.

1.7 FDI ensured for Indian textile sector

Resurgence has been witnessed in the Indian textile sector with the introduction of Foreign Direct Investment (FDI). The government is providing grants under market access initiative and market development assistance scheme for maximum utilization of FDI.

Various schemes like Technology Upgradation Fund Scheme (TUFS), Scheme for Integrated Textile Parks (SITP), Integrated Skill Development Scheme (ISDS), Scheme for development of Technical Textiles, and Schemes for the development of the Powerloom Sector etc. have been implemented in the textile sector.

India had shipped $ 36.69 billion worth during 2013 showing an upward trend of 11.58 percent. Textile, clothing and handicrafts worth $ 34.93 billion were shipped during April-March, 2012-13. Foreign direct investment (FDI) of worth $199 billion was also made in India’s textile sector in the financial year 2013-14. Especially for the period April-May 2014, the country’s textile sector attracted FDI worth $ 11.70 million. The textile ministry beckons a positive shift in India’s textile export. The industry continues to gain help as the government explores new markets by holding exhibitions in the Russian Federation, Israel, Eastern Europe, Latin American countries and other non-traditional markets.

1.8 Apparel Export Promotion Council’s Vision 2015

The world apparel market was worth US$ 345 bn in 2007. The market has grown at a rate of 8% during this decade. However, post quota the rate of growth has increased and for the last two years it has grown at a rate of 12%. There are two possibilities of growth from here on : First, the high growth scenario with average annual growth rate of 12% – In this case, growth trajectory remains same, at 12%. This could be because of supply side push of low cost apparel from China, Bangladesh, Vietnam and other emerging suppliers. Under this scenario, world apparel exports would be worth US$ 854 bn by 2015. Second, a moderate growth scenario with average annual growth rate of 8% – Moderation due to recession in 2008 & 2009 as also possibility of market saturation can result in growth of 8%. Under this scenario, world apparel exports would be worth US$ 640 bn by 2015. Thirdly, low growth scenario with average annual growth rate of 6% – In this case, under this scenario, world apparel exports would be worth US$ 550 bn by 2015.

With the moderate growth in world market, the likely scenario in 2015 will be as follows:

This scenario is based on the present growth trends prevailing in the above listed countries including India. At present it is ranked sixth, after China, EU, Hong Kong, Turkey and Bangladesh. With exports of US$ 18 bn, India is likely to fall behind Vietnam, Indonesia and Mexico and rank ninth in the world. With lower cost of labor and industry friendly labor laws in other countries as well as special treaties existing between US and EU and these countries, India is likely to slide down in this ranking.

This scenario is based on the present growth trends prevailing in the above listed countries including India. At present it is ranked sixth, after China, EU, Hong Kong, Turkey and Bangladesh. With exports of US$ 18 bn, India is likely to fall behind Vietnam, Indonesia and Mexico and rank ninth in the world. With lower cost of labor and industry friendly labor laws in other countries as well as special treaties existing between US and EU and these countries, India is likely to slide down in this ranking.

2. Textile Policy

2.1 State specific Technical Textiles Policies

Several states in India have been proactive in promoting the technical textiles sector in the country. States like Gujarat, Tamil Nadu, Maharashtra, Karnataka, Andhra Pradesh, Rajasthan, Madhya Pradesh and Punjab have especially witnessed some success in this effort. Contributing 25% to the national technical textile industry, Gujarat is a major player in the national technical textile sector. Gujarat’s nearly 900 technical textile units are engaged in each of the 12 subsectors of technical textiles, and the state is a key producer of commodity products for the technical textile and downstream industries.

Similarly Tamil Nadu, in turn, is also a fast-growing epicenter of technical textiles and is producers of agrotextiles, medical technical textiles, sport technical textiles, nonwovens. Coimbatore is also home to one of the country’s eight Centers of Excellence for technical textiles, COE: Meditech (SITRA), which specializes in medical technical textiles. Furthermore, the state’s investor-friendly environment has enabled the development of textile parks dedicated exclusively to technical textiles. The Government of Tamil Nadu approved the establishment of US$ 21.30 million technical textile park in Pallavada, which is expected to commence production in 2013.

Maharashtra is providing significant stimulus to the domestic technical textiles industry. Maharashtra is a key producer of agrotextiles, woven technical textiles, ropes and cordages, indutech, and coir fibre. There are four Centers of Excellence on technical textiles in the state: COE: Geotech (BTRA), COE: Agrotech (SASMIRA), COE: Non-wovens (DKTE), and, COE: Sportech (WRA).

The state is developing its first technical textiles park in Ichalkaranji, which hosts a large number of stakeholders in the entire textile value chain, with an investment of US$ 20 million.

Karnataka is a growing player in the Indian technical textiles sector. During the state’s Global Investor Meet 2012, held from June 6-8, 2012, the state attracted US$ 891 million in investments in its textile sector alone; these investments included proposals for the establishment of two technical textile mega projects for US$ 60 million and US$ 18.2 million in Hassan SEZ and Bellary, respectively.

Rajasthan is yet another state charting new frontiers in the national technical textiles sector. The state is a renowned leader in the global textiles sector, and is now encouraging the growth of technical textiles to advance its leadership throughout the textile value chain. Bhilwara has especially emerged as one of the largest manufacturing centres for viscose-polyester textiles.

Punjab is also proving to be a promising market for Indian sportech manufacturers. The state hosts amongst India’s largest sports industries, and is a key supplier to the Indian Raffia, ropes and cordages industries. The state demonstrates significant potential for the development of a vibrant and thriving industry for sports technical textiles.

Madhya Pradesh is another state that is demonstrating promising growth in the technical textiles sector.

The above eight states’ industrial, MSME, and textile policies have been instrumental in driving the growth of the technical textiles industry not just locally, but throughout the country.

- New National Textiles Policy to Revitalize the Textiles and Apparel Industry

The Ministry of Textiles had initiated the process of reviewing the National Textile Policy, 2000 in order to facilitate the Indian Textile Industry gain and sustain a global position in the manufacture and export of clothing and keeping in view the various changes both on the domestic and international fronts. Accordingly, an expert committee was set up to make fresh recommendations for the textile sector revival. The draft Vision, Strategy and Action Plan has been submitted after a detailed process of stakeholder consultations across the entire value chain.

Mr. Santosh Kumar Gangwar, Minister of State for Textiles (Independent Charge)Santosh Kumar Gangwar.

Considering the recommendations and feedback received at different consultation meetings, the committee identified basic concerns in the textiles sector and identified the national priorities in the form of a Vision & Strategy and the Action Plan for attaining the targets set for 2024-25. The Vision projects Indian textile and apparel exports to grow from $39 billion at present to $300 billion by 2024-25. This translates into additional investment required of the order of $120 billion, and in the process around 35 million additional jobs creation is expected to take place. Through this new and improved Textile Policy, the Government wants to address concerns pertaining to the availability of skilled work force, new labor reforms, and to attract investments in the textile sector, in order to provide a future road map for the textile and clothing industry.

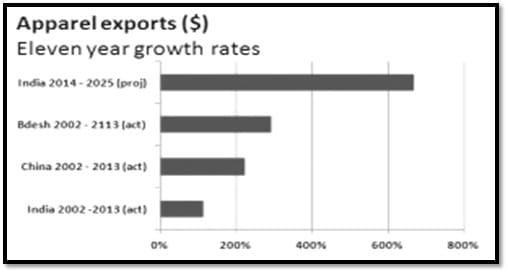

The growth programme surely appears ambitious. The chart compares the projected growth rate, in dollars, over the next 11 years with the actual growth rate of apparel exports in the past eleven.

Apparel exports by China to the EU and US in the eleven years from 2000 grew 6.1 times but at the beginning of the period China were not even in the WTO, and textile exports from practically all developing countries to the EU and US attracted fierce quota barriers. China’s eleven years of growth coincided with the withdrawal of these barriers, while Bangladesh’s 3.3-fold export increase coincided with a dramatic reduction in EU import duties levied on Bangladeshi garments. India, by contrast, apparently expects its textile and apparel exports to grow 7.7 times over eleven years.

No one can disagree with the importance of India creating 35 million new manufacturing jobs. However, the Indian textile and apparel businesses, if they’re going to increase their share of the world market at all, have to demonstrate to foreign buyers that they can compete with the kind of competition they’ll be up against in the 2020s.

- Right Focused Approach for Product Development An international study group opined to approach proper utilization of money and time by concentrating upon some chosen categories of research rather than to approach all areas. To develop right products, right scientists, right technologists and right market are vital and decision makers should look into it. In todays’s market the product should be customer driven and be designed and developed in such a fashion in order to reflect customers perception of ‘quality of value’.

4.1. Emerging trends in brand quality

Quality of design is a practice of using conceptual thinking, product designing and production planning all being done at one time. Since the customer evaluates the product in terms of value for money and expects quality product from the manufacturer, these aspects of maintaining the authenticity of product and its quality are extremely important.

4.2. Product Goals

The customer’s perception of quality and value –many a times taken as ‘product goals’ are required to be met. Hence there has to be process of evaluation of quality profile of the product.

4.3. Need of Market – driven R & D

Innovation is a key to nay flourishing business and hence market driven R&D for exploring potential new products has to be in place. Naturally custmers’ need analysis has to be there before undertaking such efforts. While cost component has to be also considered, the novel approach in designing such products got to be there to achieve competitive edge.

4.4 Need of Enhanced Technological Capability

The organized sector should start diversifying the product – mix by arranging production of conventional products with improved attributes or altogether newer products. They should undertake the gradual strengthening of technological capability of their manufacturing sector as a whole and hence they need to install high productive new generation machinery for producing yarns and fabrics of improved quality at competitive costs.

4.5 Need of Market Promotion

Presently most of the manufacturers are not fully aware of all the aspects of today’s market demands, especially export and they are following ‘product driven marketing’ instead of ‘market driven production’. In today’s market, it is the ‘consumer delight’ that is preferred over ‘consumer satisfaction’ with product quality. Hence, aggressive strategy for marketing has to be adopted, specially for creating a new brand image in order to exploit the new market opportunities likely to be created for sustainable development.

Conclusions

The Government of India through the Ministry of Textiles is giving all-round policy support to strengthen the position of Indian Textile, Apparels and Technical textile industry, so that a competitive advantage can be provided to this mother industry while exporting their goods. The domestic market is also expanding and it is important that the domestic consumer also gets their chosen goods with value for money. The support from state governments for modernization and infrastructure development over and above that from the Union government is also quite encouraging and looking at the vision and goals ,it is understandable that the industry is strongly backed by the policy support. From the industry point of view they need to invest in modernization, designing and innovation as well as R&D for being not only competitive in quality and costs ,but also innovating in delighting the customers of modern era. The kind of business opportunity which is going to be created due to China’s decline in production capacity as well as worsening situation in Bangladesh, the industry should gear itself to deliver such demands. In the present era of the globalised trade, their brand image and product value offered are also important. Sooner or later the tag of sustainability is also going to be one more emerging factor for providing an edge to newly offered product.

Acknowledgements:

- Authors have vastly depended on the information provided in public domain from the sites of MOT, AEPC, Times News, etc and are gratefully acknowledging these sources.