INDO-POLISH CHAMBER OF COMMERCE & INDUSTRY (IPCCI)

IPCCI was established in 2007. IPCCI goal is to develop Indian & Polish business and industry relations. We work to: identify and strengthen business and industry’s role in the economic development of the countries; act as a catalyst in bringing about the growth and development of Indian & Polish business; identify and address the special needs of the small sector to make it more competitive. We work with various organizations providing a platform for exchange of knowledge and experience so that the Polish and Indian cooperation interacting fruiting. On the occasion 60th

Anniversary of established diplomatic relationship between Poland and India IPCCI has been awarded by the Embassy of India in Poland for its outstanding contribution to strengthening trade and people to people ties between India and Poland. All areas of potential cooperation.

REPORT ON POLAND-INDIA TRADE FIGURES

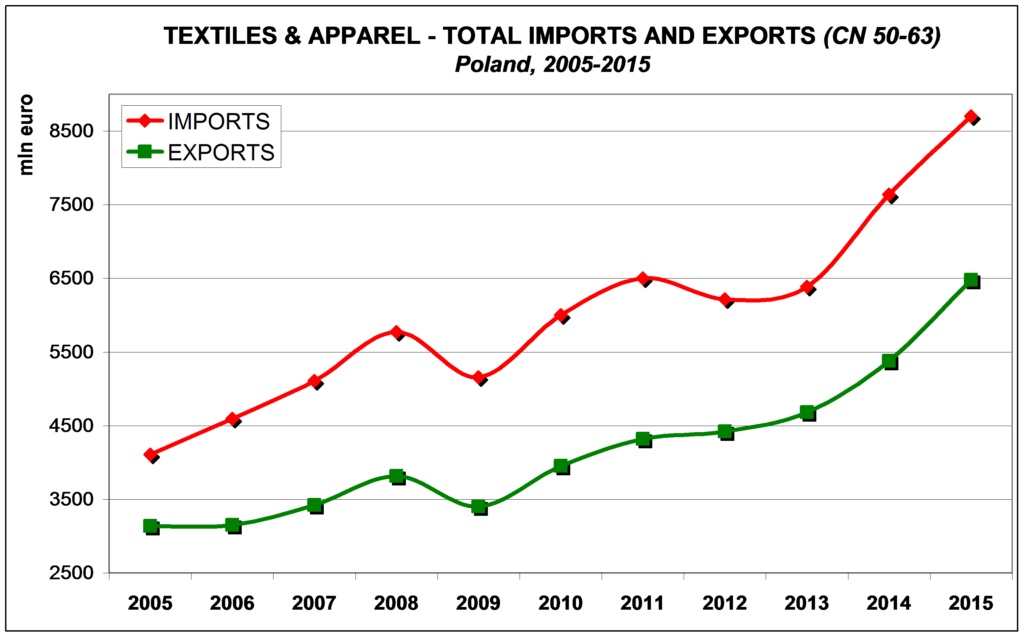

Textile and Apparel industry in Poland acted well in 2015 taking the basic economic indicators such as the value of sold production, employment and profitability of trading under consideration. Despite continued strong competition from low-cost countries, there are distinct indications of the production rebuilding in certain categories of Polish textile industry for the last two years.

FOREIGN TRADE

In 2015, the total value of imports of textiles and clothing to Poland increased by 13,9% and amounted to 8,70 bln €, being shared by 4,05 bln € on imports of textiles and 4,65 bln € on the import of clothing. (In ‘2014, imports totaled 7,64 bln € , textiles amounted to 3,86 bln €, clothing – 3,78 bln €.) In the same period, the total value of exports of textiles and clothing from Poland increased by 20,5% and amounted to 6,48 bln € being shared on 2,24 bln € in export of textiles and 4,24 bln € for the export of garments. (In 2014, exports totaled 5,38 bln €, textiles – 2,03 bln €, clothing – 3,35 bln €). Data for ‘2015 indicates that although exports of textiles and clothing grew faster than imports of the same products, the total trade deficit of Polish textile and clothing sector was amounted to 2,22 billion € in ‘2015.

Import of Textiles & Apparel from main Countries to POLAND in ‘2015

Apparel

| APPAREL (CN 61 – 62) | in mln € | |

| Total Value of Import | 4 652,00 | |

| 1. | China | 1 539,20 |

| 2. | UE | 1 154,20 |

| 3. | Bangladesh | 699,90 |

| 4. | Turkey | 348,52 |

| 5. | India | 196,34 |

| 7. | Cambodia | 182,62 |

| 8. | Pakistan | 107,88 |

| 9. | Wietnam | 101,88 |

| 10 | Indonesia | 87,51 |

| 11. | Marocco | 67,57 |

| 12. | Sri Lanka | 107,88 |

| 13. | Others | 58,50 |

YARNS (ALL KINDS)

| 100% Cotton (CN 5205 – 5507) | in mln € | 100% Chemical Filament-Fiber (CN 5402-5406) | in mln € | 100% Chemical Cut-Fiber (CN 5509 – 5511) | in mln € | |||

| Total Value of Import | 68,27 | Total Value of Import | 237,51 | Total Value of Import | 40,25 | |||

| 1. | India | 22,83 | 1. | UE | 154,13 | 1. | UE | 12,76 |

| 2. | Turkey | 18,94 | 1. | China | 31,34 | 2. | Turkey | 10,55 |

| 3. | Uzbekistan | 5,19 | 2. | India | 12,86 | 3. | Indonesia | 6,22 |

| 4. | Pakistan | 2,72 | 3. | Korea | 9,19 | 4. | India | 2,82 |

| 5. | Germany | 1,85 | 4. | Turkey | 7,88 | 5. | Others | 7,90 |

| 6. | Others | 16,74 | 5. | Others | 22,11 | |||

Fabrics

| 100% Cotton Fabrics (CN 5208 – 5512) | in mln € | 100% Chemical Filament’s Fabrics (CN 5407 – 5408) | in mln € | 100% Chemical Cut’s Fabrics (CN 5512 – 5516) | in mln € | |||

| Total Value of Import | 242,15 | Total Value of Import | 306,29 | Total Value of Import | 178,59 | |||

| 1. | UE | 148,53 | 1. | UE | 128,12 | 1. | UE | 88,21 |

| 2. | Turkey | 39,3 | 2. | China | 113,81 | 2. | China | 62,10 |

| 3. | China | 17,44 | 3. | Turkey | 31,61 | 3. | Turkey | 13,36 |

| 4. | Pakistan | 15,46 | 4. | Korea | 10,42 | 4. | Pakistan | 6,37 |

| 5. | Uzbekistan | 5,9 | 5. | India | 2,93 | 5. | India | 1,55 |

| 6. | India | 1,2 | 6. | Others | 19,40 | 6. | Korea | 0,93 |

| 7. | Others | 14,32 | 7. | Others | 6,07 | |||

Technical Fabrics, Knitted Fabrics, Home Textiles

| Technical Fabrics (CN 5901 – 5911) | in mln € | Knitted Fabrics (CN 6001 – 6002) | in mln € | Home Textiles (CN 6302) | in mln € | |||

| Total Value of Import | 494,92 | Total Value of Import | 230,29 | Total Value of Import | 176,28 | |||

| 1. | UE | 321,94 | 1. | UE | 135,28 | 1. | Pakistan | 44,42 |

| 2. | China | 96,5 | 2. | Turkey | 40,56 | 2. | UE | 43,11 |

| 3. | Turkey | 11,96 | 3. | China | 37,18 | 3. | China | 37,90 |

| 4. | India | 11,85 | 4. | Korea | 5,34 | 4. | Turkey | 16,50 |

| 5. | Korea | 10,51 | 5. | Egipt | 3,88 | 5. | India | 16,22 |

| 6. | Others | 42,16 | 6. | Others | 8,05 | 6. | Bangladesh | 15,34 |

| 7. | Others | 2,79 | ||||||

:TOTAL IMPORTS AND EXPORTS:

Source: Amit Lath (Sharda Group)

Suggested Points for Ministry of Textiles which would help to increase Trade between India-Poland

Apparel – India is losing big market share in Apparel business due to waiver of duties (0%) on imports from Bangladesh, Turkey & Pakistan to Europe. Whereas Indian goods have 10% duty in Europe. Also besides duty waiver all these countries are heavily subsiding & giving benefits to exporters in various forms – some as mentioned below. We foresee in period of 3-5 years market requirements in Central/East Europe will grow but India’s share will decrease or there would be minimal increase compared to other countries who are competing with India in similar products.

Raw Materials (yarns) – Presently India is leader is supplies of Raw materials to Poland – but India in coming years may lose big share as Pakistan, Bangladesh, Korea, Turkey have waiver on duties (0%). Besides that many countries like Indonesia, Uzbekistan have much lower duties (3.2%) whereas India has import duties of 4%.

I assume India should raise a serious point with Europe especially for duty waiver on this product –

Europe has negligible growth of Raw Cotton

Europe has very small production of Yarns on its own – 85% + yarns are imported by Europe from Turkey, Central & South-East Asia majorly.

Advantage European producers gains by getting duty waiver on Yarns – This will help EU producers to produce more in Europe and compete with certain countries who are dumping Textiles to Europe in big way. Yarn will contribute 20% of final value hence 80% value addition is done in Europe which helps the Industry directly to generate more revenue and increase in employment. The most effected countries as on date in Europe who are still having Textile production is: Portugal, Spain, Italy, Germany, Poland and Romania.

Fabrics – India has lost biggest share in Fabrics due to 8% import duty in Europe – also technology wise India lacking as compared to Turkey, China, Pakistan, Korea and Indonesia. Also countries like Turkey, Pakistan & Korea have duty waiver (0%) hence they have together gained substantial stare. Also simultaneously Italy, Portugal & Spain are also large producers of fabrics hence India faces large competition

Technical Fabrics, Knitted Fabrics & Home Textiles –

Technical Fabrics – India is last 4 years have increased supplies and we would see further increase as Technical Textiles (Non-Woven) is in demand.

Knitted fabrics – India has large reasonable setup of knitting machines but unfortunately India lacks behind in terms of having good quality process – dyeing – finishing units which could do a quality work and export to Europe. Raw Knitted fabrics are exported to Poland for final finishing in Poland.

Home Textiles – As we see Pakistan are leaders in Home Textiles followed also by Turkey & Bangladesh – these 3 countries dominate largest market share as they have duty waiver (0%) as compared to India & China. Also Europe has huge Home Textile production in Portugal, Spain, Greece, Romania and Poland.

The largest contribution in Home Textiles is Towels exports from Pakistan & Turkey which are increasing these trade figures to Poland.

Few Important points for kind consideration:

Following points should be seriously considered by Textile Ministry to boost and increase India’s share especially into Central/Europe – These markets are fast growing markets but India share is very small and we are hugely lacking behind. To Support these initiative if Indian Government can add following advantages:

Interest Rate for Exporters – Libor + 1-1.5% maximum (Presently its Libor + 4 to 6%)

Allowance of Letter of Credit 120 days at cheap discounting by Banks so Indian exporters can compete with Pakistan & Bangladesh who offers similar advantage.

Additional benefits to be provided on Focus Market Scheme to boost exports in Central/East Europe increasing India’s presence.

Countries like Turkey have established special bank for Textile Industry i.e “Tekstil Bank” if India can also focus on such possibilities which could help Textile Exporters to benefits based on export performance.

Export Credit Guarantee Corporation of India (ECGC) should develop closer co-operation with Banks & Factoring companies in Central/East Europe so that India can offer flexible terms of payments under full insurance and right formats of contracts.

For any assitance or help please contact :

Mr. Amit Lath (Vice President)

Indo-Polish Chamber of Commerce & Industry (IPCCI)

Email: [email protected] | Mobile: +48601336699