Synopsis

- Opportunities abound: During FY19-24, banks1 grew at a compounded annual growth rate (CAGR) of 17% in the housing loan space, while the Housing Finance Companies (HFCs) grew by 12%. CareEdge Ratings believes the industry has ample potential for growth supported by long-term structural growth drivers.

- Retail-focused growth for HFCs: Retail loans continued to drive growth for HFCs amid cautious growth in the wholesale segment, supported by capital raising and an overall comfortable capital structure. • Improving asset quality indicators: The asset quality indicators of HFCs are largely stable, with a stable pool of stage 2 and stage 3 assets.

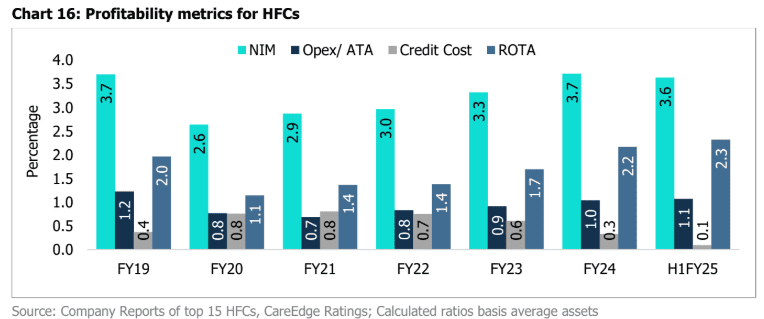

- Rebounding profitability: Easing credit cost and improved margins continue to drive profitability, which rebounded to pre-pandemic levels in FY24.

Housing Finance: Favourable medium-to-long term outlook

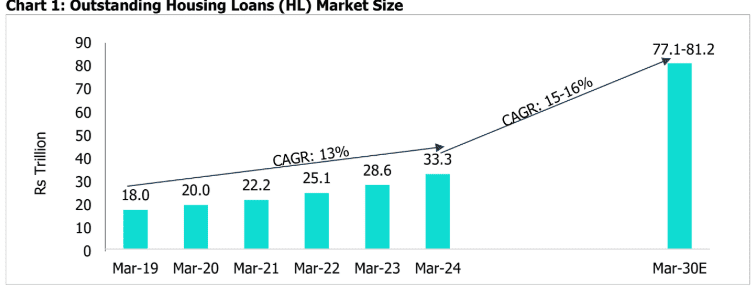

The individual housing loan portfolio for the industry (incl. banks and HFCs) stood at Rs 33 trillion as of March 2024, reflecting a steady growth of ~13% CAGR over the last six years. In the context of total systemic credit, housing loans constituted 14% of the overall share as of March 2024.

This growth is underpinned by long-term structural drivers such as improved affordability, rising urbanisation, increasing nuclear families, premiumisation in housing demand, and government initiatives like ‘Housing for All.’ Supported by these favourable growth drivers, CareEdge Ratings forecasts the housing finance market to grow at a CAGR of 15-16% between FY25-FY30.

HFCs market share has remained stable

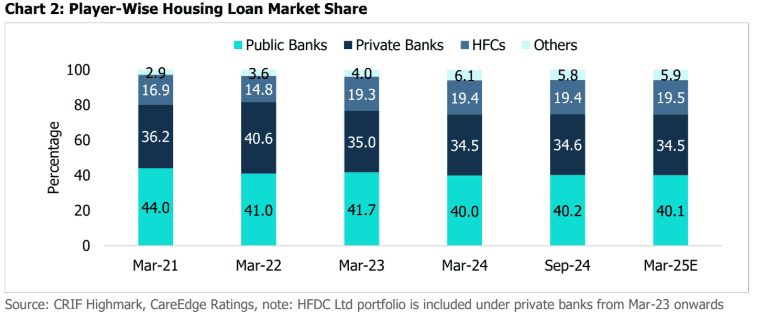

Public sector banks continued to dominate the housing loan market with a 40.0% share as of March 2024, while private sector banks had the second-largest share at 34.5%. During FY19-24, banks’ housing loan portfolio (including HDFC Ltd.’s Merger with HDFC Bank) has grown at a CAGR of 18%, while HFCs have grown by 11%. The higher growth rate of banks is partially contributed by the relative cost of funds advantage over HFCs and rising ticket sizes of disbursements, aided by increasing property prices in metro and urban cities.

Given the significant growth potential of the housing finance market and the differences in product and customer segmentation between banks and housing finance companies (HFCs), CareEdge Ratings believes that both lender segments have ample room for growth. While banks primarily focus on higher-ticket loans to salaried customers with good credit profiles in metropolitan and urban areas, HFCs focus on relatively smaller-ticket loans to customers, including the self-employed, in tier 2 and below cities, where lending is based on the assessed income model. Considering HFCs’ specialised product offerings and deeper reach, the market share of HFCs within the housing loan market has remained stable at 18-19%, and this trend is expected to continue in the medium term.

Post-pandemic surge in residential property sales with normalising disbursements As one of the key drivers of the housing finance industry, the residential properties market remained buoyant, with sales showing an absolute growth of 74% since CY19 to 4.6 Lakh units in CY24.

While the sales performance in CY24 reflected continued buyer confidence and market resilience, the year saw a slight decline in sales compared to the previous year due to demand stabilisation post-pandemic. In sync with the sales and launch trends in residential property, housing loan disbursements too moderated to 12.3% during FY24 as pent-up demand post-pandemic was seen normalising. Furthermore, this normalisation is based on higher-than average growth post-pandemic and an increase in residential property prices.

Despite some moderation, a sustained demand for residential properties remains, both as a means of housing and as an investment option, which bodes well for HFCs.

HFCs to report healthy credit growth in FY25 and FY26

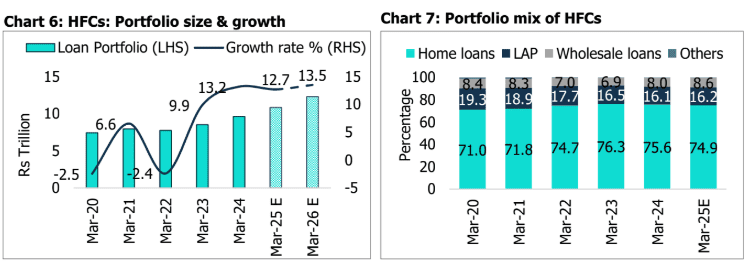

Driven by favourable growth drivers and a buoyant residential property market, the loan portfolio of HFCs grew by 13.2% to Rs 9.6 trillion as of March 2024, in line with CareEdge Ratings growth projection of 12-14% for FY24. In FY23, the first full year of post-pandemic recovery, retail loan growth rebounded, and the declining trend in the developer finance portfolio reversed. While growth continues to be led by retail loans, wholesale loans comprising

project financing and lease rental discounting also witnessed growth during FY24.

The share of wholesale loans has increased by 100 basis points to 8% as of March 2024. While HFCs are cautiously growing this segment, the share of wholesale book is expected to grow in the medium term, driven by healthy, though moderated, residential sales and a shrinking pool of stressed developer exposures for larger HFCs.

CareEdge Ratings projects YoY credit growth of 12.7% and 13.5% for FY25 and FY26, respectively, for the HFCs. The downside risks to this growth include tighter liquidity, heightened competition, and conscious credit curtailment by HFCs in riskier areas.

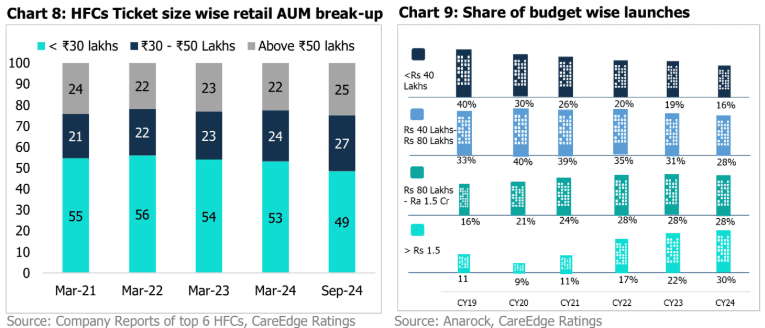

HFCs’ ticket size rises in tandem with the premiumisation of residential launches HFCs primarily operate in ticket sizes of less than Rs 30 lakhs, which accounted for 53% of the total AUM as of March 2024. However, HFCs are witnessing a gradual rise in the proportion of AUM with ticket sizes ranging between Rs 30 and Rs 50 lakhs and a decline in the proportion of AUM with ticket sizes under Rs 30 lakhs.

Notably, ticket sizes for HFCs are not increasing at the same pace as residential property launches, suggesting that the demand for higher ticket-size loans is likely being met by banks and/or through self-funding by investors.

The residential property market is noticing a shift in the pattern of new launches compared to previous years. Following the pandemic, the change towards premiumisation has continued. The share of property launches with a ticket size of >Rs 1.5 crore has risen to 30% in CY24, compared to 11% in CY19. The share of launches with ticket sizes upwards of Rs.80 lakhs increased to 58% of total launches during CY24 compared to 27% in CY19.

Asset quality demonstrating improving trend

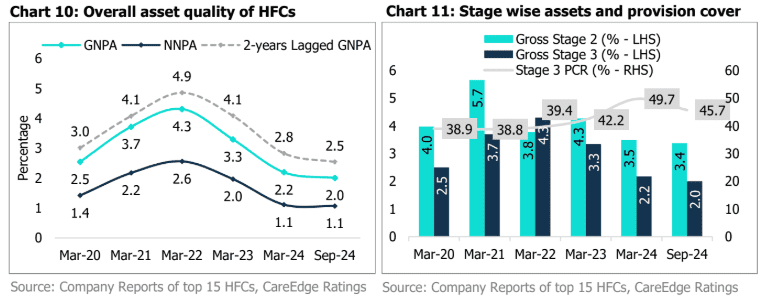

Asset quality metrics of HFCs have significantly improved, with GNPA declining to 2.2% as of March 2024, down from the peak of 4.3% in March 2022. The improved asset quality trend is largely due to improvement in developer financing portfolio and stable retail GNPAs.

While credit costs for HFCs have decreased, the Stage 3 provision coverage remains strong at 49.7% as of March 2024 and 45.7% as of September 2024, supported by improved asset quality and previously provided capital buffers. So far, there are no imminent signs of asset quality issues with the 2-year lagged GNPA and the pool of assets in Stages 2 and 3, all of which have shown improvement during FY24 and H1FY25.

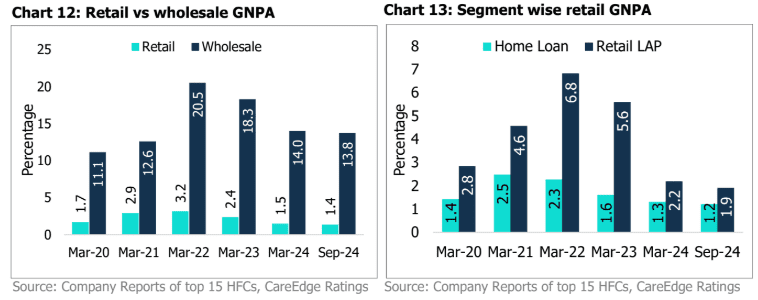

Asset quality pressure on wholesale loans and LAP book subsides

In FY22, the GNPA for the wholesale segment surged to 20.5%, driven by slippages in large project loans, which adversely affected the overall asset quality of HFCs. Since then, the impacted HFCs have focused on recoveries, NPA sell-downs and write-offs in their stressed wholesale book, leading to an improvement in wholesale GNPA to 13.8% as of September 2024.

The retail segment has also seen a significant improvement in asset quality, with levels improving to 1.4% as of September 2024, compared to the peak of 3.2% in March 2022. Additionally, softer buckets of HFCs show no imminent signs of concern.

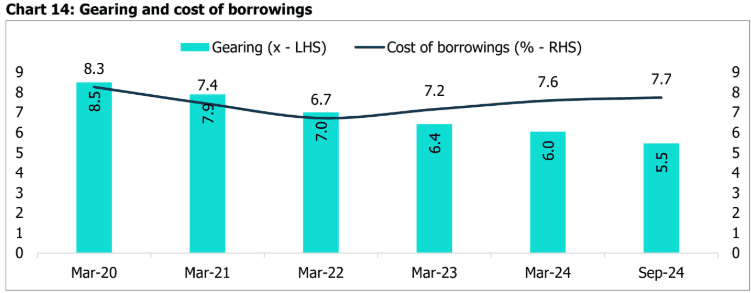

Improved gearing levels driven by fundraising spree and healthy accruals

The sector has continued to attract equity due to the secured nature of lending, improving penetration of HFCs into affordable housing and low credit costs. This, coupled with the enhancement of internal accruals, has resulted in healthy capitalisation levels. Apart from healthy capital raising, the decline in the gearing levels of HFCs since March 2020 has also been attributed to reduced gearing thresholds in the financial sector following the liquidity crisis.

HFCs’ cost of borrowings rose to 7.6% during FY24 [PY.: 7.2%], mainly on account of rate transmission via banking and capital markets. During FY23, the weighted average lending rate of SCBs to the finance sector increased by 166 bps, which was visible in the cost of borrowing movement during FY24. Furthermore, while a 25 bps cut in the repo rate was implemented in February 2025, which would lower the cost of borrowings for HFCs’ repo-linked bank borrowings, the overall cost of borrowings for FY25 is expected to remain range-bound due to tight liquidity conditions.

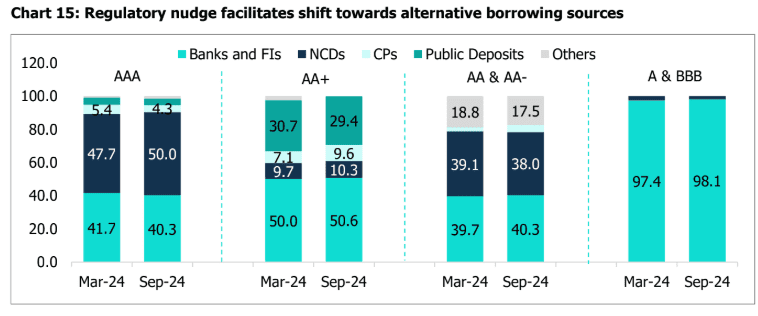

Higher-rated entities tend to have relatively more diversified sources of borrowing than lower-rated peers, who tend to rely more heavily on bank borrowings and NHB refinance. The RBI’s decision in November 2023 to increase the risk weights for bank credit exposure to NBFCs by 25 percentage points has prompted HFCs to explore alternative funding sources. This has resulted in an increased share of NCD borrowings within the mix, particularly across higher rating bands.

Profitability boosted by improving NIMs and easing credit cost

Driven by easing credit costs and improving margins, HFCs have witnessed a rebound in profitability metrics to pre pandemic levels. The rebound in NIMs is primarily driven by increased credit demand, improvement in yield, and an overall decline in gearing levels. HFCs have also begun to strengthen their presence in the affordable housing segment to protect spreads, which is positively impacting NIMs. NIMs have improved to 3.7% for FY24 and stood at 3.6% for H1FY25.

As HFCs look to augment their branch network and expand into the affordable housing segment, opex as a percentage of ATA marginally increased to 1.0% in FY24. Improved wholesale asset quality, substantial recoveries in the wholesale segment resulting in write-backs, and stable asset quality in the retail book are enabling HFCs to record minimal credit costs of 0.3% for FY24 and 0.1% for H1 FY25. The significant decline in credit cost to 10 bps during H1FY25 is due to a few large HFCs experiencing provision write-backs. Collectively, the rebound in NIMs and reduced credit costs have resulted in a return on assets of 2.2% for FY24 and 2.3% for H1FY25, aligning with pre-pandemic levels.

Outlook

- Careedge ratings project the Housing loan market (Banks + HFCs) to grow at CAGR of 15-16% over the period of FY24 -30. Within the HFC portfolio mix, the wholesale segment is expected to witness cautious growth, with its share in the overall mix is expected to rise to the 10-12% range in the medium term.

- HFCs continue to report healthy balance sheets. While gearing levels have declined for HFCs due to fundraising and improving accruals, gearing levels are expected to increase to 6.5x-7x levels in the near to medium term, as companies will look to leverage their equity.

- With no imminent asset quality risks, GNPA is projected to range between 1.6-1.8% during FY25 and FY26, while credit costs are expected at 40bps in the medium term.

- Driven by a favorable growth outlook, prospects of reducing the cost of funds and range-bound credit costs, ROTA for HFCs is expected to remain healthy in the range of 2.2-2.3 % over the next two years.