Crude oil like any other type of commodity is actively traded on the stock market. Influenced by various factors, accurate prediction of crude oil prices is a difficult process that requires thorough research and understanding of various aspects. Analysis of FII DII data can provide insights into crude oil price movements and their correlation. An increase in crude oil prices results in reduced investments by foreign investors due to fear of a total economic slowdown. On the other hand, the domestic investments increase and vice versa.

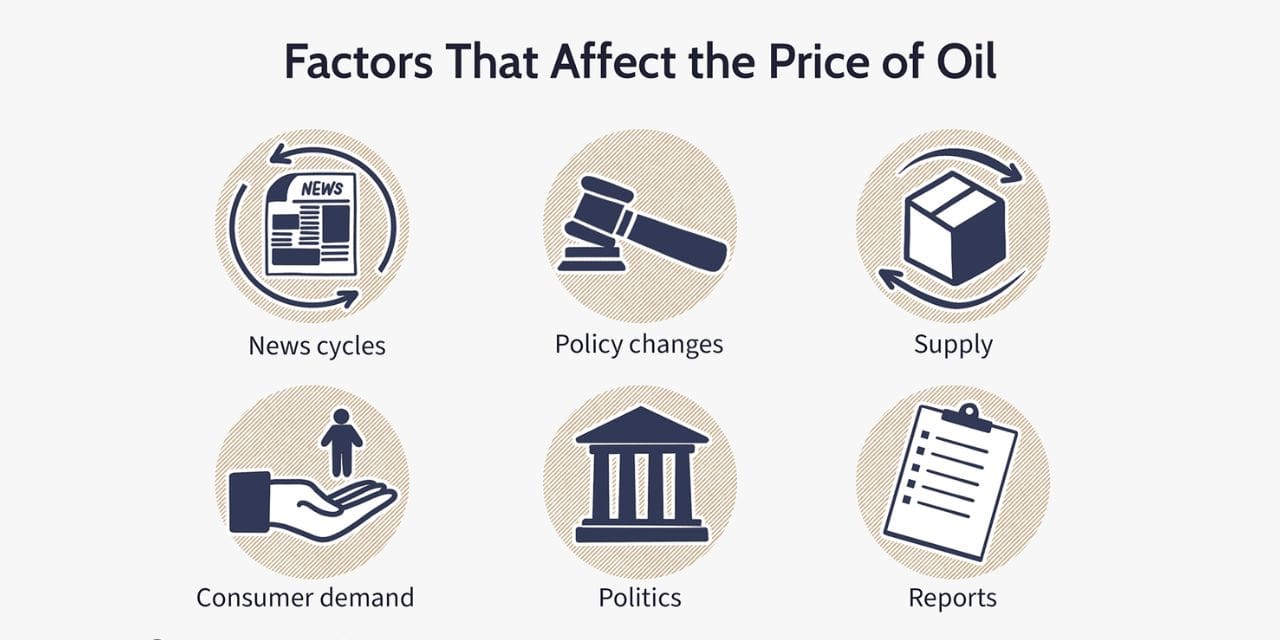

Following are certain factors that influence the crude oil prices which investors must analyse for accurate predictions:

-

Global supply and demand

The crude oil prices are affected by the global supply and demand of crude oil. An increase in the demand for crude oil by emerging economies causes a corresponding increase in crude oil prices. On the other hand, in a situation of wide availability of crude oil with limited demand, the oil prices decrease.

-

Geopolitical events

Events like wars, global conflicts, and instability in countries that produce crude oil like Saudi Arabia et cetera result in an increase in crude oil prices. On the other hand, favourable policies and stability in such countries ensure low volatility in crude oil prices.

-

Currency fluctuations

Crude oil prices are adversely affected by small fluctuations in global currencies, especially the US dollar. Serving as one of the strongest currencies in the world, an increase or decrease in the US dollar price results in the corresponding change in crude oil prices. For example, falling US dollars results in an increased demand for crude oil which increases crude oil prices and vice versa.

Traders and even investors can opt for accurate crude oil tomorrow prediction by keeping a close look at the forex markets, foreign and domestic investments inflow and outflow, and economic reports generated by world economies. Following is the correlation between foreign and domestic investment and crude oil prices that investors must consider protecting future price movements with greater scale and efficiency:

Increase in crude oil price.

A sharp increase in crude oil prices causes an adverse effect on the prices of essential commodities and creates a situation of inflation. This results in the economic slowdown of economies like India which in turn reduces the foreign direct investment.

Decrease in crude oil prices.

Decreasing crude oil prices results in a positive effect on emerging economies which in turn attracts foreign investors. Domestic investors on the other hand look for other avenues in foreign markets and slow down their investment cycles.

Conclusion

With careful analysis of essential factors like foreign direct investment, domestic institutional investments, changes in interest rates, currency fluctuations, and data reports of developed and developing economies, traders and investors can make accurate predictions. They can easily identify the future course of crude oil price movements and take necessary action regarding investments. Moreover, with accurate predictions of the crude oil price movements, they can make informed decisions regarding investment in stock market securities, bonds, and various other investment solutions for better profitability or reduction in losses.