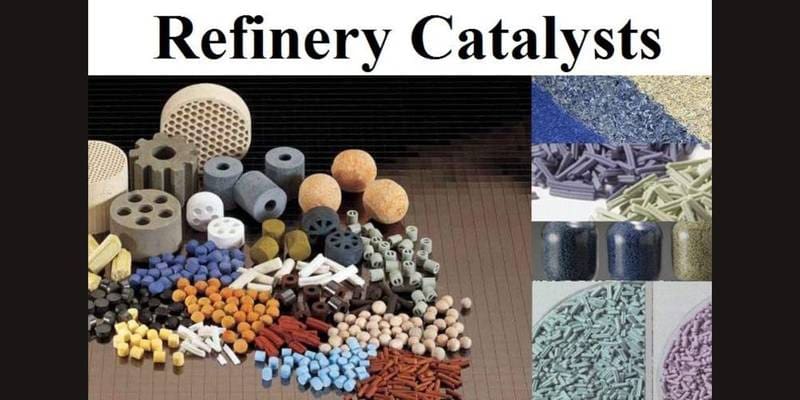

The report “Refinery Catalysts Market by Type (FCC Catalysts, Hydrotreating Catalysts, Hydrocracking Catalysts, and Catalytic Reforming Catalysts), Ingredient (Zeolites, Metal, and Chemical Compounds), Region – Global Forecast to 2025″, size is expected to grow from USD 4.0 billion in 2020 and USD 4.7 billion by 2025, at a CAGR of 2.9% during the forecast period. The major factors driving the refinery catalysts industry include a growing number of stringent regulations for vehicle emissions across the world and rising consumption of petroleum derivatives.

Browse

• 83 Market data Tables

• 40 Figures

• 136 Pages and in-depth TOC on “Refinery Catalysts Market – Global Forecast to 2025”

Some of the prominent key players are:

- Albemarle Corporation (US)

- W R Grace (US)

- BASF (Germany)

- Haldor Topsoe (Denmark)

- Honeywell UOP (US)

- Clariant (Switzerland)

- Axens (France)

- Johnson Matthey (UK)

- China Petroleum and Chemical Corporation (Sinopec) (China)

- Shell Catalyst & Technologies (Netherlands)

- Arkema (France)

- Anten Chemicals (China)

- Chempack (China)

- Dorf-Ketal Chemicals Pvt. Ltd. (India)

- Exxon Mobil Corporation (US)

- Gazprom (Russia)

Albemarble Corporation is the largest player operating in the refinery catalysts market. The company has 31 manufacturing facilities, and 45 sales offices across the globe. The company offers a wide range of refining catalysts to various customers, such as Total S.A. (France), Chevron Corporation (US), INEOS Group Holding S.A. (UK) and Saudi Aramco (Saudi Arabia). The company has adopted new product launch and joint venture strategies to broaden its product portfolio and maintain its position in the market. In November 2018, Albemarle launched XPLORE, a new platform for the clean transportation fuel market. This catalyst will help in hydroprocessing catalyst technology for refineries to produce clean transportation.

The hydrocracking catalysts segment is the fastest-growing type segment of the refinery catalysts market.

The hydrocracking catalysts segment of the refinery catalyst market is projected to grow at the highest CAGR during the forecast period. These refinery catalysts have garnered industry-wide acceptance for their performance and general characteristics. Also, these catalysts do not produce coke as a by-product, thereby resulting in the improved conversion of feedstock. Thus, benefits associated with hydrocracking catalysts such as their ability to handle a wide range of feedstock materials, are anticipated to drive the growth of the hydrocracking catalysts segment.

APAC is the fastest-growing refinery catalyst market.

APAC is the largest consumer and manufacturer of refinery catalysts globally. According to the BP Statistical Review of World Energy 2019, APAC’s total oil production was 7,633 thousand barrels per day (BPD) in 2018, with a global market share of 8.1%. APAC’s political and economic conditions have driven the market penetration of refinery catalysts.