India’s retail inflation moderated for the third straight month in April, falling to its lowest level since October 2021.

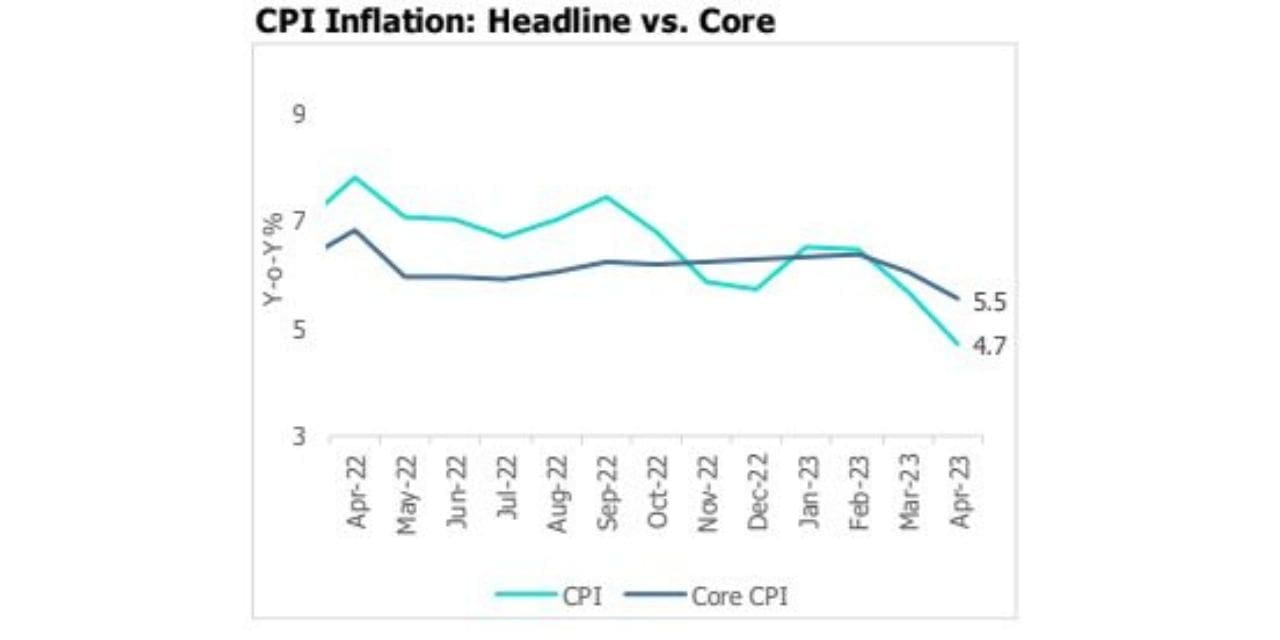

The consumer price-based inflation came in at 4.7% y-o-y in April, below CareEdge’s estimate of 4.9%. The

moderation in CPI inflation has been supported by a high base of last year. Food inflation has fallen to 4.2% from

5.1%. With this, the share of food inflation in overall inflation has reduced to 41% in April, from 48% a year ago.

Amongst food items, edible oil and vegetables have continued with a contractionary trend, while cereals prices

moderated for the second straight month in response to the government’s efforts to put a lid on wheat prices. More

notably, for the first time since July 2022, core inflationedged below RBI’s upper tolerance of 6%. Core CPI cooled

to 5.5% y-o-y in April as components such as housing, healthcare and transport & communication witnessed

softening.

Food and beverage inflation eased to 4.2% in April from 5.1% in the previous month on account of support from

a high base and deflation in vegetables and edible oils, amidst notable softening of cereals and protein items.

Meanwhile, retail wheat prices fell for the second straight month as the Centre offloaded its buffer stock amidst

the arrivals of fresh crops in the market. This helped overall cereal inflation moderate to 13.7% in April from 15.3%

a month ago, albeit remaining in double-digits for the eighth consecutive month. Going ahead, healthy wheat

procurement and production could further help in alleviating upside price pressures for the crop. Nearly 252 lakh

metric ton (MT) procurement of wheat has been done till May 9, 2023, during the ongoing Rabi Marketing Season

(RMS) 2023-24, well above the full-year wheat procurement of 188 lakh MT seen in 2022-23. Additionally, the

government has also tweaked its open market sale policy by deciding to sell buffer stocks held by the Food

Corporation of India (FCI) every quarter starting July. So far, FCI had been selling wheat to bulk buyers during the

lean season (January-March). As a result of boosting supplies and regulating prices at regular intervals, further

moderation in wheat prices could be on the cards.

While milk inflation has moderated in April (rising 8.9% in April, compared to 9.3% in March), sequentially, price

pressures have remained sticky. Rise in the cost of fodder, supply shortage due to the spread of lumpy disease

amongst cattle and high transportation costs led to multiple price hikes by dairy cooperatives over the last year.

Notably, fuel and light inflation moderated to a two-year low of 5.5% from 8.9% in the previous month. The

softening of prices in this category was largely on account of kerosene prices contracting 13% y-o-y from a rise of

8% a month prior. Inflation in the LPG category too moderated, with sequential momentum reporting a contraction

for the first time since mid-2021.

Way Forward

Looking ahead, a favourable base and continued ebbing of demand will help in bringing the headline CPI number

lower in the coming months. A positive outlook for the domestic currency and lower commodity prices could also

bode well for the inflation outlook. Nevertheless, we remain wary of upside risks emerging from weather-led

disruptions if El Nino conditions turn out to be more severe than currently anticipated. Possible heatwaves in the

summer could also pose a concern. Moreover, a seasonal uptick in prices of fruits and vegetables that is typically

seen with the onset of summer could counter the decline in food inflation to some extent. From the policy

perspective, inflation coming off the boil is a relief. We maintain our view of RBI maintaining an extended pause in

2023.