The Minister referred to the meeting between the exporters and the Prime Minister, Shri Narendra Modi, on August 6, 2021, and urged them to boost exports and become more fully integrated into the global value chain. He praised the prime minister’s leadership and vision, saying that he thought the country had enormous growth potential given the size of the economy and the strength of its industrial and service sectors.

This vision, he asserted, forms the basis of the strategy. The Minister underlined that the Prime Minister’s enthusiasm and support were responsible for the outstanding achievement of the global export total crossing US$ 760 billion in these difficult circumstances. He said that this accomplishment is consistent with the objective specified in the strategy for 2021 following the meeting with the prime minister. He emphasised the need to seize and fully use every export opportunity. He also said that there should be a significant concerted outreach with the world over the course of the next five months while India has the G20 chair, both sector- and country-wise. In addition to the Director General of Foreign Trade, the Central Board of Indirect Taxes and Customs Member, Shri Rajiv Talwar, and the Union Minister of State for Commerce & Industry, Smt. Anupriya Patel, they also attended the release of the policy.

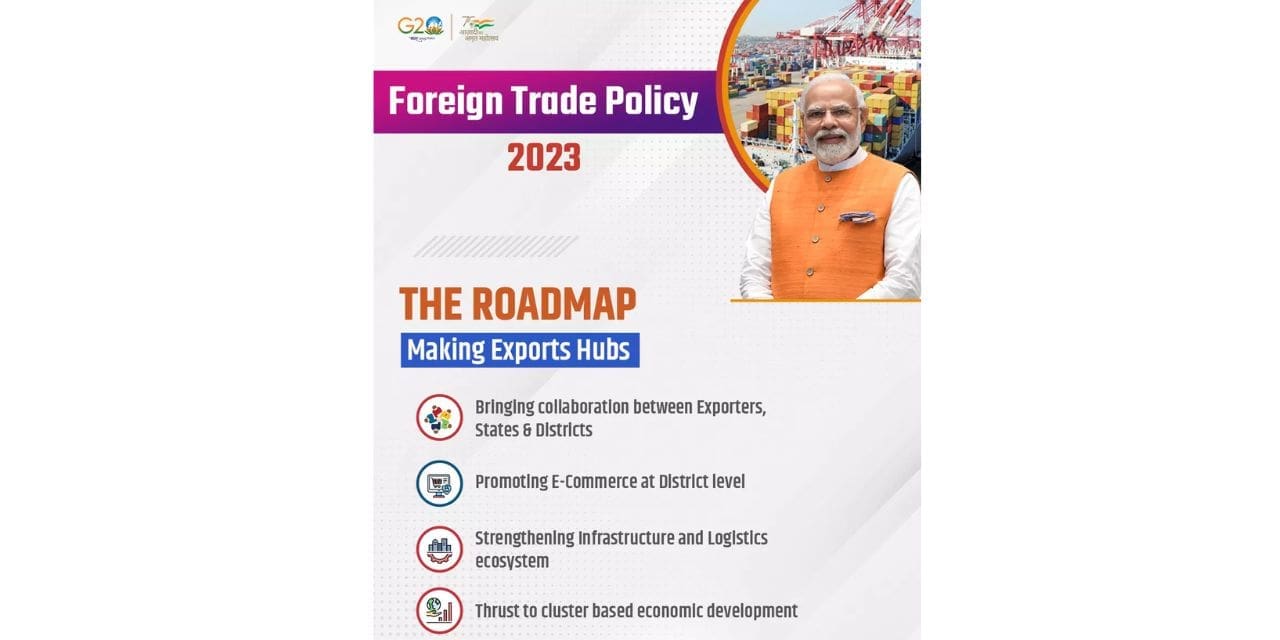

Santosh Kumar Sarangi provided a thorough explanation of the policy. These 4 pillars serve as the foundation for the policy’s Key Approach:

(i) Remission Incentive,

(ii) Collaboration among exporters, states, districts, Indian missions, as well as attempts to make doing business easier, reduce transaction costs, and use of technology are all ways to promote exports. A fourth area of growth is e-commerce. creating export hubs in districts and streamlining SCOMET policy. The Foreign Trade Policy (2023) is a document that outlines policy and is flexible and receptive to the needs of trade. It is built on the continuation of tried-and-true export facilitation programmes. Its foundation is faith in and partnership with exporters. In the FTP 2015–20, revisions were made after the first publication, even without an announcement of a new FTP that would react quickly to the conditions as they developed.

The FTP will then be revised as and when necessary going forward. Including suggestions from Trade and Industry would also be beneficial. Processes are continuously being streamlined, and FTP is periodically updated. The FTP 2023 intends to automate and re-engineer processes to make it easier for exporters to conduct business. It also emphasises on areas like high-end dual-use technology.A one-time amnesty programme is being introduced by the new FTP to allow exporters to finish off any existing pending authorizations and start over. Through the “Towns of Export Excellence Scheme” and the “Status Holder Scheme,” the FTP 2023 promotes the recognition of new towns and exporters, respectively. By streamlining the well-known Advance Authorization and EPCG systems and permitting merchanting trade, the FTP 2023 facilitates exports.

Automation & Process Re-Engineering: Through automated IT systems with risk management systems for multiple clearances in the new FTP, exporters are receiving more trust. The Policy has a focus on export promotion as it transitions to a regime that is enabling and built on technology interface.

Given the success of various currently running programmes like Advance Authorization, EPCG, etc. under FTP 2015–20, they will be continued together with significant process re-engineering and technological enablement for the benefit of exporters. Building on prior “ease of doing business” initiatives, FTP 2023 codifies implementation techniques in a paperless, online environment. Access for MSMEs would be facilitated by reduced fee structures and IT-based programmes.

All Advance and EPCG Scheme processes, including issue, revalidation, and EO extension, will be covered in stages over the FY23–24. Cases identified under the risk management framework will be manually examined, whereas the majority of applicants are anticipated to be originally protected by the “automatic” procedure.

Towns of Export Excellence: In addition to the 39 current towns, four additional towns—Faridabad, Mirzapur, Moradabad, and Varanasi—have been named Towns of Export Excellence (TEE). Under the MAI plan, the TEEs will have priority access to funding for export promotion, and under the EPCG plan, they will be eligible for Common Service Provider (CSP) incentives for export fulfilment. It is anticipated that this development will increase exports of carpets, handicrafts, and loom-made goods.

Awareness of Exporters

Exporter companies with’status’ based on export performance will now participate as partners in capacity-building projects using their best efforts. Holders of 2-star level and higher would be encouraged to offer trade-related training, similar to the “each one teach one” concept. based on an example curriculum to interested people. This would assist India in creating a skilled labour pool that can support a $5 trillion economy before 2030. More exporting companies can now attain 4 and 5-star ratings thanks to revised status recognition standards, which creates potential for branding in foreign markets.The FTP seeks to establish relationships with State Governments and advance the Districts as Export Hubs (DEH) programme, which seeks to encourage exports at the district level and hasten the growth of the informal trade ecosystem. The State Export Promotion Committee and District Export Promotion Committee at the State and District levels, respectively, will serve as the institutional vehicle for efforts to identify export-worthy goods and services and address issues at the district level. Plans for promoting exports by district will be a document that details the district-specific strategy for promoting the export of specified goods and services is developed for each district.

Simplifying the SCOMET Policy

India is emphasising the “export control” system more and more as its cooperation with export control regime nations grows. Stakeholders are more aware of SCOMET (Special Chemicals, Organisms, Materials, Equipment, and Technologies), and the policy regime is being strengthened to implement international treaties and accords that India has signed. In addition to enabling the export of SCOMET-controlled goods and technology, a strong export control regime in India would give Indian exporters access to dual-use, high-end goods and technologies.

Facilitating exports via E-commerce

Exports through e-commerce are a potential sector that requires different types of policy interventions than conventional offline trade. Numerous estimates indicate By 2030, the potential exports from e-commerce could reach $200 to $300 billion. The goal and plan for creating e-commerce hubs, together with related components including payment reconciliation, bookkeeping, returns policy, and export entitlements, are described in FTP 2023. The consignment-based limit for courier-based E-Commerce exports has been increased from 5 lakh to 10 lakh in the FTP 2023 as a starting point. This cap will either be further modified or ultimately eliminated based on exporters’ comments. Exporters will be able to make FTP claims if courier and postal exports are integrated with ICEGATE. Based on the suggestions of the working committee on e-com exports and inter-ministerial discussions, the complete e-commerce policy addressing the export/import ecosystem will be developed soon.

A lot of outreach and training initiatives will be implemented to increase the capacity of crafters, weavers, clothing producers, gem and jewellery designers, and E-Commerce platform users.

Export Promotion of Capital Goods (EPCG) Scheme Facilitation

Further rationalisation is being made to the EPCG Scheme, which permits the import of capital items at zero Customs tax for export production. Some significant additions include:

As an additional scheme eligible to receive advantages under the CSP (Common Service Provider) Scheme of the Export Promotion Capital Goods Scheme (EPCG), the Prime Minister Mega Integrated Textile Region & Apparel Parks (PM MITRA) Scheme has been added. The dairy industry will be spared from maintaining its average export obligation in order to help it modernise its technologies. All varieties of battery-electric vehicles (BEV), machinery for vertical farming, and wastewater Products that use green technology and include treatment and recycling, rainwater harvesting systems and rainwater filters, as well as green hydrogen, are now eligible for lower export obligation requirements under the EPCG Scheme.

Facilitation under the Scheme for Advance AuthorizationThe FTP 2023 has included provisions for merchanting commerce in an effort to turn India into a centre of merchanting trade. It would now be possible to trade in restricted and prohibited goods in accordance with export regulations. With the help of an Indian middleman, items are transported from one foreign country to another without ever entering Indian ports. This is subject to following RBI regulations and does not apply to products or items that are on the CITES or SCOMET list. This would eventually enable Indian businesspeople to transform places like GIFT city, etc., into significant commercial centres like Dubai, Singapore, and Hong Kong.

Amnesty Plan

In order to help exporters overcome their problems, the government is steadfastly devoted to decreasing litigation and encouraging relationships built on trust. The government is creating a unique one-time Amnesty Scheme under the FTP 2023 to resolve default on Export Obligations, in keeping with the “Vivaad se Vishwaas” strategy, which tried to settle tax disputes amicably. This programme is designed to help exporters who have struggled to fulfil their responsibilities under EPCG and Advance Authorizations and who are suffering from the high duty and interest charges brought on by pending cases.

All pending instances of failure to comply with the aforementioned authorizations’ Export Obligation (EO) can be regularised on payment of all exemptions from customs duties in proportion to unmet export obligations. Under this arrangement, the maximum amount of interest that can be paid is 100% of the exempted duties. However, since no interest is due on the share of Additional Customs Duty and Special Additional Customs Duty, exporters will likely feel relieved as their interest costs will be significantly reduced. It is envisaged that this amnesty will provide exporters with a chance to comply.

In advance approval Similar to the EOU and SEZ Scheme, the scheme used by DTA units allows duty-free import of raw materials for the production of export goods. The DTA unit, however, is adaptable enough to work for both local and export production. according to interactions Certain facilitation provisions have been added to the current FTP in collaboration with industry and Export Promotion Councils, such as the Special Advance Authorization Scheme extended to export of the apparel and clothing sector under para 4.07 of HBP on a self-declaration basis to facilitate prompt execution of export orders – Norms would be fixed within fixed timeframe.

Benefits of the Self-Ratification Scheme for fixing Input-Output Norms are currently extended to individuals with statuses of 2 stars and higher in addition to Authorised Economic Operators.