Strategies to shift from decades of reliance on imported fossil fuels to less expensive, cleaner domestic energy sources are part of the net zero growth plan (NZGP). New nuclear reactors, renewable energy sources including solar and wind, hydrogen, and carbon capture, utilisation, and storage (CCUS) are among the strategies the UK government intends to deploy to meet its targets. The strategy underscores how crucial it is to consider the continuing contribution of UK oil and gas to the transition. The main objectives of the net zero growth plan are to increase the UK’s energy security, protect it from volatile international energy markets, and aid in the country’s transition to clean energy so that it reaches net zero by 2050.

The NZGP described a three-pronged strategy to accomplish its goals. Providing a safe, reliable energy supply: Moving to a power system that heavily relies on low-carbon technology is essential for delivering cheaper, cleaner local energy and addressing our underlying sensitivity to the price of imported fossil fuels. The NZGP highlights the UK government’s plans to enhance nuclear, solar, and wind sources as well as hydrogen and CCUS innovation in order to achieve this. The strategy also emphasises the necessity of planning law reforms and electrical grid enhancements

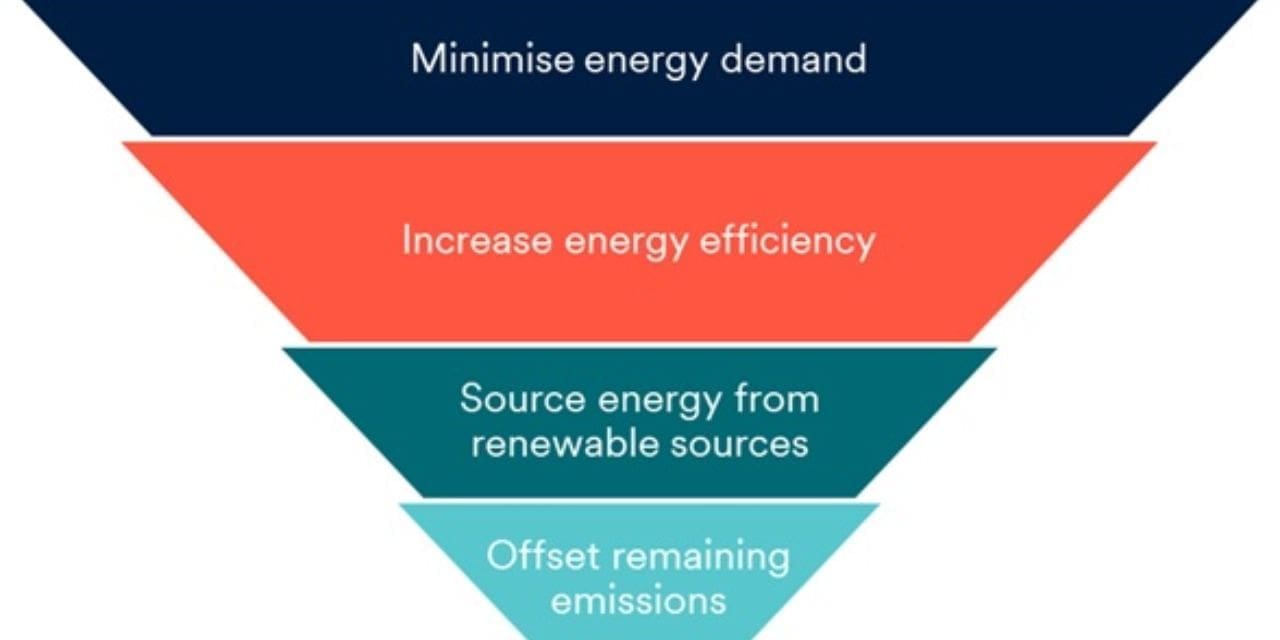

Increasing efficiency in households and businesses will help to meet demand. A significant decrease in overall energy use is necessary for the low-carbon energy system, and increasing efficiency would help save costs. This comprises using clean heating technology to significantly increase the energy efficiency of households and businesses, enhanced energy management, as well as monetary investments in such actions. By March 2026, an additional £1 billion will be invested in energy efficiency upgrades, including loft and cavity wall insulation, through the Great British Insulation Scheme, a new Energy Company Obligation programme launched by the NZGP. The strategy also increases financial support for heat pumps and heat networks while reiterating that support.

assisting the transition of the rest of the economy- It will be necessary to implement net zero throughout the remainder of the economy. A low-carbon power sector and increased electrification can assist lower the carbon footprints of buildings, industry, transportation, and agriculture. But some of these comparable businesses would be more challenging to electrify, calling for alternate decarbonization methods. expanding industry support enhanced energy management, as well as monetary investments in such through the Industrial Energy Transformation Fund (IETF), which aims to help businesses with high energy use lower their energy expenses and carbon emissions by investing in energy-efficient and low-carbon technologies.[iv] With a boost of £185 million announced by the NZGP for Phase 3, the IETF will now receive £500 million overall across all stages. The growth of green sectors will lead to the creation of new jobs that might require learning new skills. A Net Zero and Nature Workforce Action Plan will be developed in 2024, according to the NZGP, to promote this change and help people take advantage of the opportunities it will provide. According to the 2023 Green Finance Strategy, the UK will The NZGP also announces initiatives to motivate the financial services sector to help us achieve our challenging goals. Concurrently, the government’s plan for encouraging and accelerating the growth of nature markets is outlined in the Nature Markets Framework. The NZGP also intensifies its goals for the decarbonization of aviation and electric vehicles.

Comments about the NZGP

The UK’s unveiling of its new net zero policy priorities has been criticised by Carbon Brief as disorganised. The bundle, according to Carbon Brief, consists of 44 publications with a combined page count of 2,840. According to a “carbon budget delivery plan” that was part of the package, the UK will not be on schedule to fulfil its global climate target for 2030 under the Paris Agreement. This letter responds formally to a High Court judgement from 2022. According to Carbon Brief, declaring the UK’s net-zero policy unlawful won’t likely stop the possibility of a new legal challenge, even though it also shows the UK is not meeting its legally required sixth carbon budget.

The Energy Security Plan does not include the UK government’s “climate compatibility checkpoint,” which was created in 2021 to make sure that new licences would only be awarded if they were in line with the UK’s net-zero goal. At the time, scientists and environmentalists questioned if this was even conceivable. Despite a letter to Rishi Sunak from more than 700 UK academics asking with him to stop giving interviews, including climate scientists Prof. Tim Osborn and Prof. Emily Shuckburgh, There have been additional fossil fuel expansions and new oil and gas licences. Many other countries, including France, Ireland, and Denmark, have pledged to halt issuing new oil and gas licences in order to tackle climate change, similar to the UK.

The declaration has drawn criticism from political opponents in the UK who claim it merely reiterates current green policy. Ed Miliband, the opposition environment secretary for Labour, declared: “The government’s ‘green day’ turns out to be a weak and feeble Groundhog Day of re-announcements, reheated policy, and no new investment.” Caroline Lucas, a member of parliament for the Green Party, stated: “The greenest thing about this is the recycling of already announced ideas.”

The advances made in relation to the Green Finance Strategy, which described how to finance environmental initiatives, have received more favourable responses. The government would encourage green funding for environmentally friendly measures like peatland restoration and tree planting, as well as help farmers gain access to new sources of income from the private sector. The government intends to gather at least £500 million in private funding in England by the year 2027, with the ultimate objective of reaching more than $1 billion by the year 2030

The Green Finance Strategy and the Nature Markets Framework will assist to unleash this potential and create markets for a greener UK, according to Environment Agency Chair Alan Lovell. Through the Natural Environment Investment Readiness Fund, among other avenues, the Environment Agency collaborates with the government to stimulate private sector investment in climate adaptation and nature recovery. Work financing Such naturally based flood mitigation plans will assist us in lowering the future economic implications of climate changes.