Due to the production of waste nitrous oxide, the current commercial petrochemical process that produces adipic acid from KA oil and is catalyzed by nitric acid seriously pollutes the environment. Therefore, creating more environmentally friendly ways to generate adipic acid has drawn significant interest from both industry and academics.

Cyclohexane and phenol have been primarily used in the commercial synthesis of adipic acid.

Automobile makers are currently using more sophisticated plastic materials to reduce weight and improve the fuel efficiency of the vehicles as a result of current environmental and economic concerns. A recent study found that every 10% decrease in vehicle weight results in a 6-8% reduction in fuel consumption.

In the consumer electronics sector, electronic products, including smartphones, OLED TVs, tablets, and other similar devices, are growing at the fastest rate. The demand for adipic acid is expected to be driven by an increase in the need for electronic goods in the near future.

Asia Pacific Scaling up the Eco-friendly Application of Adipic Acid

In the Asia Pacific, a number of businesses have begun to expand their capacities, which has increased the demand for adipic acid. Japan’s 24th of August 2022, Tokyo The world’s first 100% bio-based adipic acid, a component of nylon 66 (polyamide 66), has been created by Toray Industries, Inc. using sugars generated from non-edible biomass.

Additionally, the company’s microbial fermentation technology and chemical purification technology, which makes use of separation membranes, were combined in a unique synthesis method to accomplish this success.

Recent Scenarios Affected North America’s Adipic Acid Market

The market was supported by fluctuating benzene prices brought on by changes in the world petrochemicals market brought on by the ongoing economic fluctuations.

Moreover, there was a lack of inventories and fewer products were being stored with the traders and suppliers as a result of the upstream Nylon-6,6 and other textile sectors’ soaring demand for the commodity. The crisis also resulted in a global shortage of shipments, which had an impact on the downstream market mood.

Manufacturers are Identifying the Opportunities in the Adipic Acid Market

The adipic acid market is quite susceptible to changes in supply and demand. This is a result of the wide spectrum of downstream industries that rely on it for their manufacturing procedures. Effective volatility management does need ongoing market and price monitoring to ensure that opportunities aren’t lost.

For instance: Genomatica, a leader in sustainable materials, and Asahi Kasei, a global company with a Japanese foundation, have announced a strategic alliance to market nylon 6,61 created from renewable resources and based on Genomatica’s bio-based HMD building block.

Moreover, in January, Genomatica and the material producer Covestro revealed that a plant-based version of HMDA had been successfully produced in large quantities. The businesses stated that throughout the course of numerous production campaigns, they anticipate producing tonnes of high-quality material.

The businesses want to take the program to its full commercial potential, and Covestro has obtained an option from Genomatica to license the integrated GENO HMD process technology that is likely to be developed as a result of its use in commercial manufacturing.

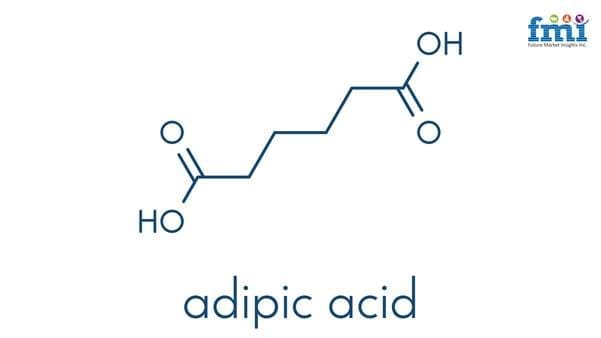

Adipic acid, also referred to as hexanedioic acid is an organic compound that is commercially formed by the reaction of cyclohexanol and cyclohexanone. The rise in the sales of adipic acid can be attributed to its high purity levels and usage in the manufacture of polyurethane. It is anticipated that adipic acid is widely being used in home furnishing applications such as furniture, carpet underlays, and bedding foams. Moreover, it is having noteworthy implications for cushioning materials to make the furniture more durable and comfortable.

Therefore, it is expected that the adipic acid market is likely to have substantial growth over the forecast period.

Demand Drivers in the Adipic Acid Market

It is identified by the experts of Future Market Insights that there are a number of factors that are contributing to the surge in the adoption of adipic acid in the global market. The major markets for adipic acid are electronics, food & beverage, electronics, pharmaceuticals, textile, and personal care. The following are some factors bolstering the growth of the adipic acid market:

Chemically Resilient Properties: It is witnessed that within the automotive industry there is a rising demand for strong and durable fibers, that are chemically resilient in nature for the manufacture of automotive parts. Adipic acid is one of the key ingredients for the production of composite materials.

Extensive Research and Development Activities: The textile production technologies are majorly contributing to the expansion of the adipic acid market size due to R&D activities carried out in the concerned industry vertical. The companies are focusing on lightweight, high absorption capacity and high-quality fibers capable of enduring extreme conditions are being manufactured.

Burgeoning Population: The rapid growth of the population is leading to huge infrastructure development activities. This factor is subsequently fueling the demand for paints, coatings, wires, and cables. Adipic acid is used as a dysfunctional crosslinking agent in paints and coatings for certain water-based emulsions. The paced growth of the populace is expected to boost demand for adipic acid during the period 2022-2032.

Deterring Factors Curbing Growth of The Adipic Acid Market

Although a number of influential factors are identified to lead to the expansion of the market size, it is also identified that some aspects are likely to inhibit the forwarding pace of the adipic acid market.

High Cost Associated with Raw Materials: The price of raw materials in the adipic acid market is witnessing fluctuations coupled with a high production cost of synthetic-based adipic acid, which is expected to be a key challenge for the market.

Generation of Toxic Elements: the manufacturing unit of adipic acid generates harmful carbon dioxide and a huge quantity of toxic waste due to the use of petroleum-based raw materials that is likely to hinder the market growth in coming years.

Huge Capital Investment: Glucose is commonly used to produce bio-based adipic acid, whereas raw materials required to manufacture synthetic-based adipic acid are petroleum and its derivatives such as paraffin wax & jellie, lubricants & friction modifiers, which require huge capital investment as compared to bio-based adipic acid which in turn is expected to hinder the growth of the synthetic based adipic acid market.

Competitive Landscape

Take of Key Market Players in The Adipic Acid Market

The market players are making continuous innovations and indulging in several mergers and acquisitions for curating eco-friendly adipic acid for the end-users. They are acquiring compelling raw materials that abide with the consumer preference for further increasing demand in the global adipic acid market.

Recent Developments

In January 2018, Ascend Performance Materials announced the plans to increase production capacity across its intermediate chemicals and polymers portfolio by 10% to 15% to support the continued demand from customers.

In January 2020, BASF SE announced the acquisition of Solvay’s polyamide business to broaden BASF’s polyamide capabilities with innovative and well-known products such as Technyl. This acquisition has also allowed BASF to support its customers with even better engineering plastics solutions, e.g., autonomous driving and e-mobility.

In December 2021, Ascend Performance Materials announced plans to purchase a compounding facility in San Jose Iturbide, Mexico, growing its global footprint and expanding production capacity for high-performance engineered materials. The purchase agreement includes the assets of DM Color Mexicana, a joint venture between Dainichiseika and Mitsubishi Corp.

In May 2022, Lanxess and Advent acquired the Engineering Materials business from DSM for a purchase price of around EUR 3.7 billion. Lanxess to transfer High-Performance Materials business into the joint venture. Lanxess is to receive a payment of at least US$ 1.8 billion and a stake of up to 40 percent in the joint venture. Lanxess will use proceeds to reduce debt and plans to buy back shares. New joint venture with the pioneering product portfolio and integrated value chain.