Synopsis

- Scheduled Commercial Banks (SCBs) Pre-Provisioning Operating Profit (PPOP) grew by 5% year on year (y- o-y) to Rs.1.30 lakh crore due to higher expansion in Net Interest Income (NII) and supported by non-interest income. Cost to income ratio of SCBs reduced by 230 bps y-o-y to 46.5% in Q3FY23.

- Total income of SCBs rose by 23.6% y-o-y to Rs.4.34 lakh crore in Q3FY23 driven by interest income. Meanwhile, non-interest income rose by 16.4% y-o-y due to stability in the investment portfolios of

- The operating expenditure (opex) of SCBs rose by 17.3% y-o-y to Rs.1.1 lakh crore in Q3FY23 due to increase in the number of employees and branches by Private Sector Banks (PVBs) along with provisioning for wage revision in Public Sector Banks (PSBs).

PPOP Rises as Growth in Income Outpaces Growth in Operating Expenses

- PPOP of SCBs grew by 5% y-o-y to Rs.1.30 lakh crore in Q3Y23. POPP of PSBs reported a robust growth of 31.6% y-o-y in the quarter, and PVBs too reported a growth of 25.3%.

- PPOP margin of SCBs rose by 30 bps y-o-y to 2.4% in Q3FY23 driven by PSBs. PSBs PPOP margin expanded by 33 bps to 98% in Q3FY23, meanwhile PVBs expanded by 20 bps to 3.1% in the quarter.

- Cost to income ratio of SCBs’ reduced by 230 bps y-o-y to 46.5% in Q3FY23 due to higher growth in NII than operating expenses. PSBs and PVBs reduced their cost to income ratio by 309 bps and 136 bps y-o-y, respectively, in the PSBs reported a higher reduction in the ratio.

Income (Rs. Lakh, Cr.)

Total income of SCBs grew by 23.6% y-o-y to Rs.4.3 lakh crore in Q3FY23 due to robust growth in advances, and a rise in the yield due to repricing of loans.

- As per the CareEdge Publication, “Banks Report Steady Net Interest Margin Growth in Q3FY23”, interest income of SCBs grew by 24.8% y-o-y to Rs.3.7 lakh crore, with growth in advances by 18.5% on y-o-y

- Non-interest income rose by 16.4% y-o-y in the quarter vs a drop of 4.9% over a year ago period due to a higher fee income driven by an uptick in business The growth was driven by stability in treasury income and growth in fee income driven by an uptick in business activities. Select 10 SCBs fee income (top 5 PSBs and top 5 PVBs) increased by 11.6% y-o-y in the quarter.

PSBs total income grew by 23.2% y-o-y to Rs.2.5 lakh crore in Q3FY23 due to growth in advances, rise in yield and robust growth in non-interest income.

- Interest income of PSBs grew by 5% y-o-y to Rs.2.2 lakh crore, meanwhile advances rose by 18.9% in the quarter.

- Non-interest income rose by 3% y-o-y vs. a drop of 10.5% over a year-ago period due to the stability of income from the investment portfolios.

PVBs total income grew by 24.2% y-o-y to Rs.1.8 lakh crore in Q3FY23 due to growth in advances (17.9%), and a rise in yield on advances. PVBs reported robust growth in interest income at 27.0% y-o-y.

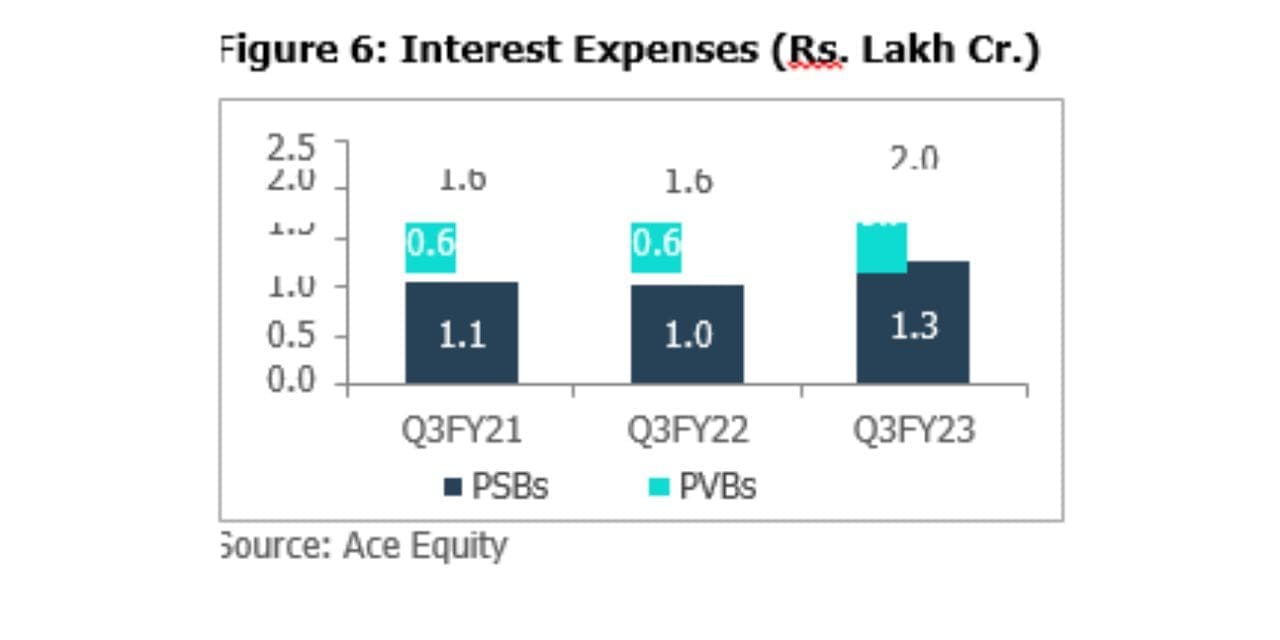

- As per the CareEdge Publication, “Banks Report Steady Net Interest Margin Growth in Q3FY23”, interest expenses of SCBs rose by 24.2% y-o-y in Q3FY23.

PVBs interest expenses rose by 27.3% y-o-y, higher than PSBs (22.6%).

Net Interest Income (NII) of Scheduled Commercial Banks (SCBs) grew by 25.5% y-o-y to Rs.1.78 lakh crore in Q3FY23 due to a healthy improvement in credit offtake, and a higher yield on advances. Operating Expenses (Rs. Lakh – Cr.)

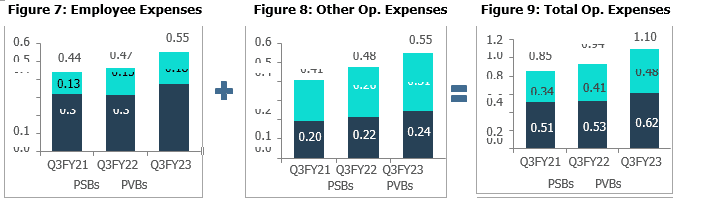

The operating expenses of SCBs rose by 17.3% y-o-y to Rs.1.1 lakh crore in Q3FY23 wherein employee expenses rose by 18.9% and other expenses by 15.8%.

- PSBs employee expenses rose by 4% due to wage revision (provision created) whereas PVBs employee expenses rose by 17.5% due to the addition of employees & branches in the quarter.

- Other expenses of SCBs rose by 8% in the quarter driven by higher technology expenses, and other operating expenses due to growth in personal loans and opening of branches by PVBs.

Conclusion

Banks reported a robust growth in total income for Q3FY23 driven by growth in interest income and as other income witnessed stability in the quarter due to growth in fee income and stability in investment portfolios, which is likely to continue in the near term. Hence, banks are also expected to report strong PPOP growth in FY23.