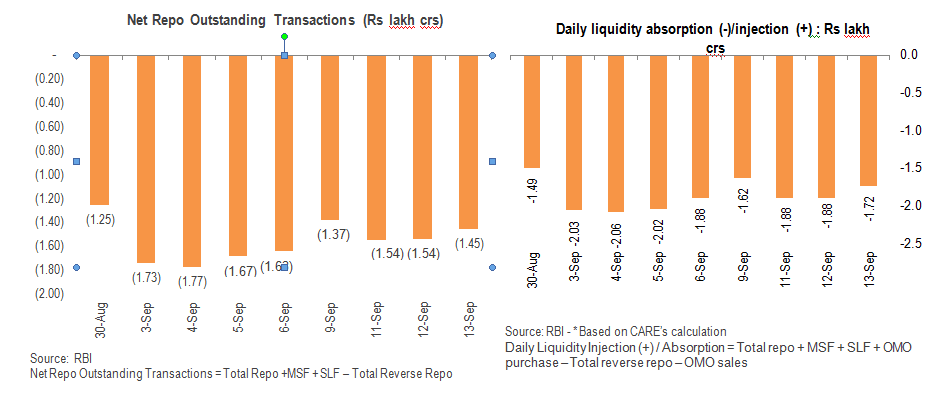

Surplus liquidity prevailed in the banking system during the week of 9-13

September’19. The net liquidity surplus in the banking system during the week has been estimated to have ranged between Rs. 1.37 – 1.53 lakh crores. Although the banking system continued to be flushed with surplus liquidity in the week ended 13 Sep’19, when compared with week ago, there has been a moderation in the surplus. The net liquidity surplus in the week of 3-6 Sep’19 was in the range of Rs. 1.62-1.76 lakh crores.

The decline in liquidity surplus in the week gone by can be attributed to the higher outflows towards meeting festive demand (as evidenced in the recent increase in currency in circulation with public which rose to Rs.21.9 lakh crs in the week of 7 Sept from Rs. 21.7 lakh crs a week ago) and advance tax payments (15 Sep’19). The scheduled fortnightly reporting of banks with the RBI could have also weighed on the overall surplus. At the same time, the sustained low credit offtake from banks (contraction in growth by 0.9% during 1 Apr- 30 Aug’19) amid higher deposits (growth of 1.6% in the same period) has been sustaining the liquidity surplus in banking system. Further supporting the liquidity in the banking system in the week of 13 Sept’19 was the inflows following the redemption of state development loans (Rs. 9,560 crores) and cash management bills (Rs. 25,000 crores).

The overall liquidity in the banking system has been in surplus for more than 3 months (15 weeks) and for over 2 months (since 1 July’19) the surplus has been on a near sustained basis been over Rs. 1 lakh crores.

During the weekends Sept’19, the daily net absorption by the RBI from the banking system i.e. the daily repo and reverse repo operations (including the fresh term repo and reverse repo auction and excluding the outstanding term repo and reverse repo operations), was more than Rs 1.5 lakh crs throughout the week (9-13 Sept’19) with the highest daily absorption being Rs 1.88 lakh crs.

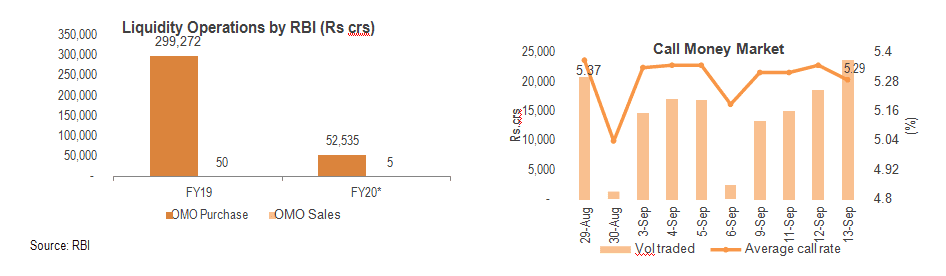

Call Money Market

The call money market rates rose during the week of 9-13 Sept’19 from week ago. It nevertheless continued to be below the RBI’s repo rate of 5.40% given the surplus liquidity in the banking system. The call money market rate in the week of 13 Sept’19 ranged between 5.29-5.35%, declining by 3 bps during the course of the week, compared with decline of 13 bps during the previous week (5.32% to 5.19%). The average call rate during the week was 5.32%, 1 bps higher than the average of the previous week. The average call market borrowings during the week ended 13 Sept’19 was Rs 17,723 crs, 37% higher than the average of the previous week.

Outlook on banking system liquidity for the week 16-20 Sept, 2019

The net liquidity in the banking system would remain in surplus in the current week but could see a moderation from the week gone by owing to scheduled outflows towards GST payments and government borrowings (Rs. 24,500 crs v/s Rs.23,613 crs of week ago) .