New York – When Cotton Incorporated fielded its international consumer survey in February, it didn’t particularly have COVID-19 in mind.

At that point, few could foresee that major markets around the world would go into a lockdown, let alone one that would last for weeks. As it happened, the winter survey across 12 countries caught consumers in something of a pre-pandemic mindset – and a follow-up survey in late April pointed to how some of their thinking had changed.

“Seventy-eight percent of U.S. consumers just want to curl up in a cozy bed right now,” said Melissa Bastos, Cotton Incorporated’s director of consumer research, pointing to the spring polling.

That’s a higher proportion than China (61%) and Mexico (53%).” Not surprisingly, U.S. consumers overwhelmingly made their most recent home textiles purchase in a physical store (76%), but almost two-fifths (38%) say they have browsed or purchased clothing or home textiles since the startof COVID-19.

Among those who have shopped, 38% said they have bought sheets and/or bedding, and 33% said they have browsed sheets and/or bedding without making a purchase.

“About 43% are spending less, and 33% are saving money,” said Bastos.

At the time of the April survey, six in 10 consumers were still wary about returning to physical stores to shop. The majority of U.S. consumers (55%) said they were delaying purchases in general, not just home textiles, because of the pandemic.

Among those delaying purchases, 52% said they plan to buy delayed purchases once the outbreak has decreased (25%) or is over (27%) in the U.S.

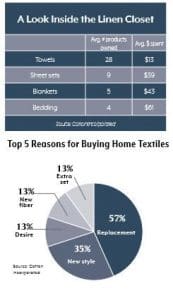

Purchase drivers are fairly consistent across bedding and bath, she noted.

The top drivers for sheets and bedding include:

• Comfort, 90%

• Quality, 86%

• Durability, 83%

• Softness, 83%

• Price, 80%

The top drivers for bath towels are:

• Quality, 86%

• Durability, 85%

• Softness, 84%

• Price, 80%

• Absorbency, 77%

Cotton continues to maintain as strong standing with consumers, with 73% saying they look for all-cotton products when shopping for home textiles, according to the survey.

“Right now, life revolves around home,” said Bastos. “Retailers that have the ability to communicate quality, softness and durability will win.”

Highlights from Cotton Incorporated’s “Supply Chain Insights” survey on home textiles are available on the organization’s website.